International business banking made easy.

With our partner Wise, e-ResidencyHub customers can open a multi-currency account to send, spend, and receive in over 50 currencies with the real exchange rate. Join over 7 million people today.

Automate work with our API

Pay invoices and people abroad

Receive money with no fees

Spend with a free debit card

e-ResidencyHub & Wise making international banking easier

Get UK, Eurozone, US, Australian, New Zealand and Singaporean bank details for a small fixed one-time fee in minutes – without a local address. Use them to get paid without any international receiving fees or withdraw money from platforms like Amazon. Hold 50+ currencies in your account for future payments or move it to your bank.

Your money will always be converted at the real exchange rate and the only fee you'll pay is a small, upfront cost on the value of the transfer or a small fixed fee for a same currency withdrawal into a domestic bank account.

Play the video to find out more

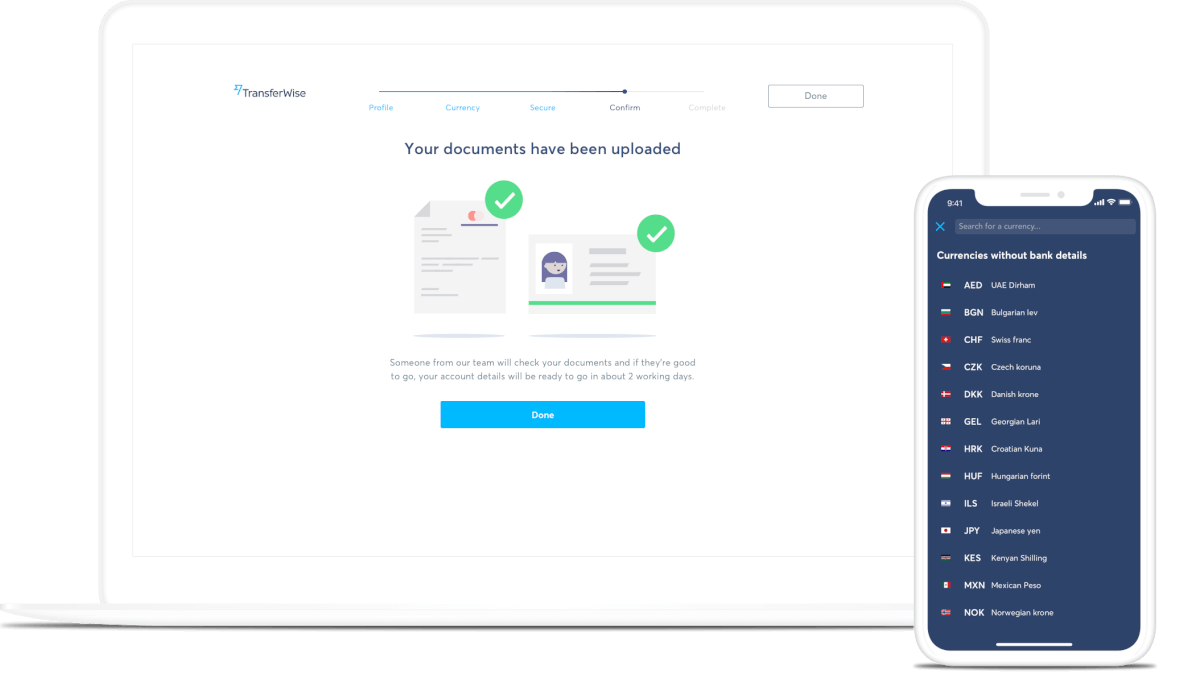

How do I get started?

Get your free account quickly and easily online.

Just complete your profile and upload your ID documents to verify your account and business for security. Then start sending and receiving money around the world.

You can activate your international account details within your account and open up additional currency accounts with just a few clicks. You'll just need to make a one-time fixed fee payment for getting access to your international account details. It's £16 for a UK business or £16-£21 in other currency equivalents.

How much are the fees?

- You pay a small, flat fee + fixed percentage of the transfer amount (you’ll always see the total cost upfront)

- Some payment methods have an added fee, but that's usually tiny too

- You always get the real, mid-market exchange rate, with no markup whatsoever

- A one-time fixed fee payment for getting access to your international account details of £16-£21 or currency equivalent dependent on country. You can pay using debit or credit card.