JiPay review - is it a great money app for migrant workers in Singapore?

Is JiPay a great money management app for migrant workers in Singapore? Read more from our review about JiPay's features, remittance and more.

If you’re a PayPal Singapore customer and hold a balance in your PayPal account, you may be wondering what you can do with the money. Of course, you can hold the balance until the next time you need to shop or send a payment to friends who use PayPal. But you can also withdraw your PayPal balance to a bank account or eligible debit card.

This guide covers all you need to know about how to make a PayPal to bank account withdrawal, including the fees, options and the time it’ll take.

And because PayPal isn’t always the best option for making payments and transacting in foreign currencies, we’ll also cover how you can cut your international spending and transfer costs with a Wise multi-currency account. Let’s dive right in.

If you have funds in your PayPal account and want to access them you can arrange a standard PayPal transfer to bank account - using the account you’ve linked to PayPal already. You can also get your money faster by using a transfer to your debit card - but there’s a fee for that service. It’s worth noting that you can’t withdraw PayPal funds to a credit card - and once you have started the withdrawal process it can’t be cancelled.

If you choose a standard transfer it’ll probably take 3 - 5 business days to arrive. Withdrawing to a debit card can take as little as 30 minutes.

There may be fees to pay, depending on how you choose to withdraw your money from your PayPal Singapore account - more on that later.

You can make a PayPal to bank account - or PayPal to debit card - transfer easily online or in the PayPal app. Here’s how¹:

On your laptop:

In the PayPal app:

PayPal has some great services for customers, but the costs when sending or spending in a foreign currency can be on the high side.

Choose Wise when you need currency conversion - for sending to friends, settling international invoices, or shopping online with overseas ecommerce stores - and you can save versus PayPal and major Singapore banks.

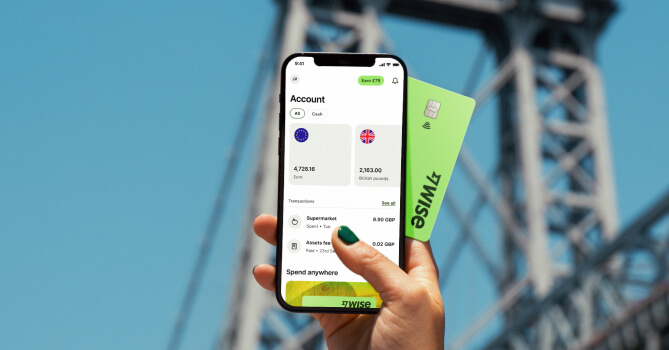

Open your Wise multi-currency account for free online and you can send payments all over the world using the real mid-market exchange rate and a low transparent conversion fee. You’ll be able to hold and handle 40+ currencies in your Wise account, to make and receive payments - and you’ll get your own local receiving account details to get paid fee free from a range of major world currencies.

Whether you’re at home or abroad you can spend with your linked Wise card, with a physical card for in person payment and Google Pay and Apple Pay compatibility for mobile payments. No hidden fees. No surprises, just simple, low cost international payments for less.

Join over 16 million people and businesses already using Wise 🎉

Open your account in minutes

You can’t withdraw money from PayPal without a bank account. You can only usually make withdrawals to a SGD or USD denominated bank account, or an eligible debit card.

The cost to make a PayPal to bank account withdrawal will depend on the specifics of the transaction. If you hold your PayPal balance in a foreign currency you’ll need to convert it before or at the point of transferring it - which comes with a fee.

You’ll also pay if you want to get your money faster, with a charge to have your balance withdrawn to a debit card instead of your regular bank account.

Let’s take a look at the PayPal bank and card withdrawal fees for Singapore.

| Withdrawal type | PayPal Singapore fee² |

|---|---|

| Withdraw funds to your local eligible card | 1% of amount transferred, to a maximum of 15 SGD |

| Withdraw funds to a USD bank account | 3% + any applicable currency conversion fee |

| Convert your PayPal balance to a different currency for withdrawal | 3% - 4% currency conversion fee will apply |

If you hold a balance in a foreign currency in your PayPal account, it’s important to consider the exchange rate being used when you need to withdraw money from PayPal.

You might have a foreign currency balance because a friend has sent you a payment from overseas - or if you’ve had a refund from an international ecommerce seller who has sent the money over in their own currency instead of SGD. You can only withdraw your funds from PayPal to a Singapore dollar or US dollar bank account - which means you’ll need to switch currencies if you hold any other balance - and that comes with a PayPal fee.

The PayPal currency conversion fee for withdrawals is usually 3%, which is added as a markup on the exchange rate used. That means you won’t get the rate you find on Google or using an online currency converter - and can get less than you expect in the end when your payment arrives in your bank account.

Make sure you know the full cost of making a PayPal to bank transfer - particularly if you’ll need currency conversion along the way. And don’t forget - if you need to send, spend or receive foreign currencies you could be better off with a free online Wise multi-currency account.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Is JiPay a great money management app for migrant workers in Singapore? Read more from our review about JiPay's features, remittance and more.

Looking for the best money changer in Singapore? We compared the 5 most popular Singapore money changers and the exchange rates

We compared who comes out on top in transfer fees and rates Singapore - Instarem vs Wise (formerly Wise).

We reviewed Western Union trasfer fees in Singapore: ✓Exchange rates ✓Charges ✓Transfer methods and more. Read more here!

PayNow is a secure, fast and convenient way to make instant SGD payments from one Singapore bank to another, without sharing bank details. Here's how it works.

Remitly offers international money transfers from Singapore to over 80 countries, but is it cheap? We reviewed the fees and exchange rates.