How to Open a POSB Bank Account for Your Domestic Helper in Singapore

Learn how to open a POSB bank account for your domestic helper in Singapore. Our guide covers the required documents and step-by-step process.

OCBC is one of the largest and longest established banks in Singapore - and the second largest financial services group in Southeast Asia. If you want to open a bank account in Singapore, the chances are that you’ve come across OCBC.

To help you get started with OCBC we’ll cover how to open a bank account online or in a branch, as well as some popular account options you might consider. We’ll also touch on Wise and the Wise multi-currency account as an alternative to a bank account with OCBC if you want a low cost, flexible way to manage your money across currencies.

| Table of contents |

|---|

Let’s start out with a look at how you can open an OCBC account.

If you’re Singaporean or a Permanent Resident of Singapore you can open any of the following OCBC accounts online:

If you have MyInfo or Singpass you can easily create an account as - with your permission - OCBC can pull your personal info from these tools to prepopulate your account application form. If you don’t have MyInfo or Singpass set up you can still create an account online as long as you have:

Here are the steps to take:

If you’re an existing OCBC customer you can choose to open a new account through the OCBC internet banking portal. The steps you’ll follow will be similar to customers opening an account online, which we set out above. You’ll need to log into your existing OCBC account’s online banking service, and follow the onscreen prompts to apply for the new account you’re looking for.

OCBC has 34 branches around Singapore, so opening an account in person can also be relatively simple. Find the closest branch to you using a Google search or the OCBC branch locator which is available on their desktop site¹.

Don’t forget you’ll need to take along some paperwork to get your account up and running. We’ll cover that in more detail later.

Here’s how to open OCBC’s most popular accounts, including a summary of the key fees you should know about.

Ways to open the account:

| Requirements | Fees/requirements in S$ |

|---|---|

| Initial Deposit | S$1000 |

| Monthly minimum average daily balance | S$3000 |

| Fall below fee | S$2/month - waived for first year |

| Additional costs | Optional S$10 fee for a cheque book |

Ways to open the account:

| Requirements | Fees/requirements in S$ |

|---|---|

| Initial Deposit | S$0 |

| Monthly minimum average daily balance | Customers aged under 26 - no minimum balance requirement S$1000 minimum balance applies to customers aged over 26 |

| Fall below fee | No fall below fee applies to customers aged under 26 Customers aged over 26 - S$2/month if your account balance falls under S$1,000 |

| Additional costs | Optional S$10 fee for a cheque book |

| Quick note, here's a review of OCBC FRANK debit card if you're interested. |

Ways to open the account:

| Requirements | Fees/requirements in S$ |

|---|---|

| Minimum placement amount | Varies by currency: SGD 5000 AUD 5000 CAD 5000 EUR 5000 GBP 5000 NZD 5000 USD 5000 HKD 50,000 CNH 250,000 |

| Additional costs | If you withdraw your funds early you may lose your accrued interest and be subject to penalty charges |

Ways to open the account:

| Requirements | Fees/requirements in S$ |

|---|---|

| Initial Deposit | S$5000 in fresh funds |

| Monthly minimum average daily balance | S$3000 |

| Fall below fee | S$2/month |

Ways to open the account:

| Requirements | Fees/requirements in S$ |

|---|---|

| Initial Deposit | S$0 |

| Monthly minimum average daily balance | S500 |

| Fall below fee | S$2/month - waived for first year |

Ways to open the account:

| Requirements | Fees/requirements in S$ |

|---|---|

| Initial Deposit | S$1000 For Basic Banking Account, a S$1 initial deposit applies |

| Monthly minimum average daily balance | S$1000 For Basic Banking Account, a S$500 minimum deposit applies |

| Fall below fee | S$2/month |

| Additional costs | S$15 fee for replacement pass book |

Ways to open the account:

| Requirements | Fees/requirements in S$ |

|---|---|

| Initial Deposit | S$1000 |

| Monthly minimum average daily balance | S$1000 |

| Fall below fee | S$2/month |

Ways to open an OCBC current account⁹:

| Requirements | Fees/requirements in S$ |

|---|---|

| Initial Deposit | S$1000 |

| Monthly minimum average daily balance | S$3000 |

| Fall below fee | S$7.50/month |

| Additional costs | S$10 fee for a cheque book |

If you’re interested in opening a foreign currency account you can get the full lowdown on the options in this OCBC foreign currency account guide. Or, read on for more on a flexible, low cost alternative - the Wise multi-currency account.

Different accounts with OCBC have different eligibility requirements. Usually accounts are open to Singaporeans, PRs and foreigners in Singapore with a valid pass. Age restrictions also apply which typically mean you need to be 16 or 18 years old or over to open your OCBC account.

You may also need to provide documents when you open your account. These are always required if you open your account in a OCBC branch, although some customers opening accounts online may be able to use their MyInfo or Singpass to skip this step.

If you’re Singaporean or a PR you’ll need:

If you’re a foreigner you’ll have to bring along:

Most OCBC accounts are available for foreigners who have legal resident status in Singapore. That means you must hold a valid pass like an Employment Pass or Student Pass - and you’ll need to visit a branch to present your paperwork in person and get your account up and running. If you're interested, you can read more about opening a bank account in Singapore as a foreigner here.

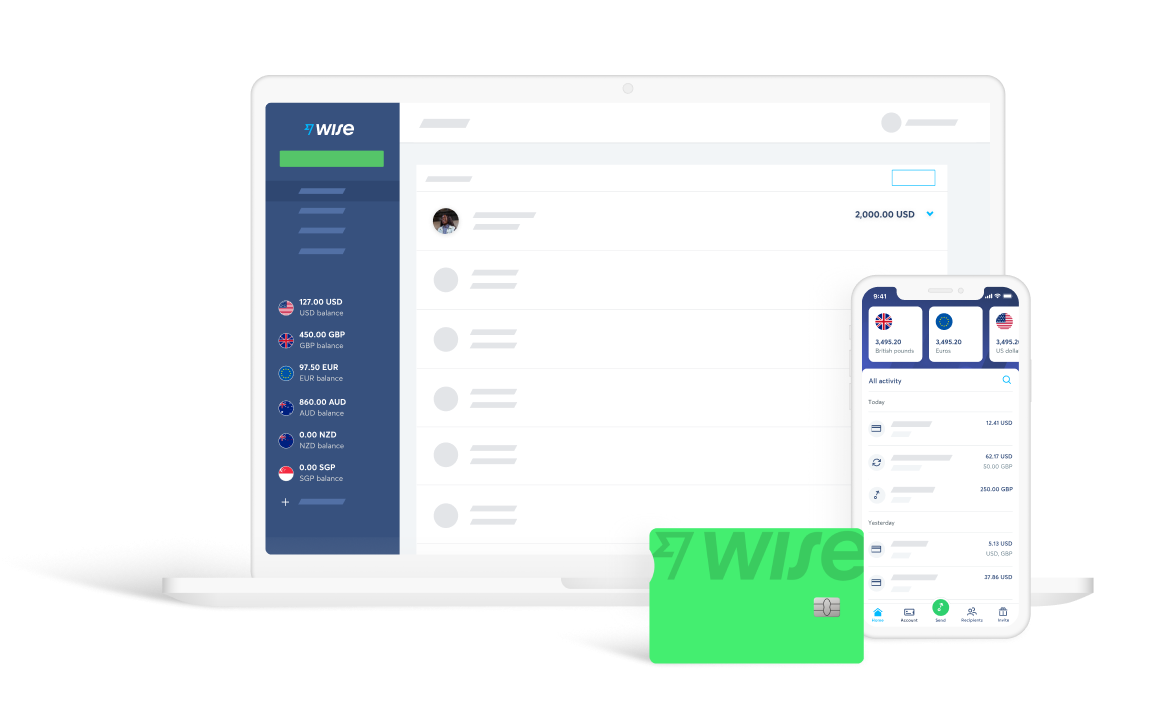

If you’re looking for a SGD account you can open without needing to be a full time resident in Singapore - or if you want to hold and manage multiple currencies more easily - you need Wise and the Wise multi-currency account.

The Wise multi-currency account is opened online or in the Wise app, with no minimum deposit, no monthly charges, and no fall below fees to worry about. You’ll be able to hold and exchange 50+ currencies with the mid-market exchange rate, and get local bank details for 10 currencies including SGD. That means you can get paid like a local from 30+ countries - including Singapore.

You can also send payments to 80+ countries, and get a linked debit card to spend and make withdrawals globally. Making international transfers with Wise is up to 6x cheaper than regular banks.

See how much you can save with the Wise multi-currency account today!

Sources:Sources checked on 31/03/2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn how to open a POSB bank account for your domestic helper in Singapore. Our guide covers the required documents and step-by-step process.

Comparing GXS and Trust? Read on to find out what a digital bank is, compare features, interest rates, and understand their exchange rates

Planning on opening a DBS multi-currency account in Singapore? Read this comprehensive guide on everything you need to know before

Both Wise (formerly Wise) and Revolut offer digital multi-currency accounts for managing money across borders - which one is better in Singapore?

Here's everything you need to know about the best multi-currency accounts and wallets in Singapore: Fees, Features, Exchange rates and more.

Looking to open a bank account online? Here are some options available in Singapore