Online Payment Methods: The Complete Guide to Digital Transactions

Discover the most secure and convenient online payment methods for your business.

One key aspect of managing your finances as a sole trader is creating invoices. Invoices enable you to get paid for your work. Effective sole trader invoices also make cash flow management easier.

This guide will cover the importance of invoices for sole traders, as well as insider tips and best practices for creating efficient invoices.

A sole trader invoice is a document you send to your clients to request payment, in exchange for the services or goods you provided them.

Presenting your invoices professionally is crucial for your business’s image and for simplifying your finances.

Some key components of sole trader invoices include:

By ensuring to include the relevant information, you can prevent overdue invoices and prevent delays in receiving payment.

Creating your first invoice can be intimidating, but it’s actually a straightforward process.

Here’s a step-by-step guide on how to invoice as a sole trader:

Add your business details. Include your business name, address and contact information at the top of the invoice.

Include the invoice number and date. Give your invoice a number and add the date the invoice is issued. Giving your invoice a number makes it easy to keep track of your cash flow.

Describe the services or goods provided. Write a detailed description of what you are billing for, whether it’s a product or service.

Include the total amount due. Add up the costs of the services or products provided and clearly state the total amount your client needs to pay you.

Use clear payment terms. Clearly state when the payment is due and your preferred payment methods. This could include options such as bank transfer, credit card or online payment platforms.

Review and send. Double-check all the details to ensure accuracy and then send the invoice to your client.

A professional-looking invoice not only helps you get paid faster but also presents your business in the best light. Here are some sole trader invoicing tips to make your invoices stand out:

Customize your sole trader invoices with your branding. Your invoices should reflect your business and brand. That means you should include your logo, font and colors on every invoice you send, to leave an impression on your clients.

Double-check for accuracy. Double-checking your invoice for accuracy is crucial. Make sure the invoice number, client details and total amount due are correct. Any mistakes can cause delays in payment and make you look unprofessional.

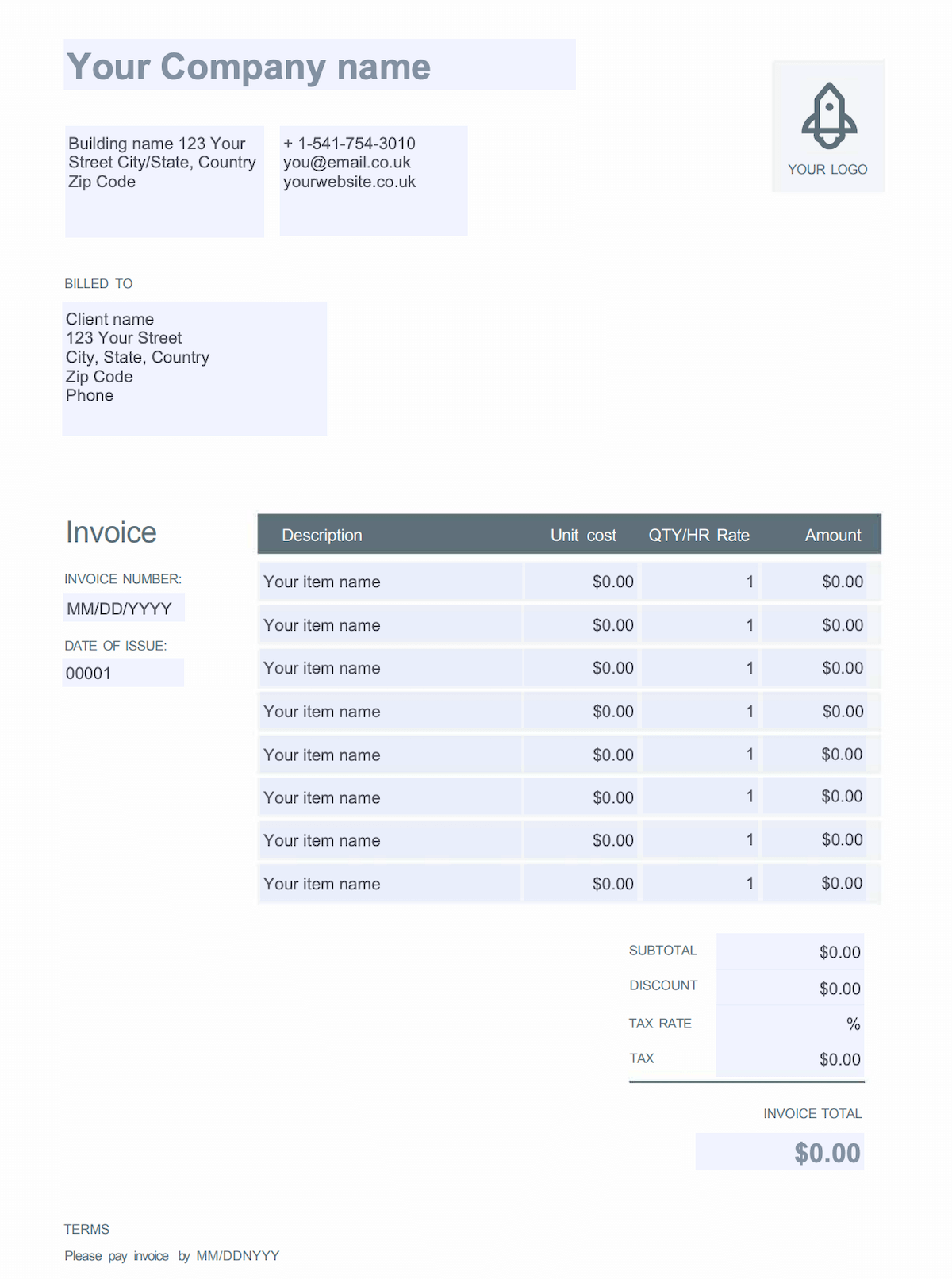

This is an example of your sole trader invoice should be laid out in order to maintain a professional appearance. You can download a template for this invoice for free or use the invoice generator from Wise and simply fill it out with your business details.

Efficient invoicing isn’t just about creating the invoice. It’s also about how you manage and follow up on them.

| Here are some best practices to keep in mind: | |

|---|---|

|

| 💡 Another thing to bear in mind is how to invoice overseas customers. A Wise Business account makes it easy to receive invoice payments like a local. You can open a Wise Business account online, set up account details, and add them to your invoice. This makes it easy for your customers to pay you - which can help you get paid faster. |

|---|

Find out more about Wise Business

There are many tools and resources out there to help you when it comes to sole trader invoices.

QuickBooks, FreshBooks and Wave are some great tools you can use to help smooth out the invoicing process.

If you prefer a simpler approach, you can also download free invoice templates for sole traders or use the free online invoice generator or free sole trader invoice template from Wise that you can customize for your business needs.

Make it a habit to invoice promptly, follow up on unpaid invoices and keep accurate records of all transactions. This will help you maintain steady cash flow and build strong relationships with your clients.

Efficient invoicing is crucial for the success of your sole trader business. It not only helps you get paid on time but also makes your business look professional. By following the tips and best practices discussed in this article, you can create professional invoices that help you manage your cash flow effectively.

| 💡 For all you need to know about invoices, don't forget to read and bookmark the ultimate guide to invoicing from Wise! |

|---|

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover the most secure and convenient online payment methods for your business.

Learn the essentials of how to invest in commercial property in the UK as a US investor.

Compare Mollie vs Stripe to find the best payment gateway for your business. Our guide covers fees, features, and integrations to help make the right choice.

Find out how to open an IBAN account with our step-by-step guide. Understand the requirements, benefits, and best practices.

Explore the top business bank accounts for international payments in the US. Compare features, fees, and benefits.

Discover how to invest in commercial property with our comprehensive guide.