PayPal charges explained: What you need to know about fees in Ireland

What are the PayPal fees for consumers in Ireland? How much do you pay when sending money? Read here.

If you’re looking for a new current account to manage your money day to day then it makes sense to do some research and compare a few options to find your match.

KBC has a range of current accounts including products for students and teens.¹ In this guide we’ll focus on the most popular ones - the Standard Current Account and the Extra Current Account - looking at features, fees, and how to get started.

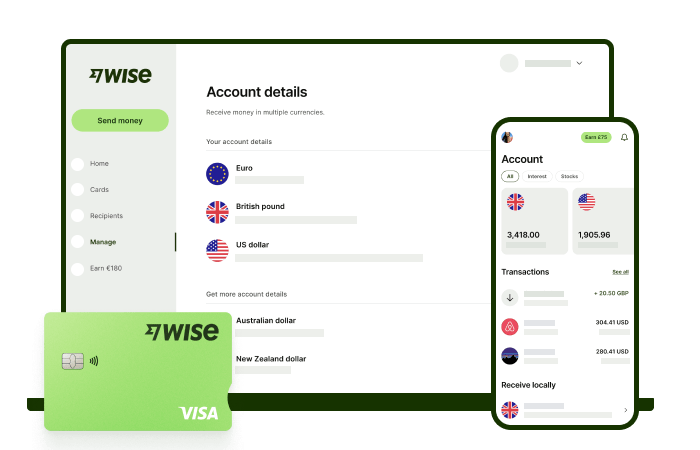

We’ll also introduce an alternative as a comparison - the Wise multi-currency account. With Wise you can hold and spend in 40+ currencies, switch between them using the mid-market exchange rate, and spend around the globe with your linked debit card.

KBC has a number of fees which are applied to all current account types - although some of these fees can be waived if you meet specific conditions in the Standard Current Account or Extra Current Account.

Here are the main KBC standard fees you should know about. We’ll cover the fee waivers available in just a moment.

| Service | KBC fee² |

|---|---|

| Account maintenance fee | €6/quarter This fee may be waived if you meet set eligibility criteria - read on for more. |

| ATM withdrawal in EUR, within SEPA zone | €0.30 This fee may be waived if you meet set eligibility criteria - read on for more. |

| ATM withdrawal in a non-euro currency | 3.5% of withdrawal value, minimum €3.17, maximum €11.43 |

| Cheque lodgement | €0.30 This fee may be waived if you meet set eligibility criteria - read on for more. |

| Transaction fee for debit card purchases in a non-euro currency | 1.75% of purchase value, minimum €0.46, maximum €11.43 |

| Cheque withdrawal | €3.17 |

| Same day transfer within SEPA zone | €25.40 |

| Unpaid direct debit or standing order due to fund shortage | €10 |

| Overdraft set up or renewal | €25 |

*All fees correct at the time of research - 15 February, 2021

The KBC Standard Current Account is one of the most popular accounts on offer. You’ll get a debit card to make contactless payments or you can link your account to a service like Apple Pay or Google Pay for mobile payments with your phone. You’ll also get free online banking services and free direct debit processing.

The other important perk with the Standard Account is that you could get your local ATM and cheque lodgement fees waived as long as you maintain a daily balance of at least €2,000 in the account.

You can open a KBC Standard Current Account if you’re over 17 and a resident of the EU.

The KBC Extra Current Account is aimed at customers who will lodge at least €2,000 a month into the account³. This might suit you if you’re expecting to have your salary paid into the account for example.

If you fulfil this requirement, you’ll get your monthly fee, local ATM and cheque lodgement fees waived. You can also opt to open a savings account with KBC and get extra benefits in the form of a higher interest rate for either a regular savings account or a 12 month term savings product.

If you don’t lodge the full €2,000 in a particular month, your account will be subject to the same fees as the Standard Account for the full quarter the month falls in.

You can open your KBC account online, using the KBC app, by phone or in person. You’ll need the following documents, based on the application route you choose:

Your proof of address could be a utility bill, bank statement or credit card statement. Documents must be issued in the last 6 months to be valid.

To open your account in person, head to a KBC hub. You can find your nearest location on the KBC website.⁴ It’s also good to know that you may need to wait for a call back from the team to activate your account if you apply online.

When you open a KBC account you’ll get a linked debit card for easy withdrawals and spending. It’s worth looking at the terms and conditions of your card carefully before you use it, to make sure you’re familiar with the fees.

Cash withdrawals in euros can cost €0.30, although you may be able to have these fees waived depending on your account and how you use it. Where the costs can really ramp up is when you use your card internationally, or when shopping online with retailers based abroad. Here’s what the KBC terms say:⁵

“When you use your debit card for purchases in foreign currency or cash withdrawal in foreign currency, these transaction charges will apply: cash withdrawal fee 3.50% of transaction value (min €3.17, max €11.43) and POS transaction 1.75% of transaction value (min €0.46, max €11.43).”

It’s particularly worth knowing about this fee if you like to shop with e-commerce retailers based outside the euro area. You may never leave the comfort of your own home to make a purchase, but the costs could still go up thanks to the foreign transaction fee attached to international POS purchases.

| ⚠️ UPDATE: KBC is exiting the Irish market. From the 1st of June 2022, KBC will begin issuing customers with a notice that gives them 90 days to close their KBC account. Here's how to close your KBC account in Ireland. |

|---|

The best account for you depends on your personal preferences and lifestyle.

The KBC Standard Current Account comes with a €6/quarter fee which pushes up the cost of operating it. But if you’re going to be depositing €2,000 a month or more into an account the KBC Extra Current Account could come with no maintenance fee, free local EUR ATM withdrawals and cheque lodgement. That may make it a good option if you’re looking for an account to pay your salary into, for example, or if you want to add on extra linked savings account options. Don’t forget that there are extra charges to use your card for purchases or ATM withdrawals in any currency other than euros - this can be pricey if you travel or shop internationally.

The Wise multi-currency account is a great choice if you don’t think you’ll be paying in €2,000 a month, or if you want a flexible account which lets you spend in foreign currencies without the extra charges.

You can open your account online, and there’s no monthly fee or minimum balance requirement. Get paid in multiple currencies including EUR, GBP, USD, AUD and NZD for free, and hold, send or spend 40+ currencies all from the same account.

You can make 2 free ATM withdrawals a month up to the value of €200, with a low fee after that - and it’s always free to spend any currency you hold in stores, restaurants or with e-commerce merchants using your linked debit card.

Weigh up all your options when choosing a bank account - you might find that having different accounts for different purposes gives you the best balance of cost and convenience - and helps you to save.

Sources:All sources last checked on February 15, 2021

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

What are the PayPal fees for consumers in Ireland? How much do you pay when sending money? Read here.

Discover how Revolut works in Ireland. Explore the mechanics of Revolut's operations tailored specifically for Irish customers.

Can Irish citizens open a Swiss bank account as non-residents? Read all about it in this guide.

Revolut’s IBAN decoded. Is it LT, IE, or another country code? Get a clear, simple breakdown of your account in Ireland.

Wondering if your Revolut card is Visa or Mastercard? Get the lowdown on the differences and how it impacts your spending.

Wondering if Revolut is safe in Ireland? Our comprehensive analysis covers deposit protection, security measures, and more.