Are you paying more than you think with Revolut?

At first, Revolut might look like the cheaper option. Dig a little deeper and it turns out Wise could offer the better deal. How do Wise and Revolut differ?...

People around the world lose billions every year when they send money internationally.

That’s because banks and exchange rate providers can make it hard to understand exactly what you’re paying for. As we explained back in December, there are usually two costs associated with sending money: the fee and the rate. To be more precise, there’s the upfront fee providers charge for their service, and the markup they add to the exchange rate that’s used to convert your money.

Because the markup is rarely stated — and a reference rate is almost never provided — most people don’t realise their rate often contains a hidden fee. And that costs them extra when they send money. A lot extra.

Wise was founded to solve this problem. Because if it’s not clear what your costs really are, providers can charge whatever they want. And they can change their prices at any time — without you knowing.

We believe you should know exactly what sending money internationally really costs.No headaches, no complicated maths.

As a part of this effort, we built our comparison tool, and a whole team dedicated to it. It helps you compare the cost of sending money internationally across providers. The team behind it also monitor the price of sending money with the banks and providers, and see how this price fluctuates with time.

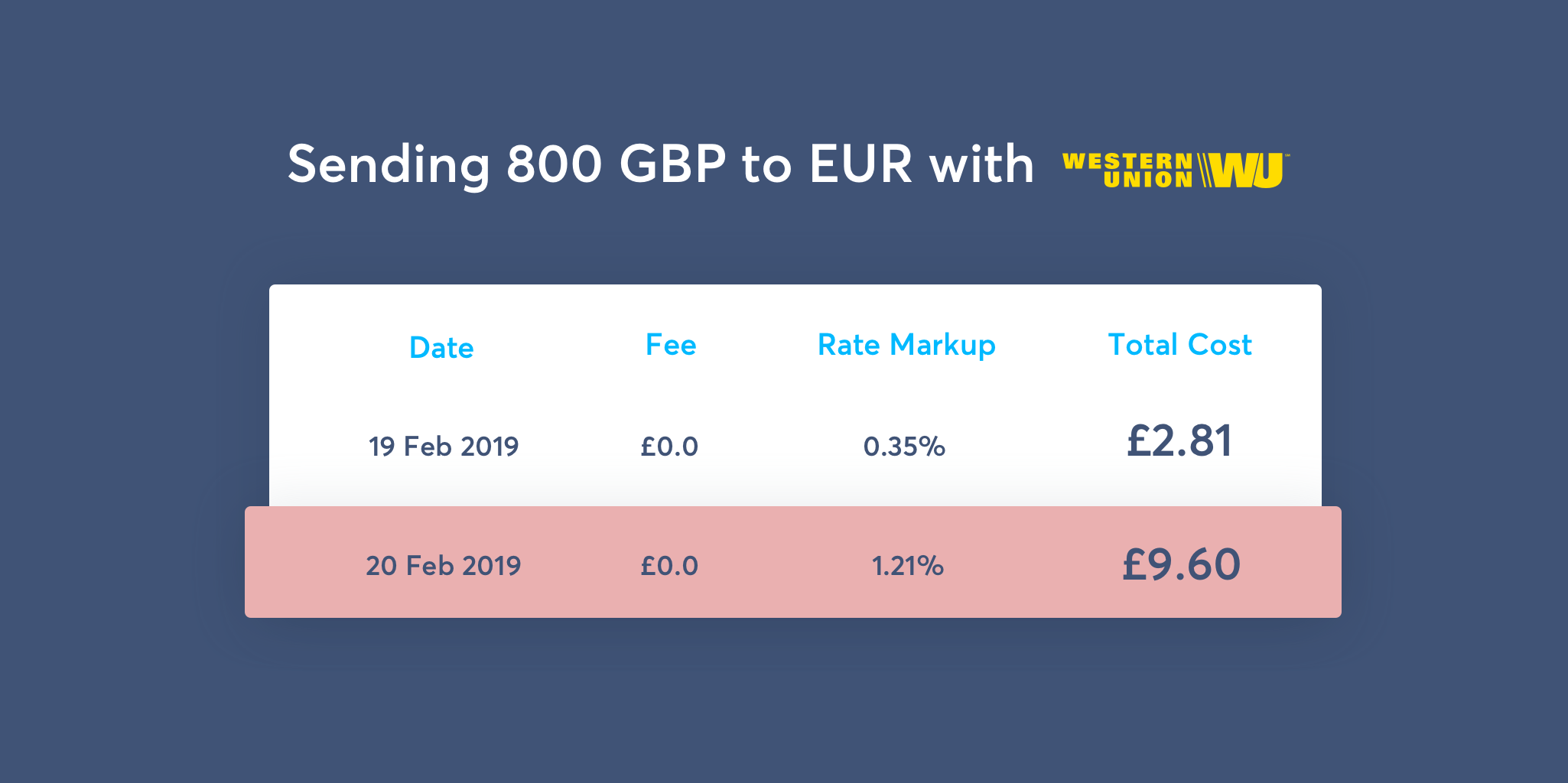

Last month, we came across a great example of a huge, unannounced price change. On the surface, it was a great deal — Western Union were offering a 0 GBP upfront fee. But they suddenly increased the markup on the exchange rate they were offering.

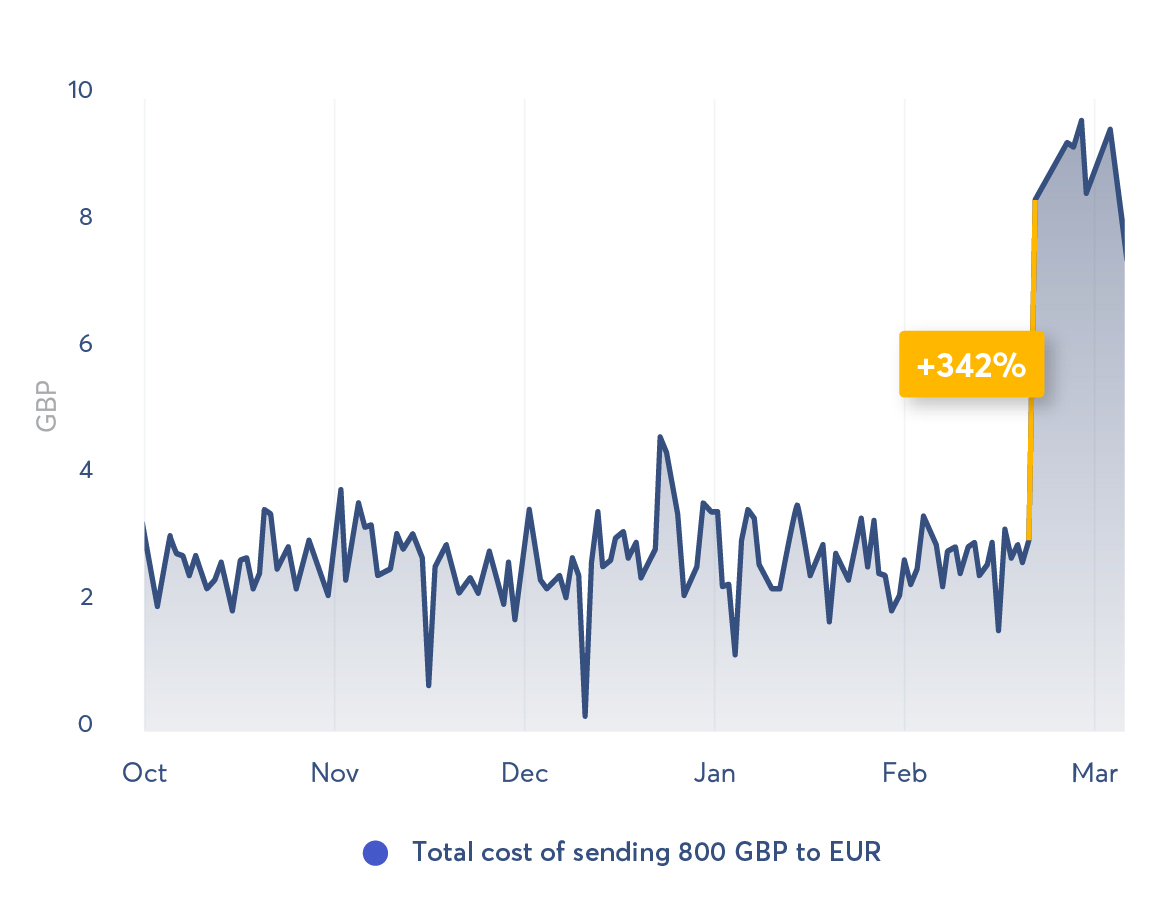

Here’s what that looks like:

The graph shows the total cost (daily average) of sending 800 GBP to EUR from October 2018, until March 2019. The huge spike in late February represents a huge increase in markup on Western Union’s exchange rate. To be clear, this means the cost of sending 800 GBP to EUR tripled overnight.

Here’s how this affected customers sending 800GBP or less:

This is the reason we’re so concerned with exchange rates that don’t explicitly state that a markup’s been applied. Banks and providers can and will bloat the total cost of your transfer without warning. Sometimes, they’ll even do it overnight. And we don’t think that’s fair.

Change is coming — with the EU recently passing a law that forces all money transfer providers to disclose what you’re paying for,and the UK and Australia looking to pass similar legislation. But, until industry standards move towards best practice, we’ll continue to work to show you exactly what you’re paying.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

At first, Revolut might look like the cheaper option. Dig a little deeper and it turns out Wise could offer the better deal. How do Wise and Revolut differ?...

An independent research team compared Wise to six UK bank accounts, as well as Monzo, Starling, Revolut, PayPal, Xoom, Western Union and Post Office. They...

A dedicated comparison research team in Wise compared Wise to four India bank accounts. They found that we’re on average 1x cheaper to send ₹9,000 abroad....

In the UK, our research found that it’s up to 87% cheaper to spend with a Wise card abroad, compared to high street banks, if you’re spending £1000. High...

Detailed research by Wise reveals substantial savings compared to Singapore banks and services like Instarem, Revolut, and Youtrip by EZ link.

Discover how Wise compares to 5 major Japanese banks and Revolut, offering savings of up to 6x on international transactions.