Chuyển tiền quốc tế

Gia nhập hơn 10 triệu người chọn Wise cho các giao dịch chuyển tiền online nhanh chóng và bảo mật. Chúng tôi tính phí rẻ hơn ngân hàng đến 5 lần.

Tìm hiểu xem chi phí bao nhiêu để gửi tiền ra nước ngoài

| Sending 2.000 USD with | Recipient gets(Total after fees) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 305.083 JPY | ||||||||||

Transfer fee 15,72 USD Exchange rate(1 USD JPY) 153,750 Exchange rate markup 0 USD Cost of transfer 15,72 USD | |||||||||||

| 302.894 JPY- 2.189 JPY | ||||||||||

Transfer fee 0 USD Exchange rate(1 USD JPY) 151,447 Exchange rate markup 29,96 USD Cost of transfer 29,96 USD | |||||||||||

| 302.778 JPY- 2.305 JPY | ||||||||||

Transfer fee 6,99 USD Exchange rate(1 USD JPY) 151,920 Exchange rate markup 23,80 USD Cost of transfer 30,79 USD | |||||||||||

| 301.440 JPY- 3.643 JPY | ||||||||||

Transfer fee 0 USD Exchange rate(1 USD JPY) 150,720 Exchange rate markup 39,41 USD Cost of transfer 39,41 USD | |||||||||||

| 293.238 JPY- 11.845 JPY | ||||||||||

Transfer fee 4,99 USD Exchange rate(1 USD JPY) 146,986 Exchange rate markup 87,99 USD Cost of transfer 92,98 USD | |||||||||||

Send money abroad từ Việt Nam in 3 easy steps

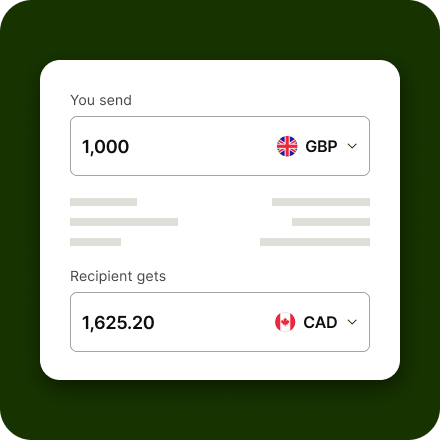

Điền số tiền để gửi theo USD.

Thanh toán tiền USD bằng thẻ ghi nợ hoặc thẻ tín dụng của bạn, hoặc gửi tiền từ ngân hàng trực tuyến của bạn.

Choose recipient.

Chọn người bạn muốn gửi tiền đến và phương thức thanh toán được sử dụng.

Gửi USD, nhận JPY.

Người nhận sẽ nhận tiền bằng JPY trực tiếp từ tài khoản ngân hàng địa phương của Wise.

Get dedicated support for large transfers

Moving big money? Get our how to guide and start a chat with our team of large-amount experts.

Get started with large transfersHow to send money abroad từ Việt Nam

How to send money abroad từ Việt Nam

- Chỉ cần nhập số tiền, và nơi chuyển đến.

- Sau đó thực hiện thanh toán địa phương cho Wise, dù là chuyển khoản, swift hoặc bằng thẻ ghi nợ hay tín dụng.

- Và thế là xong.

Wise sẽ chuyển đổi tiền của bạn theo tỷ giá 'liên ngân hàng' - tỷ giá thật - giúp bạn tiết kiệm khá nhiều (kể cả so với những người tự nhận rằng họ có hoa hồng 'bằng 0').

Phí chuyển tiền USD đến JPY là bao nhiêu?

Trả một khoản phí và khoản phần trăm nhỏ, cố định

Để chuyển tiền USD đến JPY, bạn chỉ cần thanh toán một khoản phí nhỏ, cố định 8,11 USD + 0,41% của số tiền được chuyển đổi (bạn sẽ luôn thấy trước tổng chi phí).

Phí phụ thuộc vào loại chuyển tiền bạn chọn

Một số loại chuyển tiền có mức phí khác, thường là rất nhỏ.

Không có phí ngầm

Không có khoản phí to lớn nào, dù là ngầm định hay rõ ràng. Dịch vụ này rẻ hơn mức phí quen thuộc của bạn.

Giao dịch chuyển tiền sẽ mất bao lâu?

Trên nhiều lộ trình phổ biến, Wise có thể gửi tiền của bạn trong vòng một ngày, ví dụ như trong một giao dịch chuyển tiền cùng ngày, hoặc thậm chí là một giao dịch chuyển tiền tức thì.

Đôi khi, các phương thức thanh toán khác nhau hay việc kiểm tra định kỳ có thể ảnh hưởng đến thời gian ghi có tiền chuyển. Chúng tôi sẽ luôn cập nhật cho bạn, và bạn có thể theo dõi từng bước trong tài khoản của mình.

Lộ trình chuyển khoản của bạn

Sẽ đến

by Thứ HaiHướng dẫn cách chuyển tiền từ USD đến JPY

Đăng ký miễn phí.

Đăng ký miễn phí online hoặc trong ứng dụng của chúng tôi. Tất cả những gì bạn cần là một địa chỉ email, hoặc một tài khoản Google hay Facebook.

Chọn một khoản tiền để gửi.

Hãy cho chúng tôi biết bạn muốn chuyển bao nhiêu. Chúng tôi sẽ thông báo trước cho bạn mức phí của mình, và khoảng bao lâu thì tiền sẽ được ghi có.

Thêm chi tiết ngân hàng của người nhận.

Điền vào những chi tiết của tài khoản ngân hàng người nhận.

Xác minh danh tính của bạn.

Đối với một số loại tiền tệ, hoặc cho các giao dịch chuyển khoản lớn, chúng tôi cần ảnh chứng minh thư/căn cước công dân của bạn. Điều này sẽ giúp chúng tôi đảm bảo an toàn cho tiền của bạn.

Thanh toán cho giao dịch chuyển khoản của bạn.

Gửi tiền bằng ghi nợ ngân hàng (ACH), chuyển khoản hoặc bằng thẻ ghi nợ hay tín dụng.

Thế là xong.

Chúng tôi sẽ xử lý phần còn lại. Bạn có thể theo dõi giao dịch chuyển khoản của mình trong tài khoản, và chúng tôi sẽ thông báo cho người nhận của bạn rằng họ sắp nhận được tiền.

Những cách tốt nhất để gửi tiền ra nước ngoài

Ghi nợ trực tiếp

Direct Debit is a convenient option that lets us take money from your account once you have authorised the payment on our site. It takes a little more time for your money to reach Wise, and it can be more expensive than a bank transfer.Chuyển khoản ngân hàng

Chuyển khoản ngân hàng thường là lựa chọn rẻ tiền nhất để nộp tiền chuyển khoản quốc tế với Wise. Việc chuyển khoản ngân hàng có thể chậm hơn so với thẻ ghi nợ hoặc tín dụng, nhưng chúng thường mang lại giá trị tốt nhất cho đồng tiền. Đọc thêm về cách để sử dụng chuyển khoản ngân hàng như một lựa chọn thanh toán.Thẻ ghi nợ

Paying for your transfer with a debit card is easy and fast. It’s also usually cheaper than credit card, as credit cards are more expensive to process. Read more about how to pay for your money transfer with a debit card.Thẻ tín dụng

Paying for your transfer with a credit card is easy and fast. Wise accepts Visa, Mastercard and some Maestro cards. Read more about how to pay for your money transfer with a credit card.

Bảo vệ bạn và tiền của bạn

Được bảo vệ bằng những ngân hàng hàng đầu

Chúng tôi giữ tiền của bạn bằng những tổ chức tài chính thành danh, nên nó tách biệt với tài khoản của chính chúng tôi và đối tác của chúng tôi không tiếp cận được trong quá trình kinh doanh thường ngày. Đọc thêm tại đây.

Giao dịch bảo mật tuyệt đối

Chúng tôi sử dụng xác thực 2 yếu tố để bảo vệ tài khoản và những giao dịch của bạn. Điều đó có nghĩa là bạn - chỉ mình bạn - mới có thể tiếp cận tiền của mình.

Bảo vệ dữ liệu

Chúng tôi cam kết giữ an toàn cho dữ liệu cá nhân của bạn, và chúng tôi minh bạch trong cách thức thu thập, xử lý và lưu trữ dữ liệu đó.

Đội ngũ tận tâm chống lừa đảo

Chúng tôi cố gắng liên tục để giữ cho tài khoản và tiền của bạn được bảo vệ trước cả những màn lừa đảo tinh vi nhất.

Gửi tiền ra nước ngoài với ứng dụng toàn cầu nhất

Bạn muốn tìm một ứng dụng để gửi tiền ra nước ngoài? Gửi tiền, nhận tiền thanh toán từ nước ngoài, kiểm tra tỷ giá chuyển đổi - tất cả chỉ trong một ứng dụng.

- Chuyển tiền ra nước ngoài tiết kiệm hơn - không bị phí ngầm và đội tỷ giá chuyển đổi.

- Kiểm tra tỷ giá chuyển đổi - xem diễn biến của tỷ giá chuyển đổi theo thời gian trên ứng dụng.

- Lặp lại các giao dịch chuyển khoản trước đây của bạn - lưu thông tin chi tiết, và thực hiện các thanh toán hằng tháng dễ dàng hơn.

Wise hoạt động ở hầu hết mọi nơi

See why customers choose Wise for their international money transfers

Đây là tiền của bạn. Bạn có thể tin cậy cho chúng tôi đưa tiền đến nơi cần đến, nhưng đừng nghe lời chúng tôi. Hãy đọc đánh giá về chúng tôi tại Trustpilot.com.