Revolut¹ accounts let users hold and exchange dozens of currencies, spend and make withdrawals with a linked debit card, and send money to bank accounts all over the world. As of August 2024, Revolut's Singapore customers can now open business accounts.

If you’re looking to find out more about the Revolut business account, you’re in the right place - read on for more various Revolut plans, fees and more. Also, learn more about a business account alternative - the Wise Business account, a neat solution for Singapore customers looking for a multi-currency business account.

Can I open a Revolut Business account in Singapore?

It's possible to open a Revolut Business account in Singapore. At the time of writing, Revolut Business accounts are available to registered companies and sole traders with a physical presence in the Singapore, US, EEA, UK, Australia, and Switzerland².

Business accounts created in Singapore fall under the same plans provided internationally, and will continue to work even if you're travelling. You can rest assured that you'll still have access to the full suite of Revolut features even when you're not physically present in the country.

Does Revolut Business work in Singapore?

If you’re an existing Revolut customer with a Revolut business account linked to your registered business elsewhere in the world, your account will still work just fine if you travel to Singapore, Malaysia or elsewhere in the region.

That means there’s no need to worry if you have a Revolut UK business account, for example, but are taking a business trip to Singapore. You’ll still be able to log into the Revolut app to manage your money, spend with the Revolut card, and send payments just as normal.

Revolut vs Wise (formerly TransferWise) - business account comparison

If you're wondering how Revolut Business compares with other business accounts, here's a summary of Revolut vs the Wise Business account.

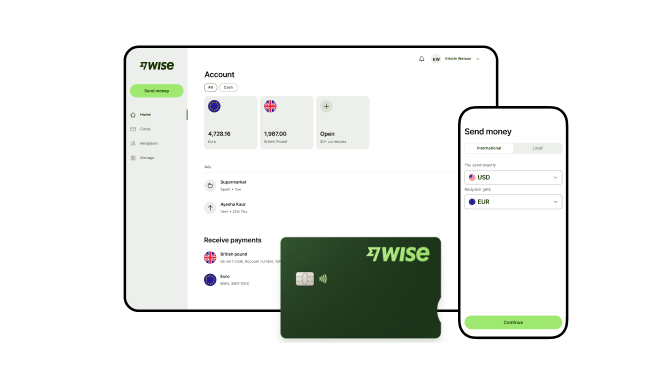

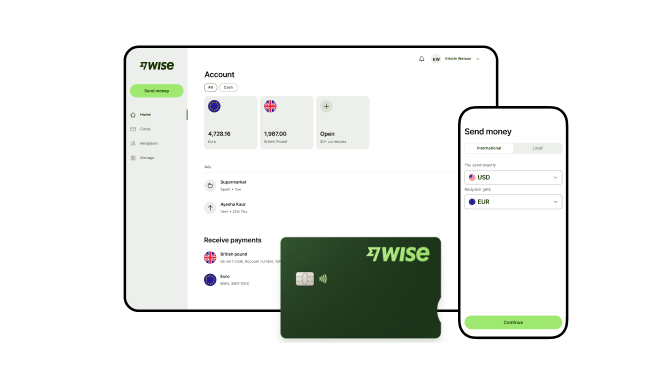

Wise Singapore accounts share many of the features of Revolut’s business account product, including:

- Multi-currency functionality

- Mid-market currency exchange rates

- Business debit cards

- Send and receive global payments

- Business friendly features like accounting integration, bulk payments and API

With Wise you’ll never pay a monthly fee, and there’s no minimum balance to worry about either. Instead you just pay low, transparent fees for the services you use. Meanwhile, Revolut offers various pre-set plans from 0 to 79 pounds a month³. The main difference being the number of fee-free transfers and conversions at the interbank rate.

Let’s take a quick look at how Wise for business measures up against Revolut business.

| | Revolut Business | Wise Business |

|---|

| Available currencies | Hold and exchange 25+ currencies Local bank details for GBP | Hold and exchange 40+ currencies Local account details 22 currencies including AUD, CAD, EUR, GBP, HUF, NZD, SGD, JPY, TRY and USD |

| Account opening fee | No account opening fee | No account opening fee (NB: there is an optional one-time fee of to unlock local account details) |

| Monthly fees | Standard plans are free, or choose a paid plan from 19 GBP - 79 GBP/month to unlock more features (around 32 SGD - 122 SGD) | No monthly fees |

| Currency exchange rate | Exchange with the mid-market exchange rate up to predefined account limits from 1000 to 50,000 GBP | Exchange with the mid-market exchange rate |

| International transfer fee | £5/transfer (about 8.50 SGD) - paid account tiers have some free monthly transfers included | Low, transparent fee, varies by destination |

| Business debit card available | Yes | Yes |

| Add team members | Yes | Yes |

| Integrate with accounting software | Yes | Yes |

| Bulk payments | Not offered on the free business plan - available with paid account tiers | Yes |

| Business API | Not offered on the free business plan - available with paid account tiers | Yes |

Learn more about Wise Business

Other available business accounts in Singapore

Of course, Revolut and Wise aren’t your only options when it comes to business accounts in Singapore. You’ll be able to pick from a few other neobanks which operate online and via apps - or go with a more traditional business bank account from one of the many local, regional and global banking brands based here.

It’s worth comparing a few options before you pick the right provider for your business, as the features and fees available do vary quite widely. Traditional banks can often offer a fuller suite of services compared with neobanks - including loans and financing - but their fees are usually higher. Specialist providers typically have been built with innovative features to offer a cheap and intuitive way to manage your business finances day to day. They also often provide extras like multi-currency options, cheap currency exchange and easy overseas payments, making them a good bet for any business with global aspirations.

Still not sure which bank or neobank business account to pick? Check out this guide to the best business bank accounts in Singapore.

Summary

Now that Revolut offers both personal and business accounts in Singapore, you'll be able to sign up for one if you find that it meets your needs. However, there are other great options if you’re looking for a way to manage your business finances online and on the move, across currencies and without worrying about excessive fees.

As we saw in our Revolut vs Wise business account comparison, Wise is a neat choice for people looking for a Revolut Singapore alternative for their business. Get your Wise account up and running with full functionality for a low one time fee of , to hold and manage 40+ currencies, get paid like a local, and send payments to 70+ countries. It couldn’t be easier.

Get a Wise Business account today!

Sources:

- Revolut Singapore

- Revolut FAQ - where is Revolut business available

- Revolut business plans

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.