How to Open a POSB Bank Account for Your Domestic Helper in Singapore

Learn how to open a POSB bank account for your domestic helper in Singapore. Our guide covers the required documents and step-by-step process.

PayPal¹ is a pioneer of online payment services for individuals and businesses. Since being founded over 20 years ago, a reported 377 million personal and merchant accounts have been created, processing billions of dollars of payments annually.

If you’re wondering how to create a PayPal account this guide is for you. We’ll run through how to set up PayPal and how to set up a business PayPal account, getting verified and using PayPal for transactions. We’ll also compare PayPal to alternatives like Wise and Skrill so you can make sure PayPal works for you.

| Table of contents 📋 |

|---|

Let’s get right into PayPal sign up processes for personal customers²:

Download the PayPal app or head to the PayPal desktop site - https://www.paypal.com/sg/home

Select the option to Sign up, which you’ll find in the top right corner of the desktop site

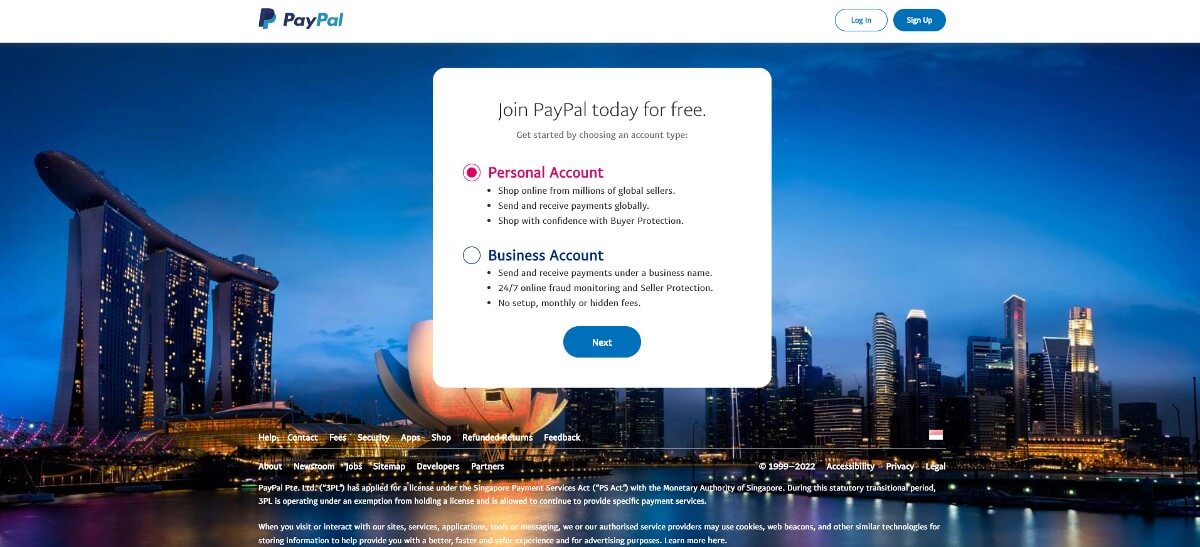

You’ll be offered the option of either a personal or business account. If you’re planning on using your account for your business you’ll need to pick the PayPal business option - we'll cover that in detail in a moment. However, if your PayPal account is for your own use only, just click the button to confirm you want to open a personal PayPal account

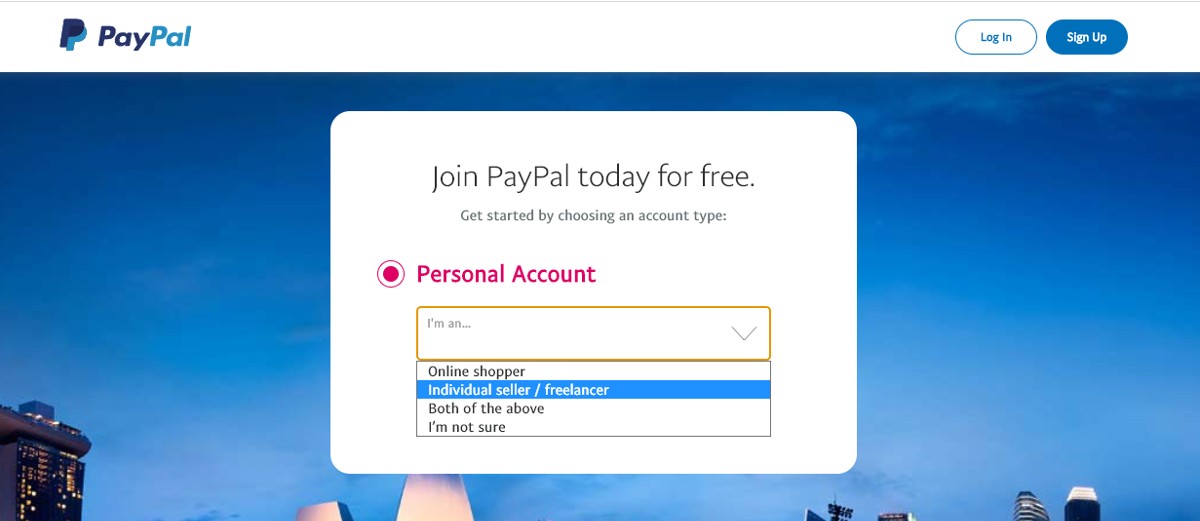

You’ll be prompted to confirm whether you’re an online shopper, or whether you’ll be selling or using your PayPal account for any business services. Don’t worry if you don’t know how you’ll use your PayPal account in future - you can also pick ‘I’m not sure’ to leave your options open

Add your phone number to receive a secure SMS for verification purposes - this keeps your account safe, and makes it easier to get notifications from PayPal

Follow the prompts to complete the remaining personal information and create and confirm a password - you’ll also need to add security questions - this is an additional authentication tool used to keep PayPal customers safe

Your account is open! Now you’ll be able to add a bank account and card to your account for payment purposes. Just follow the onscreen prompts to add any cards or accounts you’d like to use with PayPal

Complete the required verification steps to confirm your email address and phone number, and you’re good to go

Setting up a PayPal business account follows much the same process as for the personal account type. However, it’s important to remember that the fees associated with a business account aren’t the same as for the personal account - so make sure you pick the correct account type at sign up.

Here are the basic steps you’ll need to take to set up a PayPal business account:

Download the PayPal app or head to the PayPal desktop site - https://www.paypal.com/sg/home

Select the option to Sign up, which you’ll find in the top right corner of the desktop site

Click the button to confirm you want to open a business PayPal account - this will allow you to send and receive payments under a business name, and get PayPal’s seller protection. However, the fees for a business account aren’t the same as for a personal PayPal account, so do double check the detail before you start

Add your email address - it’s good to know that at this stage you’ll also be offered an opportunity to chat with PayPal’s service team if you have any questions about the PayPal business account set up, features or fees

Follow the prompts to complete the remaining personal information and create a password - you may also need to enter business information, depending on how you choose to set up your PayPal business account

Add a bank account or bank cards to your account, so that you can both send and receive payments, and make withdrawals of your PayPal balance

Complete the required verification steps to confirm your email address and phone number, and you’re good to go

Learn more about how to create a PayPal business account in Singapore, here.

To get full use of your PayPal account you’ll need to verify it. This helps keep PayPal accounts and customers safe. There are 2 ways you can verify both PayPal personal and business accounts³⁴:

Confirm your bank account - in this case, PayPal will send you 2 small deposits to your bank account directly. You’ll need to wait for them to arrive, then enter the amounts into your PayPal account for verification.

Confirm your credit or debit card - to do this, you’ll add your preferred card details and authorise PayPal to charge your card 3 SGD, When the payment goes through you’ll see a 4 digit PayPal code on your card statement. Enter this code into your PayPal account to verify it. The 3 SGD charge will be refunded to you within 30 days.

You should be able to see your account verification status in your account settings by either logging into the PayPal app or desktop site.

Once you have a balance in your PayPal account you’ll have a few choices. You can hold your funds in PayPal, and simply use them the next time you shop online or need to make a payment to someone. Or you can withdraw the funds to your linked bank account or card.

If you’re withdrawing money to your Singapore bank account there’s no fee for balance amounts of over 200 SGD - for lower amounts you’ll pay a 1 SGD charge. You can also withdraw funds to a linked card, or to a USD denominated account. However, in this case higher fees apply. Learn more about how to withdraw money from PayPal Singapore.

While PayPal offers some great features, it’s not always the perfect choice. It’ll really come down to the sort of transactions you’ll be making and your personal preferences. One important point to note is that PayPal fees can be on the high side whenever there’s currency conversion involved. That means that if you’re planning a lot of international transactions you may be better off with an alternative.

Let’s see how PayPal measures up with a couple of alternative providers, for both business and personal accounts. You can also get your full guide to PayPal Singapore fees here.

| Features for personal users | PayPal | Skrill⁶ | Wise |

|---|---|---|---|

| Available currencies | 26 | 20+ | 54 |

| Currency exchange rates | Currency conversion fee of 4%⁵ | Currency conversion fee of up to 4.99%⁷ | Mid-market rate with no markup |

| Ongoing fees | None | 5 EUR/month inactivity fee | None |

| International transfer fees | 4.99 USD per transfer when funded with bank transfer or PayPal balance 4.99 USD + 3.4% + fixed fee per transfer when funded with card | Up to 4.99%, depending on funding method | Variable fee based on currency - from 0.35% is common + low, fixed fee, often around 0.5 SGD |

| Domestic transfer fees | No fee when funded with bank transfer or PayPal balance 3.4% + fixed fee per transfer when funded with card | Up to 2% | Fixed fee of 0.54 SGD No fee when using Wise debit card |

| Debit card available | Yes | Yes | Yes |

For personal customers, Wise and the Wise multi-currency account typically come out on top when international transfers are involved. Wise is a specialist provider with a focus on moving money across borders faster, and for low, transparent fees.

Let’s dip into some of the features which are offered specifically for business account holders:

| Features for business users | PayPal | Skrill | Wise Business | |

|---|---|---|---|---|

| Payment gateway for businesses | Yes | Yes | No | |

| Get paid from overseas fee free | Merchant fees apply based on the type of payment Currency conversion fees may apply | Merchant fees apply based on the type of payment Currency conversion fees may apply | Yes - use your local bank details to get paid for free in 10+ currencies | |

| Currency exchange rates | Currency conversion fee of 4%⁸ | Currency conversion fee of up to 4.99% | Mid-market rate with no markup |

So there you have it. Whether PayPal Singapore is right for you or not will depend a lot on how you intend to use your account, including whether you’re a business or personal customer. Additionally, if you're planning to use PayPal for international transfers, check out the live price comparison calculator between PayPal vs Wise:

Where PayPal tends to win are features for businesses, payment gateways for example. However, PayPal’s costs shoot up once currency conversion is required, or if you’re funding your transfer with a credit card. Check out PayPal vs a couple of other competitors like Wise to get the best one for you, and don’t forget to look at the Wise multi-currency account for individuals and businesses looking for low cost currency conversion and international transfers.

Sources:

Sources checked on 04.05.2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn how to open a POSB bank account for your domestic helper in Singapore. Our guide covers the required documents and step-by-step process.

Comparing GXS and Trust? Read on to find out what a digital bank is, compare features, interest rates, and understand their exchange rates

Planning on opening a DBS multi-currency account in Singapore? Read this comprehensive guide on everything you need to know before

Both Wise (formerly Wise) and Revolut offer digital multi-currency accounts for managing money across borders - which one is better in Singapore?

Here's everything you need to know about the best multi-currency accounts and wallets in Singapore: Fees, Features, Exchange rates and more.

Looking to open a bank account online? Here are some options available in Singapore