By subscribing, you agree to receive marketing communications from Wise. You can unsubscribe at any time using the link in the footer of our emails. See our privacy policy

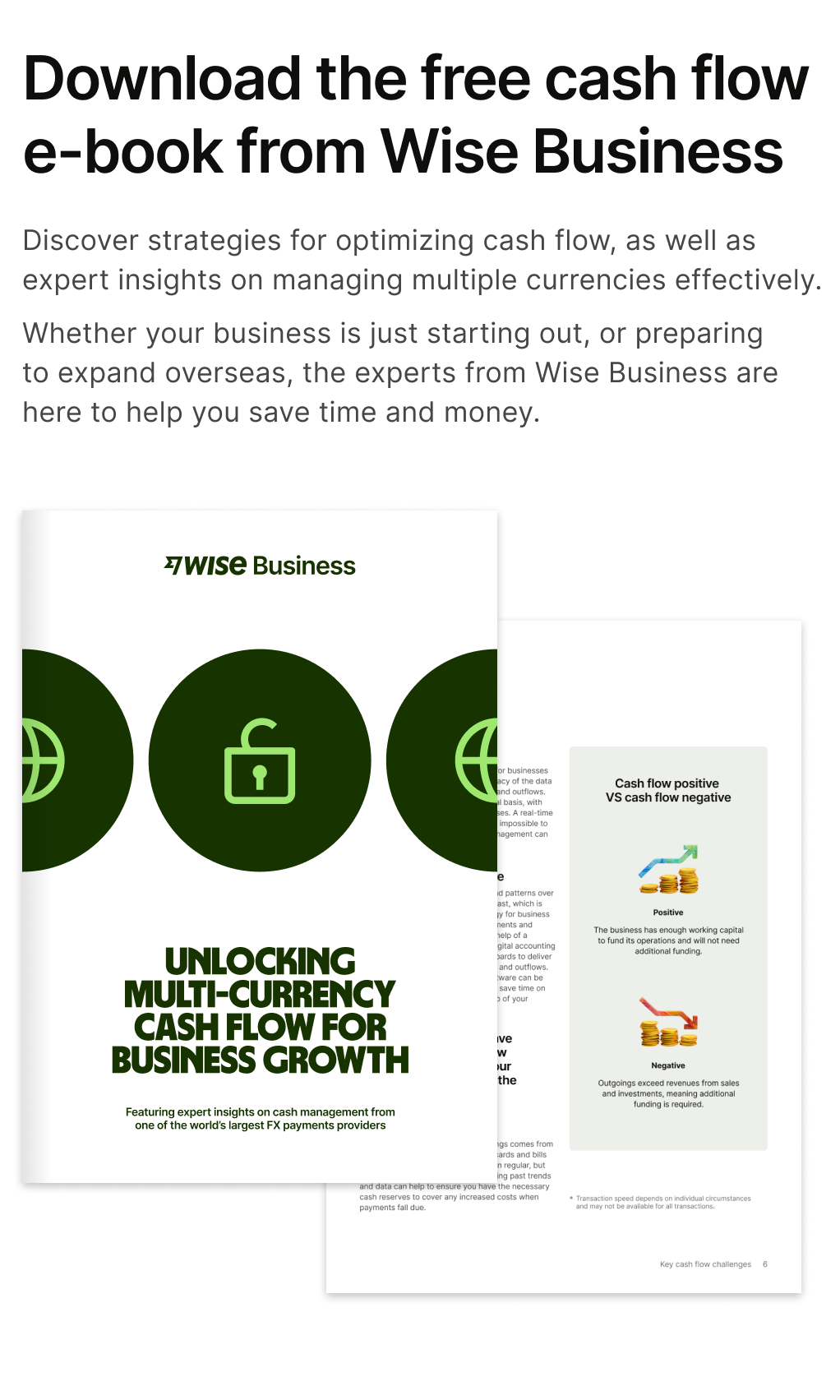

What you'll find in this free e-book:

Expert insights on cash flow management: Wise’s corporate treasurer provides insights for startups and scaleups, based on in-depth experience working in one of the world’s largest FX payments providers.

Methods for managing cash flow: Key challenges in multi-currency cash flow management and strategies for solving them.

How to minimize FX risks that can impact cash flow: Learn expert tips for managing FX risk and improving multi-currency cash flow to protect margins.

Cash flow case study: Discover how a Texas based business successfully manages multi-currency cash flow.

“Without proper planning for cashflow, even a profitable business could run into financial difficulties.”

Mo Ragab, Corporate Treasurer at Wise

Wise Business: International Cash Flow Made Easy

If your business needs to operate in multiple currencies, check out the Wise Business account.

Doing business overseas can help scale operations, but FX rates and hidden fees in cross-border payments can eat into profit margins. Managing these risks effectively can make or break a business, especially if they're just starting out.

This is where Wise Business can help. With one account for multiple currencies, it’s easier than ever to handle international payments. You'll always get the mid-market rate, and there are no hidden fees, so you can calculate your international spend accurately.

You can also integrate your Wise Business account with QuickBooks, Xero, or other popular accounting tools. Reduce the hassle of reconciling accounts and managing multi-currency cash flow, and watch your company grow.