Apple Pay vs Samsung Pay: How do they compare?

Check out our full comparison of Apple Pay vs Samsung Pay in the UK, to help you choose the right digital wallet for you.

When you buy something online from an international seller, there’s a risk you’re overpaying. That’s because credit/debit cards and PayPal add a hefty mark-up to the exchange rate when you buy something in a foreign currency.

It’s a bit like a hidden fee: on top of the price of your purchase, there may be a 5% currency conversion cost baked into the bad exchange rate that your payment provider uses. That’s an extra £25 on a £500 purchase.

So, the first step is to realise that all of these international purchases are actually currency conversions. The next step is to find a better way to convert your money.

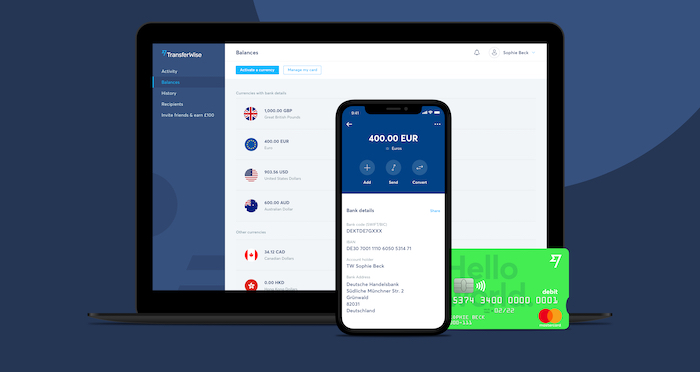

The Wise debit card makes it fast, easy and cheap to pay for foreign purchases in 150+ countries. Simply top up your Wise account in your own currency, and when you buy something on your card we’ll automatically convert your currency at the real exchange rate — with no mark-up.

We charge a small upfront fee, which is a fraction of the cost compared to other payment providers. It’s typically around 5x cheaper, depending on which currency you’re converting. There are no other transaction fees, making it the most transparent way to spend internationally.

The card is also perfect for travel. You can withdraw £200 from overseas ATMs fee-free. And you’ll always get the real rate, so you don’t need to worry about the costs of spending while abroad.

Sign up now to order your debit card

It takes minutes to set up a Wise account, and it comes with several additional features:

Send money internationally at the lowest cost. Wise typically charges between 0.3-1%, compared to banks and brokers which often charge as much as 5%, despite the low fees they advertise.

No matter what feature you’re using, we never use a hidden mark-up on the exchange rate — unlike banks, brokers, PayPal, and card providers. We always show all our fees upfront and, because you’re getting the best rate, you know that you’re saving on all those hidden costs that your card provider would charge.

Try our calculator below to see how much a transfer would cost. Or click here to see how we compare to other providers.

Wise’s founders Kristo Käärmann and Taavet Hinrikus started Wise 10 years ago because of their own frustration at the high costs they were being charged to send money between the UK, where they worked, and the EU, where they had bills. They built Wise to bypass the outdated, costly systems that banks and brokers use and slash the costs of international transfers.

Today, Wise’s 9 million customers send billions of dollars through the platform each month, saving over $3m each day in bank fees and hidden exchange rate costs. Visit wise.com to start saving time and money on your international banking. It also has an invite reward programme to thank you for spreading the word: for every 3 people who sign up and make a transfer of £200, you’ll earn £50 (or the equivalent in your currency).

| Click here to set up your free account and join 9 million customers saving at wise.com, or through our Android or iOS app. |

|---|

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Check out our full comparison of Apple Pay vs Samsung Pay in the UK, to help you choose the right digital wallet for you.

Read our helpful guide to account-to-account (A2A) payments, including how they work, how long they take and the benefits.

Want to transfer a balance between credit cards? Read our guide on Aqua balance transfers, including fees and how long it takes.

Read our guide to learn how to withdraw money from a FairFX card and understand the related fees.

Find out what exchange rate Currensea uses for card payments, ATM withdrawals and money transfers here in our handy guide.

Compare Currensea vs. Wise in our comprehensive UK guide, covering fees, features, travel cards, exchange rates and more.