What do you need to receive money with Western Union?

Receiving money through Western Union? Learn about the process, from cash pick-up to bank transfers, and find out what to expect.

In our increasingly connected world there are a multitude of reasons you might be receiving an international transfer. Whatever the reason, you’ll want to make sure you can receive your money hassle free, with as few fees as possible.

If you’re a customer of AIB in Ireland then this article is here to help you. We’re going to take a look at what they charge for you to receive an international transfer, what the limits are and what the processing is like.

We’ll also introduce you to the Wise Account as a viable option to receive international transfers for free, as a personal client.

Receive money in +9 currencies

with the Wise Account 💶

There are two ways AIB classifies incoming international transfers:

- InPay Euro are euro payments that originated from a SEPA country

- InPay Global payments come from countries outside of SEPA or currencies other than the euro.

The cost for receiving an international transfer with AIB varies depending on whether it’s an InPay Euro or InPay Global transaction and how much was sent.

| AIB charges for incoming payments¹ | |

|---|---|

| InPay Euro | InPay Global |

| €0 for all payments | €0 for payments less than or equivalent to €127 €6.35 for payments more than €127 |

🔎 Keep in mind: The sender's bank may charge them for the outbound transaction. There could also be fees associated with how the funds are sent, for example if the SWIFT system is used. This can result in you receiving less money than anticipated.

With AIB, any transaction to your account in a currency other than what your account is denominated in will result in an automatic currency conversion before the funds are deposited.

For example, if someone in the United Kingdom sends GBP to your AIB current account in Ireland, the money will be converted from GBP to EUR before AIB deposits them.

AIB has set rates that apply for incoming international foreign currency payments going to a euro account. These rates apply to amounts up to the equivalent of €70,000.² Over this, you’ll need to contact your branch.

The rates are usually updated once each business date and you can check them on the AIB website.

To give you an idea of how the AIB exchange rate stacks up, here’s how it compares to Wise.

| Currency | AIB Exchange Rate (1 EUR)² | Wise Exchange Rate (1 EUR) |

|---|---|---|

| Pound sterling | 0.8697 GBP | 0.85837 GBP |

| US dollar | 1.1030 USD | 1.08740 USD |

| Australian dollar | 1.6764 AUD | 1.65246 AUD |

| Canadian dollar | 1.4878 CAD | 1.46663 CAD |

| Danish krone | 7.5610 DKK | 7.45705 DKK |

As you can see there’s a bit of a difference in what Wise and AIB give you, with Wise having the more favourable rate across each of these currencies. This is better for you because it means you get a greater amount of EUR for the foreign currency that’s exchanged.

This is possible because Wise uses the mid-market exchange rate with no hidden fees or margins.⁴ This rate is determined by finding the midpoint between the buy and sell prices on the currency market, which is a fair way to do it.

Wise is on a mission to make international money transfers instant, convenient, transparent and eventually free.

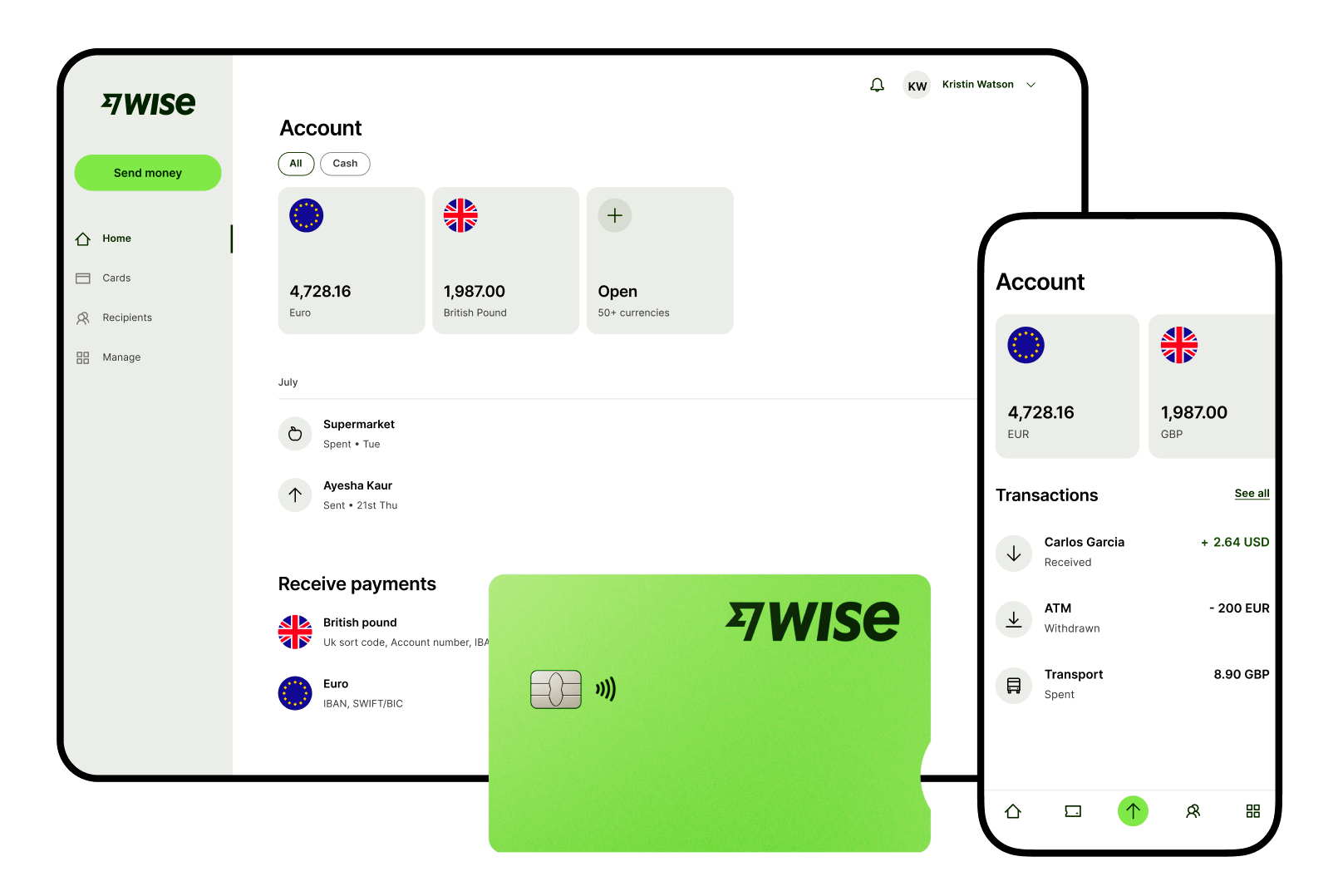

With a personal Wise Account you can get local account details for +9 currencies, making it easier to send and receive money like a local.

Here’s some of the fees for having a Wise account, including costs for receiving money.

| Wise Service | Fee |

|---|---|

| Opening an personal account | Free |

| Receiving AUD, CAD, EUR, GBP, HUF, NZD, RON, SGD, TRY, USD (non-wire) in a personal account | Free |

| Receiving USD wire payments | 4.14 USD |

| Receiving CAD SWIFT payments | 10.00 CAD |

One of the great benefits of the Wise Account are the local account details you can get. Like we said earlier, AIB automatically converts foreign currency to whatever denomination your account is in, which is usually Euro.¹

But with Wise, you can receive and hold currencies like GBP and USD using the local account details, without the need to change it to Euros. This puts the choice of how and when your funds are converted back in your hands.

Speaking of money conversion, with Wise you'll be able to do this in over 40 currencies and send money to over 160 countries. There’s also the option to get a Wise card for your daily spending needs, which is connected with your account.

Open your Wise Account today 🚀

Here’s a few things you may want to know about receiving international transfers with AIB in Ireland.

For you to receive an international payment the sender usually needs to know this information.¹

AIB Ireland doesn't specify on their website how long it can take to receive money from abroad.

It would depend in part on when and how the money is sent, and how long the sending bank takes to process it, but most people accept that 1-5 business days is the normal range.

Each day there’s a cut off time for the receival of incoming international payments.³ Any transfer received after that time will be processed the next day.

The cut off time varies depending on the currency, but to give you an idea here’s what applies to some of the major currencies:

| Currency | AIB Cut-off Time (GMT)³ |

|---|---|

| Pound sterling | 16:00 |

| Euro | 15:45 |

| US dollar | 16:00 |

| Australian dollar | 15:00 |

| Canadian dollar | 14:30 |

| Danish krone | 15:30 |

The general limit for receiving an international transfer with AIB is equivalent to €70,000.² Above this you’ll need to seek the assistance of an AIB branch.

If you’re an Irish customer of Wise you can generally receive any amount someone wants to send you. The only limit is for USD but it’s such a high amount it’s unlikely to impact most people.

Open your Wise Account

for free 🚀

Sources used:

Sources last checked on date: 19 January 2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Receiving money through Western Union? Learn about the process, from cash pick-up to bank transfers, and find out what to expect.

Need to get money from abroad? Learn about the ways you can receive international transfers through An Post in Ireland..

Discover the best way to send money from Ireland to the UK for property purchases. Compare costs, timing, and methods for transferring money safely.

Looking to receive a payment through Remitly? Discover all the ways you can get your money in Ireland.

Need to move money from Revolut to your AIB bank account? Learn how to make a quick and easy transfer with our guide.

Transferring money from Revolut to Bank of Ireland? Here’s everything you need to know about the process, from fees to transfer times.