How to avoid credit card overseas charges when spending abroad

Using your credit card overseas? Learn about foreign transaction fees, FX markups and DCC, and how to avoid extra charges when spending abroad.

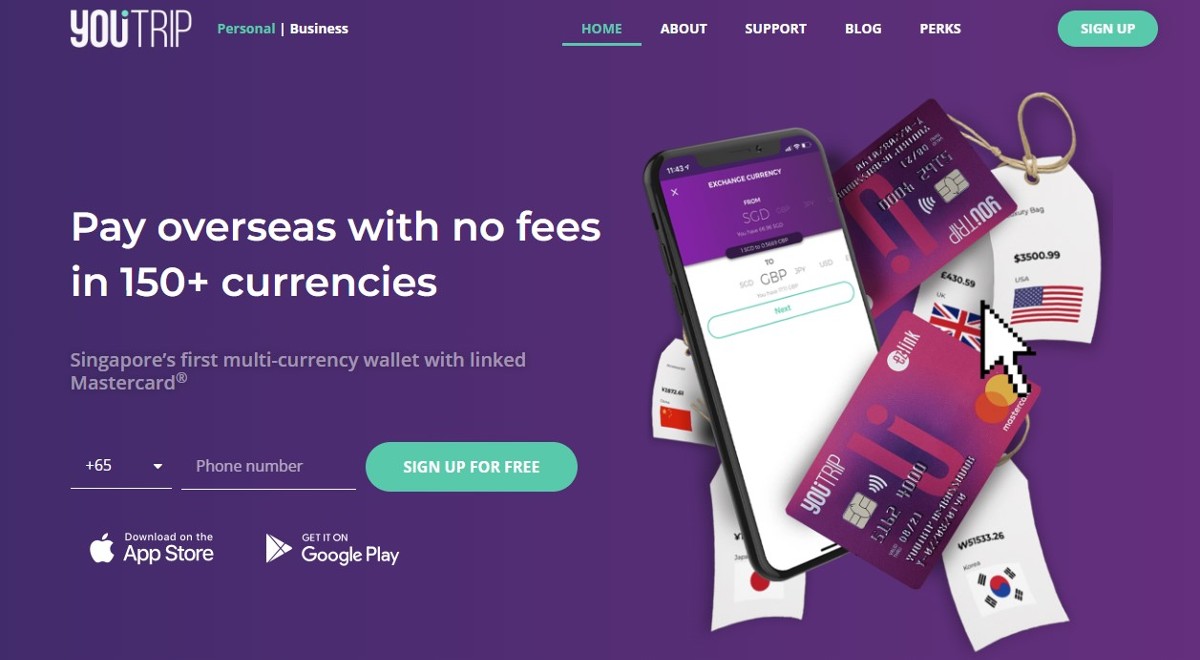

If like many other Singaporeans, you love to travel, YouTrip can be an attractive solution for easy spending during your time away. Travelers get access to multiple global currencies through a single account that they can spend online or draw cash from while overseas. But is it the right option for you?

Read on to learn more about the YouTrip multi-currency card and how it works. We'll also compare YouTrip against an alternative multi-currency card provider Wise.

| Table of contents |

|---|

The YouTrip multi-currency card allows you to travel, shop and pay around the world in over 150 currencies¹ through one account. The account is available through the YouTrip app, where you can buy and exchange currencies and spend with the card. The app is available through iOS App Store and Google PlayStore.

With zero transaction fees on currency conversions and payments², the YouTrip card can save you money as you travel. It allows you to spend at any location that accepts Mastercard, online or in-store, and also withdraw cash from designated ATMs wherever you are. You can also monitor exchange rates and convert in-app when the rate is favorable, or let YouTrip handle the conversion automatically using the applicable rate when you make a purchase.

YouTrip is safe to use. It’s a registered business in Singapore, with an MAS license as a major payments institution³. It also uses technology to keep users and their money safe, just like your normal bank would.

With your YouTrip card you can:

Here are the currencies supported by YouTrip for holding and in-app exchange:

YouTrip supports 150+ currencies for you to use worldwide when making transactions. Currency exchange is carried out using the wholesale exchange rate⁴ which is generally the one you’ll find on Google, with a marginal difference of 0.1%⁵ on average.

Currency exchange is managed by YouTrip alongside a series of foreign currency partners and Mastercard - that means you’ll be able to see the rates you can get for the 12 supported holding currencies in the app, but for any other currencies you’ll need to go to the Mastercard currency conversion calculator⁶ to understand the rates that are applied.

The good news is that the Mastercard and YouTrip exchange rates are usually pretty fair, which can mean this is a cheaper way of spending than using your normal bank card.

You can use your YouTrip card to make ATM withdrawals when you travel - however, withdrawals within Singapore are not supported. Fees and limits are as follows⁷:

It’s worth noting that ATM operators are likely to impose significantly lower limits than the 5,000 SGD YouTrip cap per withdrawal, which means that you’ll pay the withdrawal fee multiple times if you want to max out your daily withdrawal amount for any reason.

There’s no YouTrip annual fee to pay. You can top up your account up to 5,000 SGD at any one time if you are using a local bank account, or 20,000 SGD when topping up with Apple Pay, PayNow and Linked Bank Cards⁸. If you try to add more than this amount, the excess will be automatically refunded to the payment method you use to make the top up.

YouTrip can be a handy card for international spending - but it’s not the only option. Depending on what you need you may find a more flexible account from an alternative provider. Here’s a comparison of YouTrip against another popular competitor - the Wise Account and card, to help you see how they measure up against each other, and pick the right one for you.

| YouTrip card | Wise card | |

|---|---|---|

| Eligibility | Residents of Singapore, Thailand, and Australia only | Available globally in all but a few countries |

| Available currencies for holding and exchange | 12 | 40+ currencies |

| Available currencies/countries for card spending | 150+ currencies | 150+ countries |

| Account maintenance fees | No ongoing fee | No ongoing fee |

| Exchange rates | Wholesale rates | Mid-market rates |

| ATM withdrawals | Up to 400 SGD in value, fee free 2% after that | Up to 2 withdrawals per month, to 350 SGD in value, fee free¹⁴ 1.50 SGD + 1.75% after that |

| International payments | Overseas transfers from SGD wallet to 40+ countries⁹ | Available to 140+ countries |

| Receive payments | Receive payments from other YouTrip users | Receive payments with local bank details in 8+ currencies |

| Withdraw funds back to a bank account | Only for some payment methods¹⁰ | Available |

| Cashback options | Broad range of cashback and rewards available¹¹ | Some promotions and rewards available |

Please see Terms of Use for your region or visit Wise Fees & Pricing: Only Pay for What You Use for the most up-to-date pricing and fee information.

Learn more from our detailed YouTrip vs Wise comparison.

YouTrip has very few fees, and a fair exchange rate when you want to spend internationally. However, for holding and exchange it’s somewhat limited compared to the Wise Account and card, with only 12 currencies on offer compared to the 40+ available from Wise. Wise also has some fee free ATM withdrawals available, which can cut the costs if you need cash while you travel.

Where Wise really stands out against providers like YouTrip is in the breadth of features available. While YouTrip has an e-wallet and card for spending only, Wise lets you receive payments in a range of currencies, send money to a wide range of countries and pay international bills with the mid-market exchange rate. You can also withdraw funds back to your bank account in Singapore - or internationally - whenever you want to. In short, it’s like banking without a bank.

The YouTrip card is a travel-focused spending card and can be used anywhere Mastercard ® is accepted.

But how does YouTrip work in practice? Well, once you get the card, you can top it up with SGD and then exchange it into any of the 12 in-app currencies when you find the rates attractive.

Outside of these 12, YouTrip supports spending in 150+ other currencies worldwide, which are automatically converted at Mastercard’s wholesale rate when the transaction is settled.

To get a YouTrip account you’ll need to be a resident of Singapore, Thailand, or Australia, with a local contact number.

You can sign up on YouTrip easily using SingPass - here’s how¹²:

If for some reason you don’t have SingPass available you can also follow a manual process to get a YouTrip account by uploading images of your documents.

You can add funds to YouTrip using PayNow QR, a linked bank account, Apple Pay, or a linked credit or debit card. Here’s how to add money with your card¹³ - if you’d rather use PayNow the process varies a little depending on who you bank with.

You can transfer money from YouTrip back to your bank account — but only for eligible SGD balances. Funds added via PayNow or a linked bank account can be withdrawn through the app, while balances from card top-ups cannot. Foreign currency must be converted to SGD first.¹⁰

ATM while overseas using your YouTrip card. There is a 2% SGD fee for every cash withdrawal after fee free withdrawals of up to 400 SGD⁴.

When you are at the ATM abroad, there are a few simple steps to get cash from your account:

An important caveat is that YouTrip does not support local ATM withdrawals in Singapore. So you won’t be able to take out any remaining cash on the card locally when you return home. But it is still eligible to be spent domestically online and in-store.

You can use YouTrip in Malaysia for both spending and ATM withdrawals, just like you would with any Mastercard-enabled payment card.

Yes. YouTrip now supports Apple Pay and Google Pay, allowing you to make contactless payments in-store and online using your mobile device.

There’s no foreign transaction fee for YouTrip international spending. You’ll get the Mastercard wholesale exchange rate, for their supported currencies, with no additional fees.

Currently, YouTrip has cashback when spending on certain travel partners and platforms, but none for ATM withdrawals and regular travel spend.

The YouTrip card is a prepaid debit card, which means you need to add funds to your account before you can spend. You’ll then only be able to spend up to the total amount held on the card, with no credit facility.

It's not possible to withdraw money from your YouTrip account through an ATM in Singapore. YouTrip balances can only be withdrawn to your bank if your account was topped up using certain payment methods. Read more about how to withdraw from Youtrip.

So, that’s pretty much it - your full YouTrip card review, including all the details you need about YouTrip ATM withdrawals and spending abroad.

To help you pick the best e-wallet and card for you, we’ve covered YouTrip’s currency exchange rates, fees, top-ups and much more, including alternatives such as the Wise Account and card which could be a better all-round option for managing your money across currencies at home and while you travel.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Using your credit card overseas? Learn about foreign transaction fees, FX markups and DCC, and how to avoid extra charges when spending abroad.

Learn how Singapore income tax works for foreigners, including tax rates, residency rules, reliefs and how to file your return with IRAS.

Learn everything you need to know about sending an e-ang bao with DBS eGift.

Learn how to get new notes from banks in Singapore for Chinese New Year, including release dates, booking steps, ATM options, and alternatives if you miss out.

Learn how to send an e-hongbao or digital ang bao to loved ones near and far.

Compare the best no foreign transaction fee credit cards in Singapore, including fees, rewards, eligibility, and overseas spending benefits.