Permanent TSB transfer large amount: What are the limits?

Can you send large transfers with Permanent TSB Ireland? Read all about it in this article.

In our modern world, it’s not uncommon for people to make international transfers. Unfortunately for customers with KBC Ireland this is easier said than done, and now due to an agreement made with the Bank of Ireland, KBC will be withdrawing from the Irish market.¹

In this article we’ll explore what you need to know about international bank transfers with KBC, focusing on what their accounts allow you to do and the fees associated.

We’ll also let you know how Wise might be a smart alternative for your international transfers, given KBC’s limitations and impending exit from Ireland.

See how you can send

money with Wise 💶

| ⚠️ UPDATE: KBC is exiting the Irish market. From the 1st of June 2022, KBC will begin issuing customers with a notice that gives them 90 days to close their KBC account. Here's how to close your KBC account in Ireland. |

|---|

With KBC you can send and receive international payments in Euros to countries that are within the Single Euro Payments Area (SEPA).² Currently, there are over 30 members of SEPA.

Sending money to accounts held in these European countries is done using Bank Identifier Code (BIC) and International Bank Account Number (IBAN) codes, the same way you’d transfer money to another Irish account.

Sending or receiving money from an account outside SEPA is harder as all transfers to a KBC account must be in Euros.³ This means you can’t send or receive foreign currency. If you want to send Euros to a bank account outside of SEPA you’ll need to ask KBC directly if they’ll facilitate the transfer.

Given the limitations of KBC Ireland international transfers, you may need to use an alternative service like Wise to send money abroad.

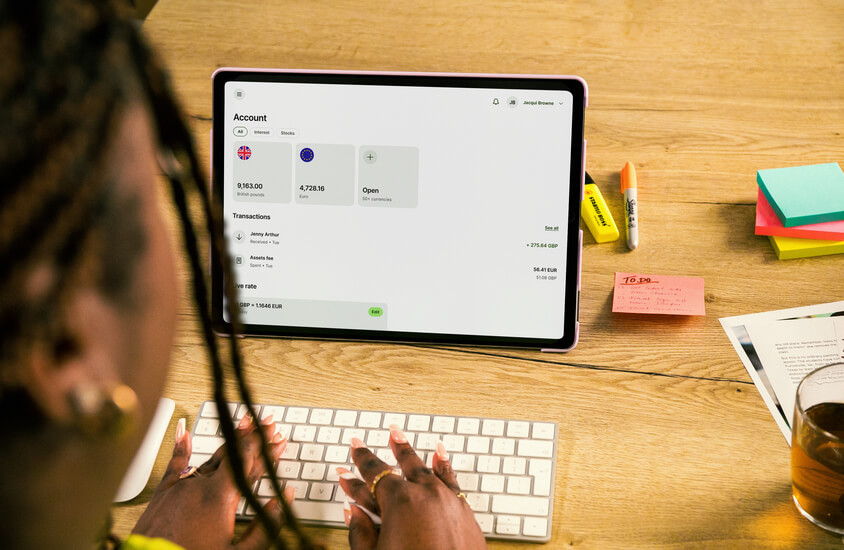

With Wise, you can send money to 80 countries around the globe and hold and convert more than 50 different currencies. There’s no account maintenance fees to worry about, and you can register your account in minutes.

Here’s some of the fees associated with KBC SEPA transfers and spending money abroad using a KBC bank card.⁴

| KBC int. transfer fees | |

|---|---|

| Service | Fees |

| ATM Euro cash withdrawals within the SEPA Zone | €0.30 or free for Standard Current Account if the daily account balance is €2,000+ |

| ATM non-Euro cash withdrawals | 3.50% of transaction value (min €3.17, max €11.43) |

| Non-Euro debit card purchases | 1.75% of transaction value (min €0.46, max €11.43) |

| Same day credit transfers within the SEPA Zone | €25.40 |

If you use your KBC debit card to make a purchase in a foreign currency your money will be exchanged based on the MasterCard Foreign Exchange rates.⁴

With Wise, your money is exchanged using the real mid-market exchange rate, just like you’d see on Google. To see what the current rates are, you can take a look at the Wise online currency converter.

As we’ve mentioned, Wise is a viable option for making international transfers. When you send money abroad with Wise, you’ll know the exchange rate and any fees upfront before you commit to the transaction.

If you think you’ll be making quite a few international transfers, you may benefit from a Wise multi-currency account.

This account allows you to convert and hold more than 50 different currencies with no account maintenance fees. You can get local account details for 10 of the world's major currencies. Also get access to the Wise debit card and use it arond the world.

Sending money abroad with Wise is pretty easy. Here’s a step by step of how it works:

Once you’ve paid, it's time to sit back and relax while Wise securely transfers your money, with live updates available along the way.

Open your Wise

account for free 🚀

In Ireland, KBC is a Euro only account so you can only send and receive Euros.³ As such, when it comes to international transfers you’re generally limited to the SEPA Zone.²

Inbound KBC SEPA transfers are processed a few times a day. Depending on when the money was sent you can generally expect it to arrive at one of the following times⁵:

The timing for outbound KBC SEPA transfers also depends on the time the money was sent⁵:

KBC does have transfer limits which vary depending on where you are sending your money.⁶

| KBC transfer limit | |

|---|---|

| Transfer to another bank | €5,000 per transaction €15,000 maximum per day |

| Transfers to another KBC account | €15,000 per transaction €15,000 maximum per day |

| Transfer to your KBC account | No limits |

If you need to transfer more than €15,000 in a day, you’ll need to split the transfer up across multiple working days.

KBC Irelands has a variety of ways you can get in touch with them⁷:

| 🔎 Read more about KBC in Ireland |

|---|

Sources used:

Sources last checked on date: 23 March 2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Can you send large transfers with Permanent TSB Ireland? Read all about it in this article.

How much can you transfer with Revolut if you want to send high amounts? Read all about it here.

Read about how you can do a large transfer with AIB Ireland, including the maximum limits.

Read on how you can make large transfers with the Bank of Ireland, including limits and transfer times.

If you need to receive an international transfer with AIB Ireland, read this article to discover all about it.

Learn how to send money on Revolut effortlessly with our step-by-step guide. Send money via phone number, username, or to non-contacts.