Buying property in Canada as a foreigner

Read our comprehensive UK guide to buying property in Canada as a foreigner, including average prices, fees, taxes and where to start house hunting.

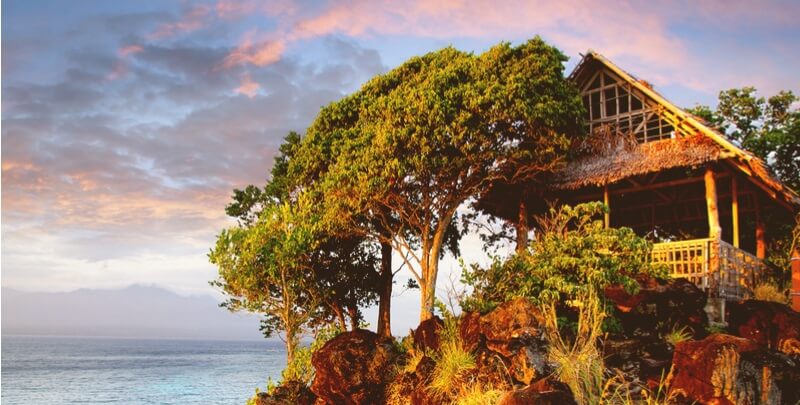

The Philippines is an island nation, famous for its friendly community, tropical climate and stunning beaches. Spreading over 7000 islands, between the Pacific Ocean and the South China Sea, it’s also known for an extremely reasonable cost of living, making it an ideal expat destination.

The Metro Manila area, made up of several cities including Manila itself, and the even larger Quezon City (former capital of the Philippines), has a population of nearly 13 million people. Unsurprisingly, many expats find themselves here, especially those moving to the Philippines for work. Another option for expats, is to head south to Davao City. Although this is the third largest city in the Philippines, the population of 1.6 million and relatively large area make it a much less densely populated, and therefore more liveable, place.

If you’re thinking of making the move to the Philippines, whether it be to work, retire or perhaps start a business, then you’ll need to know a bit about how the process of buying a home as an expat will work. Here’s a quick guide.

Like most places, the property market in the Philippines reflects the economy. That means that the turbulent global economy of the last 15 years has caused prices to be fairly volatile. Although prices fell sharply in 2008 and 2009, they've largely been on an upward incline since then - albeit with some peaks and troughs along the way.

What’s more important, perhaps, is to understand how different areas and property types have been performing. Condominium units - popular for city living especially - saw a price rise of 12.9% in the year to Q1 2016. However, some areas of the high end condo market in Manila in particular are showing signs of slowing. Because of this complexity, if you’re considering buying property in the Philippines, it’s crucial to know the market well, and have local help you can trust.

Foreigners are subject to some restrictions when it comes to buying property in the Philippines. It’s possible to buy a condo or flat, so long as the block remains at least 60% locally owned, but more difficult to own land. Basically this means that expats can own a building but not the land on which it stands.

There are alternatives if you’re determined to own land, such as buying it via a corporation. However, if you want to explore these routes then you’ll need to take detailed local legal advice.

If you’re thinking of buying a property in the Philippines, the price you pay will be influenced significantly by where you want to live. Metro Manila, for example, includes developments that vary significantly in desirability. The Ortigas Centre and the Rockwell Centre, for example, are a short drive away from each other, but a small condo in the Rockwell Centre will cost almost double that in the Ortigas Centre. Prices in USD given below.

| Metro Manila Development | Small Apartment (40-50m2) | Large Apartment (120-150m2) |

|---|---|---|

| Legaspi Village | $134,360 | $474,240 |

| Rockwell Centre | $211,800 | $494,160 |

| Salcedo Village | $113,760 | $365,550 |

There are several avenues you can take to find a property in the Philippines, however, you’re strongly recommended to use a local property agent you can trust. Buying a property in the Philippines can be complicated, and there are restrictions on the way that foreigners can buy both land and property. This means it’s easy enough to fall foul of scams and pitfalls.

A specialist agent can also offer helpful advice and insight into the local market. Although, there will be a fee to pay for this service, they'll help you avoid costly mistakes, and might be able to negotiate with the seller better than you can alone. Nevertheless, you should make sure you’re clear on what you’ll get for your money, as both the packages and prices vary wildly.

The best way to get a head start on finding a place to buy in the Philippines is to look online. Great websites to find a house or apartment to buy include:

Lamudi: This site lets you search by property type, location and price, and has a helpful English language website

The Philippines has a well developed real estate sector with a wide choice of apartments, condos and houses. Foreigners can buy condos, as long as the ownership of the block is still majority local, but it's harder to own land as a foreigner in the Philippines. Naturally, you'll find a good stock of flats and condos available in built up areas and cities, especially.

You can also lease land on a long term lease, and build a home. However, if you want to build your dream home yourself, you should talk to your lawyers about how this could be achieved.

It’s a smart idea, though not required by law, to get a survey done on any property you choose, or any land you decide to lease, before you commit. This isn’t necessarily standard practise, so you should ask your lawyer about how to find a local surveyor you can trust.

Buying a property in the Philippines can feel quite different to buying a home in Europe or North America. Foreign buyers are subject to restrictions, and the market is less regulated. It’s essential that you get the right, qualified local help to ensure that the property you're buying is being sold legally.

You’ll need to:

If you want to buy a home in the Philippines, you’ll need to either have the cash saved upfront to buy it outright, or have access to financing. If you’re considering getting a mortgage through a bank in the Philippines, you should know that not all banks are able to offer mortgage facilities to foreigners. You might benefit from having some local help - often your real estate agent will also know which local banks are best to approach for a mortgage.

Whether or not you’re eligible will depend on your visa type and personal circumstances. However, some local banks, such asBDO Unibank andMetrobank do offer mortgages to expats under some conditions. It’s also worth checking if your home bank has a presence in the Philippines. Many global brands do and if you’re already a customer with the bank elsewhere in the world, you might find it easier to make loan arrangements in the Philippines.

You’re likely to be asked to pay a deposit of 10 to 30% of the purchase price. If you’re not yet in the Philippines, you might have to pay your deposit from abroad with an international money transfer to cover the deposit amount. If you’re transferring a large amount of money across currencies, it’s important you get the best deal available.

One smart option is to get a Borderless account from Wise. With this, you can hold 15 different currencies all in one account (including GBP, USD and EUR). It’s like having a local bank account which you can use to pay like a local, wherever you need it. And if you need to, you only pay a small flat charge to transfer money from one currency to another, and you’ll always get the real exchange rate applied.

Taxes and fees can add up. However, in the Philippines, many fees are picked up by the seller, meaning it’s not too expensive to buy a property there. Naturally, you’d have to cover these costs should you ever decide to sell on the home. Fees and taxes include:

Estate agents fees are paid by the seller, and can hit 3 to 5%. There’s also a substantial capital gains tax, which the seller must pay, in the region of 6% of the selling price.

Buying a property is a big and exciting step, but navigating the system in a new country can be a challenge. Luckily, buying your dream home in the Philippines should be fairly straight forward if you follow these steps, and source the right local help if you need it.

Good luck with finding, buying and settling into your new home in the Philippines.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Read our comprehensive UK guide to buying property in Canada as a foreigner, including average prices, fees, taxes and where to start house hunting.

Read our comprehensive UK guide to buying property in Indonesia as a foreigner, including average prices, fees, taxes and where to start house hunting.

Read our comprehensive guide for non-residents selling UK property, including fees, taxes and timescales.

Read our comprehensive guide to selling property in the US, including fees, taxes, timescales and a step-by-step guide to the process.

Read our comprehensive guide to selling property in Switzerland, including fees, taxes, timescales and a step-by-step guide to the process.

Read our comprehensive guide to selling property in Portugal, including fees, taxes, timescales and a step-by-step guide to the process.