On your marks, get started

Getting to another continent isn’t cheap at the best of times. Summer 2024 is going to be a big one for anyone heading to Europe. Before you make that long jump across the pond, take a step back.

Start by setting aside a specific amount of money for your trip. A good guide is to base it on your income, your average expenses, the length of your trip and any savings you’re willing to use. That final number will be your budgetary north star.

Chic doesn’t come cheap

Now that you have your set amount you can spend, let’s cost out what you’ll be doing. We’ll leave how you travel to Paris to you, so the next big ticket item? Accommodation.

If you like to wing it and deploy some “girl math” logic here, we won’t argue. If you like to be a bit more in control, set aside money in your budget to pay for wherever you’re staying. This is likely your biggest expense of the trip in a single shot, making it easy to manage ahead of time. Haven’t booked your hotel yet? That’s okay. Take the time to do your research and figure out what works best for you in terms of pricing and location.

The flight is the bag, you have somewhere to rest your head — check. What next? You’re in an amazing — and busy — city, so you may want to make some plans in advance or play it by ear. Either way there’s some things you’ll need to bear in mind.

Most likely you’ll also spend some money on: transport (cabs, public transit), activities (museums, adventures), shopping, gifts for loved ones (this includes yourself) and most importantly, food (speaks for itself).

Our top tip: break your expenses down so they’re small and manageable. Set aside funds for each of these categories to give you a view of what you’re willing and able to spend over the course of your trip.

Finally, keep some of your money back just in case. Maybe you saw a beautiful bag you weren’t planning on buying or you want to take a boat tour you didn’t know existed. Have a little extra for these occasions. Trust us, they inevitably crop up.

You and your budget: squad goals

Congratulations, you now have a budget. Now, where to put it?

There are plenty of simple ways to track your budget and keep it close to hand throughout your trip. Use a spreadsheet and input expenses as you go; use a budgeting app; or even list amounts in your notes app. All that matters is that you store numbers in an easy, accessible and up-datable location.

From there, make sure you’re tracking expenses on the go. Maybe you take time at the start or end of each day to see how your spending is going and if you need to move money around within your budget. But do avoid updating that spreadsheet over a candlelight dinner. It can wait.

Your opponents

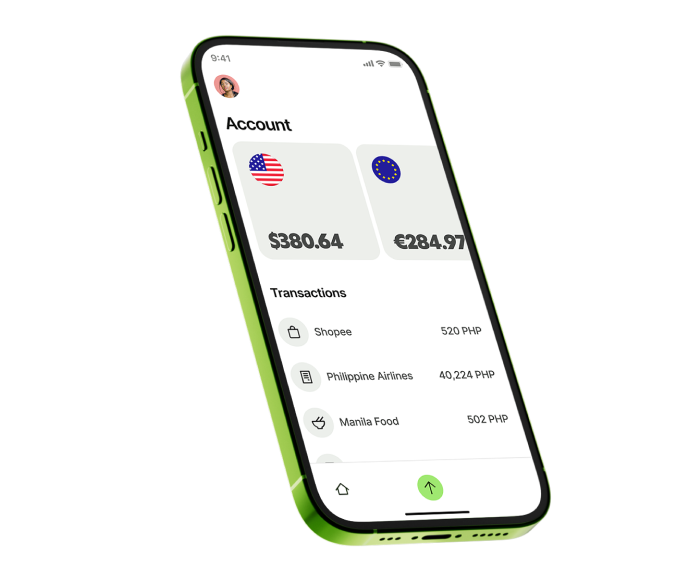

While abroad there are few ways to make your money go farther. It mostly comes down to the way you’re spending. It helps to have a few options available to you. Like the Wise debit card, so you’ll always pay like a local in the currency of the country you’re in.

Now for a few watchouts when you’re at checkout. Dynamic currency conversion. Always choose to pay in the local currency, not your home currency. When you choose USD rather than EUR you’ll likely get an inflated exchange rate that includes a hidden fee, because your US bank will make the conversion on your behalf. It’ll make every purchase more expensive — buyer beware.

Plan on carrying cash? Skip the currency exchange at the airport and head straight to the ATM for the best rates. Your credit or debit card likely charges extra fees for this. To avoid paying excess fees, use a Wise debit card. With Wise, you can withdraw twice per month up to 100 USD for free.*

Our best advice is to have multiple methods of payment. One credit card is a gamble; carry your Wise debit card and another backup payment method that you keep separate from your other cards. That way, if your credit card fails you have something else on hand.

*Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.