Review of Statrys: Great Business Account for Singapore Companies?

In-depth review of Statrys business account for Singapore, including features, pricing, and alternatives for SMEs with international transaction needs.

Wondering what’s new in digital banking in Singapore? Recently several more providers have been issued digital banking licences (Singapore) through MAS. These banks are now launching their products, enhancing the range of options for digital and virtual banks in Singapore, for both personal and business customers.

Let’s explore the new digital banks in Singapore, and have a look at the differences between a digital bank vs a traditional bank.

| Table of contents |

|---|

We’ll also touch on a couple of other digital financial service providers - like Wise, which can help cut your costs when you send, hold, spend and exchange foreign currencies.

Digital banks operate primarily online and through apps, usually with no branch network. The services available through digital banks can vary widely, particularly as some of the newer entrants to the market are still launching products.

One great feature of the new digital banks in Singapore is that they’re digitally native.

That means they’ve been built to offer services online and in-app - rather than being brick and mortar banks which have added on digital services. This can lead to a more intuitive customer experience when you use their apps, and also guarantees you’re getting the latest in online security when you bank.

One other useful thing to know is that there are also other digital financial providers - particularly financial technology platforms like Wise and Revolut, which operate here in Singapore. We’ll look at these in more detail later.

These specialist services don’t hold full MAS banking licences - but they are still MAS regulated, and safe to use. This usually means they can’t offer the full suite of services, like credit and loans, that a licensed bank can - but instead they have their own specialist niches, such as low cost currency conversion, which can be handy to anyone who manages their money online.

This offers opportunities for more providers - including non-bank entities - to offer banking services in Singapore. Holders of a DFB licence can offer services to retail customers, while the DWB licence allows business banking, and covers other non-retail customer segments. Here’s a rundown of the differences you’ll want to know about:

| Digital Full Bank | Digital Wholesale Bank |

|---|---|

| Offers retail account products and services, to individual customers | Offers SME and business deposit accounts and services |

Here are the latest players in Singapore’s digital banking scene for 2025 who either have a DFB or DWB licence.

| Provider | MAS license type | Savings/Investment account rates | Interest base rate |

|---|---|---|---|

| GXS | Digital full bank (DFB) | Up to 3.18% p.a. (variable) | 2.38% p.a. (variable) |

| Maribank | Digital full bank (DFB) | 3.16% p.a. (variable) with Mari Invest | 2.7% p.a. (variable) |

| Trust Bank | Digital full bank (DFB) | Trust Invest is coming soon | Up to 3% p.a. (variable) |

| ANEXT | Digital wholesale bank (DWB) | Term investment products available with variable rates | 2.7% p.a. (variable) on SGD and USD |

| Green Link | Digital wholesale bank (DWB) | Term investment products available with variable rates in USD and SGD | Up to 0.5% p.a. (variable) |

*Correct at time of research - 4th December 2024

Grab - Southeast Asia’s leading app - and Singtel, the leading communications technology group in Asia, have come together to launch GXS³. We all know Grab from ride hailing, food delivery and more - and now, with their partnership with Singtel, you can also use GXS for banking.

GXS² products and services at the time of writing include:

When it comes to savings you have 3 options: Boost Pocket for spare cash, Savings Pockets for meeting your savings goals and your Main Account which holds your everyday spending money, and which is still eligible for interest.

Different earning levels apply to each option, which are variable and can change over time.

GXS also offers a debit card and its innovative Flexicard. The Flexicard is a no-interest credit card with no minimum income requirement. You can spend with your card and either pay back the money at the end of the month, or roll the balance forward with a fee to pay. There’s even the option to earn cash back on some eligible spending.

Sea Limited is the internet service behind Shopee and Garena - and also Sea Money⁵ which has been offering financial products since 2014. You’ll know Sea Money through their Shopee Pay and SPayLater - and now you’ll be able to access their digital banking services, too, through MariBank Singapore.

Maribank4 offers personal customers the Mari savings account, credit cards and loans. There’s no minimum deposit, no minimum spend requirement and no need to have your salary deposited to your account, so you can simply use it as you please - and earn the Mari bank interest rate on your balance too. At the time of writing, Mari savings accounts are earning a variable 2.7% p.a. which can give you a nice boost.

Customers looking for something different from MariBank can choose to invest from 1 SGD with low risk and instant access to your money through Mari Invest. And if you’re more interested in spending than saving, there’s the Mari credit card which has cashback and Shopee Coins you can earn as you spend.

Trust is backed by Standard Chartered and FairPrice, and has solutions for saving and spending - with savings accounts, credit cards and insurance products. Because Trust⁶ has launched in part through FairPrice you can also get good discounts on your shopping when you use their services. In fact, you could save up to 21% when you use a Trust credit card at FairPrice, with easy ways to earn extra rewards and referral bonuses too.

ANEXT offers business banking services, and is wholly owned by Ant Group⁷, an Alibaba affiliate. You can open a business bank account for free, with no minimum balance, in either SGD or USD. There are options to send payments locally and internationally, including sending and receiving payments in 9 major trading currencies, like SGD, USD, GBP and EUR.

Green Link Digital Bank⁸ - also known as GLDB - offers business solutions like deposit accounts, payments, loans, overdrafts and trading tools. GLDB’s services - including current accounts and savings products - are available in both SGD and USD.

GLDB is supported by investors including the Greenland Group and Linklogis consortium.

The Greenland Group operates internationally in real estate and infrastructure development, while Linklogis is a technology solution provider for supply chain finance.

So why would a digital bank appeal - when there are so many traditional banks in Singapore to choose from? Here’s a look at some of the benefits a digital bank can offer:

The banks we have introduced so far are the most recent entrants into the digital finance scene here in Singapore. However, there are also some more providers which aren’t full fledged digital banks but which offer similar services. Here, we’ll look at two as an example, so you can see if either fits your needs.

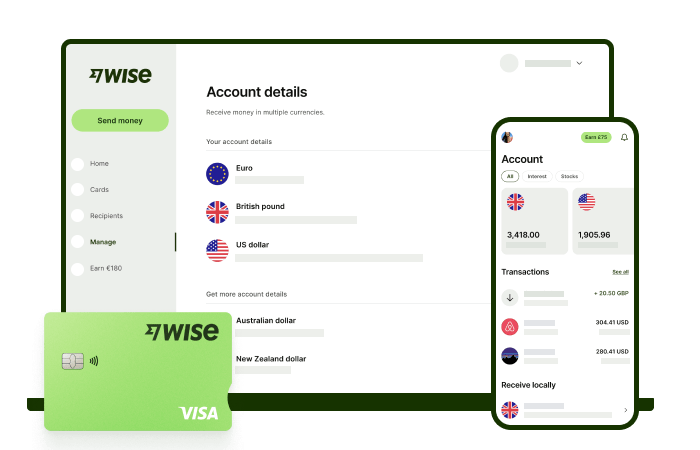

Wise arrived in Singapore in 2017, and was one of the first remittance companies allowed by MAS to verify customers online. Since then, Wise has launched services including multi-currency accounts for individuals and businesses, and low cost international transfers to 160+ countries around the world.

Wise doesn’t hold a digital banking licence but is regulated by MAS in Singapore. That means Wise is safe to use to hold, send and spend money. Open your Wise account online or in the Wise app, to hold 40+ currencies, and get paid with local and SWIFT account details in 8+ currencies. You can also get a linked Wise card for easy spending when you travel.

Where Wise stands out as an alternative to the newer digital banks is in the breadth of international services available - with flexible multi-currency account options that offer mid-market currency exchange which could suit a broad range of customers.

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

Revolut⁹ has a selection of accounts for customers, including both personal and business accounts. You can open a standard account plan which has no ongoing charges, or upgrade to an account with monthly fees to unlock more features and get a higher level of no fee transactions. All accounts offer some currency exchange which uses the mid-market exchange rate, and can be used to hold and exchange 25+ currencies.

Revolut is a strong alternative to the new digital banks in Singapore, if you’re a personal customer looking for a flexible online account which can be used to hold and exchange currencies - particularly if you’d like to offer accounts to your kids, as Revolut has Under 18 account products for family members. Revolut also has ways to buy and sell stocks, commodities, and cryptocurrencies.

SMEs will also find that Revolut has a business account that could serve their needs.

➡️Learn more about how Wise and Revolut compare here.

Digital services like Wise and Revolut cater to both personal and business customers.

If you’re opening a business account you can expect to get lots of great features to manage your money including multi-currency functions and cards, plus business focused additions like batch payments, expense management tools, and integration with accounting software. Overall this can mean getting access to low cost ways to manage your company finances, with time saving tools to cut down on administration.

To give one example, global HR management solution Slasify uses Wise to manage international payroll, which has allowed the team to cut the time spent consolidating multi-currency transfers in half. As a provider of global payroll services, Slasify found the batch payment solutions from Wise, which let you pay up to 1,000 people at a time, in a broad selection of currencies, were a game changer.

Add on the low costs of currency conversion, and digital account providers for business could help save time and money when operating day to day, and particularly when international transactions are concerned.

It’s natural to wonder: is MariBank safe? Can I trust Trust with my money? And what does GXS do to keep my funds secure?

The good news is that the newly licensed digital banks in Singapore are safe to use. They’re licensed by MAS, and have to measure up to the same rigorous safety and regulatory standards as traditional banks.

This means that your funds in a digital bank are likely to be eligible for SDIC insurance to the legal maximum of 100,000 SGD per depositor. This insurance exists to compensate customers in the unlikely event that the bank fails. You’d be able to claim your money back, to the legal limits, through the SDIC scheme.

Aside from insurance, digital banks have a focus on security which is built into their apps and operating systems. With normal safety precautions, they’re safe to use and can be a good way to manage your money day to day.

Digital banking is only going to get bigger in Singapore. As we all become more and more familiar with - and reliant on - being able to manage our lives on the move, sorting out your personal or business finances from your phone will be second nature.

While the main traditional Singapore banks all offer online and mobile banking solutions, they may also come with higher fees as they need to maintain their branch network. And as they’re not digital first providers, customers may find the apps on offer from the newer providers more intuitive to use.

Ultimately, whether a virtual bank or similar non-bank provider - or a traditional bank - works best for you comes down to your personal preferences and the sorts of transactions you need to make. Keep watching as more providers enter the market - and as the existing services launch new products - to find one which suits your needs.

Sources checked on 4/12/2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

In-depth review of Statrys business account for Singapore, including features, pricing, and alternatives for SMEs with international transaction needs.

Learn how Alipay Business works in Singapore, its fees, benefits, and alternatives to help you manage multi-currency payments faster and more transparently.

A full review of the Sleek business account for Singapore companies including its features, fees, and benefits.

Compare the best startup bank and non-bank solutions in Singapore. Find the right banking solution for your growing business with our complete guide.

A complete guide to HSBC business accounts in Singapore, covering fees, minimum balances, foreign exchange spreads, transaction fees and more.

Aspire vs Airwallex: Compare fees, cards, features, and more to find the best business account for your Singapore company.