How to Open a POSB Bank Account for Your Domestic Helper in Singapore

Learn how to open a POSB bank account for your domestic helper in Singapore. Our guide covers the required documents and step-by-step process.

If you’re new to Singapore - or simply looking for an extra account to manage your money day to day - you may be wondering how to open a bank account online. While all Singapore’s major banks offer some online account opening services, there are limitations which mean it’s not possible for everyone to open a bank account online.

This guide covers all you need to know about opening a bank account online in Singapore. We’ll run through options at some of Singapore's biggest traditional banks, and also cover an alternative provider to traditional banks.

Let’s get straight into the big question: Can I open a bank account online?

All Singapore’s major banks offer online account opening services, but in practice whether or not you can use them usually depends on whether you have an active Singpass account with Myinfo, as well as your citizenship or visa status.

You can open a great day-to-day SGD account online with some alternative providers like the Wise multi-currency account, regardless of your citizenship status. However, when it comes to traditional banks, the answer will depend on your situation.

If you’re a Singapore citizen or Permanent Resident, you’ll likely have Myinfo set up already. This makes online account opening fast and easy, as your personal data is automatically uploaded when you apply. However, if you’re a foreigner in Singapore, even if you have Singpass and Myinfo, you’ll usually have to upload or show proof of address in a branch to get your account up and running. This may mean you can start to open your account online but you need to visit a branch in person to get full access.

We’ll go through some options you have for opening a bank account online in Singapore, in just a moment, with some handy resources if you want to know more about account options available.

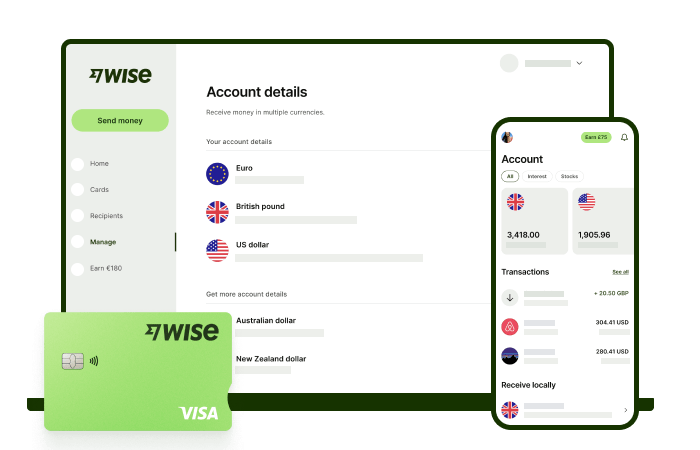

Traditional banks aren’t the only option when it comes to managing your money easily - you might find you have a smoother account opening experience, and cut your costs, with the Wise multi-currency account.

Wise is not a bank. It’s a financial technology company, and as such all accounts are opened and operated online or through the Wise app. That means you get many of the great features offered by big banks, with no need to wait in line at a branch - and often lower fees, too.

Open your Wise account online for free wherever you are - and wherever you’re from - to hold 50+ currencies, get local bank details for 10 currencies, send payments to 80+ countries, and spend all over the world with your linked debit card. You’ll get the real mid-market exchange rate every time, with no hidden costs. There’s no minimum balance or monthly fee to pay, just low, transparent charges for the services you use.

DBS is the biggest bank in Singapore, with a broad range of account options for personal and business customers. If you’re looking to open a DBS account online you may be able to do so if you’re a Singapore citizen, PR or foreigner with a valid pass. Instant account opening is even offered if you’re eligible and download the DBS banking app.

Still not sure if DBS is the one for you? Here are some more resources to help you decide.

Singapore’s second biggest bank, OCBC is another solid choice if you’re looking for a traditional bank account. If you have an active Singpass account with Myinfo you might be able to open your account instantly - if not, you can fill in an online form to get started. If you choose to open your account online with OCBC without using Myinfo, the form is likely to take just a few minutes to complete, but it’ll be about 5 working days until you can use your account.

If you’re interested to learn more you can get full guides to OCBC account products for individuals and businesses here:

You can open an HSBC Singapore account online if you’re applying for an account for yourself only, hold a valid NRIC or FIN, are over 16 and don’t have an existing HSBC account product. If you’re already an HSBC customer, or if you don’t fit the eligibility criteria for digital account opening, you’ll need to get in touch with the service team by phone or in a branch to get started.

Get a full guide to the HSBC foreign currency account options, or read all about the accounts on offer from HSBC for expats in Singapore here.

CIMB has a broad range of account products covering current account, savings and more. Most are available for online application, either using Singpass, or by uploading scanned copies of your documents.

If you’re looking to open an account with CIMB international bank in Malaysia, you’ll be able to do that from Singapore, too - however, in this case you need to make an appointment to visit a branch to get started.

Learn more about the CIMB account options, including the CIMB multi-currency account, here.

If you're a business owner or a freelancer, you might be looking to open a business account online in Singapore. Learn more here about the best corporate accounts available for you.

So there you have it, opening a bank account online in Singapore is easy enough if you have a full, active Singpass account with Myinfo. If not, you might still be able to open your account, but you’ll probably need to take a few extra verification steps including uploading your local ID and residence documents.

The exact process involved with opening a Singapore bank account online will vary based on the bank, the specific account, and your personal situation. Check out our product specific guides to learn more - and don’t forget to take a look at the Wise multi-currency account for an easy account opening process, regardless of where you are or where you come from.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn how to open a POSB bank account for your domestic helper in Singapore. Our guide covers the required documents and step-by-step process.

Comparing GXS and Trust? Read on to find out what a digital bank is, compare features, interest rates, and understand their exchange rates

Planning on opening a DBS multi-currency account in Singapore? Read this comprehensive guide on everything you need to know before

Both Wise (formerly Wise) and Revolut offer digital multi-currency accounts for managing money across borders - which one is better in Singapore?

Here's everything you need to know about the best multi-currency accounts and wallets in Singapore: Fees, Features, Exchange rates and more.

Looking how to sign up for a PayPal account in Singapore? We covered the process step-by-step, from signing up to verifying your account