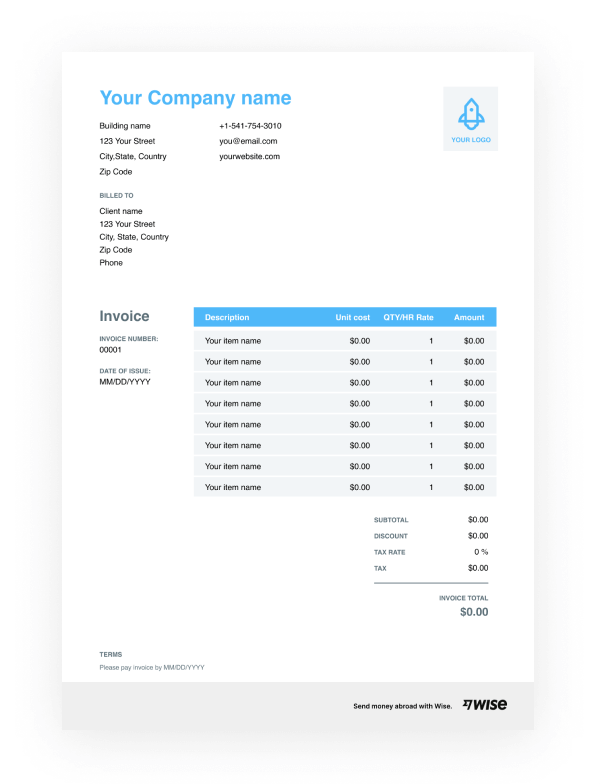

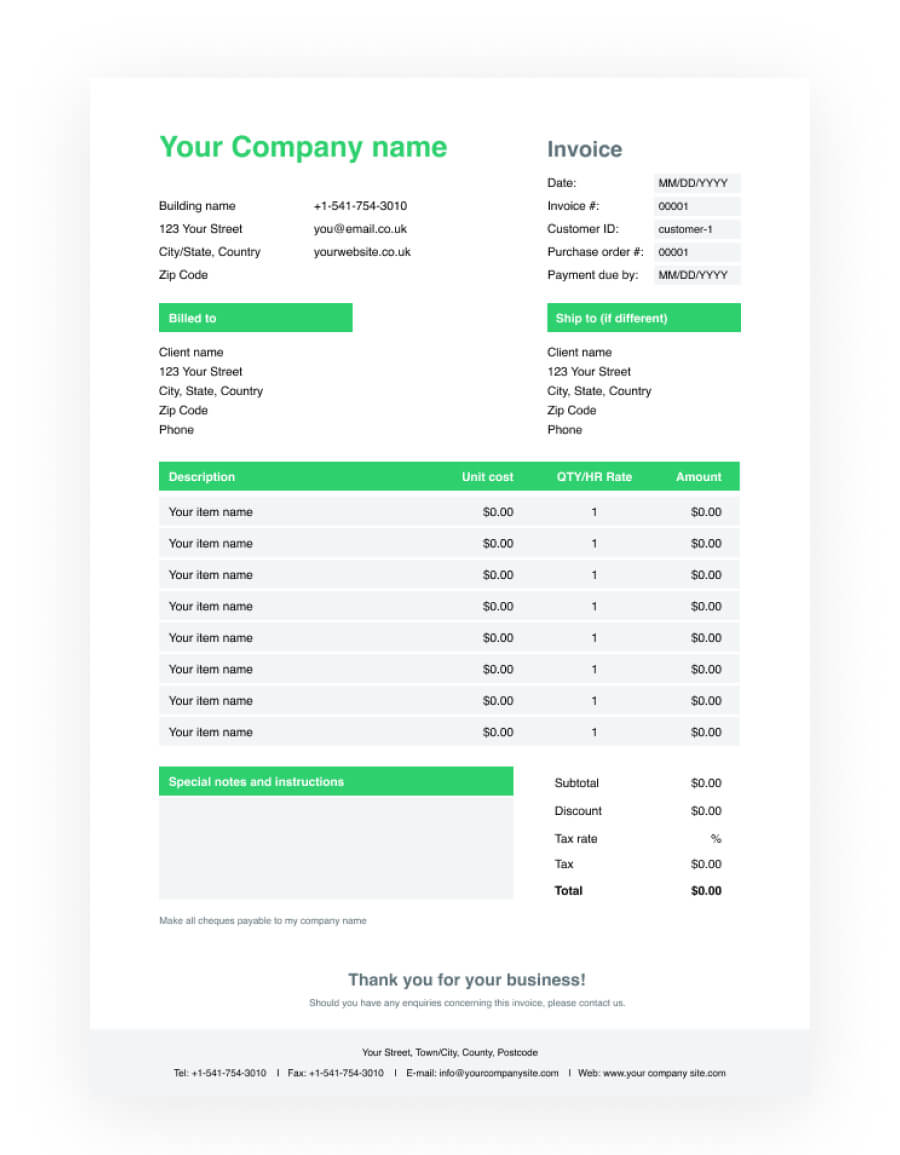

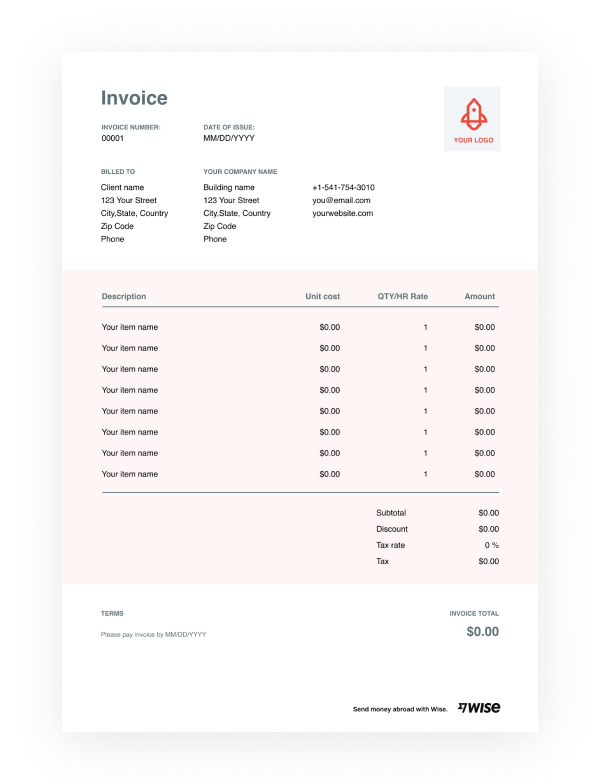

GST bill format

Create an invoice and send it to your client.

Create your invoice

If you handle your own invoicing as an entrepreneur or small business owner, you can create invoices simply, using our downloadable free invoice templates.

Send your invoice

Send your invoice online for faster payment, using your choice of Word, Google Docs, Excel, Google Sheets or PDF formats.

Wise is the cheaper, faster way to send money abroad.

Work with customers, suppliers or employees abroad? You’ll need a smart way to make fast, safe, low cost international payments.

Move your money between countries. Send money to more than 40 countries including Australia, Singapore, UK, UAE and US.

Send money on the go. Sign up online with your PAN card and proof of address in India. You can then send money from our website or app — anywhere, any time.

Easy. Fast. Convenient.

Download invoice template.

GST bill format in Word

Word documents are flexible, easy to customize, and can be opened on practically any computer.

GST invoice format in Excel download

Fill in your invoice template in Excel. Excel documents can automatically calculate subtotals, totals, tax and more.

GST tax invoice format in PDF

Create your template in PDF. PDF documents are compact, searchable, and can be password protected for security.

What is a GST invoice?

If you run a GST registered business you’ll need to make sure you issue GST invoices every time you agree a sale. GST invoices are also called GST bills, and they’re important as a transaction record for both the seller and the buyer of goods and services. As the seller, the GST invoice you create details the agreement between you and the buyer, including the goods or services you’ll provide, and how much you’ll be paid.

The format of a GST bill is important, because you’ll need to make sure your GST invoice captures all the practical and legal information required. Your GST bill will list out what’s being sold, the cost and payment due date, and the legally required tax details. As a GST registered business you’re obliged to issue GST compliant invoices every time you make a sale.

What should go on a GST invoice?

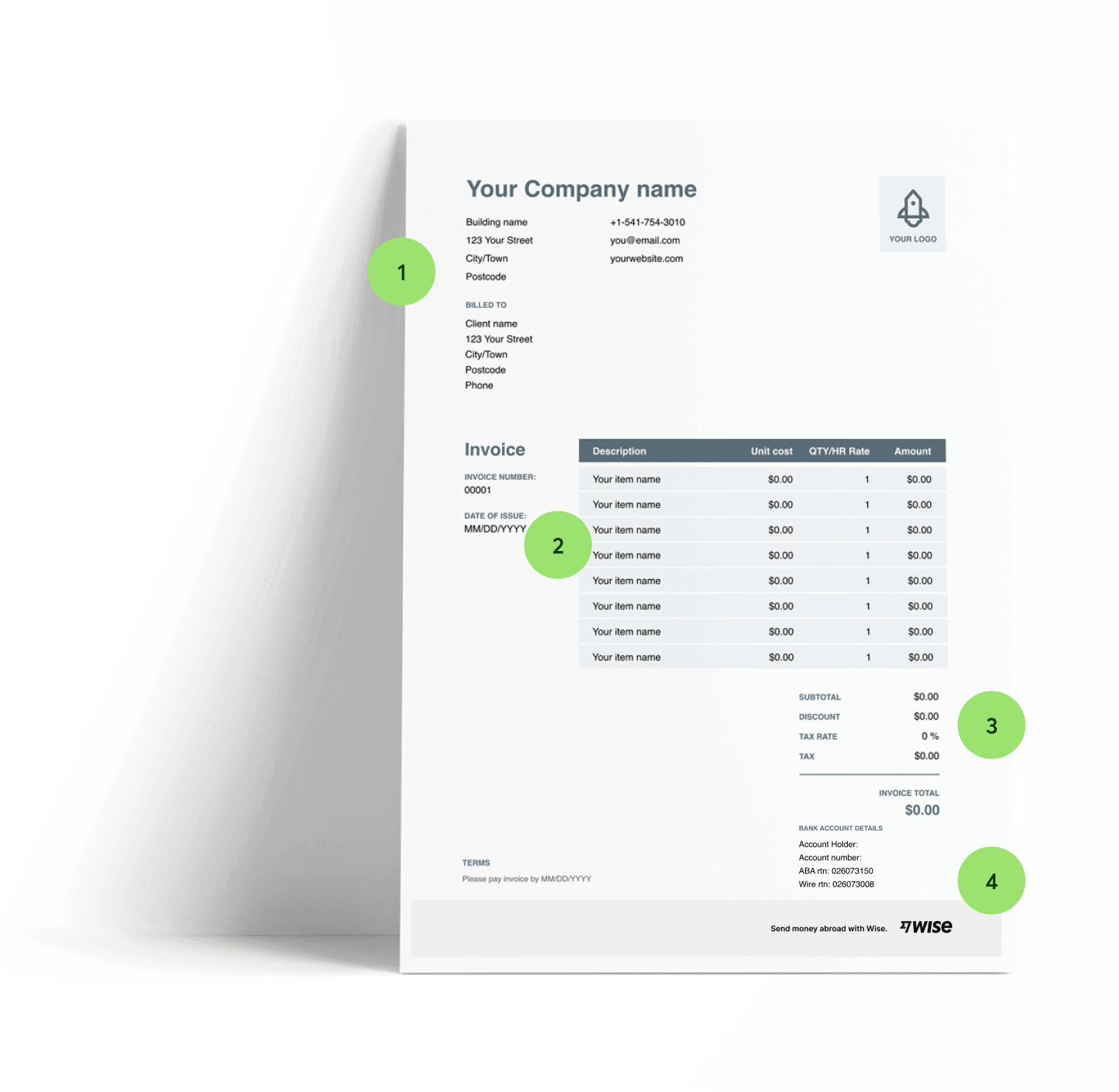

Issuing a GST tax invoice is legally required - but it’s also a good opportunity to make a professional impression on your client with a branded, accurate and easy to read document. You’ll also need to use a fully compliant GST invoice format to allow your buyer to manage input tax credit (ITC). The fields needed on your GST bill include:

- Invoice number and date

- Customer’s name, shipping and billing address

- Customer and taxpayer’s GSTIN (if registered)

- HSN code/ SAC code

- Place of supply

- Item details i.e. description, quantity, unit, total value

- Taxable value and discounts

- Rate and amount of taxes: CGST/ SGST/ IGST

- Whether GST is payable on reverse charge basis

- Suppliers’ signature

If the buyer is not GST registered, and the bill is for a purchase valued at less than 50,000 INR, the invoice can be slightly different. In this case you’ll need to make sure your invoice includes:

- Name and address of the recipient

- Delivery address

- State name and state code

How to make an invoice?

How to create a GST bill in Excel?

Steps to follow to create GST bill using MS-Excel

1. Open the downloaded invoice template in Microsoft Excel.

2. Remove the gridlines by clicking on the ‘View’ tab and then unchecking ‘Gridlines’ in the ‘Show’ section.

3. Upload the company logo in the blank sheet by clicking on ‘Insert > Picture’.

4. In the next cell, enter your company details, including company name, address, email ID and GSTIN.

5. In ‘Invoice To’ field enter your customer details like name, company name, address, email ID and GSTIN/UN.

6. To the right of the ‘Invoice To’ section, input the Invoice No., Date, Due Date, Terms.

7. In the ‘Goods or services’ solemn, enter all the data, including name of the product/service, quantity, tax rate, discount, unit, total amount, etc., as per your business requirement.

8. Once you enter your prices, tax and discounts, all the calculations will be automatically done.

9. At the bottom of the page, provide your bank details and other payment modes like UPI bar code, UPI ID, or UPI phone number.

What are the different types of invoices?

As a business owner you’ve probably seen a number of different invoice types. Here are some of the most common.

Tax invoice - a properly formatted GST invoice is a tax invoice. It’s legally required if you’re running a GST registered business, and allows a GST registered buyer to manage their ITC.

E-invoice - E-invoices are issued on the GST Network, and electronically checked to ensure they are accurate and legally issued. Not all businesses are eligible to use the E-invoice system.

Proforma invoice - some businesses issue a proforma invoice before a sale has been agreed. This can also be called a quote or estimated bill, as it contains details of the expected sale price and agreement if the buyer chooses to go ahead.

Bill of supply - a bill of supply doesn’t include GST tax information, and so can only be used in GST exempt transactions. When using a bill of supply, no GST can be charged or collected.

Commercial invoice - commercial invoices are used when exporting goods, and include customs information to ensure the shipment is properly declared.

Debit and credit note - if you need to adjust the amount charged on a GST invoice you’ve already issued, you may use a debit or credit note. Debit notes are issued when the cost of a purchase needs to be increased, while credit notes can be issued if the final amount is lower than initially anticipated.

Non-GST invoice format

If you’re not liable to register for GST, or if the specific transaction is exempt from GST, you can also use a non-GST invoice or bill of supply. These invoices don’t have mandatory fields in the same way a full GST invoice format does - but you’ll still want to make sure your invoice is professional, clear and easy to use.

Use the Wise invoice generator to effortlessly produce both GST invoices and non-GST invoices in Word, Excel, or Google doc format. Different templates are available, which can be customized to add your branding and allow you to produce professional documents in the blink of an eye.

Save time and money with Wise

The easier way to connect with customers, suppliers and staff, and watch your business grow.