Austria corporate tax - guide for international expansion

Learn about the corporate tax system in Austria, its current rates, how to pay your dues and stay compliant, and best practices.

If your business imports products from abroad, you’ll need to know about Cash Against Documents (CAD). This method of financing may be preferred by the vendors you’re buying from, so it pays to be clued up on what it is.

In this guide, we’ll cover everything you need to know about Cash Against Documents as an importer, including what the process looks like. This can help you decide whether you’re happy to go ahead with a transaction where CAD is the preferred process, and to understand what your responsibilities will be as the buyer.

| 💡 💸 Save money when paying overseas suppliers - get Wise! |

|---|

Cash Against Documents (CAD) is a kind of transaction used in international trade. It can also be described as a management and payment tool.

With a CAD agreement in place, the seller will only release the shipping and title documents for the exported goods once payment has been received from the importer. These documents often include the bill of lading, invoices and other key ownership documents.

Once the payment is received by the seller’s bank, the documents are released and the importer can take possession of the goods and clear customs.

In simple terms, Cash Against Documents can be thought of as cash on delivery. It’s also similar to real estate transactions, where funds are held in escrow by a neutral third party until the transfer of titles is complete.

Here’s what a typical CAD process involves¹:

Once the order is accepted and an agreement made between buyer and seller, the seller will initiate the Cash Against Documents process.

The seller will prepare the required shipping documents required for the country of origin (where the goods are sent from), and the country of destination (where the buyer will be receiving the goods).

These documents, which typically include a Bill of Exchange, Export Collection form and other shipping documents, are sent to the seller’s bank.

The goods are shipped to the buyer’s country, but can’t be released to the buyer until the agreed payment is made to the seller’s bank. At this stage, the seller still owns the shipment.

Once payment is made in full, the seller’s bank will release the documents to the buyer.

The buyer can then legally take possession of the shipment at customs.

There are a number of benefits to the Cash Against Documents system for both buyers and sellers. However, there are downsides too. Let’s run through the pros and cons now:

It helps to ensure that the seller gets their money on time - providing greater payment security compared to other methods

It can give the buyer an opportunity to inspect the goods before transferring funds to the exporter. This helps to ensure the goods are of the promised quality and that the shipment is as agreed.

As a financing/payment method, it’s much easier for both buyer and seller to use than formal documentary credit processes.

The cost is relatively low for both parties. In CAD transactions, the bank or financial institution will usually charge a small fee for its service¹. It’s often the case that buyer and seller will split the fee, although the sales agreement may stipulate otherwise.

There’s no guarantee that the importer will pay to complete the transaction - they may inspect the goods and find a problem, or refuse to transfer payment for another reason. If this happens, the exporter may be left out of pocket for shipping costs, and the shipment will be stuck in another country.

In some cases, poor bank processes could mean that grant documents are prematurely granted to the importer.

No bank guarantee of payment, or insurance relating to the proper management of the CAD process on the part of the bank.

Payments through bank can be expensive

Now that we’ve got a grip on the Cash Against Documents process, it’s time to think about making the actual payment.

If your business regularly imports goods from abroad, you’re going to need to find the most cost-effective way to make international payments in different currencies.

You could be losing a small fortune on transfer fees, currency conversion charges and poor exchange rates every time you make a purchase using traditional methods like banks. There’s also speed to think about, as banks tend to be slow as well as costly.

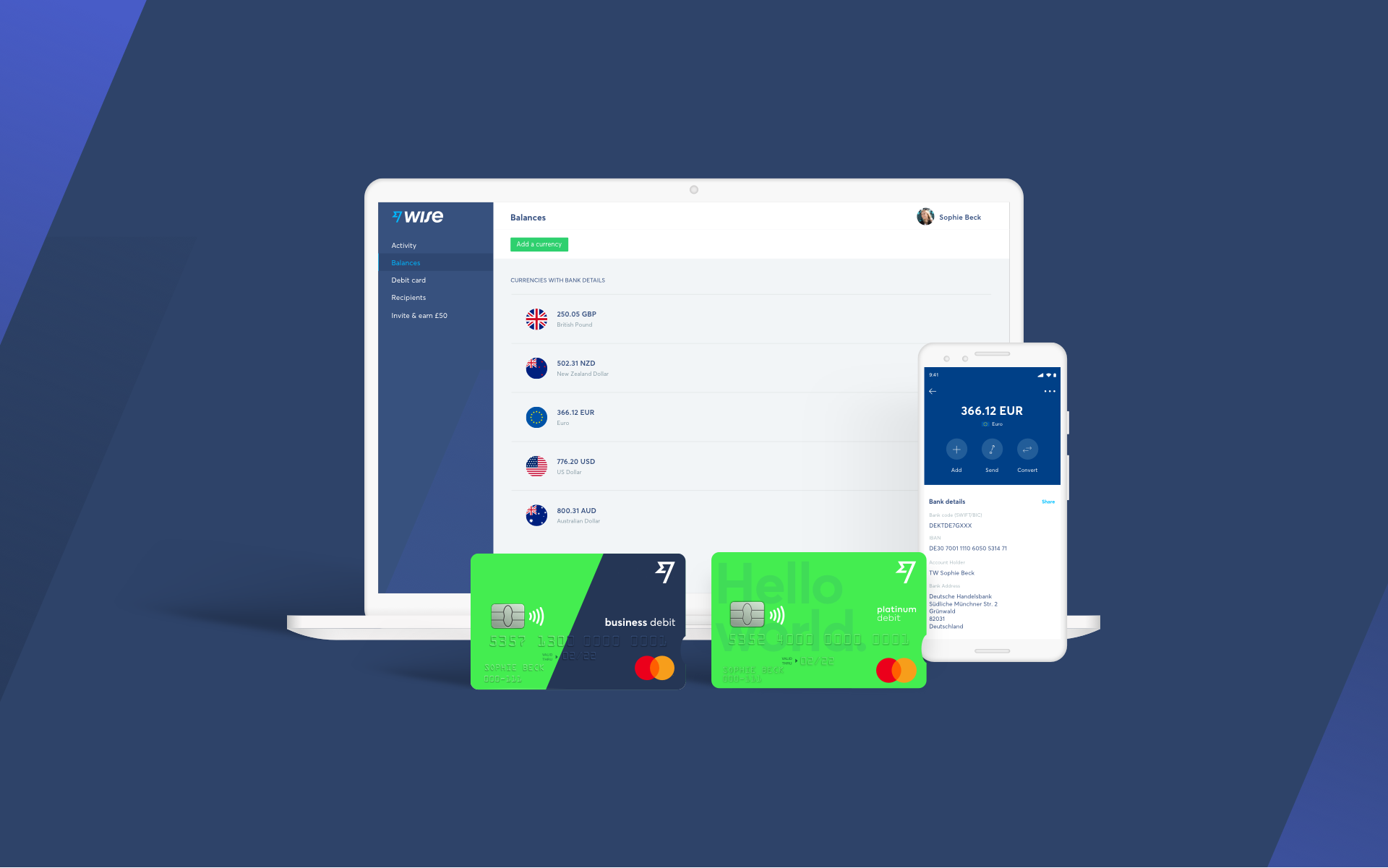

Wise is the perfect alternative for importers, or any business which trades across borders.

With the Wise multi-currency account, you can pay international invoices in just a click, up to 6x cheaper than traditional banks. There are only small, transparent fees to pay, with no hidden charges to worry about.

You can hold 50+ currencies and move money between them whenever you need to, all from the one powerful account. The best part? All transactions are done at the mid-market exchange rate.

Payments with Wise are fast and secure, so you can pay your vendors and suppliers on time and get hold of your goods faster.

Final thoughts

So, that’s pretty much it - the Cash Against Documents process in a nutshell. We’ve looked at what it is, how it works and the pros and cons for you as an importer, as well as your suppliers.

Importantly, we’ve also covered how Wise could be a game-changing payments solution for businesses with overseas suppliers.

You should now be armed with all the info you need to import goods from overseas in complete confidence. Good luck!

Sources used for this article:

Sources checked on 26-12-2021.

Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about the corporate tax system in Austria, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Botswana, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Chile, its current rates, how to pay your dues and stay compliant, and best practices.

Understand the essentials of terms sheets in business. Learn the key components to help you negotiate your next deal.

Learn about the corporate tax system in Montenegro, its current rates, how to pay your dues and stay compliant, and best practices.

Learn about the corporate tax system in Monaco, its current rates, how to pay your dues and stay compliant, and best practices