4. The Unbundling of The Banks 2.0 - Lower Barriers to Entry

Chapter 4 of 5. Read the full report here.

The most important impact of the first phase of unbundling is the proof of concept. Version 2.0 will have lower barriers to entry. New entrants will now come to a market where millions of potential customers have already turned to a non-bank technology company for their banking needs - and will expect more. Even those customers who don’t currently need or use a fintech service will consider them as an alternative equal or better than a bank. Consumers expect a major shift in their own behaviour over the next five years.

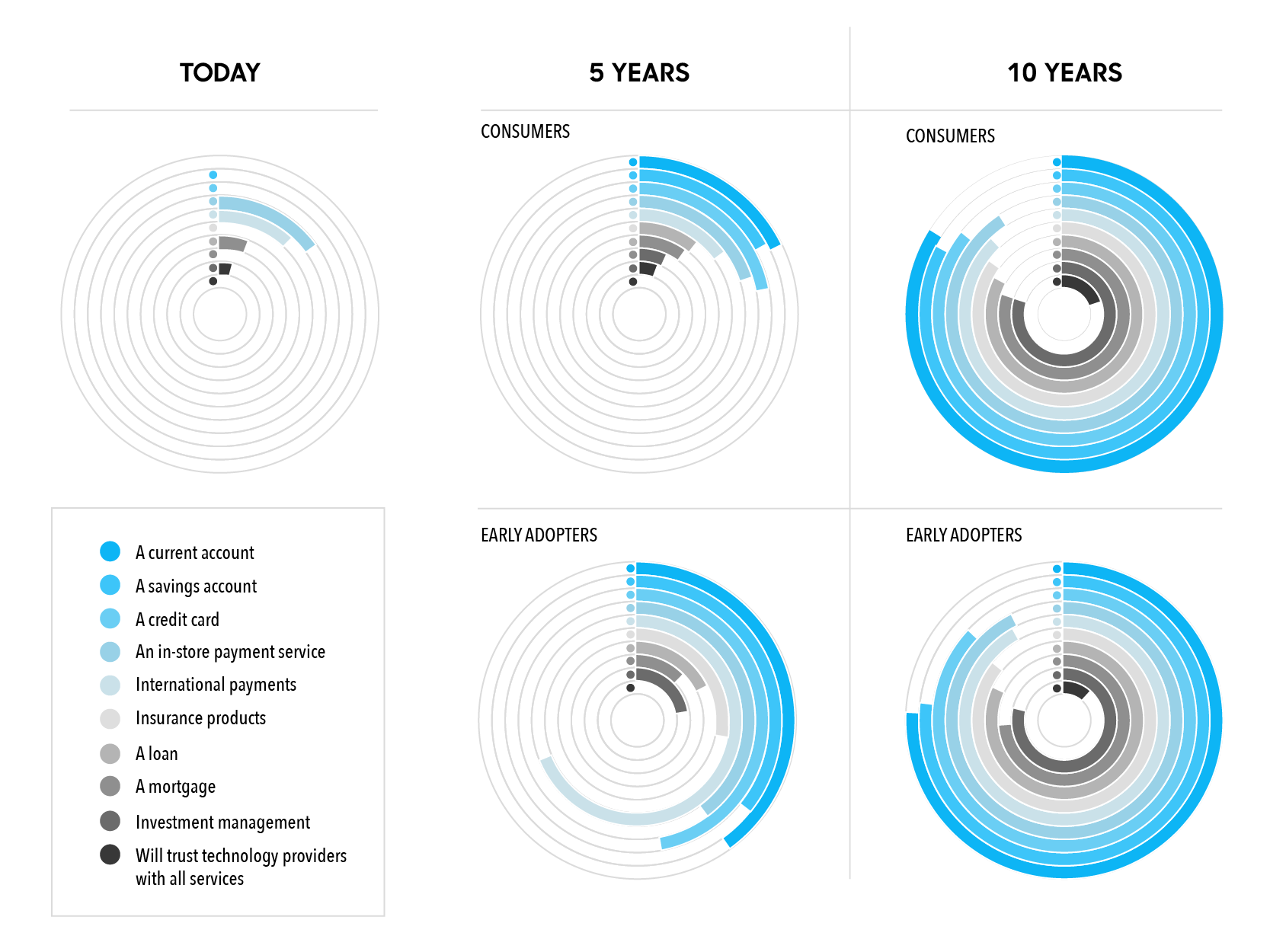

In 2015, 68% of people had never used a technology provider for financial services such as in-store payments, international money transfers, lending, wealth management, property investment. In five years’ time, half (48%) of consumers expect to use a technology provider for at least one financial service. A third (32%) expect to use a technology provider for 50% or more of their financial needs. Among early adopters, that number more than doubles, with 85% expecting to use a technology provider for 50% or more of their financial needs, or saying they already do so. Looking at specific services, on average a fifth of people think they will use a technology provider for ‘day-to day’ services such as current and savings accounts, credit cards and in-store payments in five years’ time.

Early adopters are on average 2x more likely to consider a tech provider for any given product and 3x for investment management. The ‘bigger’ financial decisions eg insurance, investment management and mortgages are the least likely activities where technology providers will be preferred. Looking ahead to ten years’ time, the picture changes even more dramatically: 20% of consumers anticipate they will trust technology providers with all their financial service across the board from credit cards to mortgages.

####Consumers’ predictions of their own uptake of fintech over the next 10 years

One of the most significant findings was that, for the most part, people from different age groups have similar views on technology providers of financial services. Those aged 18-54 were broadly similar in their responses; but the 55+ group were less likely to consider technology providers. This group was the least trustful of alternative providers with 25% (compared to an average of 17% across other age groups) saying they would not trust a technology provider for any of their financial needs. The most significant difference was that 34% of those 55+ (compared to an average of 23% across other age groups) said that currently nothing would motivate them to use technology providers for services that their banks offered. They also had the least confidence of using them in the next five years.

####What motivated the early adopters?

The most significant differentiator between early adopters and the general consumer when it comes to considering fintech is trust in the banks. For most people, their view of the banks seems to be one of ambivalence with around a fifth (19%) not trusting in the banks’ ability to look after their finances, and a third (32%) trusting them a lot. (The age group with the least trust in the banks was those aged 35-44.) This is in stark contrast to early adopters who are almost 3x as likely not to trust a bank (54%) and only 10% trust them a lot. It’s this lack of trust that appears to have been the motivator for early adopters to choose alternative providers.

####What will drive future uptake?

People are ready and willing to consider fintech alternatives. 73% of consumers say that they would consider using technology providers for services that they usually use their bank for.

It’s a common assumption that concerns about the security of non-bank providers have been a barrier in the uptake of fintech. However, there was little differentiation in the research between the views of early adopters and general consumers on this matter. 54% of early adopters - compared to 52% of general consumers - consider technology providers as or more secure than banks and around a third (32% of early adopters and 33% of general consumers) consider them less secure. As people become trusting tech companies such as Google, Amazon and Facebook with their personal information, they will also start trusting start-ups.

If security is of equal concern to early adopters and mainstream consumers alike, what is the differentiation? For 62% of early adopters, cost is the primary motivation for using technology providers rather than banks. The services that have been the first to be disrupted are those where the consumers are getting the rawest deal in bank charges - the money saved becomes then the reason for switching. Cost is also a consideration for those who have not yet switched to technology providers.

The five main factors that would prompt consumers to use technology providers for services that they usually use their bank for are:

- a more secure service than banks 34%

- a better cost than banks 29%

- a more convenient service than banks 26%

- a quicker service than banks 18%

- better customer service than banks 18%

These are all features that technology providers are now able to provide - the playing field is now level and consumers are able to choose the service they want. Interestingly, among early adopters, there’s an indication of the next development. A third (33%) would increase the amount of services they’d use technology providers for if multiple services were available from one provider.

Consumers are used to one provider offering them multiple services but that’s currently not the case with technology providers who initially focus on one service. There may be a time where technology providers offer more than one service but there is a tech solution that could meet that need too. The potential for the smartphone to act as the ‘gateway’ to multiple services is real. If different apps connect and interact with each other, for example if your messaging app allows you to pay someone from your current account as you message them, then your phone takes the place of the bank.

####Read the full report:

- Introduction and Summary - The Future of Finance

- Creating The Perfect Storm

- The Unbundling of The Banks 1.0

- The Unbundling of The Banks 2.0

- Conclusion: The Democratisation of Finance

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.