UK Price Comparison Research 2024

An independent research team compared Wise to six UK bank accounts, as well as Monzo, Starling, Revolut, PayPal, Xoom, Western Union and Post Office. They...

At Wise, we believe in radical transparency.. Which to us, means making pricing crystal clear — even when you’re not the cheapest. So people can make more informed choices on what’s right for them.

We always call out the banks if we think they’re deliberately misleading their customers. It holds us accountable too. But historically, we’ve only compared ourselves to the old incumbents — slow, expensive banks.

There are now far more alternatives — fintechs, or challengers — setting a better standard for the industry. And there’s room for us all, because X% of people are still sending with the traditional banks.

But how do challengers compare? We’ve recently included their pricing in our comparison table. It’s now time to take a peek at transparency. Are they being honest about their prices?

First up’s Revolut. Here’s what was less than transparent:

The way you talk about send money fees

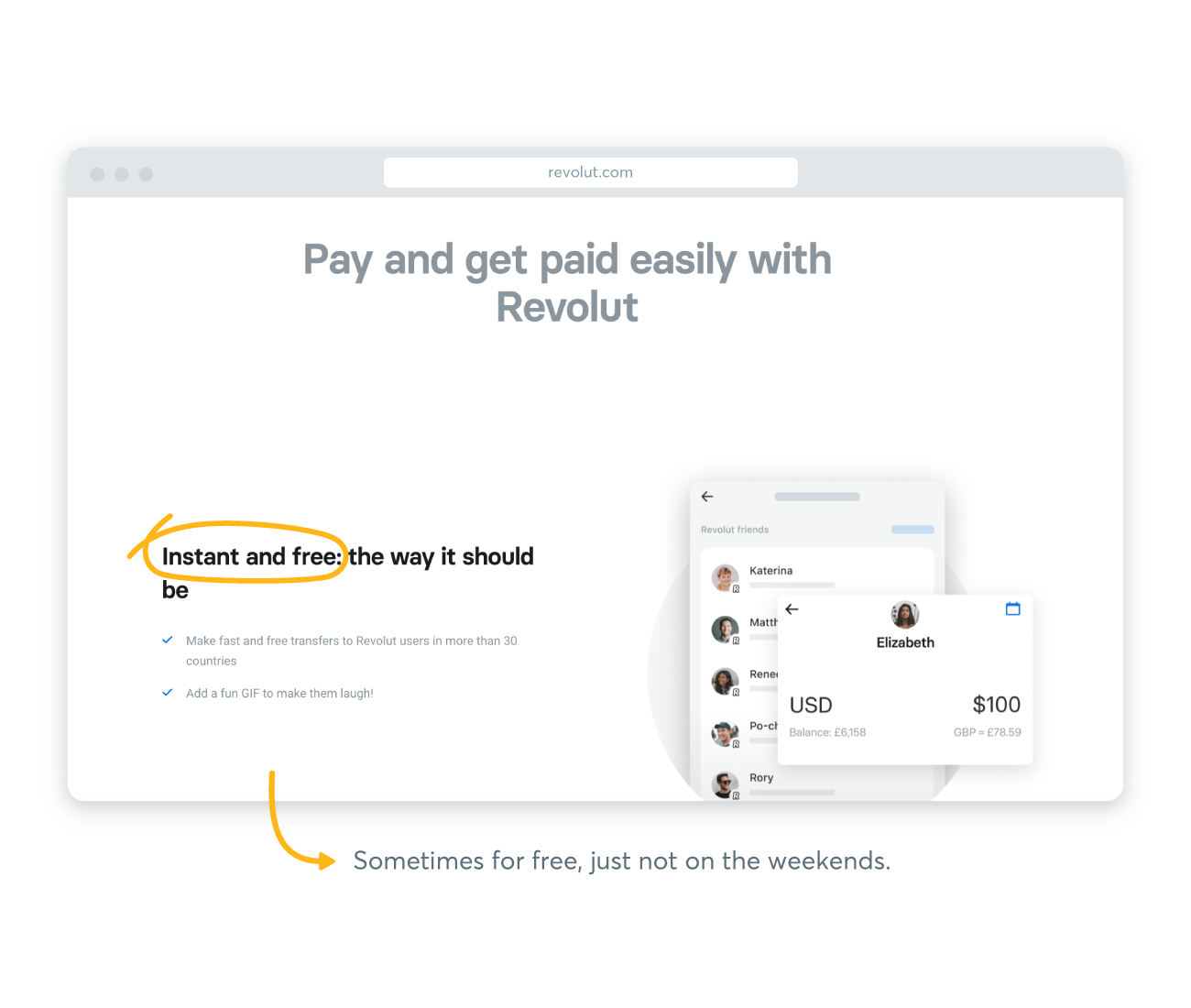

Revolut offers fast and cheap money transfers internationally — sometimes cheaper than Wise. But it can be hard to know what they truly charge.

Let's take weekend transfers, for example. There's a 1% weekend fee to convert money, which is buried in T’s and C’s. But, really how many people read those?

Well, we don't know for sure but apparently only 9% of people (according to Deloitte). Meaning that if you're not one of those special people, you'll be one of the 91% that doesn't know how expensive it is to send and convert currencies with Revolut on the weekend — which is when most people tend to travel. So much for TGIF.

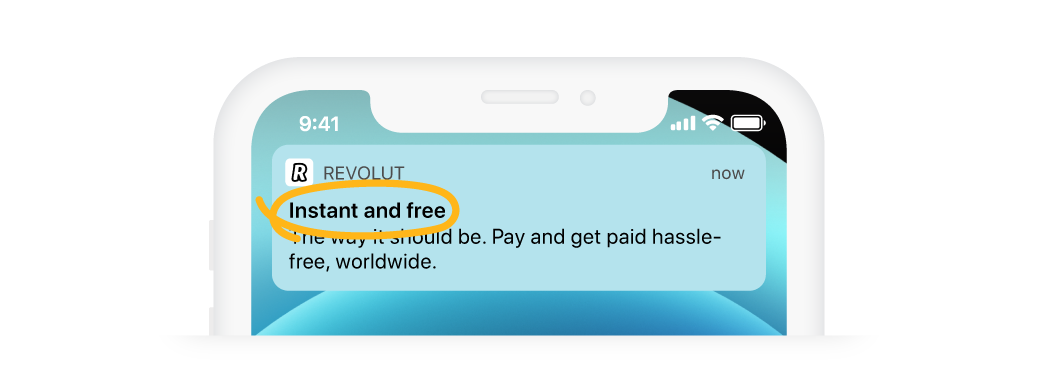

They use the word “free” a lot

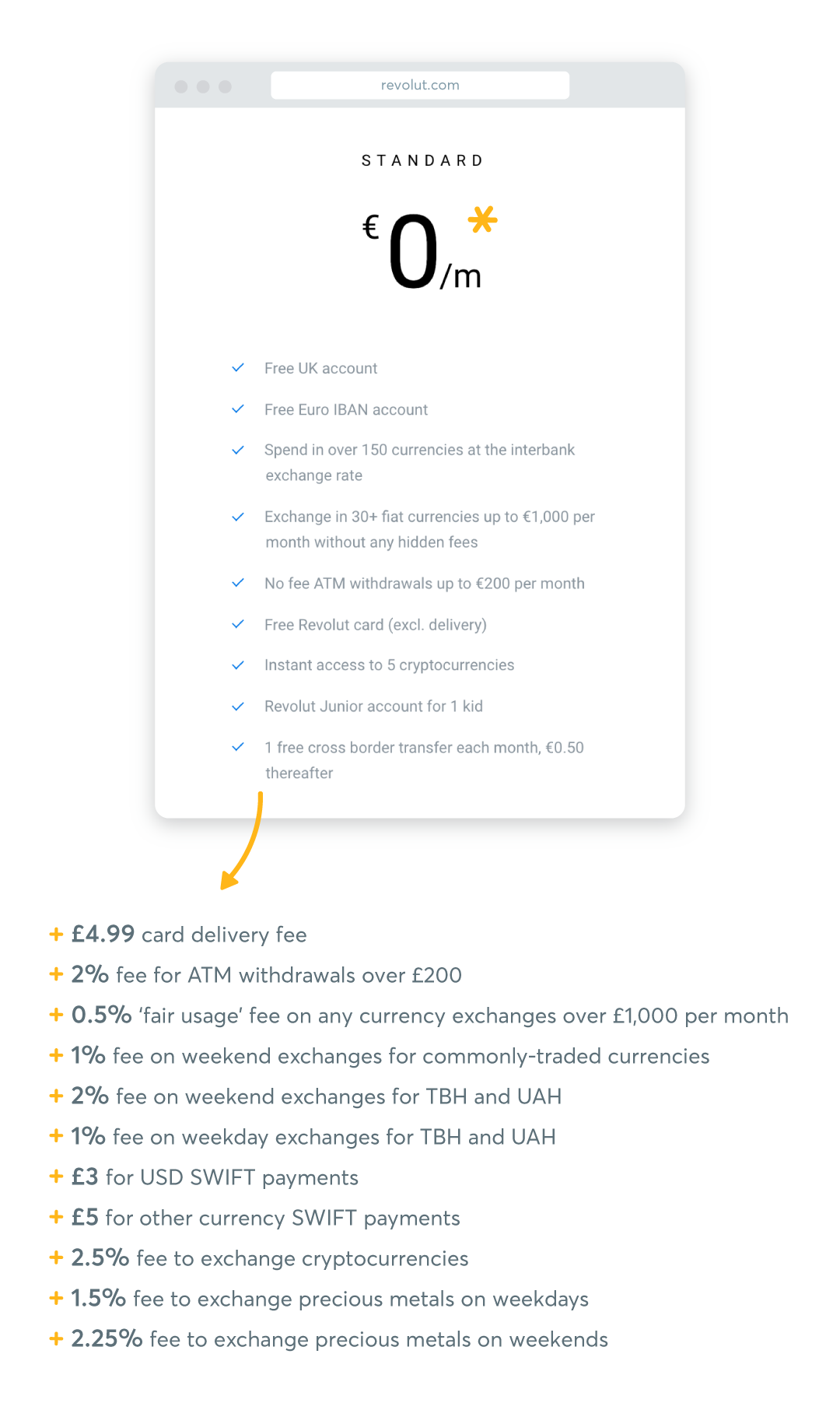

Your plan says you get a ‘Free Revolut card (excl. delivery)’, but there’s no mention of what that delivery cost is. Another T’s and C’s job. So for any philosophers out there, is a card really free if the delivery cost is £4.99?

You may be thinking, “doesn’t a Wise debit card cost £5?” And you’d be right to do so. But the point is that you need to show these costs. Because knowledge is power.

Revolut says customers can ‘send money abroad instantly and for free'...

But over £1,000/month there’s a 0.5% fee which they’re actually upfront about — just in other places.

And there’s that weekend fee of 1% fee for most currencies; and 2% fee for others. So it isn’t free. Also, sending USD with SWIFT has a £3 fee. And a £5 fee for using SWIFT for any other currency. If you send more than one payment outside of SEPA per month, there’s another fee too.

Aaaand breathe.

Disclaimer: we know that we have fees too — costs have to be covered somehow. But at Wise, we try to be upfront about them. And even show our customers when there are cheaper options.

Point in case (example of Wise recommending Revolut).

We gave your pricing info the transparency treatment — here’s what it should look like:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

An independent research team compared Wise to six UK bank accounts, as well as Monzo, Starling, Revolut, PayPal, Xoom, Western Union and Post Office. They...

A dedicated comparison research team in Wise compared Wise to four India bank accounts. They found that we’re on average 1x cheaper to send ₹9,000 abroad....

In the UK, our research found that it’s up to 87% cheaper to spend with a Wise card abroad, compared to high street banks, if you’re spending £1000. High...

Detailed research by Wise reveals substantial savings compared to Singapore banks and services like Instarem, Revolut, and Youtrip by EZ link.

Discover how Wise compares to 5 major Japanese banks and Revolut, offering savings of up to 6x on international transactions.

Discover how Wise compares to major banks and money transfer services, saving you up to 4x on international transactions.