Corporate account meaning: A guide for Singapore businesses

Learn what a corporate bank account is. Why it’s essential for separating your business finances from personal. How to open one in Singapore. Read here!

Airwallex¹ is an online and digital account provider, which offers multi-currency business accounts to receive, hold and send payments all around the world. This Airwallex review and guide will walk through all the key points you need to know about the Airwallex Singapore business account, including how to make global payments, and how to use the service to receive business payments.

We’ll also compare Airwallex Singapore with an alternative - the Wise business account which is available in Singapore and around the world.

| Table of contents |

|---|

Airwallex was founded in Australia in 2015, and now has 19 offices around the world - including in Singapore. Airwallex provides business account services to businesses and entrepreneurs globally, letting them receive payments in a range of currencies, send money to others, and spend with a linked debit card.

It’s important to know that Airwallex is not a bank - it’s a financial technology company.

However, to operate in Singapore and around the world, Airwallex must be approved by regulators like MAS - much in the same way your regular bank is. That means it’s a safe provider for managing your business finances.

When you open an Airwallex wallet for your business you’ll also have the option to open global accounts in several different currencies. These accounts let you receive foreign currency payments, which are then transferred to your Airwallex wallet for spending².

Once you have funds in your account you can also make payments to others - handy if you’re paying contractors, suppliers or staff for example. There’s no upfront Airwallex fee for international transfers, but some charges may still apply depending on how you set up your payment. Any payment which includes a currency conversion will mean paying a markup on the exchange rate, too.

Here’s the FX markup applied to different transaction types:

| Conversion type | FX markup applied³ |

|---|---|

| Customer markup in AUD, USD, HKD, CNY, JPY, EUR, GBP, CAD, CHF, NZD, SGD | 0.4% |

| Customer markup in other currencies | 0.6% |

| Auto conversion fee | 1% |

It helps to know that Airwallex sets out its transfer fees in Australian dollars, which will be converted to the relevant currency at the live exchange rate at the time of the transaction. At the time of writing the exchange rate to SGD is almost 1:1, making it pretty easy to calculate the costs at home.

Here’s what you need to know:

| Transfer type | Applicable fees⁴ |

|---|---|

| SWIFT transfer | 10 - 30 AUD + standard FX markup |

| Singapore domestic RTGS | 10 AUD + standard FX markup |

| US FedWire | 10 AUD + standard FX markup |

| Hong Kong domestic RTGS | 10 AUD + standard FX markup |

Let’s take a more detailed look at the features offered with the Airwallex Singapore business accounts.

You’ll be able to open a global account in a range of currencies, which work as though you’re based in the following countries⁵:

The exact functionality of each global account may vary - some can only accept local payments, while others can accept payments in the given currency from anywhere in the world, for example.

In addition to local payments, your Airwallex account can accept SWIFT transfers in AUD, CAD, CHF, CNH, EUR, GBP, HKD, JPY, NZD, SGD, and USD - but it’s worth knowing that SWIFT payments tend to come with high fees for the sender.

If you’re being sent a payment through SWIFT it’s also important to remember that intermediary fees may apply, which are deducted as the payment is processed. This might mean you end up with less in the end than the sender was expecting.

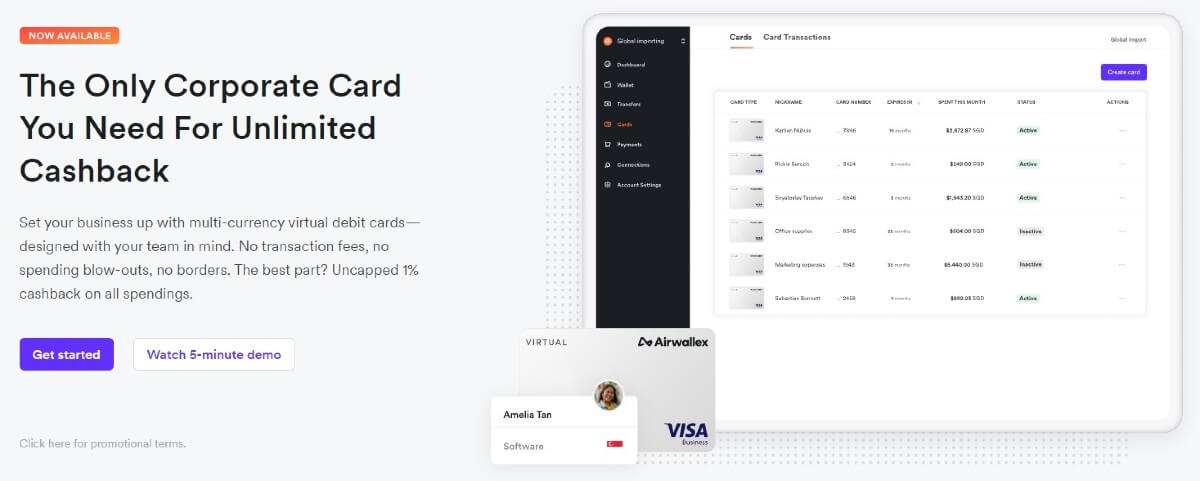

Once you have an Airwallex account you’ll be able to instantly create virtual borderless debit cards⁶, and order physical borderless cards for delivery.

💡Within your Airwallex account you’ll be able to use user permissions to decide who can issue and authorise borderless cards. Hand this task over to your accounts team to free up more of your own time, while still giving employees all the tools they need to do their jobs.

At the time of writing there’s the opportunity to earn up to 1% cashback on card spending - this is a promotional offer, and so may be limited or reviewed in future. Check the details when ordering your card to get the latest information.

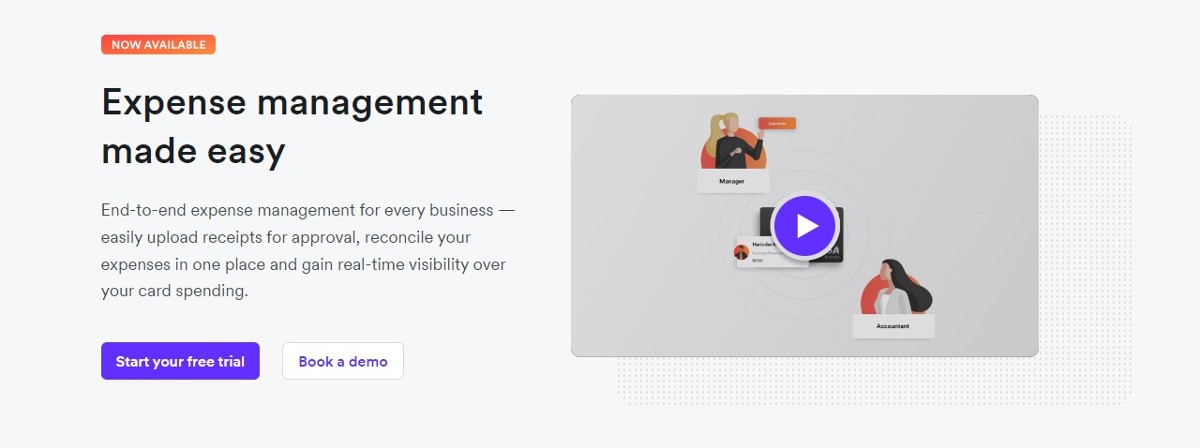

Use your Airwallex account to upload receipts, approve expense claims and manage overall business spend easily⁷. This can cut down on administration, and also improve business processes, making it easier to reconcile accounts and track all business charges.

Either you or your team can categorise spending to the right accounting and tax categories, making it easy to close your books at the end of the month.

When you use the expense tool you’ll also be able to see at a glance what is being spent and where, both through real time notifications and valuable data on your account usage.

There’s a 5 SGD/month fee for any borderless cards issued to employees when using the Expense management tool. This is billed only when expense management is turned on, and prorated if you don’t use the functionality for the whole of the month.

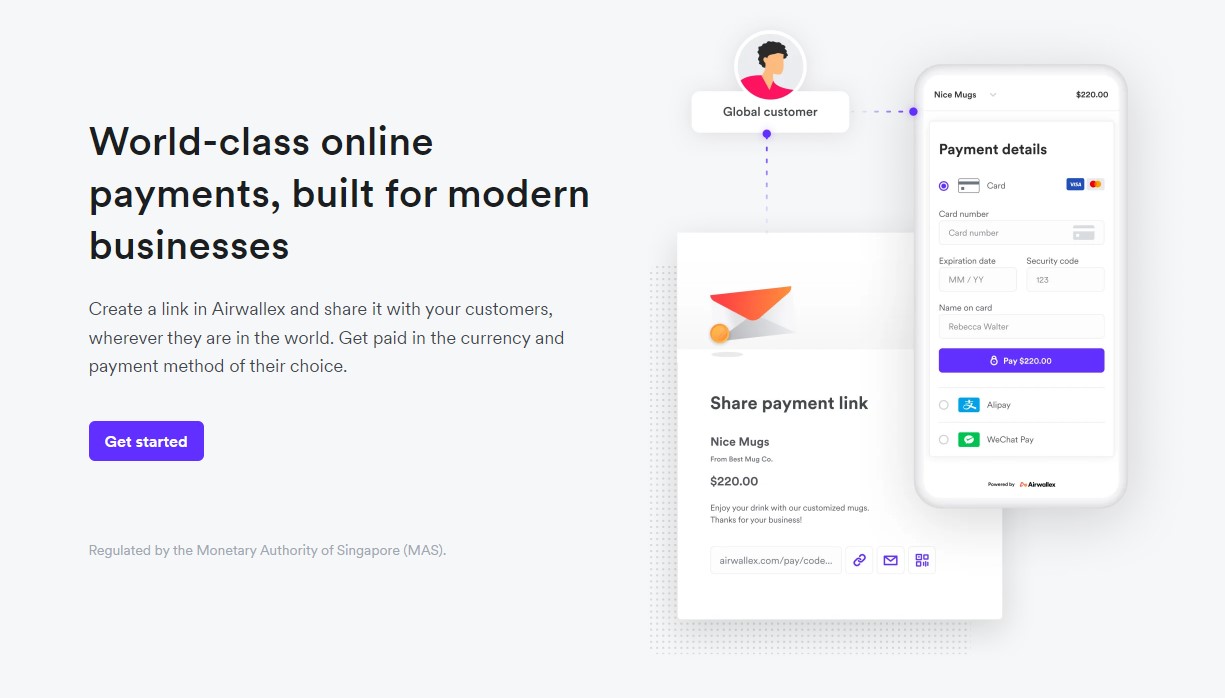

Get unique payment links⁸ which you can send to people who need to transfer money to you, to make it easier than ever to get paid in a range of currencies.

Embed your link into an email, or get a QR code which you can share using social media. You can also add your links to invoices so customers can pay you right away in just a few clicks.

Payment links are a helpful tool if you’re a freelancer or creative for example, as it’s easy to send and share your QR or link with customers. Giving customers an easier way to pay also means you get your money faster, and in the currency you and they prefer.

There may be fees for receiving payments into your Airwallex account, depending on the transfer type. Check over the account terms and conditions before you get started to make sure you understand all the costs involved.

One final business friendly feature worth noting - cloud based accounting integration⁹.

You can automatically synch your Airwallex account with Xero cloud accounting software to have real time updates of your account balance and transaction status. Your account will automatically synch every hour so you’re never far from the details, and you can keep track of your business finances more easily.

Transactions can be reconciled and categorised to see spending patterns, and you’ll be able to keep separate bank feeds for each currency. This can cut down administration and leave you and your team with more time to do the things that really matter.

Like any bank account, Airwallex must abide by local and international regulations to keep accounts secure and prevent fraud. That means you’ll need to complete a verification process to be able to use your Airwallex Singapore account. The good news is that, as an online and mobile company, Airwallex allows for a smooth digital verification you can complete from home - no need to visit a branch or wait in line to show your paperwork.

To open an Airwallex account for your Singapore registered business you’ll need to provide a range of documents, which can include¹⁰:

To open an account you’ll need to take the following steps:

It’s usually possible to get your account verified within 1 to 3 days - if the Airwallex team need any more information from you to get started, you’ll be notified.

You can get in touch with Airwallex online using the support form or choose one of the following options:

Airwallex isn’t the only specialist digital business account available in Singapore. One other great option if you’re looking for a more flexible account with greater global reach, is the Wise business account. Let’s take a look at how these providers match up:

| Feature | Airwallex | Wise Business |

|---|---|---|

| Eligibility | Registered businesses only | Personal and business accounts available |

| Account costs | No fee to open account, monthly charges may apply if you enable expense management | One time fee of 99 SGD to open full business account - no monthly charges apply |

| Currency coverage | Hold 20+ currencies | Hold 40+ currencies |

| Receiving account availability | Accounts in 8 countries, accepting 9 currencies | Receive local payments from 8+ countries |

| Debit cards | Available - cash back offered on spend at the time of writing | Available |

| Employee cards | Available | Available |

| International payments | No Airwallex fee to send, but third party charges may apply | Low fees based on destination country |

| FX markup | 0.4% - 1% depending on situation | No markup used, mid-market exchange rate applies |

| Payment links | Available | Not available |

| Accounting | Xero compatible | Compatible with Xero, QuickBooks and FreeAgent |

As seen on the table, the providers offer very similar products for businesses in Singapore. So choosing one above the other would depend on your unique needs.

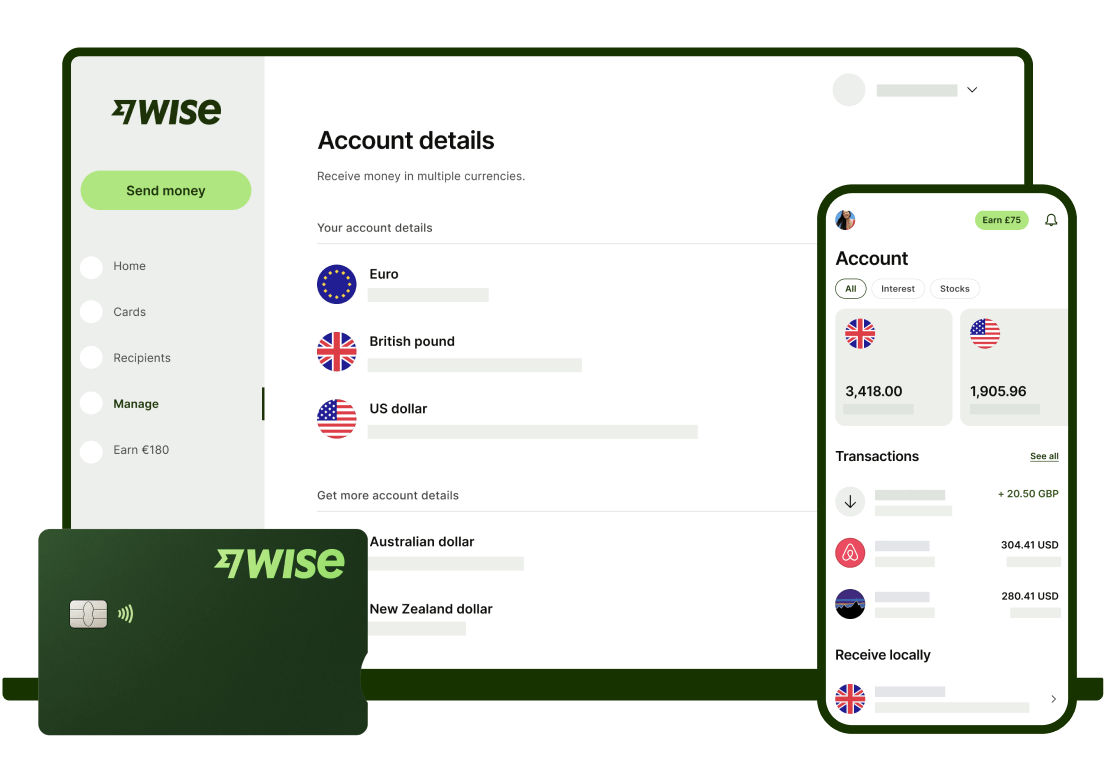

You can open a Wise account online, with just a one-time fee of 99 SGD to get all features. There’s then no ongoing cost, no minimum balance and no hidden charges to worry about. You’ll be able to hold 40+ currencies, get paid from 8+ currencies for free, send payments to 140+ countries, and spend all over the world with your linked business debit card.

| Wise is licensed by the Monetary Authority of Singapore and safeguards customer funds. Learn how. |

|---|

Illustration of Wise Business products

Having a multi-currency business account is a smart option for anyone with global ambitions for their company. Being able to receive payments in foreign currencies makes it easier for international customers to pay you. Once you have funds in your multi-currency account you can hold or exchange them, withdraw back to your local Singapore account, or use them to pay contractors, suppliers and staff. You’ll avoid unnecessary currency conversions, and cut the costs of managing your business across borders.

Since it was launched just a few years ago, Airwallex has become a popular account option for businesses in Singapore and beyond. You’ll be able to open your account online for free, to transact in a range of currencies, get paid by customers and clients, or from PSPs and online marketplaces, and send money in a range of currencies, too.

When you’re deciding which account is best for your business, don’t forget to shop around.

➡️ Check out the best corporate bank accounts in Singapore here.

Compare a few options against Airwallex - including the Wise business account - to see which suits your needs best.

Sources checked on 23.12.2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn what a corporate bank account is. Why it’s essential for separating your business finances from personal. How to open one in Singapore. Read here!

In-depth review of Statrys business account for Singapore, including features, pricing, and alternatives for SMEs with international transaction needs.

Learn how Alipay Business works in Singapore, its fees, benefits, and alternatives to help you manage multi-currency payments faster and more transparently.

A full review of the Sleek business account for Singapore companies including its features, fees, and benefits.

Compare the best startup bank and non-bank solutions in Singapore. Find the right banking solution for your growing business with our complete guide.

A complete guide to HSBC business accounts in Singapore, covering fees, minimum balances, foreign exchange spreads, transaction fees and more.