PayPal charges explained: What you need to know about fees in Ireland

What are the PayPal fees for consumers in Ireland? How much do you pay when sending money? Read here.

With over 300 million customers around the world, PayPal is one of the leading online payment platforms.¹ If you’re thinking about getting an Irish PayPal account this article is here to help, walking you through what a PayPal account can do, how to open one and answering a few FAQs.

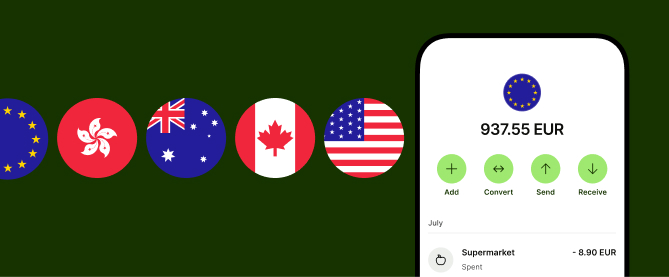

We’ll also introduce you to the Wise Account, which allows you to send, spend, receive and manage your money in different currencies.

Wise: +40 currencies

in one account 💰

PayPal is a digital payment platform that offers personal and business online accounts that are generally just referred to as a PayPal account.

With PayPal you can shop online and instore, using your PayPal account to pay for things instead of a card. You can also send and receive money from other PayPal users using a PayPal.Me link, QR Code or by searching for their account.¹

The money you spend is either taken from the balance of your PayPal account or from the credit card, debit card or bank account that’s securely attached to the account as a payment method. You can have multiple payment methods and just choose the one you want to use at the check out.

At the moment, PayPal supports 24 different currencies that can be stored in the account’s currency and used for payments.⁵

Here’s an overview of what you need to do to open a personal PayPal account in Ireland:

1️⃣ Go to the PayPal website and select “Sign Up”

2️⃣ Choose “Personal Account”

3️⃣ Provide an email address

4️⃣ Add your phone number then verify it with the code

5️⃣ Follow the prompts to set a password, enter your personal information (name, date of birth and address), and add security answers.

To start a PayPal account in Ireland there’s no documentation required but you will need to provide some personal information which may be used later to verify the account.³

- First and last name

- Address

- Phone number

- Email address

Once you’ve completed the signup process you can start receiving payments instantly. To send or make payments you’ll need to add a payment method.³

Signing up for a PayPal account doesn’t require any verification but once you start transacting you’ll need to add and confirm a bank account, debit card or credit card, proving that you’re the owner of those financial details.⁴

If you are looking for a different option to manage your money and transact in different currencies, have a look at the Wise Account.

With a Wise Account you can hold money in more than 40 currencies and send money to over 160 countries.

There’s no account opening and maintenance fees and you can send money to bank accounts and other Wise users, for example. You can also get local account details for 9+ currencies including EUR, GBP and AUD, being able to receive payments in these currencies without any currency exchange.

Once you have an account why not order the Wise card, or start using the virtual cards options for your everyday spending. These cards enable you to pay in more than 150 countries with automatic currency conversions when necessary.

Speaking in currency exchange, it's important to note that Wise converts your money using the current mid-market exchange rate with just a variable transaction fee.

If you haven’t heard of it before, the md-market rate is the midpoint between the buy and sell prices on the global currency markets, making it a fair way to decide.

Open your Wise Account

for free 🚀

Here are some common questions that pop up with people considering opening a PayPal account.

Yes. You can open a PayPal account without any payment method, and when you go to add one it can be a bank account, debit card or credit card.⁴

You can have up to two PayPal accounts provided one is a business account.⁷

There are ways to change the name on a PayPal account provided the person who owns it isn’t changing.⁶

If it is a legal or major name change that’s more than just fixing two characters of a typo then you may be required to upload supporting documents like a valid photo ID.

Unfortunately, due to variations in legislation in different places, you can’t change the country on your PayPal account.⁷ Instead you need to close the old account and open a new one from your new location.

What you need to do to link a bank account to a PayPal account depends on whether you’re using the website or app.⁸

1️⃣ Go to the PayPal website and login

2️⃣ Press on “Wallet” at the top of the page

3️⃣ Select “Link a bank account

4️⃣ Follow the prompts to complete the process

1️⃣ Login to the PayPal app

2️⃣ Tap on “Wallet”

3️⃣ Press on the + across from “Banks and cards”

4️⃣ Select “Banks”

5️⃣ Follow the prompts to complete the process

| 💡While it says bank account and Wise it's not a bank but a payment institution, you also can link your Wise EUR account details to PayPal in Ireland. |

|---|

Sources:

Sources checked on: 25 July 2024

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

What are the PayPal fees for consumers in Ireland? How much do you pay when sending money? Read here.

Discover how Revolut works in Ireland. Explore the mechanics of Revolut's operations tailored specifically for Irish customers.

Can Irish citizens open a Swiss bank account as non-residents? Read all about it in this guide.

Revolut’s IBAN decoded. Is it LT, IE, or another country code? Get a clear, simple breakdown of your account in Ireland.

Wondering if your Revolut card is Visa or Mastercard? Get the lowdown on the differences and how it impacts your spending.

Wondering if Revolut is safe in Ireland? Our comprehensive analysis covers deposit protection, security measures, and more.