Corporate account meaning: A guide for Singapore businesses

Learn what a corporate bank account is. Why it’s essential for separating your business finances from personal. How to open one in Singapore. Read here!

If you’re thinking of opening a DBS business account for your company, this guide is for you. We’ll look at the DBS corporate account opening options, features and fees - as well as DBS IDEAL banking and the DBS corporate card.

| Table of contents |

|---|

To help you compare your business account options we’ll also touch on the Wise business account as a great online alternative for businesses making frequent cross border payments, expanding internationally, or working with suppliers, contractors and staff based overseas.

Before we start our DBS SME banking review, let’s get a comparison of a few popular business banking services for Singapore. We’ll look at the popular DBS Business Multi-Currency Account1, compared to the OCBC Multi-Currency Business Account2, and another non-bank alternative - Wise Business.

We’ll run through their key costs and features side by side to help you get an idea of whether any of these may suit your specific needs.

| DBS Business Multi-Currency Account3 | OCBC Multi-Currency Business Account4 | Wise Business5 | |

|---|---|---|---|

| Eligibility | Singapore residents with locally or foreign registered businesses | Singapore residents with locally or foreign registered businesses | Can be opened by Singapore residents, and people resident in many other countries Available for registered businesses and freelancers |

| Account opening fee | 50 SGD annual fee | No fee | No fee (99 SGD one time fee to get full account features) |

| Minimum opening deposit | Not applicable - but a balance of 10,000 SGD is needed to avoid fall below fees | No minimum opening deposit | Not applicable |

| Fall below fee | 40 SGD fee applies if you hold a balance of under 10,000 SGD | Not applicable | Not applicable |

| Maintenance fee | Not applicable | 10 SGD/month unless you also have another eligible OCBC Business account | Not applicable |

| Supported currencies for holding and exchange | 13 currencies supported | 13 currencies supported | 40+ currencies supported for holding and exchange Local bank details provided for up to 9 currencies |

| International transfers | Digital transfers: 30 SGD + 35 SGD cable charges Commission in lieu of exchange applies if sending from a foreign currency with no exchange | Digital transfers: 30 SGD + agent charges Commission in lieu of exchange applies if sending from a foreign currency with no exchange | From 0.33% |

| Closure fee | 50 SGD fee if closed within 6 months | No fee | No fee |

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

If you already trade internationally - or if you plan to expand outside of Singapore in future, a multi-currency business account can help.

The DBS Business Multi-Currency Account lets you hold and manage Singapore dollars, and 12 foreign currencies all in one account. That means you can pay and get paid in SGD, AUD, CAD, CHF, CNH, EUR, GBP, HKD, JPY, NOK, NZD, SEK and USD all from the same place. There’s no specified minimum opening deposit but you’ll need to hold a balance of at least 10,000 SGD or the currency equivalent to avoid a 40 SGD/month fall below fee.

Once your account is set up, there’s a fixed fee to send international payments - rather than paying a percentage charge - although you’ll also need to pay any agent fees that apply.

Accounts come with 50 free FAST and 50 free GIRO payments monthly - or you can opt for a Starter Bundle which gives unlimited free transactions. Starter Bundles are only offered to new businesses, so you’ll need to check if you’re eligible for this when you apply for your account, based on entity type and incorporation date.

With your DBS Business Multi-Currency Account all set up you can also sign up for DBS IDEAL banking, the DBS corporate ibanking solution which lets you manage your business finances digitally. You’ll be able to view and manage transactions securely on your phone or laptop, with lower fees compared to making in branch transactions in many cases.

Aside from the DBS Business Multi-Currency Account, there’s also the option to open a fixed deposit account for your business which can allow you to make the most of any extra funds you have on hand.

DBS has business fixed deposit products in SGD and some foreign currencies, with deposits from 5,000 SGD to 50,000,000 SGD. At the time of writing you can make a fixed term deposit for up to 12 months6.

There are also specialist DBS Business accounts for law firms involved in conveyancing.

DBS promotes the following corporate cards to SME business customers7:

You’ll be able to decide which card or cards you’d like to link to your DBS Business account, depending on your specific needs.

Let’s look at the key fees related to opening and using a DBS multi-currency business account:

| Service | DBS Business Multi-Currency Account fee |

|---|---|

| Account opening fee | 50 SGD annual fee |

| Fall below fee | 40 SGD/month fee applies if you hold a balance of under 10,000 SGD |

| Corporate card | Fees may apply per debit card issued - depends on the card selected |

| Local transfers | Accounts have some free transactions monthly - fees apply, which vary by transfer type, once this is exhausted |

| International transfers | 30 SGD + agent charges Commission in lieu of exchange applies if sending from a foreign currency with no exchange |

| Overdraft fee | Prime lending rate + 5% |

| Closure fee | 50 SGD fee if closed within 6 months |

The fees for your international payment with DBS will depend on a few things. The account type you hold, and the currency you pay from and to both make a difference. In many cases there are several different potential fees, which can be confusing and which may mean a pretty high overall cost.

If you have a DBS Multi-Currency Business Account you’ll pay a flat 30 SGD fee for an international transfer, plus any agent fees. Agent fees vary depending on the country you send to. There is also likely to be a fee which is rolled into the exchange rate you use. This is called an exchange rate markup.

An exchange rate markup is a percentage that is added on to the mid-market exchange rate to calculate the rate used to convert your funds from one currency to another.

The mid-market exchange rate is the rate you’ll find when you search with a currency conversion tool, and also the rate the bank will get when trading on open markets. However, it’s common practice to add a percentage - which is a fee - into the rate used for converting customer payments. This makes it harder to see exactly what your international transfer costs you overall.

Looking for a flexible way to manage your company finances across currencies? Check out Wise Business.

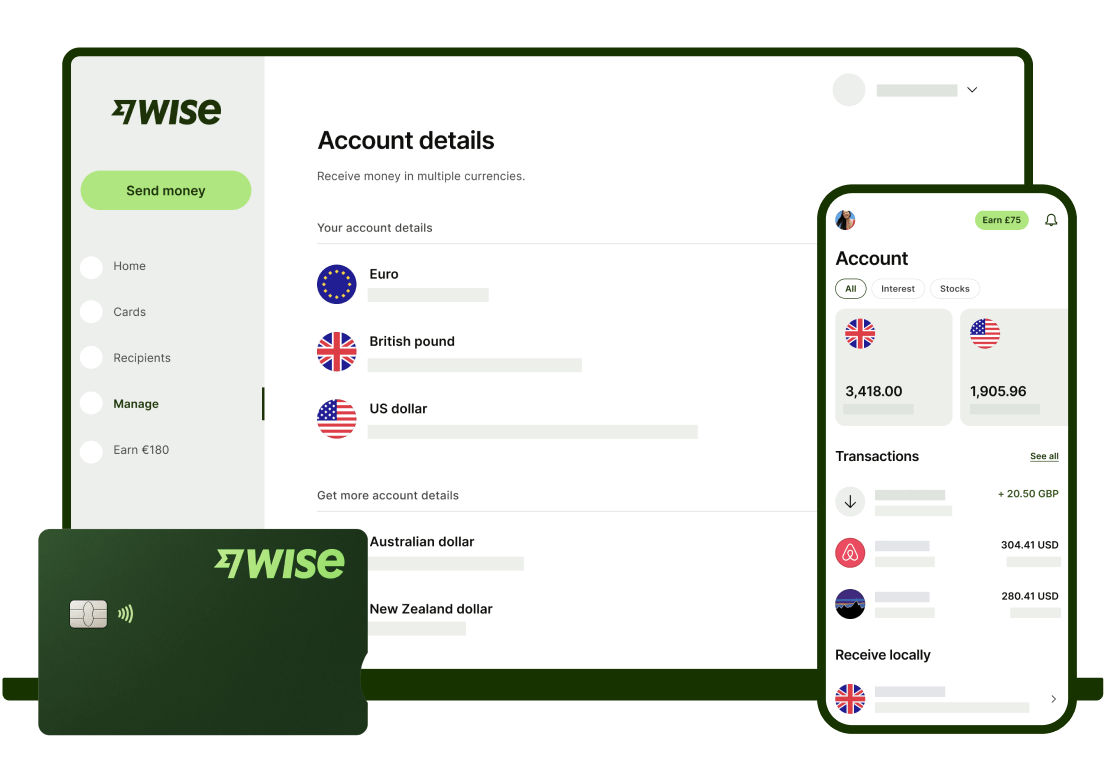

Wise isn’t a bank, and how Wise Business accounts work is a little different to the DBS business banking solutions, too. However, Wise is regulated by Singapore authorities and safe to use, as well as being overseen by regulators in a whole range of other countries globally.

With Wise you can hold and manage 40+ currencies with just your phone. Issue Wise debit and expense cards for spending at home and abroad, and exchange currencies using the mid-market exchange rate and low fees from 0.33%.

Wise is also a great way to send international payments to employees, contractors or suppliers. Unlike banks, Wise doesn’t add a markup into the exchange rate used, and there’s no complex pricing scheme. You’ll see the costs before you confirm - and they can be as low as 0.33%. Wise does this by moving money in a different way to most banks. With a network of local bank accounts globally, Wise is able to avoid the SWIFT network which banks rely on, cutting out agent fees and making your money move quicker too.

Looking for more? You can also connect your Wise Business account to your favourite cloud accounting tools like Xero and Quickbooks, you can send batch payments to up to 1,000 people conveniently, and you’ll be able to use the Wise API to automate workflows. All in all, that could save you time as well as money.

Learn more about Wise Business

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

DBS business banking services cover a range of business and organisation types including:

If you have a business registered in Singapore, or a foreign incorporated business, there’s probably a DBS corporate account for you. Applications are subject to approval by DBS, and not all account types may be available to all companies.

You can start your application for a DBS business account online, and you’ll quickly see if you’re eligible for a business product. In fact, if you’re a Singaporean or PR and opening an account for a Singaporean incorporated business, you can usually complete your entire application online in just a few minutes. You’ll just need to add some information about your business - including your ACRA registration number - to get started.

If you’re an expat or have a more complex business structure with multiple partners or directors you’ll need to register your interest in an account and then wait for a call from a member of the DBS business banking team to discuss your application.

Check the documents needed based on your company type with the handy DBS corporate account opening checklist8. Requirements vary based on business entity type, number of directors and where they come from, and a range of other factors.

Once you have a DBS business account you can add on DBS IDEAL, the DBS digital banking solution for businesses.

Use DBS IDEAL to apply for loans, monitor incoming funds, view remittance advice, access statements or make payments, often with lower fees compared to visiting a branch to arrange your transactions.

There’s no set up fee for DBS IDEAL, and you can securely transact using your phone, with a digital token. Or, if you’d rather not use your phone you can get a physical token from DBS at a cost of 50 SGD. Some transactions are free to access and view through DBS IDEAL, making this convenient and a cost saver for many businesses, too.

To apply for DBS IDEAL banking you’ll need to first have an eligible DBS business account. Once you have an account, sole traders and the owners of private companies can apply for DBS IDEAL in just a few minutes using your existing DBS iBanking service, or with your bank card and PIN. You’ll be issued DBS IDEAL corporate login details to start using the service right away.

Owners of other types of businesses need to complete an application form to get their DBS IDEAL login.

| DBS Business Banking pros | DBS Business Banking cons |

|---|---|

| ✅Several different business banking account options to suit different company types ✅Access to DBS IDEAL for online and mobile banking ✅Starter bundle solution for new businesses, to keep down costs ✅Multi-currency solutions for business payments ✅Savings accounts with DBS corporate fixed deposit rates available ✅Several different business cards offered to suit different customer needs | ❌Some accounts have high minimum deposit amounts to avoid fall below fees ❌Over the counter transactions cost 5 SGD - 40 SGD ❌High international transfer costs, which can include an exchange rate markup ❌10 SGD incoming telegraphic payment fee ❌50 SGD early close fee |

The DBS Multi-Currency Business Account is an attractive option if you want to hold several different currencies for your business, in an account from a local banking giant. Using a big bank like DBS has the advantage that you’ll be able to access all the business banking services you need under one roof.

The DBS Business Banking solutions are also a strong choice if you’re a new company as the Starter Bundle lets you waive a few common fees while your company establishes itself.

The drawback to the DBS Multi-Currency Business Account is the range of fees you’ll likely pay. Costs are pretty wide ranging and not always easy to understand, with some transactions bundled into your account monthly, and some which you’ll have to pay for every time.

Make sure you read the account terms and conditions and fee schedule carefully before you select the right business bank account for you.

If you’re unsure, check out our comprehensive review of the top corporate banking solutions in Singapore below.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn what a corporate bank account is. Why it’s essential for separating your business finances from personal. How to open one in Singapore. Read here!

In-depth review of Statrys business account for Singapore, including features, pricing, and alternatives for SMEs with international transaction needs.

Learn how Alipay Business works in Singapore, its fees, benefits, and alternatives to help you manage multi-currency payments faster and more transparently.

A full review of the Sleek business account for Singapore companies including its features, fees, and benefits.

Compare the best startup bank and non-bank solutions in Singapore. Find the right banking solution for your growing business with our complete guide.

A complete guide to HSBC business accounts in Singapore, covering fees, minimum balances, foreign exchange spreads, transaction fees and more.