DBS multi-currency account review: Fees, exchange rates and more

Planning on opening a DBS multi-currency account in Singapore? Read this comprehensive guide on everything you need to know before

Indian Bank is a long established bank owned by the Government of India, which has an overseas presence in Singapore¹. If you’re interested in Indian Bank NRI account opening in Singapore you may be wondering if you can get your account set up through Indian Bank’s Singapore branch locations.

This guide walks through Indian Bank Singapore’s key services and options for an NRI account in Singapore. We’ll also highlight the Wise multi-currency account as an alternative if you need a low cost account to hold and manage 50+ currencies including Indian rupee.

Let’s start with the basics. If you’re an NRI (Non-resident Indian) or PIO (Person of Indian Origin) you can choose to open a specific account - broadly known as an NRI account - with an approved bank, to deposit funds and easily access them in INR currency.

NRI bank accounts actually split into a few different types, and can be current, savings or fixed deposit account types. A couple of popular options include NRO (Non-resident Ordinary) and NRE (Non-resident external) accounts. Both can be opened with a deposit in foreign currency, which is then converted in INR to make it easy to send payments to friends and family in India, or access the money yourself when you’re in the country.

Learn more about the differences between NRO and NRE accounts in this full guide.

Different types of NRI bank accounts have different advantages and disadvantages - and the products offered by different banks will also all have their own fees and features to think about. One key benefit for many people is having an INR denominated account you can use to easily send payments back to India.

On their Indian desktop site, Indian Bank offers a broad range of NRI account options including NRE and NRO accounts, and foriegn currency accounts for Indians returning to India to become residents².

The Indian Bank Singapore branch does not advertise specific NRI account products, although these can be opened online through the main Indian Bank website. You may want to check if NRI accounts are available through the Singapore branch if you’d prefer to open your account in person.

Indian Bank also has a Singapore branch at Raffles Place, as well as a remittance centre in Serangoon. The specialities of the Singapore branch include remittances, currency trading and business finance³. You can also open:

If you want to open an account with Indian Bank in Singapore you’ll probably need to visit their main office. It’s worth calling in advance to check availability and confirm what paperwork you need to take along. Here are the contact details you need:

| Indian Bank Singapore branch address | Indian Bank 3 Raffles Place, Bharat Building Singapore 048617 |

| Indian Bank Singapore branch phone number | Tel : (65) 6534 3511 |

| Indian Bank Singapore branch email | indbksg@indianbank.sg |

You can also view and download the application forms for accounts offered through the Indian Bank Singapore branch here.

If you’re interested in the Indian bank NRI account opening online process you’ll probably want to look at the main Indian Bank desktop website which offers a full range of products. Check out eligibility and application processes here, to find the right Indian Bank NRI account for your needs.

Specific NRI account types like the NRE or NRO account are available to individuals who can prove their status as NRI, PIO or OCI (Overseas Citizen of India).

However, depending on your requirements and residence you may well be able to open another type of account to hold INR instead. More about one smart option - the Wise multi-currency account coming right up.

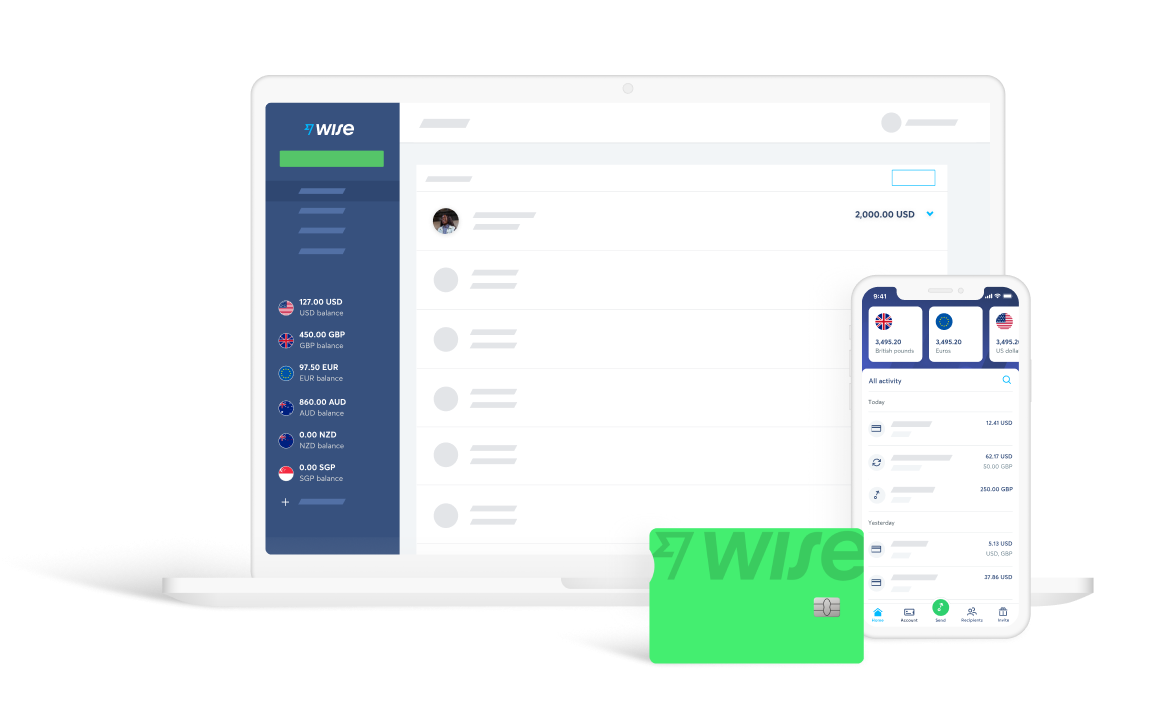

If what you’re looking for is a convenient account to hold, exchange, send and spend INR and SGD you may be better off with the Wise multi-currency account.

Open your account online for free, and get local bank details to get paid fee free in 10+ currencies including SGD. You’ll be able to hold 50+ currencies and get a linked international debit card to make spending and withdrawing money easy around the world.

Whenever you need to, convert your balance from SGD - or any other currency you might hold - to INR using the mid-market exchange rate. Hold your money as INR, or send payments to India with low fees which can beat the banks.

Overall your Wise account can save you 6x compared to your bank - see how much you can save today!

Sources:

Sources checked on 01.04.2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Planning on opening a DBS multi-currency account in Singapore? Read this comprehensive guide on everything you need to know before

Both Wise (formerly Wise) and Revolut offer digital multi-currency accounts for managing money across borders - which one is better in Singapore?

Here's everything you need to know about the best multi-currency accounts and wallets in Singapore: Fees, Features, Exchange rates and more.

Looking to open a bank account online? Here are some options available in Singapore

Looking how to sign up for a PayPal account in Singapore? We covered the process step-by-step, from signing up to verifying your account

Planning on opening a HSBC foreign currency account? Here’s everything you need to know beforehand