DBS multi-currency account review: Fees, exchange rates and more

Planning on opening a DBS multi-currency account in Singapore? Read this comprehensive guide on everything you need to know before

Having a foreign currency or a multi-currency account can make it more convenient and cheaper to handle foreign currencies. If you need to send international payments, travel a lot or get paid in a foreign currency you might be wondering how to open a foreign currency account.

This guide covers all you need to know about the HSBC foreign currency account options available, and also introduces the Wise multi-currency account as a cheaper and more flexible alternative.

Foreign currency accounts let you hold, convert and manage a currency other than SGD. That can be helpful if you want to make and receive payments in a different currency, if you’re planning on investing in a foreign currency, or even if you travel and shop internationally a lot.

As well as foreign currency accounts which allow you to hold one other currency you can also get multi-currency accounts from many providers. Multi-currency accounts typically let you hold and convert a range of currencies for added flexibility.

There are a lot of different options out there for both foreign currency accounts and multi-currency accounts. Some have relatively high fees and can only be used in a limited range of ways - to diversify your investment portfolio for example. Others are intended for day to day use and may have lower fees - we’ll take a look at a few different HSBC foreign currency account options now, as well as the Wise multi-currency account as a comparison.

One popular option for people looking for a foreign currency account which can be used for daily spending is the HSBC everyday global account¹. Open your account and transact in up to 11 currencies:

You’ll be able to make withdrawals and spend in 10 currencies (all apart from Chinese renminbi which is not freely convertible) without HSBC fees. Plus, send international payments online and via an app, and sign up to HSBD Everyday+ for cashback opportunities. Keep reading for more on our HSBC everyday global account review.

Let’s look at the fees applicable to the HSBC Everyday Global Account. The HSBC Everyday Global Account interest rate isn’t specified online - learn more for your account by logging into your online banking service.

| Service | HSBC Everyday Global Account fee² |

|---|---|

| Minimum opening deposit | 100 SGD or equivalent |

| HSBC Everyday Global Account minimum balance | 2,000 SGD or equivalent If you fall below this balance you’ll pay a monthly 5 SGD charge |

| Early closure fee | 50 SGD if you close your account within 6 months of opening |

| Fee for cash deposit/withdrawal in the same currency as the account | 1.5% commission, minimum 50 SGD |

| Receive an inward remittance | 10 SGD |

| Send a telegraphic transfer | HSBC fees are waived if you send online In branch fees - 35 SGD + 20 SGD cable charge |

| Foreign currency transactions | Up to 1.5% (minimum 50 SGD) |

Apply for the HSBC Everyday Global Account as a personal customer by maintaining a minimum account balance of 2,000 SGD or the currency equivalent. Or you can choose to apply as a Premier customer based on holding a total relationship balance of 200,000 SGD or the equivalent, or depositing a salary of 15,000 SGD or more into your account monthly.

You can open an HSBC Foreign Currency Current Account³ in a range of currencies including:

You’ll get an ATM card linked to your account, monthly statements, online and mobile banking services, and a cheque book if you open a USD account.

Here are the fees you’ll pay when you open and operate an HSBC Foreign Currency Current Account:

| Service | HSBC Foreign Currency Current Account fee |

|---|---|

| Minimum opening deposit | 5,000 USD or equivalent |

| Minimum balance | Based on currency involved: 800 USD/GBP/AUD/EUR 7,000 HKD 3,000 NZD 100,000 JPY If you do not hold the minimum balance you’ll pay a monthly service fee based on your currency: 10 USD/GBP/AUD/EUR 100 HKD 15 NZD 1,000 JPY |

| Early closure fee | 50 USD if you close your account within 6 months of opening |

| Fee for cash deposit/withdrawal in the same currency as the account | 1.5% commission, minimum 50 SGD |

| Receive an inward remittance | 10 SGD |

| Send a telegraphic transfer | HSBC fees are waived if you send online In branch fees - 35 SGD + 20 SGD cable charge |

| Foreign currency transactions | Up to 1.5% (minimum 50 SGD) |

Eligibility requirements for the HSBC Foreign Currency Current Account include:

If you’re looking to save money in a foreign currency you might be interested in an HSBC Foreign Currency Time Deposit Account⁴. In this account type you’ll deposit funds which you commit to leave with the bank for a fixed period in return for a better interest rate. If you need to get your money bank before the term ends you may pay penalty charges or lose the interest you had accrued.

HSBC Foreign Currency Time Deposit Accounts are available in the following currencies:

The interest you can earn from your HSBC Foreign Currency Time Deposit Account will vary based on the currency, the amount of money, and how long you can leave it. Deposits can be left for 1 - 12 months, with more interest payable for higher value and longer term deposits⁵.

Minimum deposit amounts apply which vary by currency:

If you’re already an HSBC customer you may be able to open your time deposit account online by logging into your regular online banking service. However if you’re new to HSBC you’ll need to contact HSBC via their online contact page and wait for a call back from a wealth manager to discuss your requirements.

If you’re already an HSBC customer you may be able to open a foreign currency account online by logging into your online banking service. Availability will depend on whether you meet eligibility requirements.

If you’re new to HSBC you’ll need to provide:

To open your account head to the HSBC website:

If you’d rather you can also open your account by visiting an HSBC branch in Singapore. It’s worth calling ahead to make sure you have everything you require to get your account up and running when you visit.

When you send an international payment or exchange currencies, you’ll usually be able to see the live exchange rate offered by HSBC online or in the HSBC app. Out of hours, exchange rates may not be live⁶.

It’s useful to know that the HSBC currency exchange rate is likely to include a markup added to the mid-market exchange rate. That’s an extra fee, and it means the rate you get won’t normally be as good as the one you see when you search for your exchange rate using a currency converter tool or Google search. Adding a markup to the exchange rate is common - but not all providers do this.

Let’s compare HSBC foreign currency accounts, including with a popular alternative -the Wise multi-currency account.

| Everyday Global Account | Foreign Currency Current Account | Foreign Currency Time Deposit Account | Wise multi-currency account | |

|---|---|---|---|---|

| Currencies | Transact in 11 currencies, spend without HSBC fees in 10 | 7 currencies | 9 currencies | 54 currencies |

| Minimum opening deposit | 100 SGD or equivalent | 5,000 USD or equivalent | 25,000 USD or equivalent | None |

| Minimum balance | 2,000 SGD or equivalent - a 5 SGD fall below fee applies | 800 USD or equivalent - a 10 USD fall below fee applies | 25,000 USD or equivalent | None |

| Early closure fee | 50 SGD | 50 USD | You’re likely to lose accrued interest and may pay a penalty fee | None |

| Exchange rate | Exchange rate is likely to include a markup | Exchange rate is likely to include a markup | Exchange rate is likely to include a markup | Mid-market exchange rate with no markup |

| Interest paid? | No interest is specified on the HSBC website | No interest is specified on the HSBC website | Yes | No |

HSBC foreign currency account options include the multi-currency Everyday Global Account, foreign currency accounts in a range of currencies, and options for longer term saving in foreign currencies. Accounts come with some great features - the Everyday Global Account for example, has a linked debit card and the opportunity to earn cashback. However, all HSBC foreign currency accounts also have minimum balance requirements and fees or penalties if you don’t maintain a fixed amount in the account. Exchange rates can also include extra fees.

Before you sign up for an HSBC account, check out a few alternatives, including online options from popular providers, like the Wise multi-currency account. You may be able to get a more flexible account, which can do more, for less.

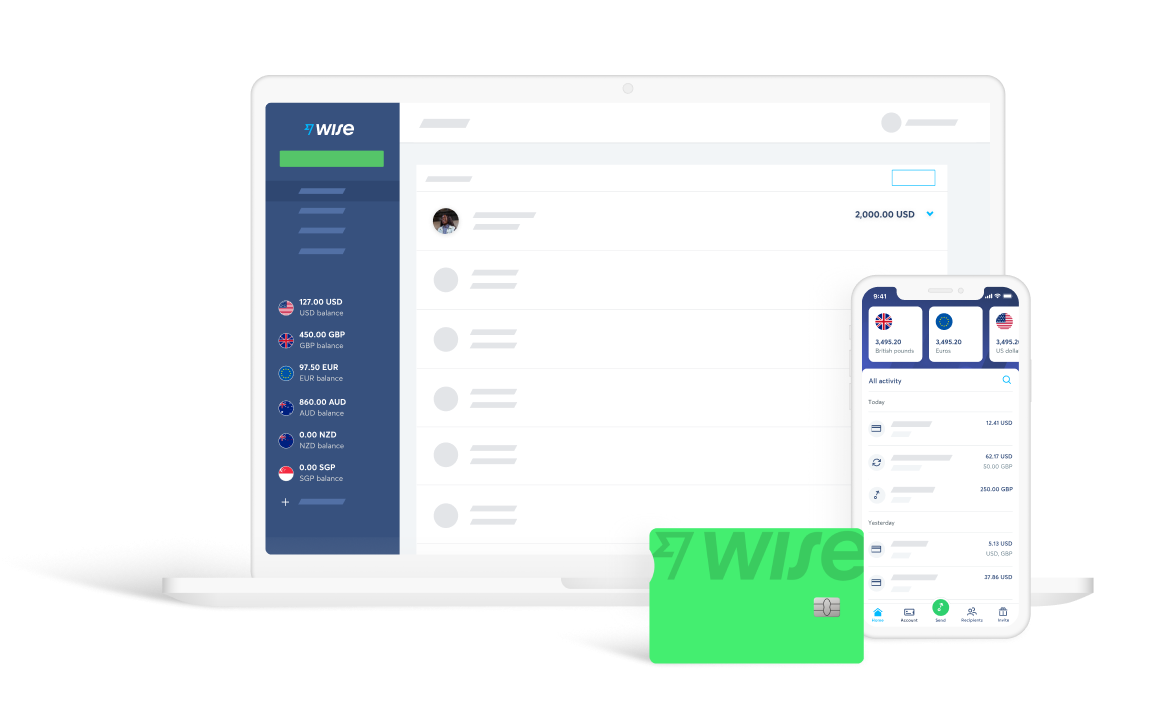

Open your Wise multi-currency account online for free, with no minimum deposit and no minimum balance requirement. The application process is fast - and you can get signed up even if you’re not a permanent or long term resident in Singapore. Just use your normal proof of ID like your passport - and a proof of address from wherever you call home. Easy.

Hold and exchange 54 currencies, send payments to 80+ countries, and get paid like a local from 30+ countries, with your own bank details for SGD, USD, GBP, EUR and a range of other major currencies. You’ll get your own linked international debit card for spending and withdrawals in 200+ countries around the world.

Whenever you need to exchange currencies with Wise - or you want to send or spend in a foreign currency - you’ll get the real exchange rate with a low, transparent fee based on the transaction. That makes it easier to see exactly what you’re paying, and can mean you save significantly compared with using a regular bank. In fact, with the Wise account you could save 6x compared to an old school bank.

See how much you can save with the Wise multi-currency account today!

Sources:

Sources checked on 01.04.2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Planning on opening a DBS multi-currency account in Singapore? Read this comprehensive guide on everything you need to know before

Both Wise (formerly Wise) and Revolut offer digital multi-currency accounts for managing money across borders - which one is better in Singapore?

Here's everything you need to know about the best multi-currency accounts and wallets in Singapore: Fees, Features, Exchange rates and more.

Looking to open a bank account online? Here are some options available in Singapore

Looking how to sign up for a PayPal account in Singapore? We covered the process step-by-step, from signing up to verifying your account

How to open the Indian Bank NRI account for Indians living abroad in Singapore