Sprinting ahead: 5 cross-border payment trends set to mature in 2026

Explore the 5 cross-border payment trends defining 2026. From G20 targets to retail customers, discover how global payments are moving from sprint to standard.

In the ever-evolving landscape of digital banking and international money transfers, collaboration and innovation are key.

We embarked on a journey with N26, our first connected Wise Platform partner, back in 2016, to provide their customers with fast and low-cost international payments. We’ve come a long way since then, and as of today customers can send funds to 35 currencies globally through our integration.

Today, we're excited to announce that we’re expanding our partnership further to bring N26 customers an enhanced and even more convenient experience.

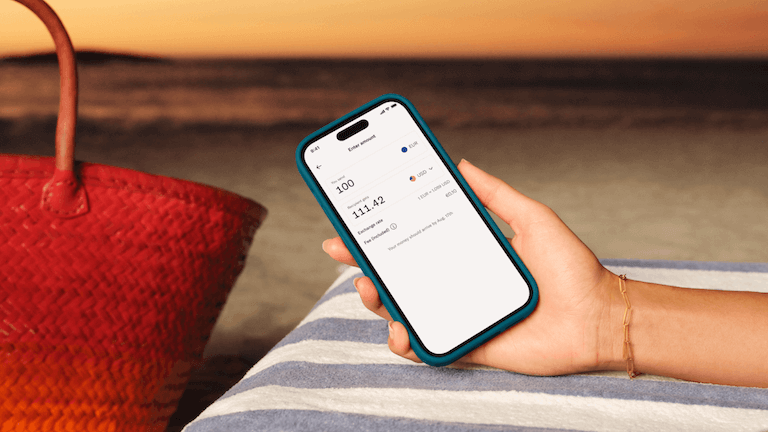

Thanks to our powerful API, Wise is seamlessly integrated into the N26 app, so customers can make international transfers right from their smartphone on one platform. As part of this transition, we’re rolling out nine additional currencies - BDT, CLP, JPY, KRW, LKR, PKR, THB, TZS, UYU (with more in development) - and opening up more possibilities for international transactions.

Pablo Suarez, Head of Product - Payments at N26 commented: “The new interface and features reflect our commitment to providing a personalised and seamless experience to our customers. This integration not only streamlines the payments process but also ensures that customers have a consistent experience across all their financial interactions.”

Customers are now greeted with an even more user-friendly platform that is not only more intuitive, but also more aligned with the N26 brand. They are able to complete the end-to-end transfer within the N26 app, so managing and tracking international payments directly from their app is easier than ever.

We share our vision for transparency with N26, so customers will always get the mid-market exchange rate with no hidden mark-up - prices are transparently shown upfront with real-time updates on the status of each transfer.

Learn more about how Wise Platform is opening up a world of payments for banks and global enterprises on our website.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Explore the 5 cross-border payment trends defining 2026. From G20 targets to retail customers, discover how global payments are moving from sprint to standard.

Discover how EQ Bank launched international payments in just one month — with 75% arriving instantly* and 70% becoming repeat users.

Many banks are taking the first steps toward delivering exceptional customer experiences by using next-generation correspondent service providers.

Triin Teppo, Wise's Head of Global Products Operations, examines the importance of straight-through processing for improving the customer experience.

Problem Getting paid on time and the right amount has long been the biggest downside of flexible work for freelancers or contractors. Often it is the...

Deel is a leading global HR and payroll company enabling more than 15,000 companies, spanning from SMBs to large enterprises, to scale their teams around the...