What is ACRA: Business owners' guide to understanding the Registrar of Companies in Singapore

In this guide to ACRA for Singapore business owners, we'll cover what the agency does, and the most popular services available on BizFile+.

Singapore is an extremely business friendly environment, which makes it a very attractive place to launch a new business. If you’re planning on running a Singapore business, you’ll need to know about the ACRA business registration process, costs and requirements. The good news is that registering a Singapore business is a fairly straightforward task, and can bring some great benefits.

Ready to start your entrepreneurial journey in Singapore? This guide walks through how to register a company in Singapore with ACRA.

We'll cover:

| Table of contents |

|---|

Business registration in Singapore is managed by ACRA - the Accounting and Corporate Regulatory Authority1. You’ll need to get familiar with the registration rules and requirements, and then set up your new business entity on Bizfile+2, ACRA’s self service portal to allow you to manage the administration side of things.

All in all, this makes the process of how to register a company in Singapore pretty simple - but what’s the benefit of registering at all?

Different business owners choose to register their company in Singapore for different reasons - but some common factors include:

There are several important corporate tax rebates available for businesses in Singapore, including the CIT Rebate and the CIT Rebate Cash Grant. This can mean getting a rebate of 50% of corporate tax payable, and is open to all taxpaying companies, including those which are not tax residents.

As we'll see in a moment, there are several different business entity types which do have slightly different requirements in terms of the process to register, the number of people involved, the cost and so on. Different entity types also have their own reporting rules which you’ll need to be aware of.

The basic requirements if you want to register a local company (rather than as a sole proprietor for example) include having the following:

In addition to these requirements, one of the most important aspects of setting up your business in Singapore is establishing a corporate bank account. This is crucial for managing your company’s finances efficiently. It separates personal and business expenses, simplifies tax preparation, and helps build a financial profile for your company. Moreover, as your business grows and you start to engage with international clients and vendors, an account that facilitates easy cross-border transactions will be invaluable.

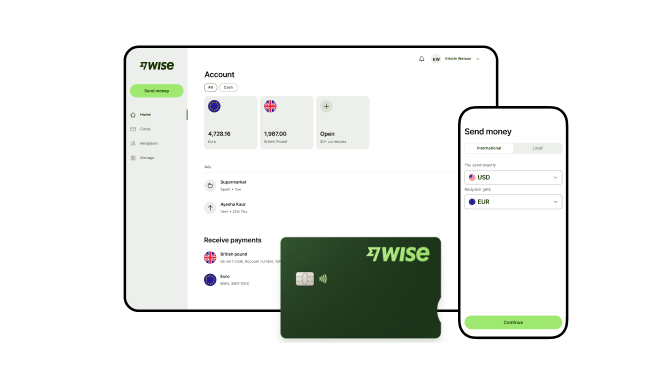

Wise Business offers a seamless solution to manage your funds globally while keeping costs low.

Get a Wise Business account today!

Let's now take a look at the step by step requirements to set up your business, including how much it costs to register a company in Singapore and how long it takes to register a company in Singapore.

Your first step will be to choose the business entity type that best suits your requirements. The most commonly used entity types in Singapore are3:

Each of these entity types have their own pros and cons, including differences in liability and annual reporting requirements.

You can change the entity type you select if you need to do so in future - but it’s still worth investing some time to consider which structure will work best for your needs before you start the registration process.

You’ll now need to choose and reserve your company name. There are some important rules to respect here, including4:

Once you have a few ideas on choosing the name you can use the ACRA Free Company Name Check Tool to make sure nobody else has used or reserved the name already.

You can reserve your business name on Bizfile+ which will then mean that nobody else can use this name5. You have 120 days to register your business using this name before the reservation lapses. Once you’ve got everything sorted you can register the business on Bizfile+6 - we’ll look at how that works in just a moment.

Registering your business with ACRA is a simple process, but it’ll all go much more smoothly if you have all the required paperwork and information to hand. While the requirements can vary depending on the entity type you pick, you’ll normally need:

| ✍️ In some cases, one or more of the partners or shareholders may actually be a registered company rather than an individual. In this case you’ll also need the company’s registration documents and shareholder information. This is also a good time to nominate your company secretary, which is a mandatory requirement once your company is organised. |

|---|

You’re ready to register your business. Here’s what to do:

The ACRA process is designed to be self service - that is, to be easy enough that you can work through it on your own following the on-screen prompts. There are helpful tools like autosave features and a checker which confirms how far through the page you are, so you can easily see your progress.

Once you’ve registered your business you'll get a Certificate of Incorporation by email from ACRA, and ACRA will also send your Business Profile (or "Bizfile").

Depending on what your business does, you might need to apply for certain licences. Make sure you’re clear on any permits needed based on the niche you’re working in - you can’t trade without having all your paperwork lined up. Another important thing to consider is GST8. If you expect your annual turnover to exceed S$1 million, you must register for Goods & Services Tax (GST). If you're expecting less than that, you can skip this step or you can register voluntarily. GST registration can be done with IRAS through BizFile+.

| 💡Now you have a business in Singapore, you need a business bank account. Not sure which business account will best suit your needs? Check out our handy review of the 6 best business bank accounts in Singapore. |

|---|

You can register a company as a foreigner, with or without being resident in Singapore. If you’re not planning on moving to Singapore yourself, you’ll need to make sure that at least one of the directors, authorised representatives, general partners, or managers is a local resident, to fulfill the ACRA residency rules9.

Learn more about how to start a business in Singapore as a foreigner.

Yes - you can conduct business without registering with ACRA as long as you’re using your full name as reflected in your NRIC, with no other words or descriptions used10. So, working under your name only is usually OK, but if you add a word - for example ‘Flowers by Jenny Lim’ - you would need to register.

You’ll register your business on Bizfile+, which is likely to take you 10 or 20 minutes assuming you’ve chosen your name and simply need to enter the details onto the Bizfile system.

Once the registration documents are completed, ACRA will usually approve them in about 3 working days - although it can take a few weeks if there are any issues to be reviewed or any other agencies need to be involved in the process.

You’ll need to provide ACRA with your business address and a residential address when you register your business. If you don’t want your residential address to be made publicly available you can also use an alternative address such as a corporate service provider’s office11.

Many companies in Singapore offer virtual office services which fulfil ACRA’s requirements - compare your options and make sure you’re meeting all the rules based on your entity type.

A minimum capital requirement of 1 SGD is needed to start a private limited company12.

This is known as share capital. Share capital is the amount of money shareholders have committed to the business - this can either be paid upfront, or or issued without full payment being made immediately.

The cost of registering a company can vary according to company type and the registration period.

To give you an idea, registering a company costs 315 SGD, while a sole proprietorship will set you back 115 SGD for a 1 year registration, or 175 SGD for 3 years.

Singapore has one of the most business-friendly ecosystems in the world which makes it attractive to any business looking to set up shop here. The registration process in Singapore via ACRA Bizfile is relatively straightforward, but does require you to plan ahead a bit —you don't want to get caught out by unforeseen delays or missing documents that could postpone the launch of your business.

While you’re investing the time in planning your new enterprise, take a moment to think about managing your business finances too.

As an aspiring entrepreneur, the chances are that you're eyeing expansion beyond the borders of Singapore - perhaps with customers, suppliers or staff based overseas. In that case, using a business bank account can come with some unexpected - and costly - fees, which eat into your profits.

Don’t spend more than you have to on currency conversion and overseas payments - check out Wise Business instead, as a simple, low cost way to manage your money across currencies, including ways to pay and get paid in foreign currencies with the mid-market exchange rate.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

In this guide to ACRA for Singapore business owners, we'll cover what the agency does, and the most popular services available on BizFile+.

This Youbiz review walks through all you need to know about Youtrip’s SME corporate card, including features, fees and a handy guide to opening an account.

Not sure which corporate tax rebates in Singapore apply to your startup for Budget 2024? This guide has you covered for everything you need to know.

Starting a business in Singapore can be a little confusing especially if you are a foreign entrepreneur. This guide will help make your startup journey easier.

Discover how Novelship leverages Wise Business to pay international suppliers with low costs and the mid-market rate: Explore Novelship's growth story.

Discover how Slasify leverages Wise Business for seamless international payroll payouts, and learn how they manage global HR and payroll efficiently.