Inheritance tax for UK non-residents: A guide

Read our helpful guide on inheritance tax for UK non-residents, including how IHT works, current tax rates and whether non-residents have to pay it.

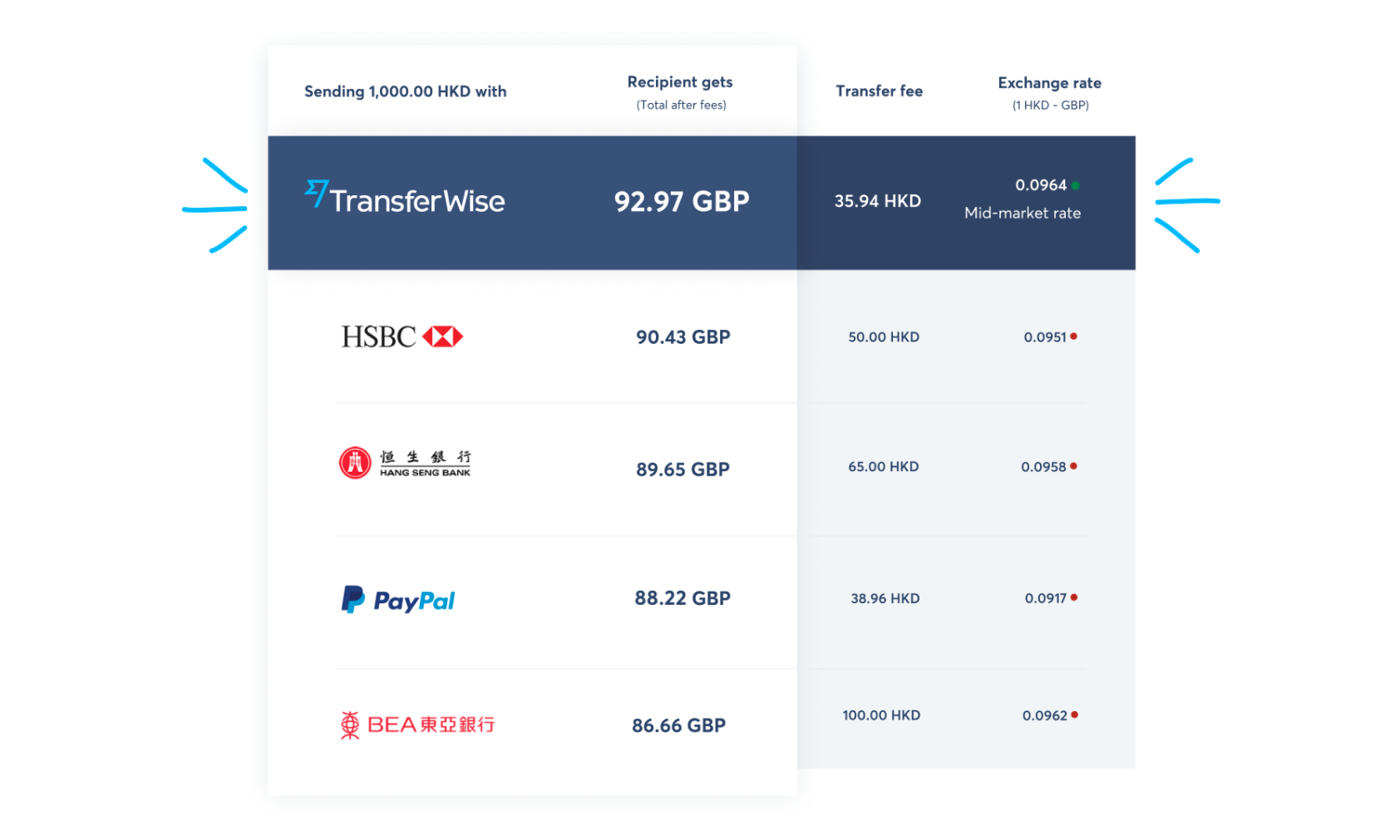

There are usually two costs associated with sending money abroad: the fee, and the exchange rate. To be precise, there’s the upfront fee providers charge you for their service, and the markup many of them add to the rate that’s used to convert your money.

Banks and other providers can make it hard to understand exactly what you’re paying for. They might say they have low, or even no fees, but they won’t tell you whether they’re using the real, mid-market exchange rate.

Since many providers mark up the exchange rate without telling you, you’re liable to pay more than you need to for an international transfer.

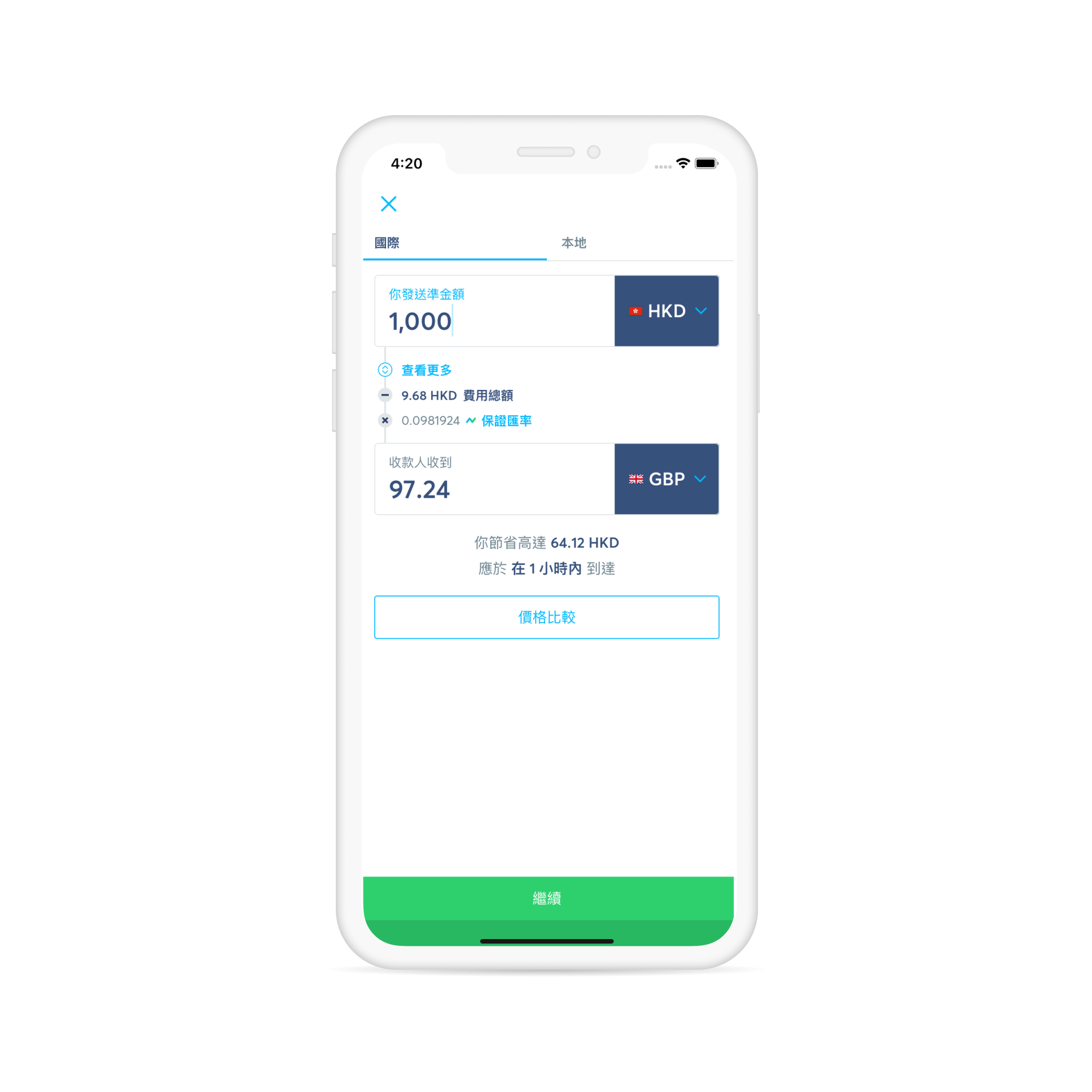

At Wise, we always want you to know exactly what you’re paying for. That’s why we put our rate and fee right upfront.

But we also don’t want you to pay any more than you really need to, so we’ve built a comparison tool for you. It makes it easy to compare the cost of your transfer with different providers. If there’s a cheaper option out there, the tool will just tell you.

Rates displayed as of 2 September 2020. Check our comparison tool for the latest rates.

If you’re sending money to the UK, EU, or US, and you pay for your transfer with an instant pay-in method — like a debit or credit card — we’ll get the money to your recipient instantly.

If you’re sending money to other countries, we always tell you how long it will take to reach them. Fifty percent of all our transfers arrive within one hour, and you can track the status of any transfer in your account.

Besides sending money to your loved ones, you can also send money to pay for your online shopping purchases abroad — and save on exchange rates and transaction fees.

Wise’s mission is money without borders — instant, convenient, transparent, and eventually free. Our goal is to open up Wise to every person. That’s why we’ve also launched our service in Traditional Chinese.

Here’s how you can start using Wise in Traditional Chinese.

On laptop:

On phone, if your language setting is 繁體中文(香港), the app will automatically be translated to Traditional Chinese.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Read our helpful guide on inheritance tax for UK non-residents, including how IHT works, current tax rates and whether non-residents have to pay it.

How much money can you receive as a gift from overseas in the UK? Read our guide and find out the latest rules.

Find out everything about retiring in the UK, including visa options, money requirements and healthcare.

Learn how to pay bills in Italy, using different methods like post offices, banks and online platforms.

Learn how to pay a bill in euros from the UK with Wise at a mid-market rate and save on unnecessary fees and foreign exchange conversions.

Wondering how to pay a bill in France from the UK? Discover secure methods like bank transfers and online tools to manage payments with ease.