Review of Statrys: Great Business Account for Singapore Companies?

In-depth review of Statrys business account for Singapore, including features, pricing, and alternatives for SMEs with international transaction needs.

As a Singapore-based small and medium enterprise (SME) looking to expand your customer base and gain overseas market share, Maybank’s corporate banking solutions can seem attractive. Its international network of 2,400 offices in 20 countries and strong presence in all 10 ASEAN countries makes it well-positioned to help businesses like yours grow into multinational corporations¹. To help you understand whether Maybank truly meets your business’s needs, this article delves into the most well-received Maybank business credit and debit cards, their features, fees, benefits, and more. We’ll also introduce an alternative non-bank card option, the Wise Business Card, for your consideration.

| Table of contents |

|---|

Here’s an overview of the cards we’ll review — there’s more detail coming up later on each.

| Maybank business credit card | Annual fee | Cashback | Minimum annual sales turnover | Foreign transaction fee | Benefits |

|---|---|---|---|---|---|

| Maybank Business Platinum Mastercard2 | S$196.20, waived for the first 2 years | 1 TREATS Point rewarded for every S$1 spent³ S$1 cash credit per 380 TREATS Points redeemed via Maybank Pay with Points⁴ | S$200,000 | Up to 3.25% | Consolidated statements Complimentary travel insurance Up to 51 days of interest-free credit on purchases Automatic payments of recurring expenses |

| Maybank Business Platinum Visa Debit Card⁵ | No annual fee | 3 TREATS Points rewarded for every S$5 spent in Malaysian Ringgit 1 TREATS Point rewarded for every S$5 spent in Singapore dollar and other foreign currencies S$1 cash credit per 380 TREATS Points redeemed via Maybank Pay with Points⁴ | S$0 | Up to 3.25%⁶ | Complimentary travel insurance coverage of up to S$1,000,000 when air tickets or travel packages are charged in full to the card |

| Wise Business Card* | No annual fee | No cashback | S$0 | No foreign transaction fee | Instant spending notifications Set spending limits on your business account Mid-market rate currency conversion |

*Details accurate as of 19 March 2025

**Please see the Terms of Use for your region or visit Wise Fees & Pricing for the most up-to-date pricing and fee information.

| 🔍 Looking for a corporate banking account to pair with a Maybank Business credit card?➡️Check out our review of the best corporate bank accounts in Singapore here. |

|---|

Unlike personal cards intended for personal expenses, corporate cards are company-issued cards provided to employees for business-related expenses, such as travel, entertainment, and office supplies. Employees can make necessary purchases without using personal funds and seeking reimbursement, streamlining the expense management process by using corporate cards. This approach reduces the administrative burden on a company’s finance team, allowing them to focus on more strategic financial tasks.

There are 2 types of corporate cards: corporate credit cards and corporate debit cards.

A corporate credit card allows employees to make purchases using a line of credit extended by the card issuer, enabling the company to pay for expenses and settle the balance later, often with the option to carry over balances with interest. In contrast, a corporate debit card is directly linked to the company’s bank account; transactions deduct funds immediately.

For many Singapore businesses (SMEs, especially), a business debit card is often enough to meet their daily needs, including vendor payments, employee expenses, and operational costs.

An excellent business debit card option is the Wise Business Card linked with the Wise Business account. In addition to covering most of those daily needs, it has the advantage of no annual or monthly fees, foreign transaction fees, or hidden forex markups. These can quickly add up and eat into a business’s profits, especially if you frequently make payments in foreign currencies to your suppliers, vendors, contractors, and/or consultants based overseas.

| Take your business global with Wise Business | |

|---|---|

| 🚀 Always Get the Mid-Market Rate No more hidden markup fees or foreign transaction fees - We give you the exact mid-market exchange rate + a transparent, low conversion fee. | 🌍 Global Multi-Currency Account that Feels Local Send money to over 70 countries and manage multiple currencies without breaking a sweat. Get account details to receive payments in GBP, EUR, AUD and more currencies just like a local |

| 💸 Pay Once, Unlock Forever Forget about monthly charges or annual fees. With Wise Business, you can unlock the full suite of features for a one-time fee of 99 SGD | 💼 Batch Payments Brilliance Too many invoices? Power through up to 1,000 invoices in just one click with our Batch Payments Tool |

| 💳 Command Your Cash Flow with Wise Business Cards Give your team their own corporate debit cards to keep expenses clean and easy to monitor. Need more control? Approve payments, set spending limits, and freeze your card if you've lost it. | 📄 Free Invoicing Tool Level up your invoicing game with our free tool. Create and send professional invoices that not only get noticed but get paid. |

Learn more about Wise Business

Singapore-based SMEs with a minimum annual sales turnover of S$200,000 can consider the Maybank Business Platinum Mastercard², a Maybank business credit card that charges an annual fee of S$196.20 (waived for the first 2 years).

Pros of this card include:

Cons of this card include:

Given this, the Maybank Business Platinum Mastercard may be more suitable for established SMEs with consistent transaction volumes (to leverage the rewards program) and businesses looking to streamline their financial processes and gain better control over expenditures.

Like all debit cards, the Maybank Business Platinum Visa Debit Card⁵ has no annual fee.

Pros of the card include:

Cons of the card include:

Given this, the Maybank Business Platinum Visa Debit Card may be more suitable for small businesses and startups, especially those who frequently transact in Malaysian ringgit for the accelerated TREATS Points award.

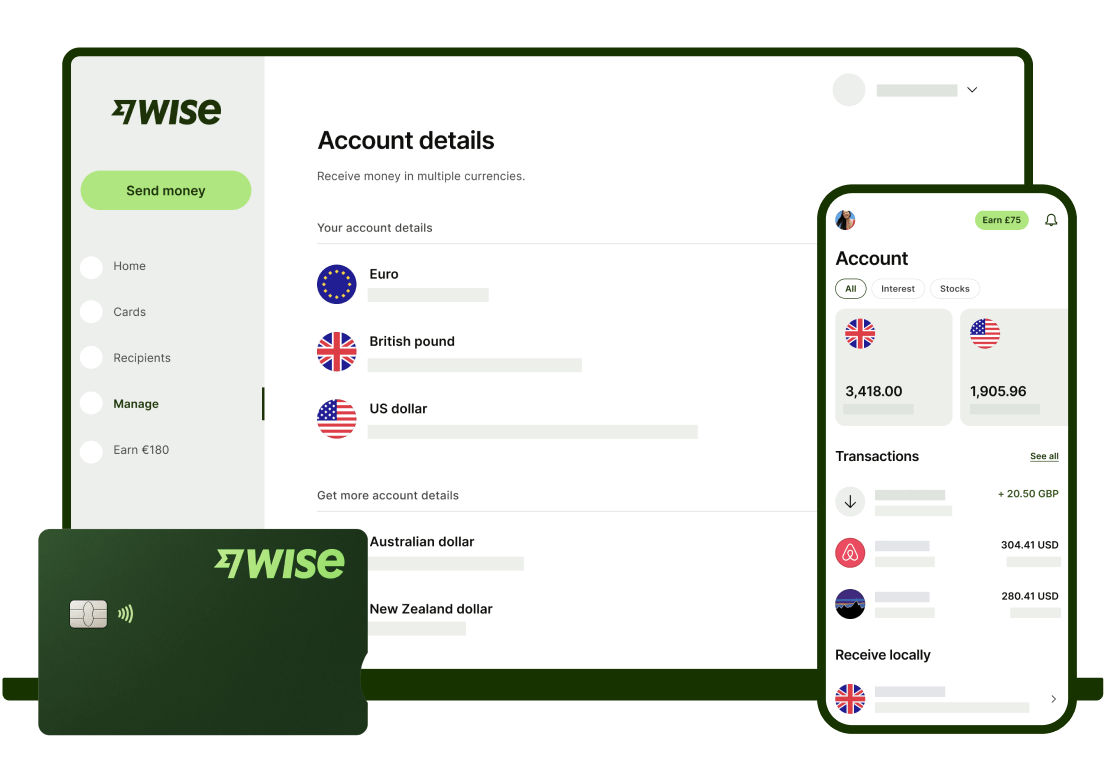

Illustration of Wise Business products

The Wise Business Card, coupled with the Wise Business account, is a great overseas payment solution for international businesses. That’s because Wise Business has no foreign transaction fees and offers currency conversion with the mid-market exchange rate, low, transparent fees, and no hidden costs.

Compare that to the Maybank business cards in this guide, which charge up to 3.25% in foreign transaction fees.

Overall, Maybank offers decent business credit and debit card options to support Singapore businesses of different sizes. Its strong regional focus on ASEAN makes it a reliable choice for any Singapore SME looking to expand their business.

That said, Maybank’s offerings may not be the best choice if you and your employees travel frequently, conduct business internationally, or purchase online from foreign merchants.

| 💡Wise Business could be a better alternative if you’d like an internationally-focused business account. With the Wise Business Card, you can handle international payments with low fees and transparent pricing, ensuring you can handle cross-border transactions with no hidden fees eating into your profits. |

|---|

➡️Get started with Wise Business today

***Sources:

Sources checked on 19th March 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

In-depth review of Statrys business account for Singapore, including features, pricing, and alternatives for SMEs with international transaction needs.

Learn how Alipay Business works in Singapore, its fees, benefits, and alternatives to help you manage multi-currency payments faster and more transparently.

A full review of the Sleek business account for Singapore companies including its features, fees, and benefits.

Compare the best startup bank and non-bank solutions in Singapore. Find the right banking solution for your growing business with our complete guide.

A complete guide to HSBC business accounts in Singapore, covering fees, minimum balances, foreign exchange spreads, transaction fees and more.

Aspire vs Airwallex: Compare fees, cards, features, and more to find the best business account for your Singapore company.