Review of Statrys: Great Business Account for Singapore Companies?

In-depth review of Statrys business account for Singapore, including features, pricing, and alternatives for SMEs with international transaction needs.

Opening a corporate bank account that meets your needs is an important step in establishing and growing your company. The good news is there’s a broad range of accounts for Singapore businesses, including SME accounts from major local, regional and international banks, and non-bank providers which have varied features, fees and service options.

Use this guide to get an overview of the best business bank accounts in Singapore, and to help you pick the perfect match for your company's specific needs.

Here’s an overview of the accounts we’ll review - there’s more detail coming up later on each.

| Non-bank providers | Minimum balance | Monthly account fees | Currencies supported | Payment options | Notable features |

|---|---|---|---|---|---|

| Wise Business | No minimum balance | No monthly account fee One time 99 SGD fee for full account services | 40+ currencies supported | Send international payments from 0.31% | International debit cards available Ways to receive payments in foreign currencies |

| Aspire Business Account | No minimum balance | No monthly account fee | Local receiving accounts in SGD, USD and IDR | Free local transfers International payments from 8 USD | Virtual and physical cards available Cashback on some business spending |

| Revolut Business | No minimum balance | 0 SGD - 417 SGD/month depending on plan | 25+ currencies supported | 0.2 SGD for local transfers, 8 SGD for international payments - some plans include no-fee payment options | Several different accounts to choose from Some no-fee currency conversion based on account plan |

| Airwallex Business Account | No minimum balance | No monthly fee | 20+ currencies supported | Free local transfers International payments 20 - 35 SGD | Accept customer card payments conveniently Issue company spending cards |

| Youbiz | No minimum balance | No monthly fee | 9 currencies supported | Variable fees for transfers | Cashback on eligible card spending Xero integration |

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up-to-date pricing and fee information.

| Bank business accounts | Minimum balance | Monthly account fees | Currencies supported | Payment options | Notable features |

|---|---|---|---|---|---|

| DBS Business Multi-currency Account Starter bundle | No minimum balance - hold 10,000 SGD to avoid extra fees | 10 SGD/month | 13 currencies supported | Some free local payments depending on type 30 SGD international transfer fee | Extra charges apply if you want to transact in a branch For businesses incorporated less than 3 years |

| OCBC Business Growth Account | 1,000 SGD | 10 SGD monthly fee 15 SGD fall below fee | SGD | Some local payments may be free or included in your account package International transfers 30 SGD | Monthly fee waived for first 2 months Extra charges may apply if you want to transact in a branch, depending on your account details |

| Maybank Flexibiz | 1,000 SGD | 10 SGD fall below fee | SGD | 0.125% commission (minimum S$20, maximum S$100) + agent fee + cable fee | Aimed at startups and new businesses |

| UOB eBusiness Account | 5,000 SGD | 35 SGD annual fee 15 SGD fall below fee | SGD | International transfers may not have an upfront fee, although exchange rate markups will still apply | For startups - fall below fee waived for 12 months Some fee waivers are available for new customers |

| CIMB SME Account | No minimum | 28 SGD/month, waived for 12 months | SGD | 15 SGD for international transfers | No fall below fees, monthly fee waived for first year |

Before we consider the features and fees available from different business account providers, it’s worth getting an overview of things to think about when choosing the best corporate bank account in Singapore for you.

Eligibility- Banks and specialist account services set their own eligibility rules, which may include specific countries of residence or having an entity legally registered in Singapore, for example.

Registration fees- If you’ve not registered your business yet, you may be able to do so for a favourable price by going through your chosen account provider.

Minimum initial deposit - When choosing your account provider, check the minimum initial deposit requirements suit your situation. Some accounts have no minimum deposit - making them more suited to businesses in their infancy - while others are more restrictive.

Minimum monthly balance and fall below fee- Another important feature to check is the minimum daily or monthly balance. It’s common to find that fall below fees will apply if you don’t maintain a fixed balance - which can eat into your profits.

Monthly maintenance fees - Banking isn’t free, so some costs are to be expected with any business account. Check what fixed fees are applied to accounts you’re interested in - and whether these fees buy you any useful perks like free transfers or lower payment costs.

Online banking features - As a business owner you’re busy. Make sure you’re choosing a corporate account which has easy access to online and mobile banking to cut your admin time. It’s also worth checking the support on offer if you have questions or if anything goes wrong.

Features - Many account providers offer a range of products to suit businesses of different sizes, which come with different features. Check you can access all the services you need, like credit or working capital, international payments or accounting integrations. It’s also worth looking for batch payment solutions as these allow you to pay multiple people at once, saving time on admin.

Multi-currency options- Having easy ways to hold and exchange foreign currencies, as well as options to receive payments in foreign currencies, and to send money transfers abroad, is useful for most businesses. Whether you have customers, contractors, suppliers or employees overseas, most businesses today are globally connected - so your money should be too.

Transaction fees- Transaction fees are likely to apply on some transaction types, like sending and receiving payments, depositing cash, and using an ATM. These costs can add up - particularly if the transactions you need to make frequently have high fees.

Scalability- Some of the accounts we have picked are ideal for startups and new businesses - but you’ll also need a provider which you can grow with. Check what happens when you need to trade up to a more functional account in future.

Transaction limits - Some business transactions are likely to involve high value payments - to suppliers for example. Make sure you have an account which has transaction limits you can work with, for sending and receiving money, ATM use and other common transaction types.

We’ll kick off our overview with some non-bank providers. Wise is a fintech company, not a bank - but Wise Business is basically multi-currency banking without a bank. And because Wise is a specialist in borderless transactions and currency conversion, you don’t even need to have a Singapore business to get SGD bank details - Wise is available globally.

Illustration of Wise Business products

Open your Wise Business account online or in the Wise app, to hold and exchange 40+ currencies, and get local bank details for 8+ currencies. You can send payments to 50+ currencies, and get international debit cards for your team for easy business spending. Wise also has business friendly perks like cloud accounting integrations, and batch payments so you can pay up to 1000 people internationally with one of the fairest exchange rates around.

|

|---|

| Wise Business pros | Wise Business cons |

|---|---|

| ✅No ongoing fees or minimum deposit ✅Free to register ✅40+ currencies supported ✅Mid-market exchange rates ✅Issue debit and expense cards for employees | ❌99 SGD One time account fee to enjoy all features ❌No branch network ❌Some transaction fees apply |

Learn more about Wise Business

Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up-to-date pricing and fee information.

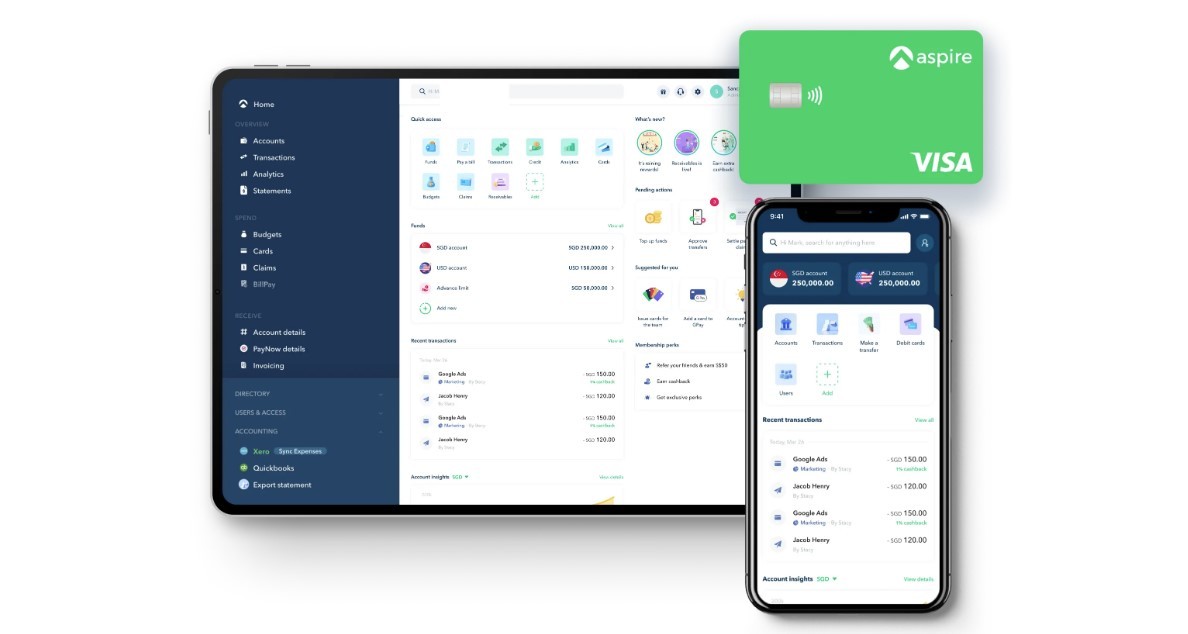

Aspire¹ business accounts allow customers to integrate with their accounting software, to manage their money, pay bills, issue corporate expense cards, and earn cashback on digital spend.

Illustration from Aspire's homepage

There’s no monthly service fee², no minimum balance, and it’s free to send and receive payments locally. You’ll just pay a small fee when sending or receiving international transfers to your account.

|

|---|

| Aspire Business Account pros | Aspire Business Account cons |

|---|---|

| ✅No ongoing fees or minimum deposit ✅Free local transfers ✅Some cashback on digital marketing and SaaS spend ✅Accounting integrations available | ❌International transfers cost at least 8 USD ❌Multi-user access fees apply ❌Exchange rates may include a markup |

Revolut Business3 offers Singapore customers the choice between 4 different account plans, from the Basic plan which has no monthly fee, through to products which are aimed at enterprise level customers4. This gives flexibility and scalability - plus, all accounts come with cards and multi-currency features to hold and exchange 25+ currencies. Different account plans have their own no-fee transaction limits, with fair usage fees after that.

| Revolut Business pros | Revolut Business cons |

|---|---|

| ✅Choose different plans based on transaction needs ✅25+ currencies available ✅All accounts come with debit and expense cards ✅Some no fee transactions monthly before fees begin | ❌Monthly fees apply for top tier accounts ❌Fair usage and out of hours fees can apply ❌No option to pay in cash |

The Airwallex5 business account lets you get paid in 20+ currencies, with easy ways to take card payments, send money locally and internationally and more. Accounts have no ongoing charges and are convenient to operate from your phone. You can also issue virtual and physical debit cards for simple spending.

| Airwallex Business Account pros | Airwallex Business Account cons |

|---|---|

| ✅No ongoing fees to pay ✅20+ currencies supported ✅Take customer card payments conveniently ✅Issue cards to team members | ❌Debit cards can’t be used in an ATM ❌Payment processing comes with extra charges6 ❌Foreign exchange fees apply |

Youbiz7 is provided by Youtrip, which you may know from its personal card services. Youbiz accounts support 9 currencies and come with the option of debit cards which can accumulate cashback on some eligible spending. There are no monthly fees to pay making this an affordable option, with some extras like Xero accounting integration if you need it.

| Youbiz pros | Youbiz cons |

|---|---|

| ✅Offered by a well liked local provider ✅9 currencies supported ✅Expense management tools ✅Some cashback on eligible spending available | ❌Variable fees apply on international payments ❌Some transaction fees apply ❌No cash deposit options |

DBS has a range of SME banking options, as well as corporate accounts for larger enterprises. One good option for smaller businesses is the DBS Business multi-currency account which comes with a starter bundle8 if your business was incorporated under 3 years ago.

You’ll have easy access to online and mobile banking solutions, but it’s worth knowing that you’ll have extra fees to pay if you want in branch services.

If your account is fully locally owned and registered you may be able to complete registration online - more complex businesses will need to register and then talk their needs through with a DBS representative.

| DBS Business Multi-Currency Account - Starter Bundle pros | DBS Business Multi-Currency Account - Starter Bundle cons |

|---|---|

| ✅Multi-currency functions ✅Starter bundle waives some fees for newer businesses ✅Local and international payments available, including bulk payments ✅Large bank network for face to face service | ❌Branch service incurs a fee ❌30 SGD + agent fees for international transfers ❌10 SGD monthly fee applies |

Business bank accounts from OCBC9 include products aimed at new businesses and entrepreneurs, and accounts for larger businesses with specialist needs.

We’ve picked out the OCBC Growth account as one to consider. There’s a minimum deposit of 1,000 SGD and account monthly fees are waived for the first 2 months. Sending local transfers is usually free10, and as the account is aimed at startups there are also lots of useful tools for new and growing companies.

| OCBC Business Growth Account pros | OCBC Business Growth Account cons |

|---|---|

| ✅Monthly fee waived for 2 months ✅Free local payments ✅Instant online opening ✅Some cashback on card spending | ❌Fairly complicated fee structure including monthly fee and possible fall below fees ❌Branch transactions incur fees ❌10 SGD incoming telegraphic transfer fee, 30 SGD outgoing fee |

Flexibiz accounts from Maybank11 have no fall below fee and can be opened by a range of business types, including charities. You’ll need a 1,000 SGD deposit to get started, and can access mobile and online banking solutions easily12.

Because Maybank has branches and partners throughout the region you can access some instant and 24/7 payment services between Singapore and Malaysia, as well as other major payment destinations in Southeast Asia.

If you need a more comprehensive account package you could also take a look at the Maybank PremierBiz account as an alternative with extra features.

| Maybank FlexiBiz Account pros | Maybank FlexiBiz Account cons |

|---|---|

| ✅Lots of branch services available ✅No monthly fees ✅24/7 online banking access ✅Good choice for newer businesses | ❌10 SGD fall below fee ❌Outward remittances subject to several different fees13 ❌Exchange rates may include a markup |

The business account UOB recommends for startups and new businesses is the UOB eBusiness account14. This account allows customers to manage their money online and using the UOB BizSmart digital banking tools.

There are also free local payments, and dedicated support from FX experts when you need to send money internationally.

| UOB Business Account pros | UOB Business Account cons |

|---|---|

| ✅Large branch and ATM network ✅Scalable account options - trade up as you grow ✅No fall below fee for 12 months ✅Large regional bank | ❌5,000 SGD balance needed to avoid fall below fee ❌Branch services have a fee ❌Exchange rates may incur a markup |

The CIMB SME Account15 offers some handy perks for growing businesses including free local payments and flat rates for international transfers. There are no minimum balance requirements - and so no fall below fee - and you can also get both SGD and USD chequing services if you need them.

| CIMB SME Account pros | CIMB SME Account cons |

|---|---|

| ✅No initial deposit and no minimum balance needed ✅Free local payments ✅Flexible account solutions ✅Competitive interest rates | ❌15 SGD international transfer fee ❌Chequing fees apply ❌Exchange rates may include a markup |

Opening your business account shouldn’t be too much of a headache - as long as your business is registered and you’re able to provide all the required paperwork to get started.

The exact process to follow depends on the bank or account provider you choose.

Online services will usually allow you to upload images of all your documents for a faster verification, while traditional banks may require you to attend a branch.

To give a couple of examples, you can register for a Wise account by completing your business and personal details online. Aspire also offers users the opportunity to get verified online. The paperwork you need varies, but will usually include:

The right business account can set up your company for financial success. You’ll be able to arrange and manage your money more easily, and cut the costs of day to day banking and financial services.

The right account for you may be from one of Singapore’s traditional banks - or from a non-bank provider like Wise or Aspire. Traditional banks can offer a broader range of services including in person transaction options - but may have higher fees compared to non-bank and digital alternatives.

Check out the options, features and fees for a range of account providers, including regular banks and modern online alternatives like the Wise Business account to make sure you get the right account for your business.

Sources checked on 04.12.2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

In-depth review of Statrys business account for Singapore, including features, pricing, and alternatives for SMEs with international transaction needs.

Learn how Alipay Business works in Singapore, its fees, benefits, and alternatives to help you manage multi-currency payments faster and more transparently.

A full review of the Sleek business account for Singapore companies including its features, fees, and benefits.

Compare the best startup bank and non-bank solutions in Singapore. Find the right banking solution for your growing business with our complete guide.

A complete guide to HSBC business accounts in Singapore, covering fees, minimum balances, foreign exchange spreads, transaction fees and more.

Aspire vs Airwallex: Compare fees, cards, features, and more to find the best business account for your Singapore company.