7 Cheapest Payment Processing Services for Small Businesses

The best payment processor can simplify all of your customer transactions. Check out the cheapest payment processing services for small businesses in 2026.

If you're a small business owner, online invoices can improve cash flow by giving customers a fast and easy way to pay.

This guide will walk you through the methods, benefits and best practices for online invoice payment processing.

Selecting the right payment solution is crucial to successfully accepting online invoice payments and running your business efficiently.

When choosing a payment platform, you need to consider certain factors. These can include fees, integration capabilities and ease of use. You should compare different platforms to find the one that best meets your business’s needs.

For example, Stripe is a payment platform which offers robust features and customization options. You can also connect Stripe to Wise Business to receive international payments without high fees. This can be useful if you have customers around the world.

To maximize efficiency, you should integrate your payment system with your invoicing software. This integration allows you to automatically include payment links in your invoices. This makes it easy for customers to pay online.

Some popular invoicing tools with payment integrations include QuickBooks, FreshBooks and Xero.

Integrating your payment systems with your invoicing software may sound complex. But it’s typically a straightforward process. You’ll need to:

Most software will guide you through each step. This makes for an easy integration process.

| 💡 With a Wise Business account, your transactions can be synced with Wave, FreshBooks, QuickBooks, or Xero easily, saving you time on manual entry. |

|---|

Payment gateways are a popular choice for online invoice payments. They act as intermediaries between your business and your customer’s bank. They ensure secure processing of the transaction.

Some popular payment gateways include:

Payment gateways are secure and tend to be easy to set up. But fees can often add up, especially for small transactions.

ACH (Automated Clearing House) payments and direct bank transfers are reliable payment methods.

ACH payments transfer funds electronically from the customer’s bank account to yours. They’re typically processed within a few business days.

ACH and direct bank payments come with lower fees compared to credit card payments. They're a secure, efficient method of payment.

Enabling credit card payments for invoices is a must for many businesses. It provides customers with a quick and easy payment option. Customers use credit cards for a number of reasons, including:

That makes it key to be able to accept credit cards for invoice payments.

To do so, you’ll need to ensure that your payment system is PCI-compliant to protect against data breaches. You’ll also need to use secure payment gateways that offer encryption.

Accepting payments via mobile apps is becoming increasingly popular. Mobile payment solutions like Apple Pay, Google Pay and Venmo offer a convenient way to pay.

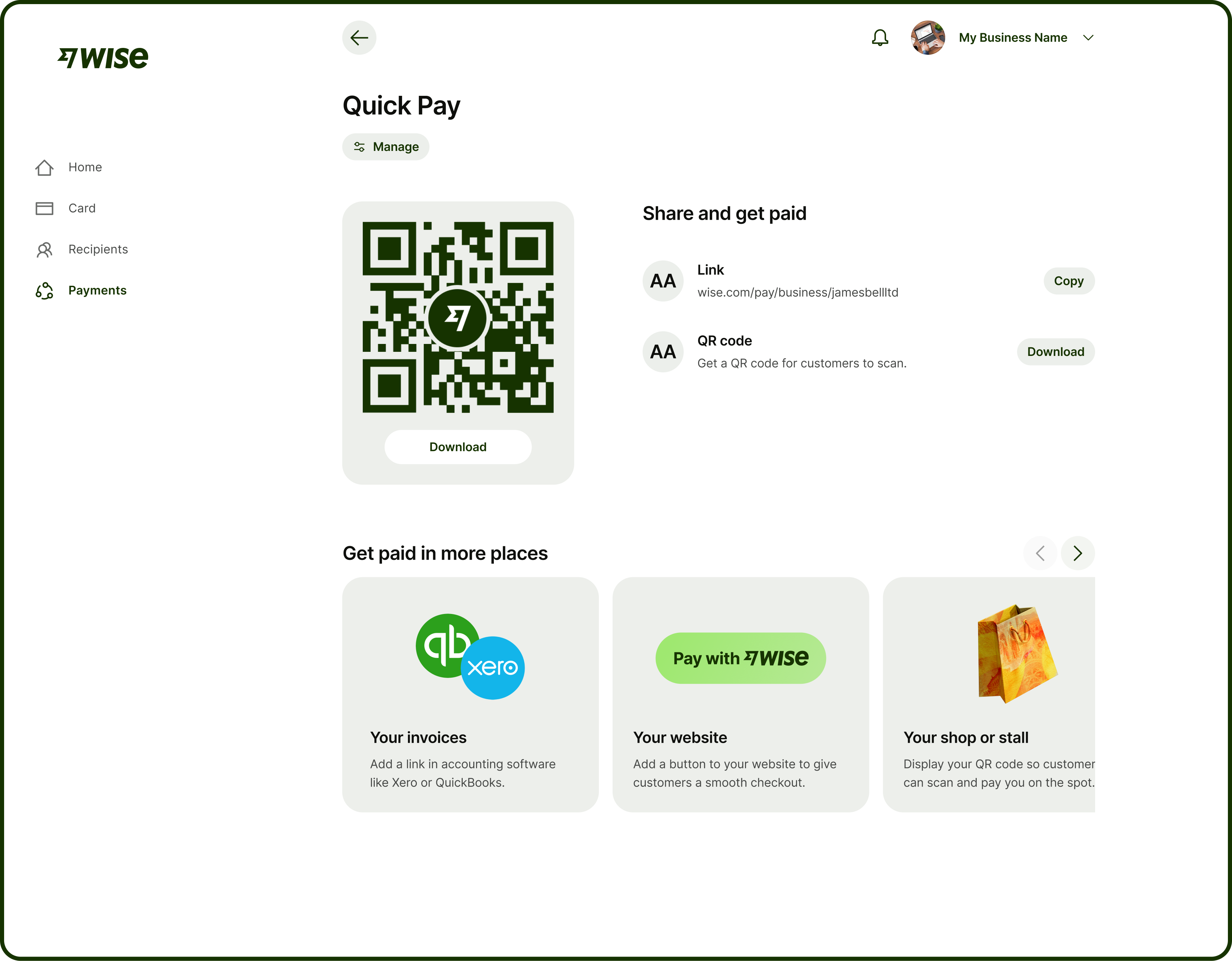

With Wise Business, you can start accepting invoice payments online from customers around the world.

Wise helps you manage international payments with low fees, making it an ideal solution for global businesses. Simply add your Wise account details or QuickPay link to your online invoice for easy payment. Compatible with Xero, QuickBooks, and more. You can even use a free invoice template or invoice generator from Wise to make sure your online invoices are professional.

Wise is not a bank, but a Money Services Business (MSB) provider and a smart alternative to banks. The Wise Business account is designed with international business in mind, and makes it easy to send, hold, and manage business funds in 40+ currencies. You can get major currency account details for a one-off fee to receive overseas payments like a local. You can also send money to 140+ countries.

Open a Wise Business account online

You’ll have access to the mid-market exchange rate, saving you on hidden fees. For a one-time fee, you can also get local account details for 8+ currencies, so you can pay and get paid like a local.

The shift toward digital transactions has transformed the way businesses operate. With more customers shopping online, the demand for digital payment methods has increased. Businesses now require efficient and secure methods to accept invoice payments online.

Traditional payment methods, like checks and cash, are becoming less common. Both businesses and consumers alike prefer the speed and convenience of online payments.

When it comes to invoices, many customers prefer the ability to pay online quickly and easily. This avoids the hassle of writing checks or making trips to the bank. By offering online invoice payments, your business can meet these expectations.

One of the benefits of accepting online invoice payments is the impact on your cash flow.

Online payments are usually processed faster than traditional methods. That means you get paid sooner. This improved cash flow can help your business manage expenses more effectively. This can enable you to invest in other opportunities for growth

Online invoice payments also create a smoother and convenient experience for your customers. They can pay their invoices with just a few clicks, any time and anywhere. This convenience can lead to increased customer loyalty, and also helps you to get paid faster. The easier you make it for your customers to pay, the less likely you are to face late payments.

Online invoicing not only makes the payment process smooth for your customers. It also makes it smooth for your business. You can track payments and generate receipts. You can also reduce the time spent handling paper checks or cash. Automatic reminders and recurring payments can also be set up with online payments. This helps to ensure that you get paid when invoices are due.

This efficiency can save your business time and money.

Establishing clear payment terms is essential for ensuring timely payments.

Define your payment due dates and any late fees upfront. You’ll need to communicate these terms clearly on your invoices.

Automating invoice reminders is an effective way to reduce late payments. Invoicing tools offer features that allow you to send automatic reminders to customers. That means if an invoice is overdue, your customer will receive a payment reminder.

This reduces work on your end and ensures payments are made promptly.

Tracking payments and maintaining accurate records is crucial. You can use your invoicing software to track which invoices have been paid and which are still outstanding. That way, you can keep your payment records up to date and avoid missed payments.

It’s essential that your payment processes are secure and compliant.

Businesses that accept credit card payments must be PCI compliant. Make sure your payment processor meets these standards.

You’ll also need to use encryption and other security measures. These help to safeguard sensitive information, such as your customers’ payment details.

Reducing transaction fees can help your business save money.

For example, you can encourage customers to use ACH payments or bank transfers. These typically have lower fees compared to credit card payments. You should also look for platforms that offer discounted rates for high sales volume.

If your business works internationally, managing currency conversion and fees is important. Choosing a payment platform that offers mid-market exchange rates and low fees, such as Wise Business, is crucial. If not, you can lose a significant amount of money on unnecessary fees.

Accepting invoice payments online is essential for modern businesses looking to improve efficiency and customer satisfaction. By choosing the right tools, setting up secure payment processes and following best practices, you can streamline your payment collection and focus on growing your business.

| 💡 For all you need to know about invoices, don't forget to read and bookmark the ultimate guide to invoicing from Wise! |

|---|

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

The best payment processor can simplify all of your customer transactions. Check out the cheapest payment processing services for small businesses in 2026.

Learn how US entrepreneurs can maximize online earnings with Payoneer, from freelancing to cross-border payments.

Discover the minimum withdrawal amounts for Payoneer in our comprehensive guide tailored for US freelancers, business professionals, and entrepreneurs.

Learn how to transfer money from Payoneer to Wise Business with clear instructions, practical tips and insights on overcoming common hurdles.

Explore the best ecommerce funding options—from loans to revenue-based financing—to scale your online business with confidence and flexibility.

Discover how third-party payment providers can streamline transactions for your growing US business