Variable Cost: Definition, Formula and Calculation

What is a variable cost?

A variable cost is an ongoing business expense that is subject to change directly based on how much of product is made or sold. If the total volume of goods you produce increases, then the variable costs will increase, too.

Likewise, if theres a reduction in the quantity of products made, then the variable costs will also decrease.

It's important to know how much and where your variable costs are coming from to have better control and visibility of your business's expenses. It can help streamline your operations and increase profitability.

In the income statement, it is represented, primarily, by the Cost of Goods Sold (COGS).

Assuming the variable cost is the only component in the Cost of Goods Sold, Gross Profit can be calculated as:

So, the higher the variable cost per unit, the lower the Gross Profit, reducing the operating margin and profitability margin. In other words, the profit margin is indirectly related to variable costs.

Variable vs. Fixed Cost

In order to understand how variable costs impact your profit margins, it's useful to know how fixed costs work. Unlike variable costs, this type of expense stays the same regardless of how much (or how little) you produce or sell of your products.

Take the example of a business that manufactures bikes, the fixed cost does not vary based on the number of bikes made or sold. Consider the cost of owning a manufacturing building. If the manufacturing is ramped up by 10%, the cost for owning or renting the building remains the same.

A few examples of common fixed costs for this kind of business would be:

- Lease for the facility

- Taxes on property

- Equipment maintenance

- Depreciation

- Insurance

- Salaries (for indirect labor)

Financial costs like interest expense may also be considered a fixed cost because it is not dependent on the production level.

In contrast, if the number of bikes produced increases, thevariable cost would increase in line new number of manufactured units

Several typical costs are variable, and some of the most common ones include:

- Materials

- Labor

- Cost for utilities like electricity

- Commission

- Transaction fees

| 🌎💸 Save money when you pay overseas suppliers - get Wise today! |

|---|

How variable and fixed costs affect decision making

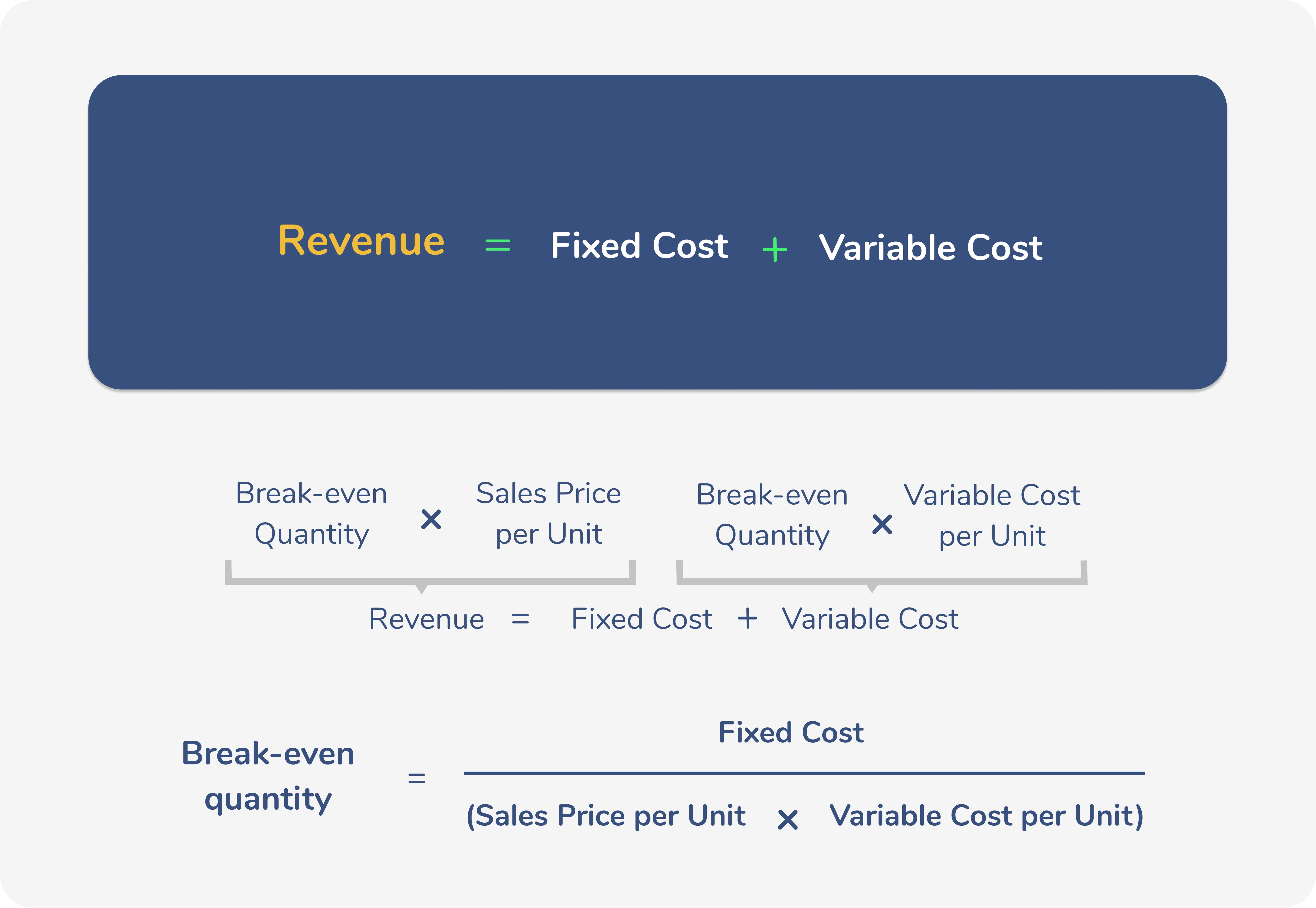

A business needs to sell at least a certain number of units or goods to cover all costs to be profitable. This number of units or goods is called the break-even point or quantity. The number of units sold ensures that enough revenue has been made to cover both the variable and fixed costs.

Mathematically, the revenue (R) should be equal to fixed cost (FC) plus variable cost (VC) in order to determine the precise break-even quantity.

The difference between the sales price per unit and the variable cost per unit is called the contribution margin. The higher the margin, the less the number of units required to achieve the break-even quantity.

The goal for most businesses it to generate enough sales that at least covers the fixed costs as this expense stays the same.

It's important for the contribution margin to be positive as if a business suddently decided to stop operations, there are likely to be some fixed costs that will still need to be paid for until contracts expire (e.g. rental agreements).

Variable and Fixed Costs Analysis

The break-even analysis is an excellent way to understand the dynamics of fixed and variable costs and the sales level required to cover these.

Another way of analysing fixed and variable costs is determining the degree of operating leverage. The degree of operating leverage is a way to understand how sensitive Earning Before Interest and Tax (EBIT) is regarding sales.

Companies with a higher proportion of fixed cost to variable cost will have a higher degree of operating leverage. This means that if the sales drop, the EBIT will drop at a higher rate for a company having a higher proportion of fixed cost compared to a company with a low level of fixed cost.

This can be illustrated with the help of an example below.

| Company | Sales | Variable Cost | Fixed Cost |

|---|---|---|---|

| A | 100 | 50 | 20 |

| B | 100 | 50 | 30 |

Both the companies have the same sales and variable cost, but the fixed cost is different. The assumption is that variable cost is 50% of sales. The EBIT for A and B are 30 and 20, respectively.

Now assume that the sales drop by 20%.

| Company | Sales | Variable Cost | Fixed Cost |

|---|---|---|---|

| A | 80 | 40 | 20 |

| B | 80 | 40 | 30 |

In this case, the EBIT now becomes 20 and 10 respectively. Therefore, for a 20% drop in sales the drop in EBIT for A and B can be calculated as:

% change in EBIT for A = (20-30)/30 = -33.33%

% change in EBIT for B = (10-20)/20 = -50%

It can be seen that the profitability for B is more sensitive to the fluctuations in revenue on account of a higher fixed cost. For companies looking to reduce the degree of operating leverage, it is essential to consider the role of fixed cost.

Variable and Fixed costs of an international business

In an international business, consolidating variable and fixed costs can be a difficult task. Sales and costs can be incurred in multiple currencies as companies source and sell across different countries. While expanding globally allows businesses to access foreign markets, it poses a new set of challenges.

Some of the challenges that a business can face are:

- Impact of foreign exchange on these costs

- Different rates of taxation

- Accounting methods may vary across jurisdictions

- Unforeseen costs on account of international business

Aggregating these additional costs for an international business can impact the profit margin. If a company does not hedge or pays too much commission for exchanging foreign currencies, costs can creep higher. For example, a European carmaker may have to import steel from China and pay in Yuan. Volatility in the exchange rate could drive steel prices higher when converted into Euros, and this, in turn, would increase the variable cost.

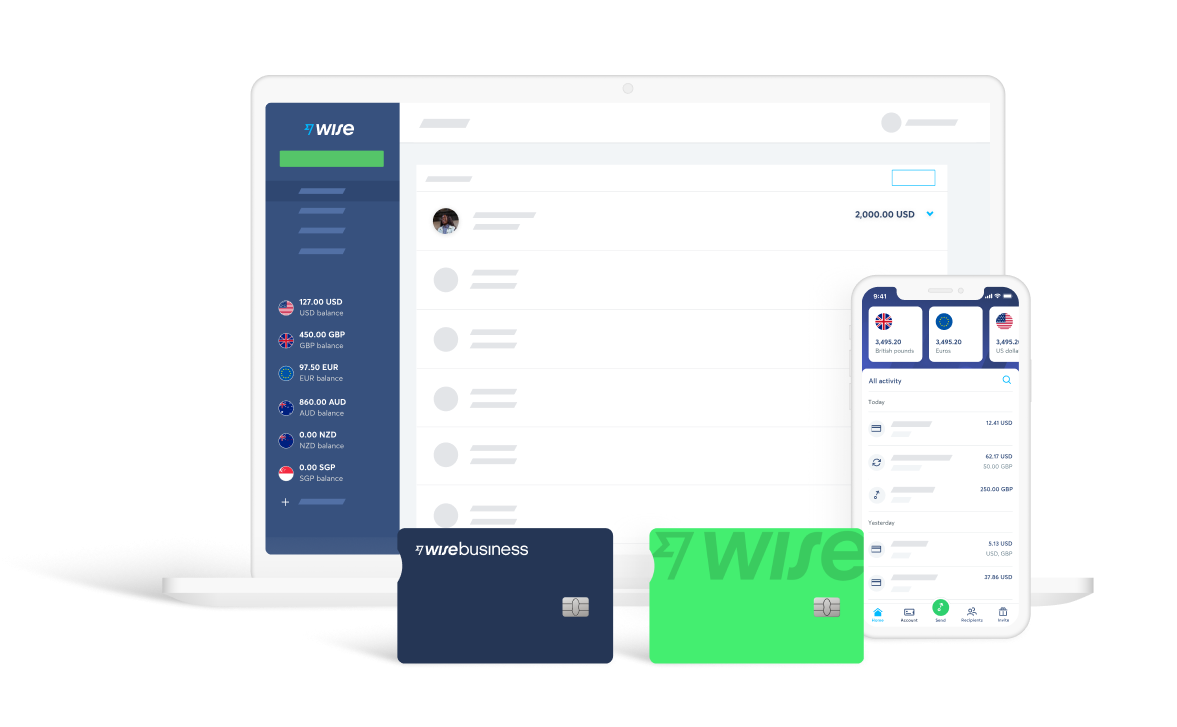

| 💡🌎 Tip! If you’re looking for an easy way to manage your business costs as a multinational business or simply need a cheaper way to pay suppliers and contractors overseas, check out Wise Multi-currency Account so you could receive payments in 10 currencies like a local and make conversions at the mid-market rate with no mark-up. |

|---|

Are there ways to reduce business costs?

There are several ways in which a business can reduce the total cost involved.

-

Use a multi-currency account when handing payments in different currencies

Another important way to reduce costs is by reducing the commission or fees when payment has to be done in multiple currencies. For payments involving the exchange of currencies, businesses could use multi-currency accounts like Wise for business. Wise offers numerous advantages like a competitive conversion rate, a multi-currency account, and low international transfer fees. In the context of a business that is sending tens of thousands or millions in different currencies, the impact could be a few percentage points to profitability margin. -

Buying raw materials in bulk and asking for a discount from the supplier

Making bulk orders is a common way to reduce the cost of materials. This can also reduce the transportation cost by decreasing shipments as the number of badges decreases. -

Outsourcing some of the activities to regions where labor is cheaper

Outsourcing, if done right, can also reduce the cost required for manpower. Shifting the production facilities to countries that promote industries by waiving off costs related to capital investments is another effective way to reduce overall costs.

| Find out more today on how to increase your foreign exchange margins with Wise. |

|---|

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.