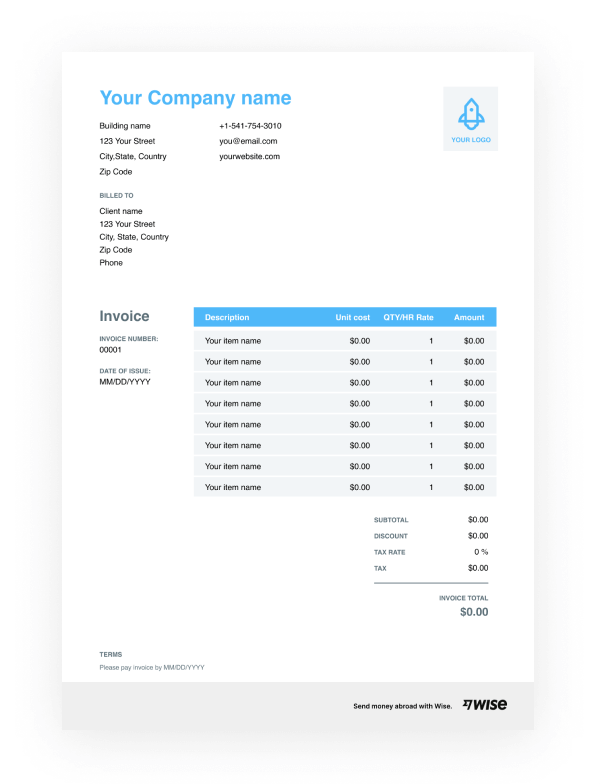

Free format of bill

Create an invoice and send it to your client.

Create your invoice

If you handle your own invoicing as an entrepreneur or small business owner, you can create invoices simply, using our downloadable free invoice templates.

Send your invoice

Send your bill online for faster payment, using your choice of Word, Google Docs, Excel, Google Sheets or PDF formats.

Wise is the cheaper, faster way to send money abroad.

Work with customers, suppliers or employees abroad? You’ll need a smart way to make fast, safe, low cost international payments.

Move your money between countries. Send money to more than 40 countries including Australia, Singapore, UK, UAE and US.

Send money on the go. Sign up online with your PAN card and proof of address in India. You can then send money from our website or app — anywhere, any time.

Easy. Fast. Convenient.

Download invoice template.

Word bill format

Word documents are flexible, easy to customize, and can be opened on practically any computer.

Excel bill format

Fill in your bill format in Excel. Excel documents can automatically calculate subtotals, totals, tax and more.

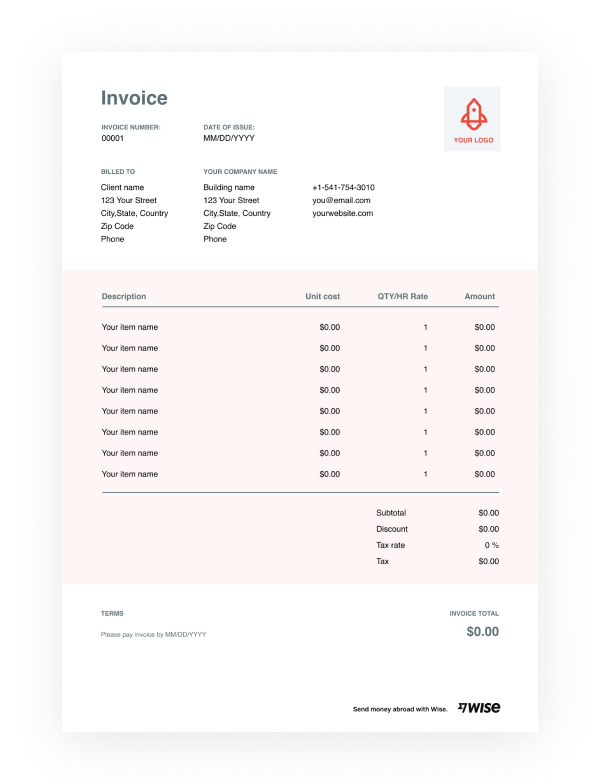

PDF bill format

Create your bill in PDF. PDF documents are compact, searchable, and can be password protected for security.

Which bill template format to choose?

Bill formats in Word and Google Docs. Templates in Microsoft Word and Google Docs are easy to customize — change colors, fonts, and add your own logo to send a well designed invoice. The smart, quick, and familiar option.

Bill formats in Excel and Google Sheets.

Use formulas to calculate totals or taxes quickly on the Microsoft Excel bill format. Choose Excel for a tailored invoice which cuts the the admin burden by doing the math for you.Bill formats as PDF.

You can easily edit your PDF bill format and send it to your client as a compact file, in a matter of minutes. Perfect for keeping it from unwanted edits, especially with the ability to protect it with a password. A good choice if you want to reduce the file size of your invoice without sacrificing design or security.

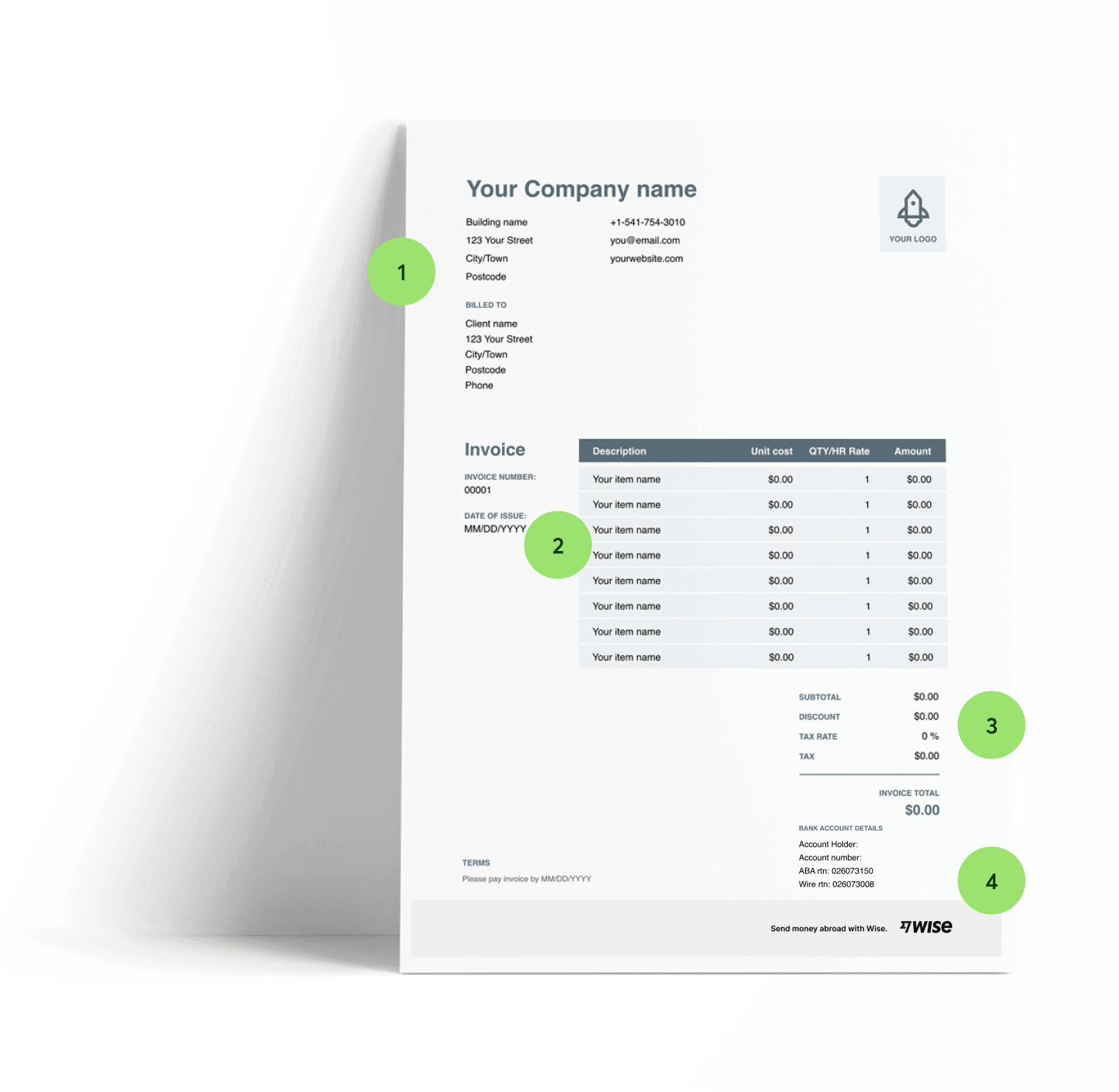

How to make an invoice?

What are the different types of invoices?

As a business owner you’ve probably seen a number of different invoice types. Here are some of the most common.

Tax invoice - a properly formatted GST invoice is a tax invoice. It’s legally required if you’re running a GST registered business, and allows a GST registered buyer to manage their ITC.

E-invoice - E-invoices are issued on the GST Network, and electronically checked to ensure they are accurate and legally issued. Not all businesses are eligible to use the E-invoice system.

Proforma invoice - some businesses issue a proforma invoice before a sale has been agreed. This can also be called a quote or estimated bill, as it contains details of the expected sale price and agreement if the buyer chooses to go ahead.

Bill of supply - a bill of supply doesn’t include GST tax information, and so can only be used in GST exempt transactions. When using a bill of supply, no GST can be charged or collected.

Commercial invoice - commercial invoices are used when exporting goods, and include customs information to ensure the shipment is properly declared.

Debit and credit note - if you need to adjust the amount charged on a GST invoice you’ve already issued, you may use a debit or credit note. Debit notes are issued when the cost of a purchase needs to be increased, while credit notes can be issued if the final amount is lower than initially anticipated.

For more information, read our guide explaining what an invoice is, the requirements of each type and tips from the experts on invoicing.

Save time and money with Wise

The easier way to connect with customers, suppliers and staff, and watch your business grow.