Review of Statrys: Great Business Account for Singapore Companies?

In-depth review of Statrys business account for Singapore, including features, pricing, and alternatives for SMEs with international transaction needs.

Youbiz1 is the Youtrip2 business account. If you’ve used Youtrip for paying for things when you travel, you may be wondering whether or not the Youbiz business account is worth choosing for your business finance needs.

Youbiz offers a corporate card for use in 150+ countries, with a linked multi-currency account for holding and exchanging up to 9 currencies. The Youbiz card also features unlimited 1% cashback on all card spending.

So - is Youbiz the right choice for your Singapore business? This Youbiz review walks through all you need to know, including:

| Table of contents |

|---|

The Youbiz account has some neat features for Singapore businesses looking to manage their money both here and abroad.

Some useful features you’ll get include:

Card features:

Multi-currency account features:

Youbiz offers many services to Singapore business customers with no fees. However, there are a few charges you should know about. Here’s a roundup of some important costs:

| Service | Youbiz fee |

|---|---|

| Open an account | No fee |

| Monthly fee | No fee |

| Outgoing overseas payment | Variable fee which you can see in the Youbiz dashboard3 |

| Incoming overseas payment | No fee from Youbiz4 Other banks might charge fees which may mean you get less than you expect |

| Local payment | No fee5 |

| Currency conversion | Typically 0.1% - 0.4%6 |

| Corporate cards | No fee, but delivery charges may apply on replacement cards7 |

| ATM withdrawal | Youbiz ATM fee is waived (correct at time of writing)8 ATM operator may charge a fee which Youbiz can not control |

*Correct at time of research - 12th November 2024

If you’re a Singapore business owner you’ll want to compare a few different account and card service providers before you pick one, to make sure you get the very best match for your company needs now and in the future. Youbiz is a solid choice from a local Singapore provider you may already be familiar with — Youtrip — but another option worth looking at is Wise Business.

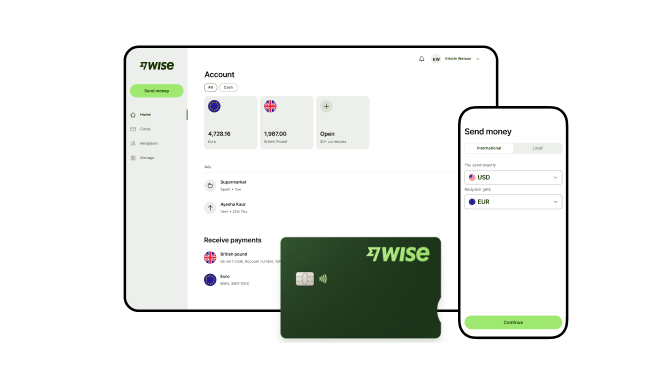

Wise Business was launched back in 2011 and has upwards of 16 million personal and business customers in many countries and regions globally. Wise offers business account and card services with 40+ supported holding currencies, extras like multi-user access, debit and expense cards and more - with mid-market exchange rates and low fees.

To give you a flavour of how Wise Business and Youbiz measure up side by side, here’s a quick comparison based on some important features and fees:

| Wise Business | Youbiz | |

|---|---|---|

| Eligibility | Available in Singapore and many other countries and regions globally | Available in Singapore |

| Account opening and monthly fees | 99 SGD one time opening fee No monthly fee | No opening fee No monthly fee |

| Supported currencies for holding and exchange | 40+ currencies supported for holding and exchange | 9 currencies supported for holding and exchange |

| Currency exchange rate | Mid-market rate | Youbiz rates are set based on wholesale rates, usually with a cost of 0.1% to 0.4% built in |

| International transfer currencies | 40+ | Around 20 |

| International transfer fees | Variable fee from 0.31% Discounted fees apply on high value payments | Variable fee |

| Debit and expense card costs | 4 SGD card order fee | No card order fee Delivery fee may apply on replacement cards |

| Foreign transaction fee for card spend | No foreign transaction fee | No foreign transaction fee |

| Expense management | Available with no extra costs | Available with no extra costs |

| Accounting integrations | Available - integrate with Freshbooks, Quickbooks, Xero and more, with no extra costs | Available - integrate with Xero, with no extra costs |

| Batch payments | Available with no extra costs | Not available |

| Safeguarding of funds | Funds are safeguarded in a top tier establishment for security | Funds are safeguarded in a top tier establishment for security |

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

As you can see, while Youbiz and Wise Business have some overlapping features, they’re not quite the same in terms of how they operate or the fees they charge. Probably the major difference in feature availability is the breadth of currencies available from Wise compared to Youbiz.

Wise does have a couple of one time costs to take into consideration, including a one time account opening fee and a small charge to issue a debit or expense card - but it also offers holding and exchange of 40+ currencies, and ways to get paid with local and SWIFT account details in a broad range of global currencies, too.

| Looking for a corporate banking account for your SME? Check out our resources covering other business bank accounts in Singapore below: |

|---|

Ultimately, which provider is best for you will depend on the type of transactions you need to make for your business. We’ll take a closer look at the types of businesses which might benefit from Youbiz in just a moment to help you decide.

Made up your mind? Opening a Youbiz account is pretty easy and can be done without leaving home. In fact if you’re opening an account for a business in which you’re a director and you have Singpass active, you don’t even need any documents. Just apply using Singpass and Youbiz can verify you and your business digitally.

Here’s how to open a Youbiz account if that’s the right option for your needs:

If you’re submitting your Youbiz application using Singpass you’ll also need to provide an authorisation letter if the person applying for a YouBiz account on behalf of the company is not a company director.

The other option if you don’t want to use Singpass is to make a manual application. In this case you’re asked to provide the following documents:

Once you’ve submitted everything needed and completed your application you should hear back from Youbiz in a day or two, to confirm you can start to use your account. If you run into any problems or have a question about your account you can reach out to Youbiz directly through their online help pages.

Smaller businesses with less complex finance operations, which still need to send and receive payments globally and require multi-currency capabilities may benefit from a Youbiz account.

Youbiz is simple to use and has relatively few fees to worry about. If you want an account to use to get paid in one of their 9 supported currencies, with relatively simple transaction needs, Youbiz might be a good choice for you. You can order cards for your team members to make it easy to spend, and you can add users to your account to allow your team to get access to the tools they need to do the job.

Youbiz might suit a small Singapore business which has one or two customers or suppliers abroad, trading in major currencies, and with occasional business travel.

Where Youbiz may fall short is if you’ve got a bigger or more complex organisation sending and receiving higher value payments, and with more frequent transactions to think about.

If you’ve got a bigger company operating out of Singapore, with relatively high turnover, such as a business in IT, software or consulting, which offers services around the world and needs to receive payments and transfer to contractors globally, an alternative like Wise Business might work better than Youtrip.

Wise Business has a few advantages in this respect - including a far greater selection of currencies for holding and exchange. You’ll also get local and SWIFT account details to get paid in foreign currencies conveniently.

Get a Wise Business account today!

Wise offers fee discounts if you send over 20,000 GBP (about 34,000 SGD) in a month, which is not something Youbiz markets. This could mean you get a significant discount on the costs of converting currencies and sending money overseas. Plus, Wise Business has much higher payment limits compared to Youbiz9.

Both providers have variable limits based on the currency you’re sending, but to give context, while Youbiz supports payments to the UK up to 200,000 GBP only, Wise limits are 1 million GBP - and Youbiz caps USD payments at 500,000 USD, whereas Wise has options to send up to 6 million USD per transfer.

Wise Business has some unique features which can help SMEs that are expanding their operations in the region.

These include batch payments - saving time - and more options for multi-user access on accounts. This allows you to set a broader range of access options to make sure your team can access the functions they need in the Wise Business account, without any security implications.

Ultimately, whether Youbiz or Wise is right for you depends on your business needs - weigh both up carefully, and remember to think about your future business needs as well as how you transact today.

YouBiz offers a suite of finance solutions for businesses, such as multi-currency accounts, and corporate cards, along with bill payments and spend controls. It has attractive features such as 1% Cashback on all card spend with no cap, and no foreign transaction fees on payments in over 150 currencies which could certainly suit smaller Singapore businesses with global ambitions.

However, if you are a growing business with slightly more complex financial operations, you might quickly outgrow Youbiz.

Check out Wise Business as an add on to your business financial toolkit, and enjoy a more robust feature set including batch payments, accounting software integration, high value payment discounts and more.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

In-depth review of Statrys business account for Singapore, including features, pricing, and alternatives for SMEs with international transaction needs.

Learn how Alipay Business works in Singapore, its fees, benefits, and alternatives to help you manage multi-currency payments faster and more transparently.

A full review of the Sleek business account for Singapore companies including its features, fees, and benefits.

Compare the best startup bank and non-bank solutions in Singapore. Find the right banking solution for your growing business with our complete guide.

A complete guide to HSBC business accounts in Singapore, covering fees, minimum balances, foreign exchange spreads, transaction fees and more.

Aspire vs Airwallex: Compare fees, cards, features, and more to find the best business account for your Singapore company.