In 2022, SMBs lost £3.6 billion in transaction fees

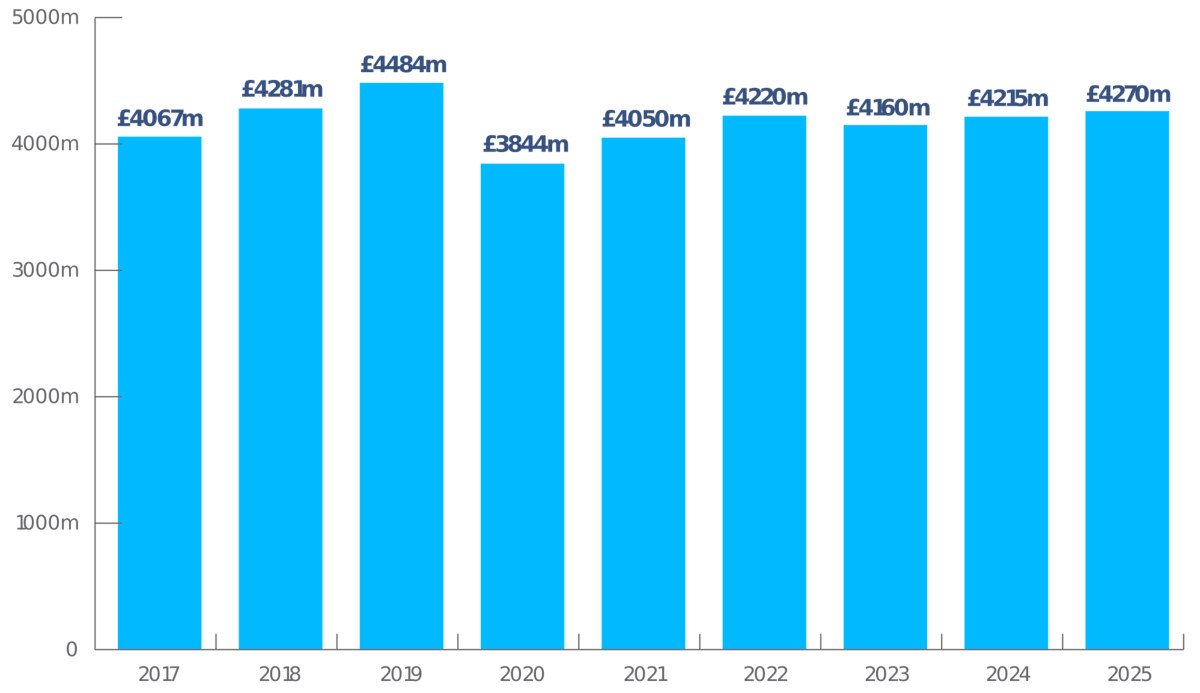

UK businesses lost an estimated £4.2 billion in transaction fees while sending goods and services abroad

The UK’s SMBs are facing a raft of economic challenges. From rising energy costs, record inflation, staff shortages and supply chain disruption, the headwinds for SMBs are building into a perfect storm. Faced with a darkening outlook in the domestic market, many entrepreneurs and SMBs are shifting their focus overseas to tap into growth by expanding business globally. But even here they face rising costs.

New research from Public First, commissioned by Wise, has found that Small and Medium Businesses (SMBs) in the UK lost an estimated £3.6 billion in transaction fees while selling goods and services abroad in 2022. The figure for all businesses was an estimated £4.2 billion. Transaction fees for cross-border transfers and payments are often hidden within the exchange rates quoted by banks, which are often considerably worse than the mid-market exchange rate at the time, allowing them to pocket the difference between the two to boost revenues. This means many SMBs are unaware of the overall transfer fee, which can eat into their operating margins and have a serious impact on cash flow.