Best savings accounts for non-UK residents

Read our roundup of the best savings accounts for non-UK residents, including options from Barclays, HSBC Expat, NatWest and Skipton International.

Looking for a new bank account? If you’re tired of using a traditional bank, you might be considering using one of the new wave of digital banks.

These ‘neobanks’ or mobile banks have rocketed in popularity in recent years. They’re a great option for people who love the convenience of banking using mobile apps, and are tired of the bureaucracy of an old-school bank.

But which are the best online banks in the UK, and which is the right choice for you?

Here in this guide, we’ll pit the UK’s most popular digital banks against each other. This includes the likes of Revolut, Starling, Monzo, Monese and Chase. We’ll also take a look at an alternative e-money account provider like Wise.

We’ll compare them on all the key things that matter - account types, features and of course, fees. This should help you choose the solution that best suits your needs.

So, let’s get started.

| Providers listed in this guide |

|---|

Launched in 2015, Revolut is currently one of the fastest growing digital banks in Europe. It has recently obtained a UK banking licence, although it still needs to complete what is known as a ‘mobilisation’ process before it can operate as an official UK bank.1

It has over 50 million personal users, along with over 500,000 business accounts.2

Revolut offers a range of financial services through its innovative mobile app, from everyday transactions right through to cryptocurrency trading.

As Revolut is still an e-money institution authorised by UK Electronic Money Regulations rather than a licensed bank, it doesn’t yet offer protection under the Financial Services Compensation Scheme (FSCS).

Instead, it uses a measure known as safeguarding to separate customer money from its own funds, and keep it at other trusted banks and institutions. You can read more on this on the Revolut website.

Revolut has a choice of plans available, starting with a basic free plan. It has three tiers of paid plans above this, where you get more features for a higher monthly cost. The free plan is called Standard, while the paid plans are Plus, Premium, Metal and Ultra.

All Revolut plans come with a debit card, access to the Revolut app and the option to pay money in and out. There’s also daily interest on your savings.

But as you go up towards the Metal and Ultra plans, you’ll get increased interest rates and higher limits on things like free ATM withdrawals.3 You’ll also get perks such as exclusive personalised cards, overseas medical insurance and unlimited currency exchange.

Revolut offers a huge range of features, although some are dependent on the plan you choose. If you’re on a Standard free plan, you’ll only be able to access basic features.

Here are just a few of the highlights:3

Here’s what you can expect to pay for each tier of Revolut plan:3

| Plan | Monthly fee |

|---|---|

| Standard | Free |

| Plus | £3.99 |

| Premium | £7.99 |

| Metal | £14.99 |

| Ultra | £45 |

Revolut also has some other fees you should be aware of. This includes:5

Starling Bank was one of the UK’s first digital banks. The idea was dreamed up back in 2014, it gained a UK banking licence in 2016 and eventually launched its mobile app in 2017.

Since then, Starling has attracted millions of customers and won multiple awards. It was even named the Which? Banking Brand of the Year in 2024.6

Starling Bank has a user-friendly and award-winning mobile banking app. And as it’s a fully regulated UK bank, your money is FSCS protected as a Starling customer.6

Starling Bank offers just one main account, its free current account. However, you can also apply for a joint account or Euro account. And for young people, there’s Starling Kite (a debit card for kids) and a teen account.

For business users, there’s a business current account, dedicated sole trader account and multi-currency account.

Here’s what you can expect when you sign up for a Starling Personal Current Account:7

One of the great things about the Starling current account is that it’s free, which means no monthly fees.

However, there are some other fees and charges you need to know about:8

One of the largest digital banks with 11 million personal and business customers,9 London-based Monzo launched in 2016.

A UK regulated online bank with FSCS protection, Monzo is also a Which? Recommended provider.9

Similar to Revolut, Monzo has a choice of current accounts, starting with a free plan. This is the original Monzo current account, which comes with a debit card, savings and access to borrowing and overdrafts. Everything’s managed in the Monzo app.

If you want more benefits, you can upgrade to Monzo Extra, Perks or Max. These paid plans are similar to packaged bank accounts, and start from £3 a month.10 They offer all the free features plus extras such as interest on your balance, railcards and travel insurance, cinema tickets and discounts (depending on plan). We’ll look at more features next.

The features you’ll get with Monzo vary depending on which account level you opt for. But here are just a few of the highlights:10

Now, how much does it cost to use Monzo? Let’s start with the monthly account fee:10

| Account | Monthly fee | Minimum term |

|---|---|---|

| Monzo | Free | None |

| Monzo Extra | £3 | None |

| Monzo Perks | £7 | None |

| Monzo Max | From £17 | 3 months |

There are also some other charges you should know about11:

Higher fees than the above may apply if you don’t meet certain Monzo requirements, such as paying at least £500 a month into your account.

Monese is a mobile money account provider first launched in the UK in 2015. It now has millions of customers across 31 countries.12

The service has an international focus, offering accounts in different currencies along with overseas money transfer services.

It’s not a regulated UK bank though, so doesn’t offer FSCS protection.

Monese offers an Instant Account for personal customers, along with dedicated accounts for businesses. You can choose to open your account in Sterling (GBP), Euro (EUR) or Romanian leu (RON).

Like Revolut and Monzo, it has a choice of plans - Simple, Classic and Premium. The Simple plan is free, while the others have a monthly fee in return for extra features like lower fees and higher allowances.

The features you’ll get with a Monese account all depend on your plan, with the paid plans unsurprisingly offering the most features.

Here’s a quick roundup of the most attractive features:13

There are quite a few fees applicable to Monese accounts. Let’s start with the monthly account fee:13

| Plan | Monthly fee |

|---|---|

| Simple | Free |

| Classic | £7.95 |

| Premium | £14.95 |

In terms of other charges, here are the main ones you need to know about:13

Chase is one of the UK’s newest digital banks, launched in 2021 by US banking giant J.P. Morgan. Millions of customers in the US already use Chase for everyday banking services.

Chase accounts are free to open, and deposits are protected by the Financial Services Compensation Scheme (FSCS). The bank was named ‘Best British Bank’ at the Smart Money People awards in 2023 and 2024.14

Chase offers a current account and a couple of savings accounts for personal customers. It’s also partnered with Nutmeg to offer investment services.

The current account comes with a debit card, access to the linked savings account and 24/7 support. It’s free to open, and there are no monthly fees. Everything is managed through the Chase mobile app.

Here’s what benefits you can expect when you open a Chase current account:15

The only major thing missing on this list is international transfers, as Chase UK doesn’t currently support them.

The great news is that Chase doesn’t charge any fees. There are no monthly fees for maintaining the account, and it’s fee-free to use your card internationally.

Chase uses Mastercard’s exchange rate for converting currency, and doesn’t add on any of its own mark-ups or transaction fees.16

While Wise is not a bank, it is an e-money institution authorised by UK Electronic Money Regulations and has many similar features.

Wise offers a multi-currency account that allows you to hold 40+ currencies and accept payments in 8+ currencies. So, it could be a good option if you’re considering switching from a bank or looking for an alternative if you’re unable to keep your existing UK bank account if you move abroad.

With Wise, you can send and receive money internationally, convert currency, and even spend worldwide with a linked debit card for spending in 150+ countries.

If you’re looking for an account you can use internationally, it’s a great option. Wise uses the mid-market exchange rate and only charges low, transparent fees*.

Wise is regulated in the UK, which means we are expected to adhere to strict rules and regulations to protect our customers.

Wise offers a free multi-currency account for individuals, along with a dedicated business account full of feature-packed solutions for businesses. It lets you manage your money in multiple currencies, all through your online account or the Wise app. You’ll get access to local account details so you can receive money in major currencies without the need for currency conversion.

And for a small one-time fee, you can get a physical Wise card linked to the account which can be used in 150+ countries. You can order a physical card for £7 or opt for a free virtual card. Whichever you choose, a Wise card automatically converts your money to the local currency using the mid-market exchange rate whenever you spend for only a small (but transparent and upfront) fee*.

There’s also a feature called Wise Interest, which lets you earn returns on GBP, EUR and USD and is available for both personal and business account holders. Capital at risk. Growth not guaranteed.

Investments can fluctuate, and your capital is at risk. Interest is offered by Wise Assets UK Ltd, a subsidiary of Wise Payments Ltd. Wise Assets UK Ltd is authorised and regulated by the Financial Conduct Authority with registration number 839689. When facilitating access to Wise investment products, Wise Payments Ltd acts as an Introducer Appointed Representative of Wise Assets UK Ltd. Please be aware that we do not offer investment advice, and you may be liable for taxes on any earnings. If you're uncertain, we urge you to seek professional advice. To find out more about the Funds, visit our website.

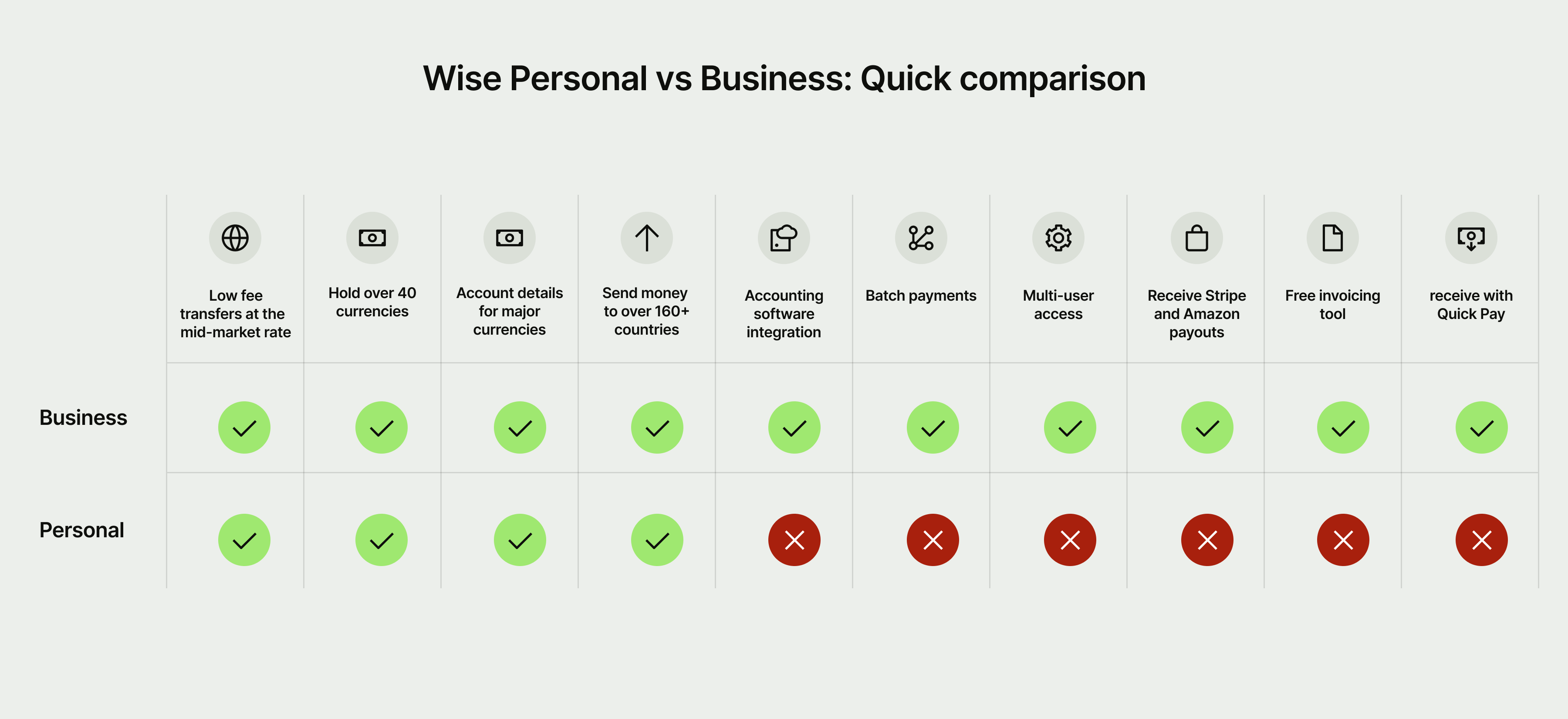

And if you’re looking for a Wise business account, it costs £50 (Advanced plan) or for free (Essentials plan) to open and has no monthly subscription fees. Learn more about the key differences between Wise’s personal and business account offerings below.

Wise personal vs Wise business

There’s no fee to open a Wise account as an individual, and no monthly fees. Here are the other charges you need to know about:

Please see the Terms of Use for your region or visit Wise fees & pricing for the most up-to-date information on pricing and fees.

Sources used:

1. Revolut - Revolut receives UK banking licence

2. Revolut - About Revolut

3. Revolut - Pricing Plans

4. Revolut - Revolut Account

5. Revolut - Fees (Standard plan)

6. Starling Bank - Awards

7. Starling Bank - Current account

8. Starling Bank - Rates, fees and charges

9. Monzo- Homepage

10. Monzo - Current Account

11. Monzo - Fee information

12. Monese - About Monese

13. Monese - Pricing

14. Chase - Homepage

15. Chase - Chase Account

16. Chase - Travel with Chase

Sources last checked on date: 18-Apr-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Read our roundup of the best savings accounts for non-UK residents, including options from Barclays, HSBC Expat, NatWest and Skipton International.

Check out our essential guide on how to open a bank account online, including bank types, required documents, fees, and more.

Check out our essential guide on how to open a bank account in Jersey as a British expat, including documents, fees, banks and much more.

Check out our essential guide on how to open a bank account in Monaco as a British expat, including documents, fees, banks and much more.

Check out our essential guide on how to open a bank account in Andorra as a British expat, including documents, fees, banks and much more.

Read our rundown of the best Nationwide USD account alternatives available in the UK, including HSBC, Lloyds, Wise, Barclays, Revolut and more.