Your Christmas Dinner in numbers

Tis the season to eat a lot of yummy food, so Wise has teamed up with the food-and-culture expert and Chef, Mallika Basu as part of our Christmas Without...

You’re a smart cookie. But even the smartest of cookies needs a little help sometimes. It can be a big bad world out there, full of tricksters, booby traps and worst of all, hidden ATM fees. Sigh.

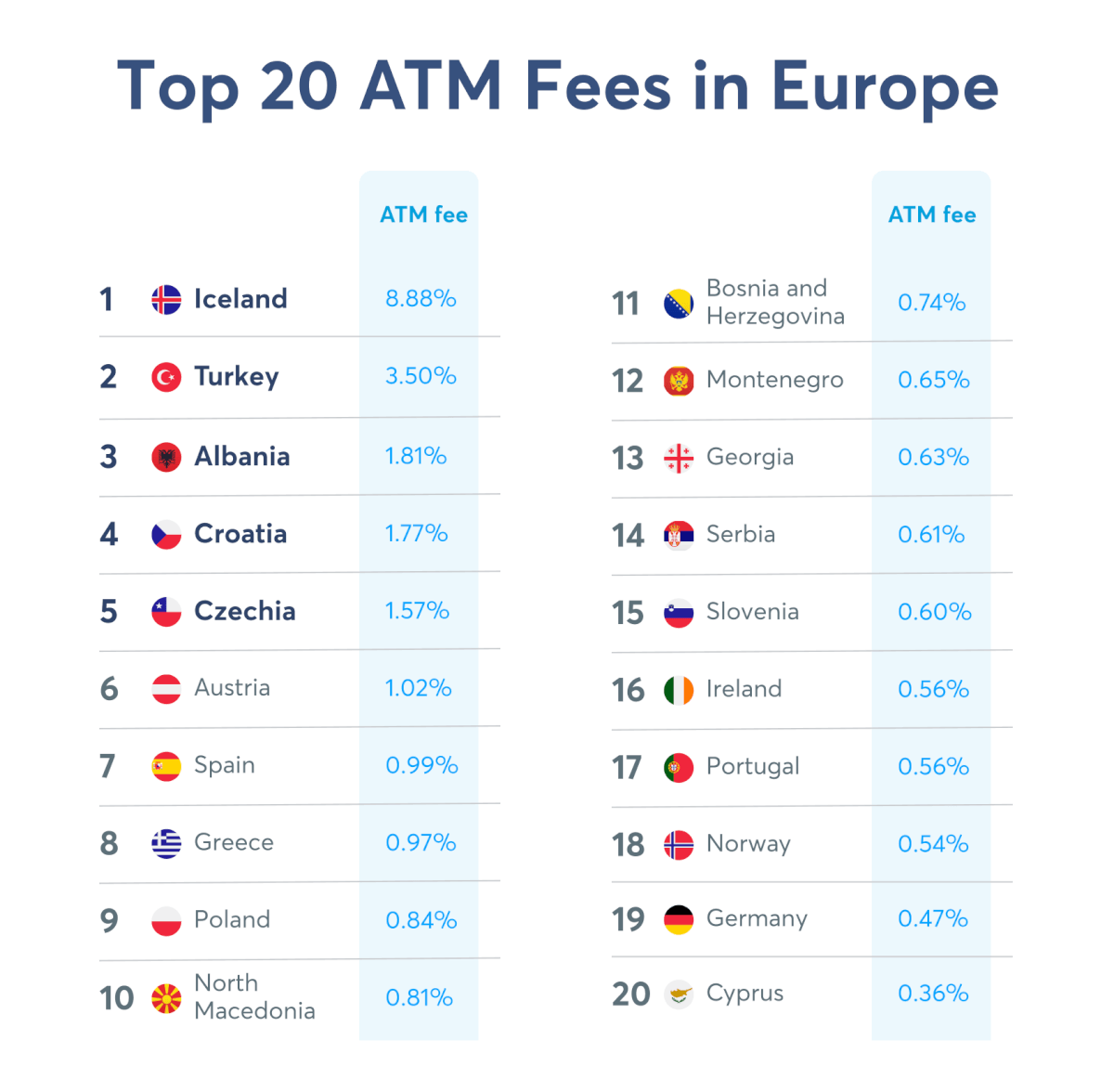

But fear not friends, we’re here to help you laugh in the face of unnecessary travel costs. We’ve compiled a list of the top 20 ATM fee costs across Europe along with some tips on how to get wise with your money when abroad.

Did you like that pun? Get wise? Course you liked it.

😘 Kiss goodbye to excess digital fees too 😘

Iceland, Turkey and Albania topped the charts with fees ranging from 8.8% to 1.81% per cash withdrawal. So if you’re looking to cut cost corners while still going on a trip, consider heading to Norway, Germany or Cyprus. Such range.

Just for a little perspective on why it's important to be in the know, if you were to take out £50 a day on a 7 day trip in Iceland you’d be paying £31.50 in withdrawal fees. If you took the same amount of cash out in let’s say, Portugal, you’d only be paying £1.96. Every penny counts people.

Obviously tip number one is going to be to get that multi-currency Wise card out so you can spend abroad like a local in shops, restaurants, and pretty much anywhere your little heart desires. But if you’re still keen on being cash-forward here are a few things you can do:

Take a look at the withdrawal fees before you travel so you can think about whether or not it would be cheaper for you to take out your money beforehand. But bear in mind that Bureau de Change fees may be a bit steeper at the airport.

Yes, this is me humble bragging about how amazing our Wise card is, yet again, and maybe throwing a little shade at providers who (unlike us) charge heaps… Consider taking a look at how much your bank charges you to take out money overseas as these charges are usually pretty expensive. You may be getting charged for ATM withdrawals past a certain threshold and for general payments. If you have a multi-currency card (hint hint) then you can simply withdraw money once you arrive at your destination of choice.

Different ATM machines can have different withdrawal rates, so much like online dating, you may have to swipe left on a few of them until you find the right fit for you. Yes, this analogy is a stretch but here we are.

Credit cards are great when it comes to things like improving your credit rating so you can get a mortgage more easily in the future, but they’re bad bad bad for oversea money withdrawals. You’ll be charged interest and the fees will be significantly higher than if you had used a debit card.

Finally, when you’re taking out money from an ATM remember to always make sure you select the local currency.

All the data in this article was taken from 3.8 million analysed cash withdrawals using a Wise card at 3rd party ATMs over a span of 12 months - September 2021 to August 2022. So, you could say these figures are pretty legit. Ignore the pretty. These figures are legit. You can find the updated ATM fees in Europe figures here.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Tis the season to eat a lot of yummy food, so Wise has teamed up with the food-and-culture expert and Chef, Mallika Basu as part of our Christmas Without...

Millions of people around the world travel over Christmas, Hanukkah and Kwanzaa. In 2022 alone, 77,000 flights took off on Christmas Day globally. That may...

Salt-N-Pepa the iconic hip hop group = ❤️ love Salt and pepper, AKA the only seasoning I used as a university student = 🥲sigh Taking the Spice Girls advice...

The festive season is upon us, and it’s pretty much the same deal every year: Shop for gifts last minute Eat like a Sumo wrestler in training Travel to see...

We've teamed up with personal finance expert, Kia Commodore to help give your money a kick up the backside so you can go ahead and sleep. “Lazy Money” is what...

We've teamed up with personal finance expert, Kia Commodore to help give your money a kick up the backside so you can go ahead and sleep. “Lazy Money”...