How to make money online and from home: For beginners, students and more (MY)

Learn more about how to make money online in Malaysia through platforms like YouTube, TikTok, and more.

If you use PayPal¹ to shop online, send or receive payments, you may be wondering how to check your PayPal balance - and, importantly, how to use your PayPal balance to pay, next time you send a transfer or spend online.

Read on for all you need to know about how to top up and use the balance of your PayPal account in Malaysia.

A PayPal balance is any funds you hold in your PayPal account. You may have money in your PayPal account because someone sent you a PayPal transfer, for example. Or you might be able to top up your PayPal balance directly from your RHB bank account, so you can shop online without needing a credit card.

PayPal balances can be held in a broad range of currencies - so someone could send you a payment in USD, GBP or EUR and you can hold it in that currency alongside your regular MYR balance. However, when it comes to time to spend or withdraw your foreign currency balance, PayPal may apply pretty steep currency conversion fees. We’ll look at this - and a smart way to limit your currency conversion fees, in just a moment.

One handy note for PayPal Malaysia users - to comply with Malaysian law, PayPal is obliged to hand any balance in an inactive PayPal account over to Jabatan Akauntan Negara Malaysia (JANM) - the Accountant General. This applies if your account has been dormant or inactive for 7 years².

If you don’t use PayPal frequently, but have a PayPal balance in your account you’ll need to make sure you transact with PayPal from time to time to keep your account active. This could be by making a withdrawal or payment with PayPal, or by adding further funds to your PayPal balance.

Let’s start at the beginning - how do you check the balance of a PayPal account in the first place?

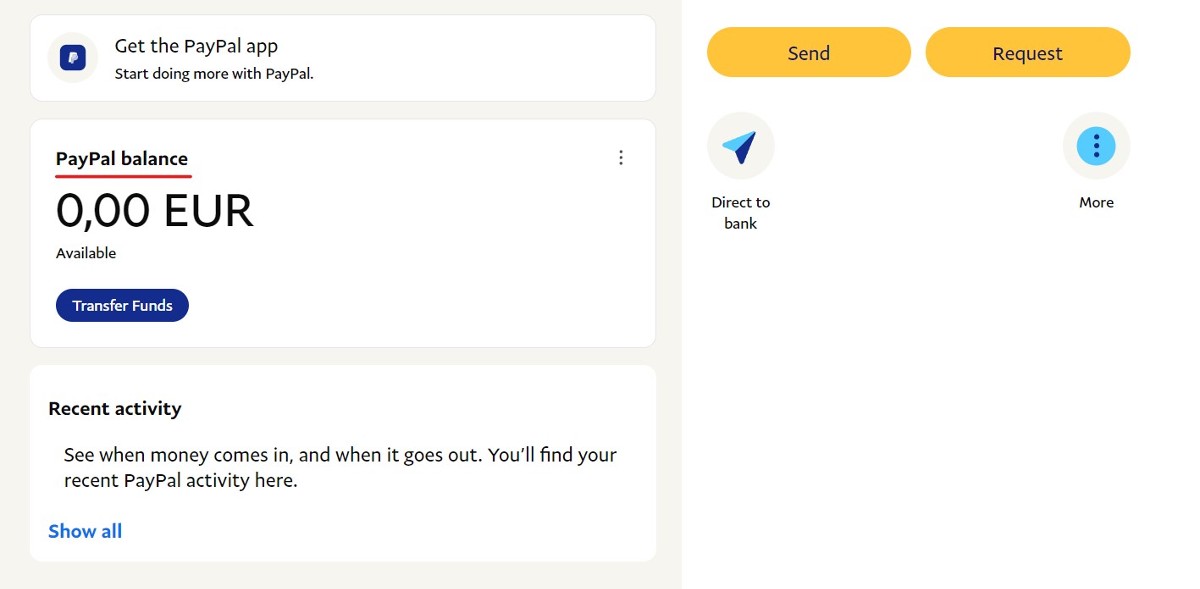

You’ll be able to view your PayPal balance online or in the PayPal app depending on your personal preference. The process to follow is pretty simple in each case. Here’s how to check your PayPal balance online:

- Log into your PayPal account

- On the home page, tap Wallet - on the top menu bar

- You can view your balance on the Wallet page

You’ll be shown your balance, split by currency on the right hand side, if you hold a PayPal balance across more than one currency. You’ll also be given an estimated total balance amount converted back to your home currency using the PayPal exchange rate, so you can quickly calculate how much you might have in MYR if you were to switch it over with PayPal.

If you have an RHB bank account which you have linked to your PayPal account, you can use this to add money to your PayPal balance³. This can be convenient if you don’t have a credit card and want to shop securely online. Just top up your PayPal balance, then use the funds next time you’re shopping in your favourite ecommerce store.

If you don’t have an RHB bank account you can’t top up your PayPal balance this way. Instead you’d have to have someone send you a payment on PayPal.

Here’s how to add money to PayPal balances using a linked RHB bank account⁴:

- Log into PayPal online or in the PayPal app

- Tap Wallet, and then Add money to your balance

- Select your linked RHB bank account

- Enter the amount you want to top up to PayPal

- Tap Add

Learn more about how to add a PayPal balance here.

When you have a PayPal balance you’ll be able to set the primary currency of your account, which will then be used for sending and receiving payments⁵. However, as we highlighted earlier, you can actually hold a PayPal balance in multiple currencies, and convert between them within your PayPal account whenever you want to.

PayPal can also convert your funds automatically for you, if you hold a balance in multiple currencies, and try to make a payment which exceeds the amount you have in the required currency. So let’s say you hold a balance of 100 USD, but want to send a payment of 150 USD to someone, PayPal can use the 100 USD you have in the account, before converting the equivalent of the additional 50 USD you need from an alternative currency balance within your account.

PayPal’s currency conversion options can be convenient - but there’s a downside: the cost. PayPal charges a currency conversion fee whenever you switch from one currency to another, which is a percentage charge based on the currencies involved and the transaction type.

Here’s the PayPal currency conversion costs if you have a PayPal Malaysia account - if your account was set up somewhere else, the fees may be slightly different, so do double check:

| PayPal transaction type | PayPal currency conversion fee⁶ |

|---|---|

| Commercial transactions and refunds | 3.5% for USD and CAD 4% for all other available currencies |

| Converting a balance in your PayPal account | 2.5% |

| All other currency conversion | 3.5% |

If you’d rather avoid the PayPal currency conversion fee entirely, you may prefer to use a specialist multi-currency account and card for your online shopping and sending payments. More on one great option, next.

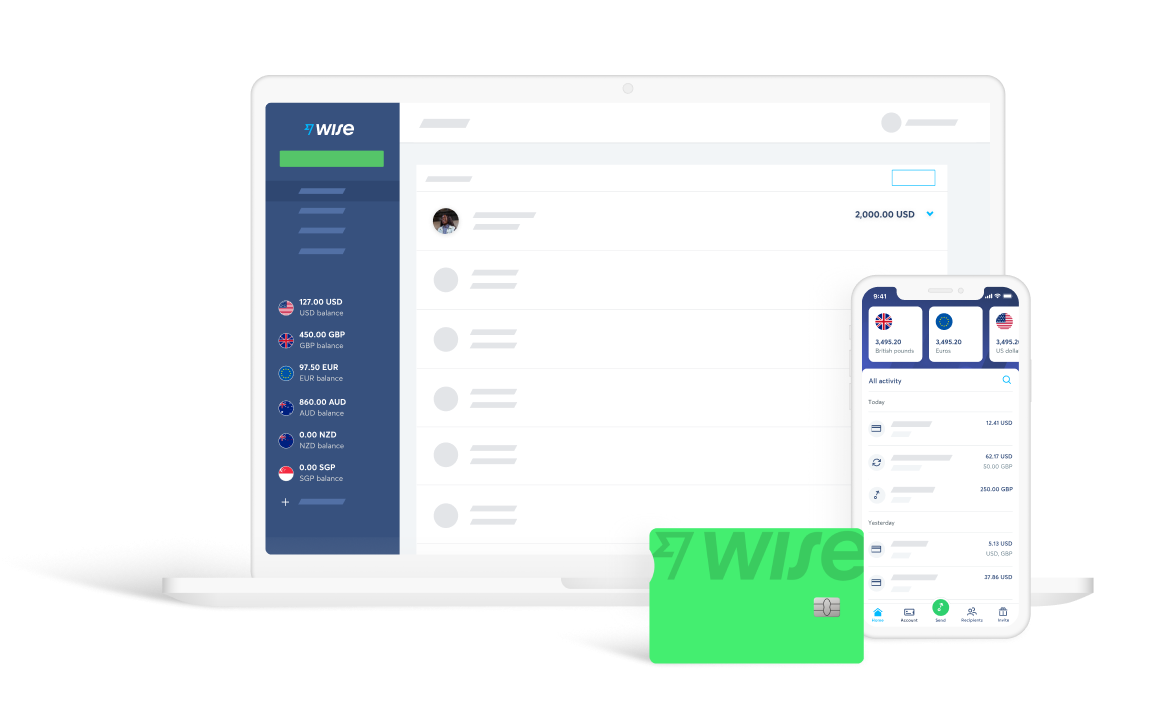

PayPal is a super convenient option for sending and receiving payments, and for shopping online. But when it comes to currency conversion, and transacting in foreign currencies, PayPal isn’t necessarily your best option. Meet Wise.

Interested in learning more? Here’s how to sign up for a Wise account:

Pricing/fees: Please see Terms of Use for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information

PayPal Malaysia offers handy ways to add a PayPal balance to your account if you have an RHB bank account - or if you’ve had someone send you money directly through PayPal. You can then use this balance to send a transfer, withdraw to your own bank account, or for your online spending. However, where you’re spending or sending foreign currencies, PayPal’s currency conversion fees can be pretty steep. Compare PayPal’s fees and exchange rates against alternative providers like Wise, to see if you can save.

Sources checked on 07/02/2023

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn more about how to make money online in Malaysia through platforms like YouTube, TikTok, and more.

Learn more about the RHB Multi Currency Debit card in Malaysia, including benefits, requirements, fees and whether it’s worth getting.

We compared the top Affin Bank cards in Malaysia. Whether you’re looking for points, fees or rewards on travel spend, find out which credit card is for you.

Learn more about Revolut and Wise, including exchange rate comparisons, and whether the product can be used in Malaysia,

Want to know how much transaction fees you’re paying when using your Malaysian credit card overseas? Learn more about the types of fees and how to avoid them.

Learn more about the Maybank World Elite Mastercard in Malaysia, including benefits, requirements, fees and whether it’s worth getting.