We'll lose £215 billion to hidden fees unless we act

We’re set to lose £215 billion to hidden fees this year alone. That's because today, banks and other providers are able to tell you your transfer is free, has...

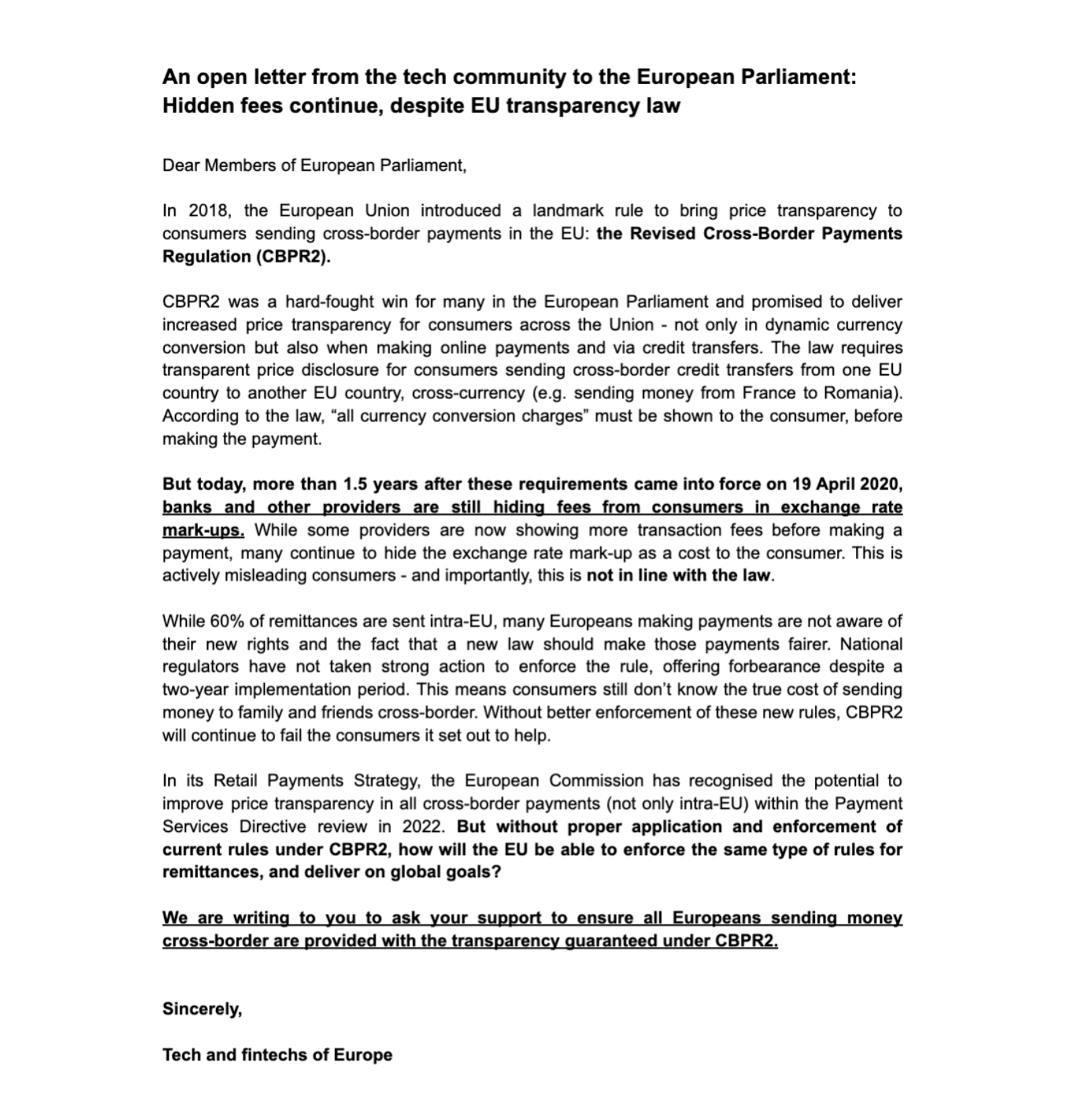

Cross-border payments are a secret rip-off: European consumers lost 12.5 billion in hidden fees in a single year. In 2018, the European Union introduced a landmark rule to fix this. The goal was to give price transparency to consumers sending cross-border payments in the EU: the Revised Cross-Border Payments Regulation (CBPR2).

Its goal is to ensure consumers understand what they’re paying, before making a payment. The rule requires transparent pricing for consumers sending cross-border bank transfers from one EU country to another EU country, cross-currency (e.g. sending money from France to Romania). According to the law, “all currency conversion charges” must be shown to the consumer, before making the payment.

But today, big banks and other providers are continuing to hide fees in exchange rate mark-ups. That’s when they deliberately give you an exchange rate that’s much worse than the one you see on Google.

We came together with a group of tech companies in Europe to call on the European Parliament to take notice. As long as CBPR2 isn’t applied and enforced, European consumers will continue to lose out.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

We’re set to lose £215 billion to hidden fees this year alone. That's because today, banks and other providers are able to tell you your transfer is free, has...

From holidaymakers, students funding their student loans, people sending money to support loved ones back home, to small businesses working with overseas...

Chancellor of the Exchequer HM Treasury 1 Horse Guards Road London SW1A 2HQ Dear Chancellor, We are writing to you to take this opportunity to stop hidden...

£187 billion! That’s how much people and businesses lost to hidden fees in a single year.

Share your story with us. Why is sending money abroad important to you? How are hidden fees impacting you and your family? The International Day of Family...

Help change the law! Last year, when sending money abroad, British consumers and businesses lost £5.6 billion in fees. Is it bonkers? Yes! Is it surprising?...