How to make money online and from home: For beginners, students and more (MY)

Learn more about how to make money online in Malaysia through platforms like YouTube, TikTok, and more.

PayPal¹ is a leading digital payment platform, commonly accepted when spending online with ecommerce stores. PayPal is secure and easy to use, with extra buyer protections in place for some transactions. You can also use PayPal to send money to friends and family here and around the world.

PayPal offers some very helpful services - and some transactions can be made fee free. However, it’s not the right choice every time, particularly when transacting in a foreign currency, as charges and currency conversion costs can creep in - pushing up your overall costs.

If you’re wondering how to use PayPal in Malaysia, including services available, fees and how to get started, this guide has you covered.

| Table of contents |

|---|

PayPal has been in operation for over 20 years, and has transformed ecommerce shopping and digital payments. You can use PayPal to shop securely online, or to send money to someone using just their phone number or email address.

These days, the PayPal Group is a financial technology company covering a broad range of businesses and services to help people pay and get paid online and through the PayPal app, as well as offering add-on products such as credit and loans in some countries. This guide will focus on the PayPal services available in Malaysia, including secure online spending and payments.

But what about security? PayPal is safe to use as long as you take normal common sense precautions, such as securing your account with a strong password, and never sending money to anyone you don’t know.

So - can I use PayPal in Malaysia? The good news is that PayPal Malaysia offers a range of services to people here, including simple ways to pay online and send money to friends and family around the world.

Let’s walk through four different PayPal Malaysia service options.

Millions of stores offer PayPal as a way to pay when you shop online. From getting lunch delivered with food panda, to picking up fashion essentials with asos, PayPal offers a convenient and secure way to pay. All you need to do is select PayPal as your preferred payment method when you get to the checkout, and follow the prompts to pay with your PayPal balance or a linked card or bank account.

We’ll cover how to set up a PayPal Malaysia account a little later - but it’s a pretty simple process, and once you’ve linked your preferred card or bank account to PayPal you can pay easily without needing to enter your banking details every time you shop. You’ll also continue to earn any reward or loyalty points offered by your card issuer.

It’s free to use PayPal to shop when you’re paying in your local currency - so MYR in this case. However, when currency conversion is needed there’s a fee to pay which can be pretty steep. The exact fee varies based on the currencies involved, but 2.5% - 4% is normal².

PayPal offers options to send payments to friends and family using just a phone number or email address². That’s super convenient - and depending on how you fund the payment, it can be quick too. The money will be deposited into the recipient’s PayPal account, and they can either spend it next time they shop online, or withdraw the funds back to their bank account or card.

Fees may apply when you send money with PayPal - and they can be pretty steep if you need to convert from one currency to another to get your money moving. Here’s a rundown of the most common fees that can apply.

| Service | PayPal Malaysia fee³ |

|---|---|

| Sending domestic payments - funded with PayPal balance or bank account | No fee as long as no currency conversion is required Recipient may pay a fee depending on the transfer details |

| Sending domestic payments - funded with card | 3.4% + fixed fee If currency conversion is required a fee will apply Recipient may pay a fee depending on the transfer details |

| Sending international payments - funded with PayPal balance or bank account | 4.99 USD or the currency equivalent + currency conversion charge |

| Sending international payments - funded with card | 4.99 USD or the currency equivalent + 3.4% + fixed fee + currency conversion charge |

| Currency conversion | 2.5% - 4% in most cases |

Another convenient service from PayPal is recurring payments⁴ - handy for managing subscriptions for example. In this case you’ll simply need to pick PayPal on the merchant’s site when it comes to paying, and you can then view and manage your recurring transfers via your PayPal account.

This guide mainly focuses on PayPal Malaysia for personal account holders. However, you may also be interested in checking out PayPal for business⁵ if you’re looking for a convenient way to receive payments online for your company. PayPal business accounts have different features and fees to personal accounts - so you’ll need to make sure you pick the right account type for your needs. However, for businesses, PayPal has features including secure payment options from shareable links, website buttons and full featured checkouts.

Need to pay someone with PayPal? Here’s what you’ll have to do:

It’s important to double check the fees you’ll pay when sending a payment with PayPal, as some transactions can have one or more charges which quickly add up. PayPal international fees can be particularly high - and in general, any transfer funded with a card comes at a higher cost, too. Learn more about PayPal fees here.

Once you have an active PayPal account you can receive payments easily from other PayPal users. All you’ll need to do is give them the email or phone number associated with your PayPal account, and the money will be automatically deposited when the payment has been processed.

When you have money in your PayPal balance you can choose to hold it there - for future payments for example - or withdraw it to your linked bank account or card. Bear in mind that fees may apply to withdraw your money, depending on the currency you hold and the account or card you want to have it deposited in.

Get a guide to receiving PayPal payments in Malaysia here.

If you’re transacting internationally, PayPal may not be your best bet. Check out

Wise if you need to receive money from abroad or send money internationally, to see if you can save. Wise offers many of the features available through PayPal - and a few extras too.

Here’s a topline comparison of Wise vs PayPal:

| Feature/service | PayPal | Wise |

|---|---|---|

| Account opening fee | Free | Free for personal customers |

| Supported currencies for holding | 25⁶ | 40+ |

| Fee to send payments overseas | Fee varies based on payment type | Fee varies based on destination and value |

| Exchange rate | Conversion fees of 2.5% - 4% apply³ | Mid-market rate with no added markup |

| Linked debit card | Not available | Available for in person and online spending |

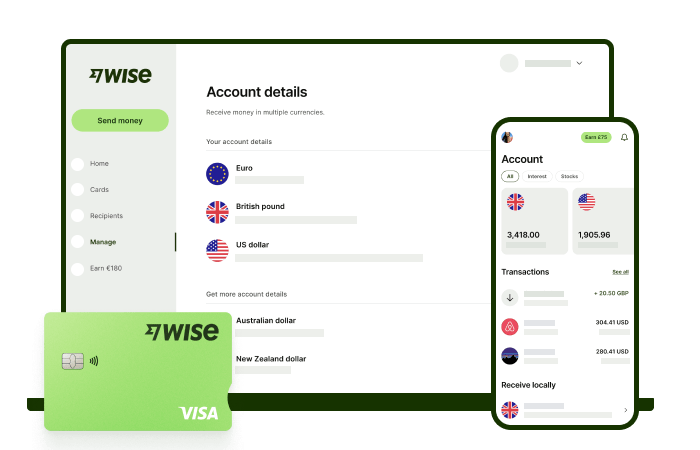

Wise is a specialist in currency conversion, international payments, and multi-currency accounts for personal and business customers. When you open a Wise Account you’ll be able to hold 40+ currencies, and exchange between them using the mid-market exchange rate (the same rate you see on Google) with no markup. You can also get a linked debit card to spend easily online and in person, plus local bank details to get paid to your account fee free from 30+ countries (except for USD wire transfers).

Before you use PayPal Malaysia to send your international payment, compare the convenience and fees available with Wise. You may find you can get a far better exchange rate - and save on costs overall.

| ✅ Learn more about how to use Wise in Malaysia to send money and pay in 40+ currencies |

|---|

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

Creating a PayPal Malaysia account is very easy and can be done online or with your smartphone. Here’s what to do:

You may be prompted to complete a verification step for security during the process of setting up your PayPal account, and you’ll need to add a bank account or card before you can start to make payments. This can be done by navigating to the Wallet menu and following the prompts.

To get full feature access with PayPal you’ll need to verify your account⁷. This usually involves adding your personal information, and linking a verified bank account or card. The exact process may vary based on the transactions you’re making - however, you’ll be guided through each step online or in the PayPal app.

You don’t need to add funds to your PayPal account to shop or send a payment. Your money can simply be debited from your linked bank account or card automatically. However, if you do want to add funds to your PayPal account for any reason, you’ll usually be able to follow these steps⁸:

There’s more about adding funds to PayPal in this guide to topping up PayPal

So now you know how to create a PayPal account in Malaysia, how to verify your PayPal account, and maybe most importantly how to receive money from PayPal. Before you use your PayPal Malaysia account be sure to check out the fees that apply for different transaction types. While lots of PayPal services are free, some do come with charges - which can be particularly steep if you’re transacting internationally.

If you’re sending and receiving payments in foreign currencies - or if you need to shop online with a merchant based overseas, check out Wise instead, to see if you can save on conversion and transaction fees!

Start saving money with Wise 🚀

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn more about how to make money online in Malaysia through platforms like YouTube, TikTok, and more.

Learn more about the RHB Multi Currency Debit card in Malaysia, including benefits, requirements, fees and whether it’s worth getting.

We compared the top Affin Bank cards in Malaysia. Whether you’re looking for points, fees or rewards on travel spend, find out which credit card is for you.

Learn more about Revolut and Wise, including exchange rate comparisons, and whether the product can be used in Malaysia,

Want to know how much transaction fees you’re paying when using your Malaysian credit card overseas? Learn more about the types of fees and how to avoid them.

Learn more about the Maybank World Elite Mastercard in Malaysia, including benefits, requirements, fees and whether it’s worth getting.