了解跨境汇款的手续费

| 1,000 HKD匯款 - | 收款人收到(扣除費用後的總金額) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 126.98 USD | ||||||||||

匯款費用 8 HKD 匯率(1 HKD USD) 0.128000 匯率提價 0.77 HKD 匯款成本 8.77 HKD | |||||||||||

| 126.96 USD- 0.02 USD | ||||||||||

匯款費用 5 HKD 匯率(1 HKD USD) 0.127600 匯率提價 3.90 HKD 匯款成本 8.90 HKD | |||||||||||

| 125.72 USD- 1.26 USD | ||||||||||

匯款費用 18.54 HKD 匯率(1 HKD USD) 0.128099 匯率提價 0 HKD 匯款成本 18.54 HKD | |||||||||||

| 119.30 USD- 7.68 USD | ||||||||||

匯款費用 65 HKD 匯率(1 HKD USD) 0.127595 匯率提價 3.93 HKD 匯款成本 68.93 HKD | |||||||||||

| 118.16 USD- 8.82 USD | ||||||||||

匯款費用 38.99 HKD 匯率(1 HKD USD) 0.122952 匯率提價 40.18 HKD 匯款成本 79.17 HKD | |||||||||||

| 118.13 USD- 8.85 USD | ||||||||||

匯款費用 60 HKD 匯率(1 HKD USD) 0.125668 匯率提價 18.98 HKD 匯款成本 78.98 HKD | |||||||||||

| 114.87 USD- 12.11 USD | ||||||||||

匯款費用 100 HKD 匯率(1 HKD USD) 0.127629 匯率提價 3.67 HKD 匯款成本 103.67 HKD | |||||||||||

| 113.19 USD- 13.79 USD | ||||||||||

匯款費用 115 HKD 匯率(1 HKD USD) 0.127903 匯率提價 1.53 HKD 匯款成本 116.53 HKD | |||||||||||

| 98.48 USD- 28.50 USD | ||||||||||

匯款費用 230 HKD 匯率(1 HKD USD) 0.127898 匯率提價 1.57 HKD 匯款成本 231.57 HKD | |||||||||||

適用於以下付款方式: 銀行轉賬。 我們如何收集此資料?

由香港汇款到海外的 3 个简单步骤

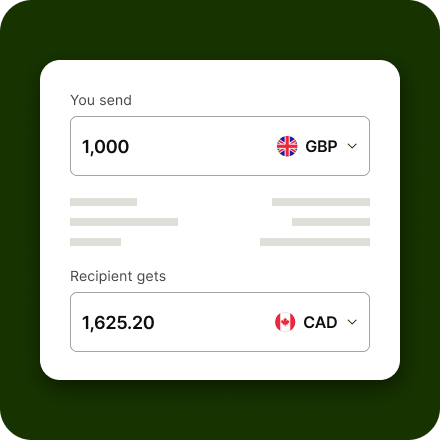

输入HKD汇出的金额。

使用网上银行转账存入HKD,也可使用借记卡或信用卡进行转账

选择收款人.

选择收款人以及您要使用的付款方式。

汇出HKD,接收USD。

收款人直接从 Wise 的当地银行账户收USD。

如何由香港汇款到海外

如何由香港汇款到海外

- 输入汇款金额及收款人帐户资料

- 通过银行转账、SWIFT、借记卡或信用卡进行本地转账付款给 Wise。

- 汇款完成,就是如此简单

Wise 以“银行内部”汇率(实际汇率)兑换您的资金 ,能为您节省一大笔钱(比起那些所谓“零”佣金的机构还要便宜)。

HKD 兑 USD 的境外汇款手续费是多少?

只需一笔小额固定费用外加汇款金额一定比例的费用

要以 HKD 汇款至 USD,您需要支付少量固定费用 15.20 HKD + 兑换金额的 0.34%(您始终会看到预付的总费用)。查看我们的汇款计算器。

费用取决于所选的汇款类型

不同类型的汇款收费会不一样,但通常费用都很低。

无隐性费用

没有隐性费用或其他昂贵的费用,所以它比您平时使用的汇款服务更便宜。

如何使用 Wise 汇款

1

免费注册

在线或在我们的应用中免费注册。只需一个电邮地址、Google 或 Facebook 帐户。

2

选择汇款金额

告诉我们您的汇款金额。我们会预先向您展示费用,并告知您的资金何时到账。

3

添加收款人的银行信息

填写收款人银行账户的详细信息。

4

验证身份

对于某些货币或大额汇款,我们需要您的身份证照片。这有助于确保您资金的安全。

5

支付汇款费用

您可以选择银行转账、借记卡或信用卡作为您的支付方式。

6

大功告成

剩下的交给我们处理。您可以在账户中查看汇款状态,我们会通知您的收款人将有款项到达。

国际汇款的最佳方式

银行转账

使用 Wise 进行跨境汇款时,通过银行转账付款通常是最便宜的选择。银行转账可能比借记卡或信用卡要慢,但通常是最划算的。 了解如何使用银行转账作为付款方式。借记卡

使用借记卡支付汇款费用既简单又快捷。它通常也比信用卡便宜,因为信用卡的处理费用更高。 详细了解如何使用借记卡支付汇款费用。信用卡

使用信用卡支付汇款费用既快速又方便。Wise 接受 Visa、Mastercard 和部分 Maestro 卡。 详细了解如何使用信用卡支付汇款费用。Apple Pay

如果您在手机上设置了 Apple Pay,则可以使用它来支付汇款费用。使用 Apple Pay 付款既方便又快捷。如果您在 Apple Pay 绑定信用卡付款,请注意有些银行会将此类付款视为提现,因此可能会向您收取额外的费用。Google Pay

如果您在手机上设置了 Google Pay,则可以使用它来支付汇款费用。使用 Google Pay 付款既方便又快捷。如果您在 Google Pay 绑定了信用卡付款,请注意有些银行会将此类付款视为提现,因此可能会向您收取额外的费用。

保护您和您的资金

周全的交易安全保障

我们采用双重身份验证来保护您的账户和交易。这意味着只有您自己能动用您的资金。

数据保护

我们致力于确保个人数据的安全,并且我们对这些数据的收集、处理和存储方式均保持透明。

专门的防欺诈团队

我们全天候工作,全力保护您的账户和资金免受各种欺诈的影响。

网络诈骗越来越多。了解如何保障资金安全

用最国际化的 app 汇款到海外

想汇款到海外?无论是汇款、接收海外付款还是查看汇率,只需一个 app 就足够。

- 汇款到海外 - 汇率优惠,绝无隐性费用。

- 查看汇率 - 在 app 中查看历史汇率。

- 重复以往汇款 - 保存详细信息,轻松完成每月的定期付款。

See why customers choose Wise for their international money transfers

这是您的资金,您可以选择信赖我们,使用我们的服务。您也可以听听其他人的意见。请访问 Trustpilot.com 阅读客户给我们的评论。