How to choose the right business structure for your company in Singapore

Different business structure types suit different business needs in Singapore. Learn how to pick the best entity type that fits your corporate needs.

Singapore is a very attractive location for foreign entrepreneurs seeking to start up new businesses, thanks to its business friendly climate, low corporate income tax1 (CIT) and enticing incentives which could lower tax or offer extra support for startups. In fact, recent statistics show that over 7% of businesses in Singapore are classed as foreign affiliates (being more than 50% foreign owned), employing over 25% of people working in Singapore2.

For the most part, it is quite straightforward for foreigners to start a business in Singapore. To make the process as smooth as possible though, it always helps to learn some of the details with regards to company formation, registration and operation.

Join us as we explore the process of setting up your company through to your obligations when employing others. In this guide, we'll cover the following:

| Table of contents |

|---|

The first step is to register your business with the Accounting and Corporate Regulatory Authority (ACRA)3, and apply for a suitable work or employment pass if you need one.

If you are a foreign entrepreneur residing in Singapore, you can apply for an Entrepreneur Pass (EntrePass) with the Ministry of Manpower (MOM).

As a non-resident foreigner, you’ll need to register via an authorised registered filing agent - but understanding the end to end process is still extremely important. Here’s an overview of how to register a company in Singapore for foreigners, step by step.

Before you can create and register your Singapore business, you need to decide which business entity type will best suit your needs. The most common options are4:

Here’s an overview of these entity types on some key factors - we explore each in a little more detail right after5:

| Private Limited Company (Pte Ltd) | Sole Proprietorship | Limited Partnership (LP) | Limited Liability Partnership (LLP) | |

|---|---|---|---|---|

| Definition | Legally separate business distinct from its shareholders and directors | Business owned by one person | Two or more persons, with at least one general partner and one limited partner | Partnership where the individual partner’s own liability is generally limited |

| Owned by | 50 members or less | One person | At least 2 partners - one general and one limited | At least 2 partners |

| Legal status | Separate legal entity to the owners and directors | Not a separate entity to the individual owner - owner has unlimited liability | Not a separate entity to the partners - general partner has unlimited liability | Separate legal entity to the partners |

| Set up fee | 315 SGD | 115 SGD - 175 SGD | 115 SGD - 175 SGD | 115 SGD - 175 SGD |

A sole proprietorship is popular as it is easy to set up, but as your personal and business finances are not legally separate, you can be personally liable for any debts or legal issues your business incurs.

A limited partnership must consist of at least one general partner who becomes fully liable for the company, but there may also be limited partners who aren't personally liable beyond their investment in the business.

A limited liability partnership is a separate entity to the individual partners, which limits the liability of the partners, aside from where they are personally at fault.

The most common of all these business entity types is the private limited company.

A private limited company has limited liability, and requires at least one registered director and one shareholder. This entity type must have 50 or fewer members, and although it’s more complex in terms of record keeping, accounting and tax compared to the other entity types, the flexibility and the limited liability factor makes this a popular choice for both local and foreign entrepreneurs.

To create a private limited company you need at least one shareholder and at least one director ordinarily resident in Singapore, who is at least 18 years old. As a foreigner you can act as a local director of a private limited company, but to do so you need to get a visa known as the EntrePass from the Ministry of Manpower.

There are requirements in place for locally resident business owners, directors, managers or representatives which vary a little depending on the entity type. Broadly speaking, all entity types in Singapore must have at least one locally resident senior member or owner, who should be 18 or older.6

There’s not a limit on nationality here - so if you are a foreigner living legally in Singapore with an appropriate visa type you could be the local director of your own business.

ACRA describes some of the responsibilities of company directors and the company secretary, as well as other key personnel, online, which can be a handy reference when you’re starting to learn about Singapore’s business requirements7.

A company director is responsible for managing the company and ensuring accurate record keeping, corporate filings and so on. The director must act honestly and in the interests of the company. If you break any of the rules around company director duties you may be subject to civil and criminal penalties, including fines and imprisonment.

A company secretary is responsible for company administration. You must appoint a company secretary within 6 months of forming your business, or you may face a penalty of up to 1,000 SGD. It’s also helpful to note that the company secretary should be a resident in Singapore. Duties include attending and taking notes at directors meetings, keeping up to date with changes in corporate law, and ensuring the directors are aware of ACRA duties and deadlines.

One common question is: Can a foreigner be a director in a Singapore company?

Here the answer is yes. You can be a director if you’re a local Singapore resident on an eligible work pass, such as the Entrepass. Or, non-resident foreigners can own shares in a Singapore-registered company and be appointed as foreign directors of the company.

There are several different visas which can give the right to start a business in Singapore as a foreigner, either automatically or on further application. Common options include:

Employment pass holders - and dependent pass holders - may be able to start a business but are likely to need consent from the Ministry of Manpower before they can do so. Other visa types are expressly intended for entrepreneurs and automatically confer the right to start a business once you are granted this visa type.

Here’s a quick overview - in all cases, there are multiple eligibility criteria to consider, so doing further research is essential before you pick the best visa or pass for your needs.

| Employment Pass8 | Entrepass9 | Tech.Pass10 | One Pass11 | |

|---|---|---|---|---|

| Who applies | Business applies on behalf of applicant | Applicant applies for themself | Applicant applies for themself | Applicant applies for themself - agents can also apply for applicant |

| Automatic right to start one or more businesses | Not automatic - apply to MOM in advance | Granted | Granted | Granted |

| Minimum salary requirement | 5,000 SGD/month | No minimum requirement | 22,500 SGD/month | 30,000SGD/month |

| Other requirements | Business must prove need for foreign employee | Must be starting a venture backed or innovative business | Intended for established tech entrepreneurs, leaders or technical experts | Intended for top talent in business, arts and culture, sports, academia and research |

Your next step as a foreigner opening a company in Singapore is to decide on a company name, and apply through ACRA’s BizFile+ platform. You must pick a name which is not too similar to an existing business name, and which does not have banned or restricted words in it12. Once you have a few ideas on choosing the name you can use the ACRA Free Company Name Check Tool to make sure nobody else has used or reserved the name already.

As part of your registration you’ll need to detail your proposed business activities with a Singapore Standard Industrial Classification code (SSIC code). To work out which SSIC code you need, you can use the SSIC search tool13, which lets you enter keywords about your business activity and generate the SSIC codes which may be suitable. Pick the code which most closely describes your business area. If you’re unsure, you can also get support from a company formation agent or from ACRA directly.

After your name application is approved, you can incorporate your business, which must be completed within 120 days from the date that your business name is approved. When this step is completed, you will receive a system-generated Unique entity Number - your UEN.

This UEN is very important and will be used whenever you communicate with government agencies. You must also indicate the UEN in all business correspondences such as invoices. Plus, if you use a payment service like PayNow to take customer payments, you can have them pay to your UEN as an easy way to receive SGD transfers.

It is mandatory for companies to establish a local registered office that serves as the designated location for receiving official correspondence and documents, and which will appear on the required registers in accordance with the law.

Your registered business address must be a physical office address. It cannot be a PO Box or similar, for example.

So, you’re now well on the way to starting a business in Singapore for foreigners. Next, it’s time to work through some of the key financial activities you’ll need to get in place before you can start to operate.

You’ll need smart ways to manage your money now you have a Singapore business. Singapore citizens and residents may be able to open a business account with a bank like DBS without needing to provide much in the way of documents. However, as a foreigner there’s a far higher likelihood that you’ll have to provide additional paperwork. You may also need to visit the branch to open your account, rather than being able to do so online.

The documents which are most commonly requested include things like,

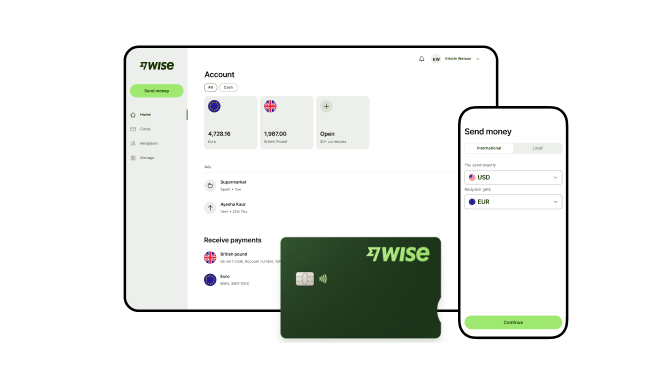

Fees may apply to own your business bank account, and transaction fees can also be on the higher side. Make sure you read through the specified account’s fee schedule before you get started. Or consider a corporate banking alternative like Wise Business.

Wise Business accounts have a one time opening fee with no monthly fee after that. You can hold and exchange 40+ currencies, send money overseas quickly, cheaply and easily, and get debit and expense cards for yourself and your team. Plus, all currency exchange uses the mid-market rate with no hidden fees or exchange rate markups.

*Please see Terms of Use for your region or visit Wise Fees & Pricing: Only Pay for What You Use for the most up-to-date pricing and fee information.

You may need to register for GST if you expect your taxable turnover to be over 1 million SGD annually, or if your turnover exceeds this amount during the year14. You can also choose to register for GST if you would prefer to, even if you do not expect to hit this turnover initially. GST registration can be done with IRAS through BizFile+.

The Singapore GST rate is currently 9%.

There are several Government assistance and incentive programmes to help foreign-owned businesses, including grants, loans, and tax breaks

It’s well worth looking at the options for Enterprise SG15 grants and support. Options do change from time to time, but as Singapore wants to encourage foreign investment, there are often options there for foreign owned businesses.

You’ll also be happy to know that Singapore currently offers a CIT rebate of 50% of corporate tax payable, and which was granted to all taxpaying companies - both local and foreign.

It’s crucial that you understand all of the tax filing and other deadlines which may impact your Singapore business. Your company secretary will help here, but being ahead of the game is never a bad idea. Plus, fines and penalties may be due if you miss a deadline.

For example, missing the deadlines for submitting annual returns to the Accounting and Corporate Regulatory Authority (ACRA) could mean running up a 600 SGD fine16 - not great for business.

The last stop on our exploration of how to start a business in Singapore as a foreigner touches on getting licensed and hiring others.

Some business activities need a licence to operate. For example, if you’re going to be working in the food industry, in construction, finance, or education. You can check out the options, and apply for a licence if you need one, through an online platform called GoBusiness Licensing17. There’s a very helpful search function which allows you to put in business keywords to generate the licences which might apply, so you can read more and learn if you need one or more licences in place before you get started trading.

If you intend to hire anyone now or in the future, it’s also important to familiarise yourself with Singapore’s employment regulations, including the Employment of Foreign Manpower Act (EFMA) and the Employment Act. This helps you to understand some of the rules involved in employing others locally and from overseas.

The requirements may vary a little depending on whether you are hiring someone who is Singaporean or foreign. For example, for local talent, you will need to apply for a CPF Submission Number through BizFile. This isn’t needed for most foreigners, but the rules for hiring someone from overseas have other rules to consider, including the Fair Consideration Framework (FCF)18 for Employment Pass (EP) and S-Pass, and business quotas for overseas employees.

If you’re hiring foreign employees, you’ll need to set up a work pass account to apply for visas for potential employees, and learn more about the different pass eligibility rules which will apply. When it’s time to hire from abroad, you can apply for suitable work passes using Work Permit Online19 or Employment Pass eService20.

And there you have it - from choosing your entity type right through to making your first hires. We’ve come a long way but the good news is that it’s not that difficult a process - and Singapore has one of the most business-friendly ecosystems in the world which is why it is attractive to foreigners looking to start a business in Asia.

Besides choosing the right business entity type and business registration type to fit your requirements, you’ll also want to invest time to choose the right service to fit your banking needs. If you want a flexible way to manage your business finances across multiple currencies with no monthly fees, why not try the Wise Business account? Just pay a one-off fee and get access to a full suite of money management features plus time saving extras like cloud accounting integrations, batch payments and more.

Get a Wise Business account today!

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Different business structure types suit different business needs in Singapore. Learn how to pick the best entity type that fits your corporate needs.

This article covers opportunity cost and its application in smart, data-driven decision-making for more informed and effective business strategies.

This article serves as a simple guide to selecting a corporate bank account, what documents are needed, and how to open an account for your business.

This guide covers all you need to know about using ACRA SSIC search to check the right code for your business.

In this guide to ACRA for Singapore business owners, we'll cover what the agency does, and the most popular services available on BizFile+.

Ready to set up your business in Singapore? This handy guide includes step-by-step instructions for Bizfile+, and the important documents you need.