What the Supreme Court’s tariff decision means for your business

Last month, the United States (US) Supreme Court ruled that many of the government’s tariffs were unconstitutional. The 6-3 decision found that the...

If you use PayPal for your business in the UK, you can set up PayPal Direct Debit payments to enable fast automatic payments of ongoing bills. That can be handy for paying a subscription or retainer, for example, and allows you to ‘set and forget’ important payments so you never need to worry about missing one.

So - what is PayPal Direct Debit and how does it work? This guide walks through how to set up PayPal Direct Debit, how PayPal’s fees work, and some common questions and answers.

We’ll also touch on Wise Business as a great alternative way to set up Direct Debits to pay bills - with low currency conversion costs when you’re dealing with overseas suppliers, contractors or team members.

💡 Learn more about Wise Business

PayPal Direct Debit is a simple way to set up recurring automatic payments, in which you can authorise a merchant to debit your account automatically as long as you know in advance the amount they’re billing you. The funds are then automatically debited from your preferred payment method - such as your bank - and you can also indicate a back up payment method for occasions when your primary payment method can’t be used.

When you set up a PayPal Direct Debit agreement you complete a Direct Debit instruction on PayPal, and the payments are then automatically taken from the payment method you indicate. This can be handy if you’re signing up for a SaaS subscription for example. You’ll complete your Direct Debit agreement - known as a Direct Debit mandate - and then the money is deducted according to your agreed schedule, from your preferred payment method.

If you nominate your business bank account as your payment method you’ll then be able to see the billed amount on your normal bank statements, and can manage, change or cancel the ongoing payments in your PayPal Business account whenever you need to.

There are no specific PayPal fees for Direct Debits. However, it’s important to note that some costs might apply if you’re making payments in foreign currencies. If you sign up for a Direct Debit and PayPal needs to convert your currency to make the deposit in your recipient’s account, a currency conversion fee is likely to apply. In the UK this is usually 3% for business customers on PayPal¹

To set up Direct Debits from your PayPal account you need first to choose PayPal as your preferred payment method at the checkout. You’ll need to pick PayPal Direct Debit as the payment method you want to use, and then follow the instructions which are given by the merchant you’re shopping with.

Generally this will then require you to agree to the Direct Debit mandate which is set up to follow SEPA standards. You only need to complete this step the first time you want a specific payment to be made.

Here’s how to accept the PayPal SEPA Direct Debit mandate²:

Once you have an active Direct Debit you can then manage it to change your primary or back up payment method in the PayPal app or by logging in online.

Here’s how to find your Direct Debits on the PayPal website when you need to make changes:

Once you’ve selected the correct payment, you can change your payment methods for any PayPal Direct Debit easily. Here’s how:

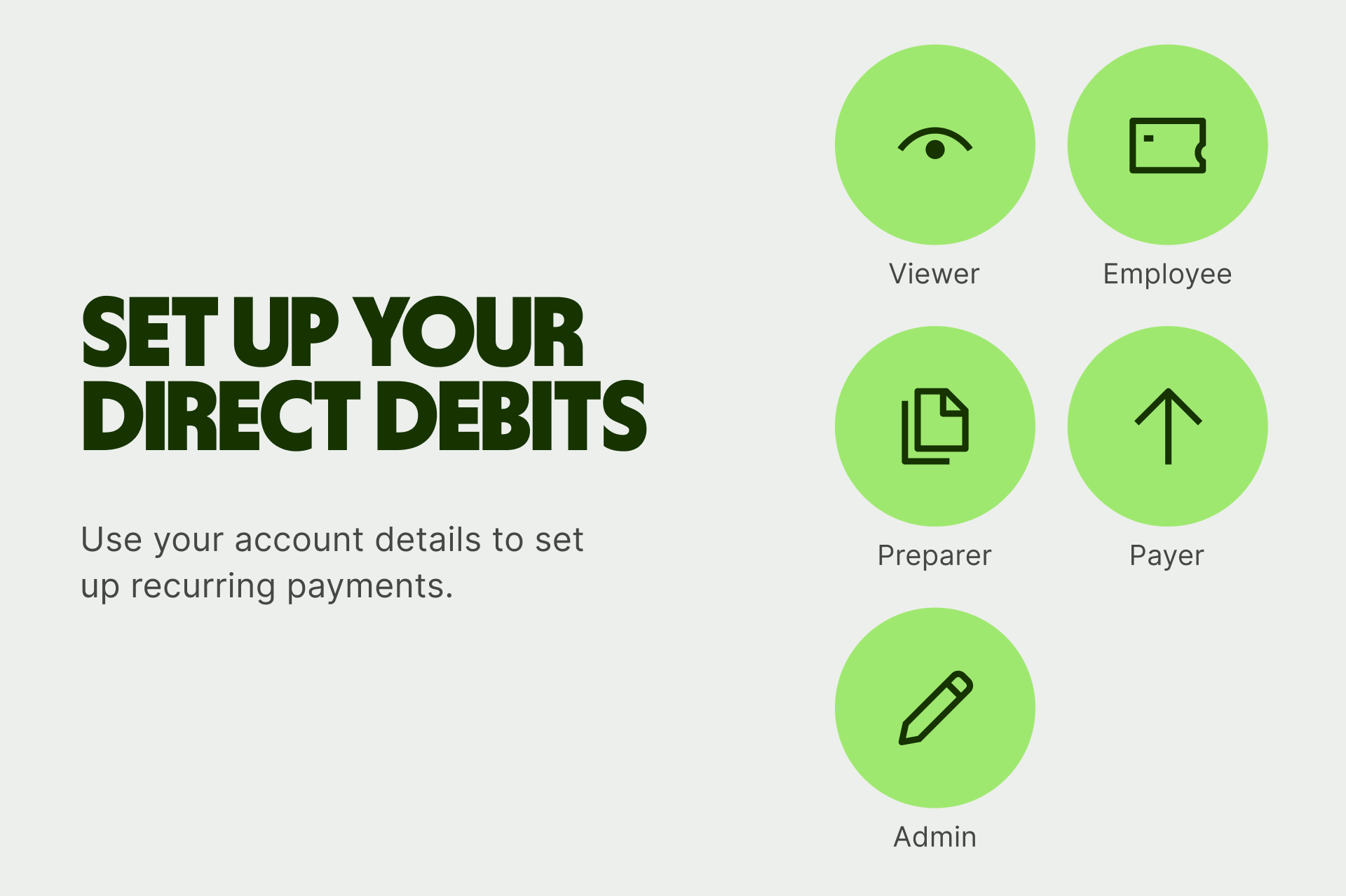

You’ll see the PayPal Direct Debit payment methods which apply to your account and payment type, when you arrange your automatic payment. The standard options for PayPal payment methods include³:

You’ll see which is available when you set up your payment, and can also add additional bank accounts or cards when you’re getting your payments sorted. If you’re making recurring payments in foreign currencies you may benefit from linking PayPal to your Wise Business account, to pay with low currency conversion costs.

Or, you can also skip PayPal altogether and use Wise to set up Direct Debits for your business in currencies like GBP. EUR and AUD (only with Wise Business Advanced). This allows you to pay directly in foreign currencies if you hold them in your Wise Business account, without incurring additional currency conversion fees. That can be handy if your business receives customer payments in a currency like euros, and also needs to pay suppliers or contractors in the Eurozone. Just set up your EUR Direct Debit and pay from the funds you receive from customers in euros, to make the process as streamlined as possible and cut out unnecessary fees for currency conversion.

💡 Learn more about Wise Business

Once you have a PayPal Direct Debit set up you can manage the payment and make changes in the PayPal app or online, by logging into your account.

Here’s how to cancel a Direct Debit on PayPal:

You can also follow similar steps if you want to change your payment method, rather than cancelling the instruction entirely.

Here’s how to update your Direct Debit payment method in the PayPal app:

If you have suppliers in other countries, or would love to trade internationally in the future, it’s super handy to have a Wise Business account.

With this powerful multi-currency account, you can send payments to 140+ and set up direct debits for your international bills. You can hold 40+ currencies in your account at once and switch between them when you need to, always with the mid-market exchange rate.

Get started with Wise Business 🚀

*Disclaimer: The UK Wise Business pricing structure is changing with effect from 26/11/2025 date. Receiving money, direct debits and getting paid features are not available with the Essential Plan which you can open for free. Pay a one-time set up fee of £50 to unlock Advanced features including account details to receive payments in 22+ currencies or 8+ currencies for non-swift payments. You’ll also get access to our invoice generating tool, payment links, QuickPay QR codes and the ability to set up direct debits all within one account. Please check our website for the latest pricing information.

The exact length of time it takes for your PayPal Direct Debit payment to arrive with the recipient can vary depending on the payment method you select. Generally, Direct Debit payments can arrive in 1 - 3 days, which makes them a good choice for recurring payments, but not necessarily the ideal option for very urgent transfers.

You can use PayPal Direct Debit for any transaction where this is shown as a payment method available. Merchants may change the payment methods they accept and prefer, so if you don’t see this option at the check out you may need to choose a different payment method instead.

If your Direct Debit comes due and there’s not enough money in your bank account, PayPal may choose to use your backup payment method to fund the transfer. If there’s not enough money available in the backup, the payment might be declined.

If a PayPal payment is declined by your bank or your card issuer, PayPal will not receive details of why this has happened, to protect your privacy⁴. You’ll need to reach out to the bank or card provider yourself to get more information.

If you have a UK business and use PayPal to manage your company finances, you might find that the PayPal Direct Debit service is a convenient way to set up and manage recurring payments like subscriptions and retainers for contractors. Direct Debits allow you to set and forget important payments, so you won’t miss them in future and can get on with running your business.

If you’re managing international payments, there may be PayPal fees to send foreign currency Direct Debit transfers. Take a look at Wise Business to see if you could be better off - either by connecting Wise to PayPal to manage PayPal Direct Debits in foreign currencies for low fees, or by making Direct Debit payments through Wise directly in currencies like GBP. EUR and AUD.

Sources used in this article:

Sources last checked 25/06/2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Last month, the United States (US) Supreme Court ruled that many of the government’s tariffs were unconstitutional. The 6-3 decision found that the...

Having trouble deciding which Wise Business account is best for your business? We’re breaking down the differences between the ‘Essential’ and ‘Advanced’...

From messaging upgrades to hosted onboarding, here is how we’re evolving to help you and your end customers move money with speed and confidence.

Discover the essential costs involved in starting a business in Malaysia as a UK resident. Our guide covers incorporation fees, capital requirements, and more.

There comes a time in almost every startup’s journey — whether in the UK, Europe or further afield — when its executive team considers expansion to...

Learn about all the costs to budget for to start a business in Spain as a UK resident. Our guide covers incorporation fees, capital requirements, and more.