The Wise Way to Send Money to Africa

Do you need to send money to Africa? Meet Wise, the smart new way to make international payments. Sending money internationally through a bank or broker like...

Making the hop from Australia to the US is an increasingly popular move. In fact, it’s estimated that there are over 130,000 Aussies currently residing in the US. It’s not that surprising – we all speak the same language (kinda) and have a love for sports.

So, we grabbed some Australian Wise customers and team members for a chat to find out what their biggest surprises were when they moved to the US.

From getting used to American dunnies to dealing with the healthcare system – here are some obstacles you’ll meet as a Aussie in the US:

Like quantum physics, the US healthcare system is based on the principal that the more you know, the less you understand it. Even the bloody customer service people at the insurance companies don’t understand any of it. What’s the difference between a deductible, copay and coinsurance? No one knows.

If trying learn about your new healthcare system gets you in the mood for a coldie, don't be surprised that you when order a pint and you get a schooner instead. But once you realise that the beer you are drinking could be anything up to 8% alcohol, you soon get over it. One thing they do have nailed is free refills for your soft drinks.

Being a Aussie in the US means having a constant sensation that you should be tipping someone for something right now, but you don’t know who, how much or what for. Restaurants are OK, just go 20% and don’t argue. Drinks at a bar are $1 per drink (or is it 10%, or 20% on a tab). But what about hotel maids? Or your hairdresser. The good news? You don’t have to tip your Uber driver. Unless maybe you do?

First off, don’t ask anyone where the “dunny” is, that doesn’t work. You probably shouldn’t bother with “toilet” either. In fact, you should ask for the “bathroom,” even though there probably won’t be a bath in there, or for the “restroom,” although laying down for a kip is frowned upon. And why, oh why, is there such a large gap between cubicles!?

So you've settled into your new life and now want to send money to Australia. Well forget about using your bank. The 4% exchange rate markups, $40 wire fees and 6 day waits, are just some of the ways your new bank will try to rip you off.

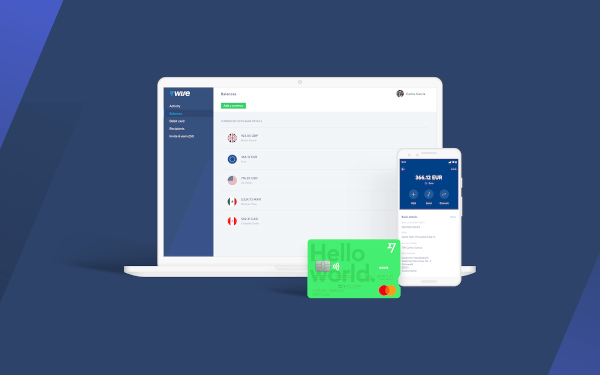

But not to worry, Wise is here to change this.

Yet to make the move across the pond? Make sure to read our Moving to the US guide.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Do you need to send money to Africa? Meet Wise, the smart new way to make international payments. Sending money internationally through a bank or broker like...

Planning a trip? Moving country? Don’t get stung by nasty fees and even nastier rates. Banks, brokers and PayPal are more expensive than they look....

Türkiye'ye hâlâ banka ya da komisyoncu aracılığıyla mı para gönderiyorsunuz? Şimdi para göndermenin daha akıllı ve ucuz bir yolu var. Eğer Türkiye'ye para...

ถ้าคุณยังโอนเงินกลับไทยด้วยวิธีเดิมๆ ผ่านธนาคารหรือโบรคเกอร์ เราอยากบอกว่า มันมีวิธีที่ถูกและดีกว่าให้คุณได้ลองนะ Wise จะช่วยให้การโอนเงินกลับไทยถูกลง...

คุณยังคงใช้ธนาคารหรือนายหน้า ในการส่งเงินไปยังประเทศไทยอยู่รึเปล่า? Wise เป็นอีกหนึ่งตัวเลือก ที่จะช่วยให้คุณส่งเงินปอนด์...

If you’re a small business in Singapore that operates overseas, Wise could save you a lot of time and money when you pay invoices in foreign...