UK Price Comparison Research 2024

An independent research team compared Wise to six UK bank accounts, as well as Monzo, Starling, Revolut, PayPal, Xoom, Western Union and Post Office. They...

At Wise, we believe in radical transparency. Which to us, means making pricing crystal clear. So people can make more informed choices on what’s right for them.

We know that the old, traditional banks don’t fare so well when it comes to price. But customers now have far better alternatives — fintechs, challenger banks and digital providers — who are setting far better standards for international transfers. And honestly, there’s space for us all. But are these new dogs up to old tricks when it comes to being transparent with their pricing?

We had a trawl of Starling’s site. And honestly, they’re pretty transparent when it comes to their pricing.

Here’s what we found:

Their exchange rate and fees for sending abroad are crystal clear

Starling make a point of explaining to their customers what the live and real exchange rate is. Even better, they use it.

Unlike the examples we've seen with the good old banks, Starling has little to hide when you're sending money abroad.

Much like Wise, Starling also uses a live fee calculator, that uses the mid-market rate. The same calculator shows customers exactly what the delivery fee is (£0.30 for local payments and £4 for SWIFT payments) and a flat 0.4% conversion fee to cover for Starling's costs – so there are no hidden surprises for Starling customers.

Starling's Euro account is free if you're topping up and cashing out in euros

Starling also offers an euro account that lets you "hold, send and receive euros for free".

And this is true if you're someone who is using their euro account as a domestic account, or simply using the account in euros – i.e., topping up your account in euros, receiving in euros and spending in euros.

However, the same 0.4% conversion fee will also apply to convert your pounds to euros and vice versa. So, if you're topping up your euro account using pounds, or cashing out your euros in pounds, the "free" claim isn't strictly true.

There’s also a negative interest rate of -0.5% for ballers holding more than 50,000€. It’s only applied to anything above 50k though, and they are clear about it.

That being said, both fees are made clear, and are — thankfully — very small.

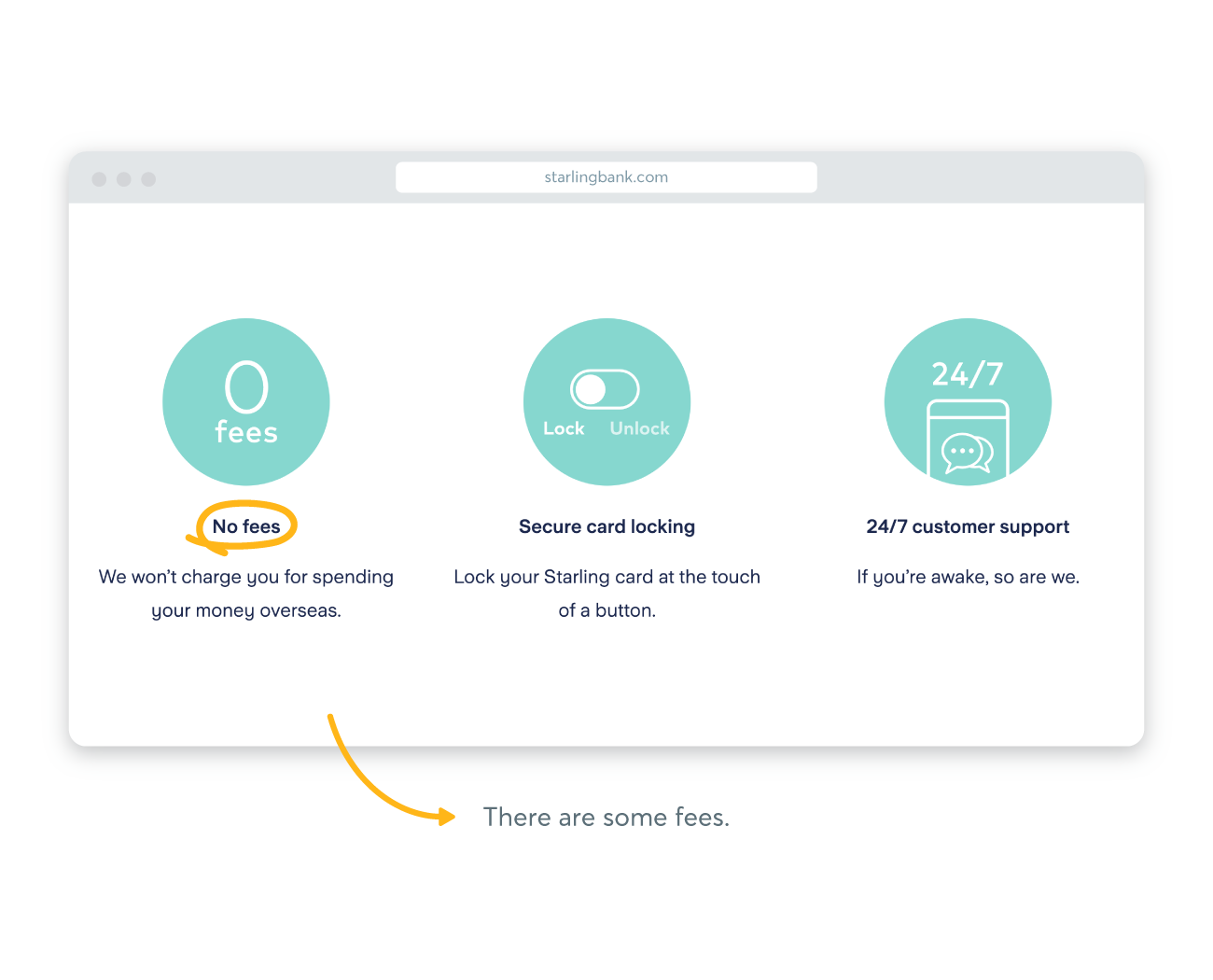

Their “no fees overseas” claims is mostly true

Credit to them, they don’t charge ATM fees and they don’t charge for using your card abroad either. That's great!

More specific to that "no fees" claim is, if you end up converting pounds to euros on a trip (the other currency you can hold with them), you’ll get that 0.4% flat fee from above.

The verdict

Starling is setting a great standard for the rest of fintech. They are cheap and they stand by their word. They pass our transparency exam with flying colours (purple and turquoise). But as they add more offerings, they might need to take a second look at earlier “free” claims. And it’s ok to charge for some things — if the prices are easy for customers to find.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

An independent research team compared Wise to six UK bank accounts, as well as Monzo, Starling, Revolut, PayPal, Xoom, Western Union and Post Office. They...

A dedicated comparison research team in Wise compared Wise to four India bank accounts. They found that we’re on average 1x cheaper to send ₹9,000 abroad....

In the UK, our research found that it’s up to 87% cheaper to spend with a Wise card abroad, compared to high street banks, if you’re spending £1000. High...

Detailed research by Wise reveals substantial savings compared to Singapore banks and services like Instarem, Revolut, and Youtrip by EZ link.

Discover how Wise compares to 5 major Japanese banks and Revolut, offering savings of up to 6x on international transactions.

Discover how Wise compares to major banks and money transfer services, saving you up to 4x on international transactions.