Cash or card in Barbados: Which is the best way to pay?

Should you pay with cash or card in Barbados? A handy guide including cash etiquette, Barbadian ATMs and using your UK card.

When it asks which currency to charge you in, there's only one right answer... In the Eurozone, that answer is euros. In Sweden, Swedish krona. In Britain, pounds. In Australia, AUD. In the US, dollars.

Always, always, always choose to be charged in the local currency of the country you're in. If a Spanish ATM asks if you want to be charged in GBP, say no. Don't let the machine do your currency conversion.

Foreign ATMs and card machines often say nice things like: This ATM offers conversion to your home currency.

On the surface, that seems pretty generous. It looks like you'll know exactly what you're paying, and in amounts you're way more familiar with.

Nice, right?

But, in reality, paying in your home currency is hidden-fee-hell.

It's a scam that goes by the name of Dynamic Currency Conversion (DCC). DCC means you effectively ask a foreign ATM provider or bank to gleefully make up an exchange rate for you. And the only thing more likely to screw you over than your bank, is a foreign bank.

This isn't a kind-hearted service. It's something banks use to take more of your money without you knowing.

Taking out EUR in Barcelona, with a UK card.

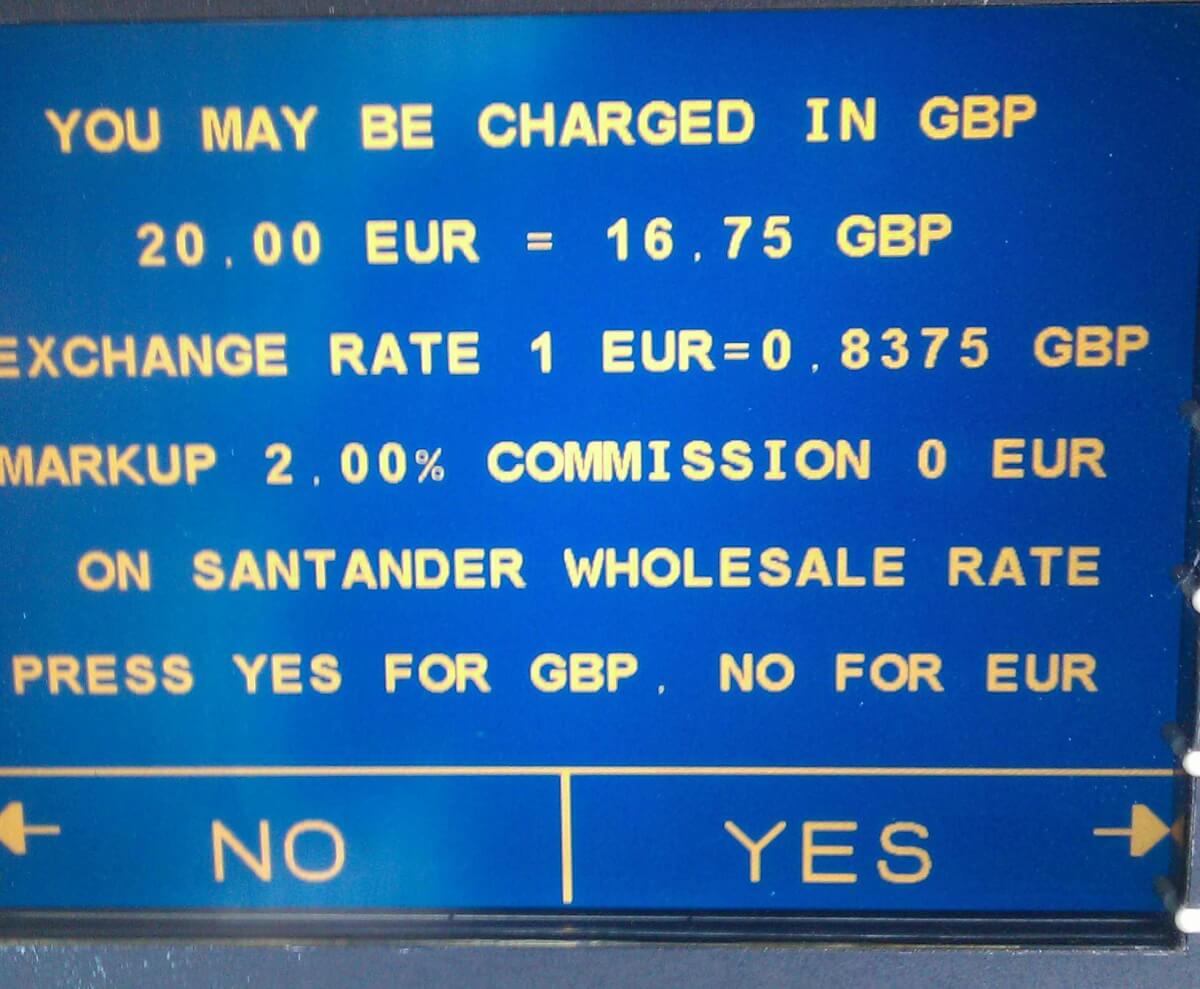

I took out 20.00 EUR from a Spanish ATM owned by Santander bank, using my HSBC debit card from the UK (GBP).

The screen says “Press Yes for GBP, No for EUR”.

While it seems innocent enough, just the wording makes it clear the machine has an opinion. It's trying to encourage you in the direction that makes Santander the most profit. Sneaky.

The Santander ATM tells me the currency exchange rate is 0.8375, and that I'll be charged 16.75 GBP for my 20.00 EUR .

The screen states

“Mark-up 2.00% commission on Santander Wholesale Rate”

This is a Santander ATM, and the account I'm using is with HSBC, so this 2% is the extra cost of letting the ATM do my currency conversion for me.

Being charged with DCC (choosing my home bank currency):

20.00 EUR = 16.75 GBP

Because I know that DCC hurts consumers like me, I chose to be charged in the local currency - EUR.

Later, when I checked my HSBC statement, I'd been charged 16.44GBP. – 2% better that what the ATM quoted for the Santander ATM conversion.

Being charged in the local currency (EUR):

20.00 EUR = 16.44 GBP

If my bank had actually charged me using the real mid-market currency exchange rate (the same rate you'll find on Google), then at the time my money was worth even more than I realized.

Using the real rate found on Google:

20.00 EUR should have cost me 15.79 GBP

Falling for the DCC scam and using the Santander ATM's made up rate:

20.00 EUR = 16.75 GBP

The difference: (i.e. the true fee charged): 0.96 GBP (6.1%)

Again, the theoretical cost of 20 EUR at the mid-market rate (the rate I looked up on Google) was 15.79 GBP.

Using the real rate found on Google:

20.00 EUR should have cost me 15.79 GBP

Rejecting DCC (being charged in the local currency):

20.00 EUR = 16.44 GBP

The difference (i.e. the true fee charged): 0.65 GBP (4.1%)

In this example, choosing my home currency would have pushed the hidden fee up from 4.1% to 6.1%.

Choose to be charged in whatever the local currency is.

Now. Let's look at the opposite...

Taking out GBP in London, with an EUR card.

I took out 100 GBP from a UK ATM using a EUR card issued by an Estonian bank.

No DCC commission was stated on-screen this time.

All I'm given is a rate of 1.3551 for conversion to my account's 'Home Currency' (in this example, that's EUR).

For DCC, the machine tells me I’ll be charged:

135.51 EUR for 100 GBP

When I checked on Google, the mid-market rate that day was 1.2601.

So the amount I should have been charged was:

126.01 EUR for 100 GBP

I chose to be charged in GBP. Which meant I had to do a little extra investigation later. I pulled up my home bank's EUR statement and found that my Estonian bank had given me a present.

Being charged in the local currency (no DCC) I was charged:

126.12 EUR for 100 GBP

That’s a massive savings of nearly 10 EUR over choosing the DCC option. Read more about this one in a previous post.

What my money was actually worth at the real interbank exchange rate:

100 GBP should have cost me 126.01 EUR

What DCC actually cost me:

100 GBP = 135.51 EUR

Difference (i.e. the total real fee charged): 9.50 EUR (7%)

What my money was actually worth at the real rate:

100 GBP should have cost me 126.01 EUR

What rejecting DCC actually cost me:

100 GBP = 126.12 EUR

Difference (i.e. the total real fee charged): 0.11 EUR (0.1%)

P.S. Best deal ever, thanks to my Estonian bank.

Choose GBP when in the UK.

And EUR when you're in a Eurozone country (you know - Spain, Germany, France, Italy, Ireland, Portugal, the Netherlands, etc.)

And USD when in the United States.

And AUD when in Australia.

And NZD when in New Zealand.

And CAD when in Canada.

You get the picture.

So there you go. Yet another hidden charge, this time brought to you by foreign banks.

The good news is that DCC is one scam you can easily avoid, even on someone else's home turf.

Just always keep that simple rule in mind: choose to be charged in the local currency of the country you're in, and don't let the ATM do your conversion for you.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Should you pay with cash or card in Barbados? A handy guide including cash etiquette, Barbadian ATMs and using your UK card.

Read our guide on ATMs abroad including networks, locations and tips on how to avoid ATM fees abroad.

Read our guide to Edinburgh Airport ATMs, including locations, fees, withdrawal limits and helpful tips to save money when you land.

Should you pay with cash or card in Albania? A handy guide including cash etiquette, Albanian ATMs and using your UK card.

Our guide to using your Virgin Money card abroad, including features, fees and exchange rates.

Read our helpful guide to Heathrow Airport ATMs, including locations, fees, withdrawal limits and tips to save money.