PayPal charges explained: What you need to know about fees in Ireland

What are the PayPal fees for consumers in Ireland? How much do you pay when sending money? Read here.

Starting university soon? If you’re getting ready to begin third level education, you’re likely to have a long list of things to do. But press pause on your packing for just a moment, as one of the first things to get sorted is opening a student bank account.

A dedicated current account is a must-have for any student, as with it you can get paid for part-time work and receive your student loan. Plus, you’ll be able to spend using a linked debit card. This means you can cover all your everyday expenses during your studies, from food and drink to books and clothes.

But student accounts have other perks too, including discounts, freebies and interest-free overdrafts. Many of these are only available to students, so make the most of it while you can.

If you’re shopping around for a new student account, you’re likely to come across KBC. In this guide, we’ll look at the features, fees and everything else you need to know about the KBC student account. This should help you decide if it's the right choice for you.

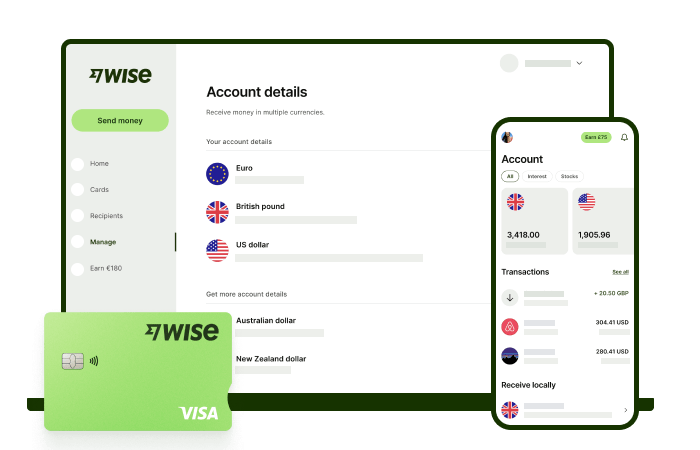

Studying can be expensive, particularly for international students. If you need a cheaper way to send and receive money from back home, Wise can help.

Open a free Wise multi-currency accountand you can receive money from family and friends all over the world with zero fees. If you need to make an international payment, you’ll only pay tiny fees and get the mid-market exchange rate every time.

There’s only one student account available at KBC, but it’s a pretty decent option.

The KBC Student Current Account is packed with features and perks, including an initial €50 free when you open the account. This will be automatically transferred to your account within 24 hours (if you open your account via the KBC app) or 20 working days (if you open your account online or at a KBC hub).

You’ll get a contactless debit card to make free payments in euros, along with free euro cash withdrawals. This card can also be used with a full suite of digital wallets, including Google Pay, Apple Pay, Fitbit Pay, Garmin Pay and wena Pay. So, you won’t even need to take your card out shopping with you, as you can just pay for purchases using your smartphone or other device.

The KBC Student Current Account also offers:

You’re eligible for this account if you’re a full-time student aged 17 or over on an eligible course in Ireland. Your course must last at least a year and involve 21 hours of tuition a week. The account is only open to EU residents.

An important point to note with this account is that it doesn’t permit sending or receiving money in any currency other than euros². This means you won’t be able to use it for international transfers in other currencies.

Also, KBC Hubs (the physical branches of KBC) don’t have cash facilities, so you won’t be able to deposit or withdraw cash at a hub in person. However, you can still use ATMs to withdraw money using your KBC debit card.

When you open your new student account, you’ll get a KBC debit Mastercard. This can be used in a huge 36 million locations worldwide³, as well as for secure online shopping.

It’s a contactless card, so you can just tap and go wherever contactless payments are accepted. You can also spend using mobile wallets such as Google Pay, Apple Pay and many more.

You can spend using your KBC student debit card in Ireland or abroad, although there are fees to pay for using your card internationally. We’ll take a look at that in more detail next.

Like many student current accounts, KBC offers third level learners a number of fee-free banking services. This should help you to keep your student budget in check.

This means you won’t pay⁴:

But banking with KBC isn’t completely free. There are some other charges you need to know about, especially if you’d like to use your new KBC debit card abroad or make any international transactions.

Let’s take a look at the main fees that apply to the KBC Student Current Account:

| Transaction type | Fee⁴ |

|---|---|

| ATM withdrawals within Ireland | Free |

| ATM withdrawals outside of Ireland - non euro | 3.5% of transaction value (max €11.43) |

| Debit card purchases in foreign currency | 1.75% of transaction value (max €11.43) |

| Sending/receiving money within Ireland | Free for non-urgent transfers€25.40 for same-day transfers |

| Sending money overseas | Free for non-urgent transfers (euros only)€25.40 for same-day transfers (euros only)Sending in other currencies not possible with this account |

| Receiving money from overseas | Free if in eurosReceiving other currencies not possible with this account |

Like the sound of the KBC Student Current Account? There are a few different ways you can open one, including over the phone, online, in your local KBC Hub or through the KBC mobile banking app.

The KBC customer service phone line is available from 8am to 11pm, 7 days a week. And if you’re applying in a KBC Hub, there’s no need to make an appointment. Simply take along your documents and pop in, where an expert will be waiting to guide you through the process of opening your account.

Before you start, you’ll need to make sure you have a few key documents to hand. These include¹:

If you’re applying through the KBC mobile banking app, you’ll also need to take and upload a selfie along with your other documents.

The process for applying for an account is slightly different depending which channel you go through. If in doubt about what to do or what paperwork you’ll need, it’s a good idea to call KBC customer services for advice.

| ⚠️ UPDATE: KBC is exiting the Irish market. From the 1st of June 2022, KBC will begin issuing customers with a notice that gives them 90 days to close their KBC account. Here's how to close your KBC account in Ireland. |

|---|

KBC doesn’t offer an overdraft facility as standard for student current accounts⁴, and charges an eye-watering unauthorised overdraft fee of 21.50% variable⁴ if you do accidentally go overdrawn. So, it’s probably best to keep a close eye on your spending to avoid this.

If you must absolutely have an overdraft, get in touch with KBC. Its website does mention that you can apply for one if you’re over 18 years old¹. However, there’s no guarantee that your application will be accepted.

And that’s pretty much everything you need to know about the KBC student account. We’ve looked at the features and benefits, including that lovely €50 incentive for opening an account, along with how to open an account and any fees you need to know about.

One thing about the KBC student account that should leap right out at you is how restrictive it is in terms of international spending. You can only send and receive money in euros using your account, and spending or withdrawing cash overseas comes with some pretty expensive fees.

Luckily, there is a cheaper alternative available. Open a free multi-currency Wise account and you can send and receive money internationally at the click of a button - or a tap on the handy Wise app. You’ll only pay tiny fees and always get the mid-market exchange rate - the fairest rate around.

You can also spend in 150+ countries worldwide with your Wise debit card. There are no transaction fees to worry about, only a tiny fee for converting currency - and this happens automatically at the mid-market rate. Even better, you can withdraw up to €200 twice a month from global ATMs for zero fees from Wise side.

Sources used for this article:

Sources checked on 9 March 2021

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

What are the PayPal fees for consumers in Ireland? How much do you pay when sending money? Read here.

Discover how Revolut works in Ireland. Explore the mechanics of Revolut's operations tailored specifically for Irish customers.

Can Irish citizens open a Swiss bank account as non-residents? Read all about it in this guide.

Revolut’s IBAN decoded. Is it LT, IE, or another country code? Get a clear, simple breakdown of your account in Ireland.

Wondering if your Revolut card is Visa or Mastercard? Get the lowdown on the differences and how it impacts your spending.

Wondering if Revolut is safe in Ireland? Our comprehensive analysis covers deposit protection, security measures, and more.