Best eSIM for India: Top 5 plans compared for UK travellers

Find the best eSIM for India for UK travellers. Compare top plans, learn how to activate your eSIM, and avoid roaming charges on your trip.

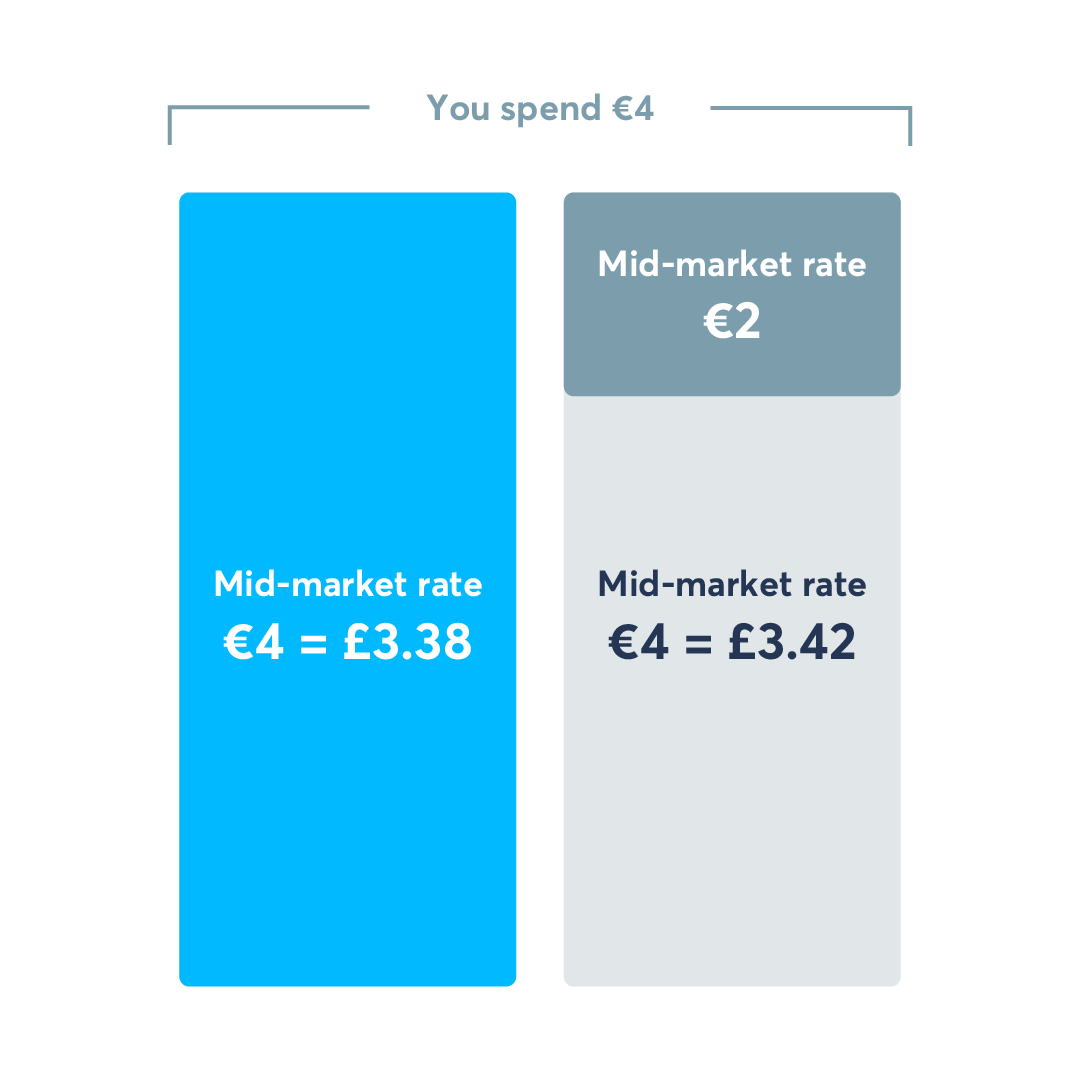

Have you ever used your bank or credit card to buy something abroad, like a 4-EUR coffee, only to realise it ended up costing you 6 or 7 GBP (if you’re British), 8 USD (if you’re American), and so on?

There’s a simple, if not depressing, explanation. The merchant obviously needed to be paid in their local currency, so your card provider converted your home currency for you, and they either marked up the exchange rate, charged extra fees, or both. Or, the merchant’s bank or payment processor did similar things.

Either way, you paid more than you should have.

But don’t worry — it’s an honest mistake, and one you’ll never have to make again, thanks to Smart Conversion.

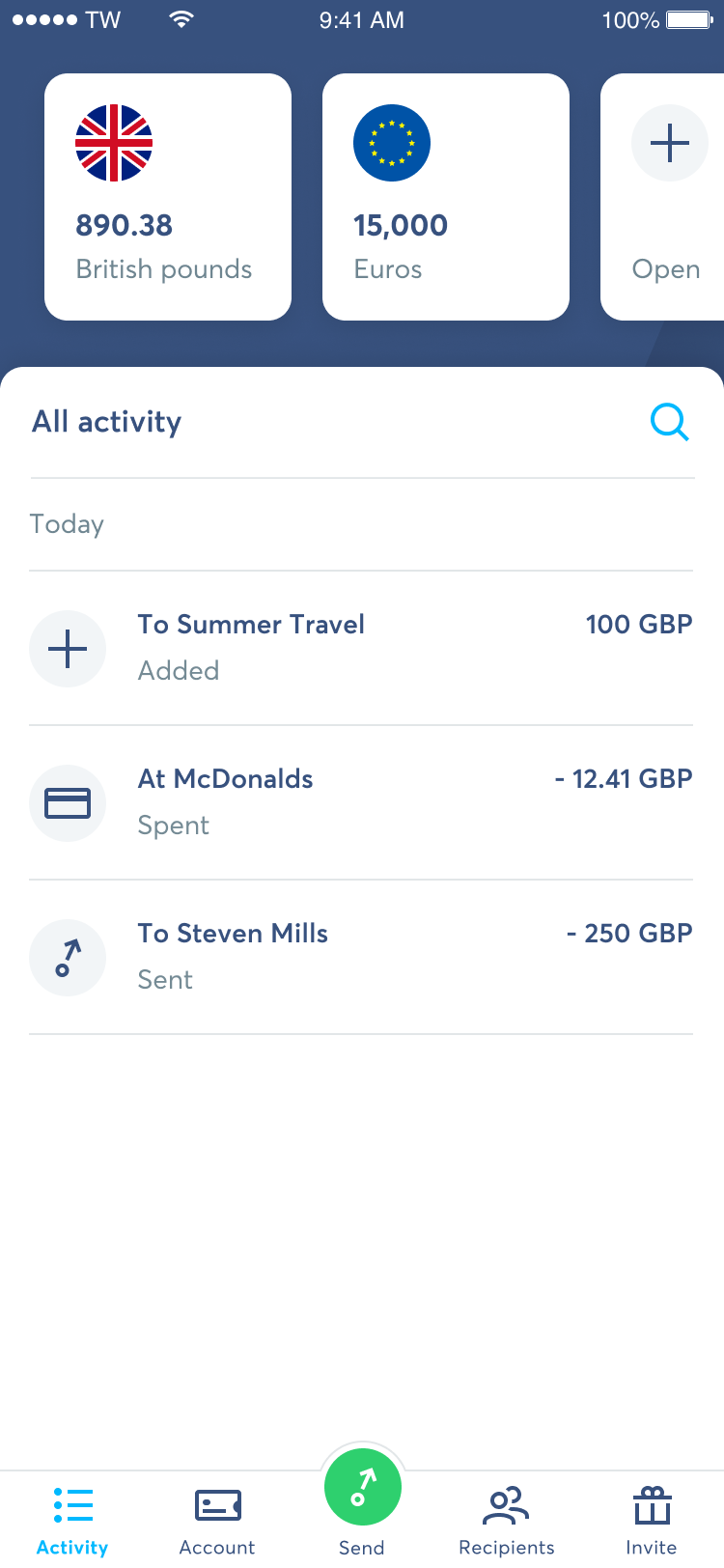

Smart Conversion is the Wise debit card’s superpower. When you buy something abroad with the Wise card — online or in person — the card pays the merchant in their local currency by automatically converting the balance in your Wise account that’s cheapest for you. (And of course, if you’ve already converted some of your money to the local currency, it will use that.)

Wise will always give you the real exchange rate, and you’ll pay only a small conversion fee — the same low, transparent fee you’d pay if you converted the currencies in your Wise account yourself.

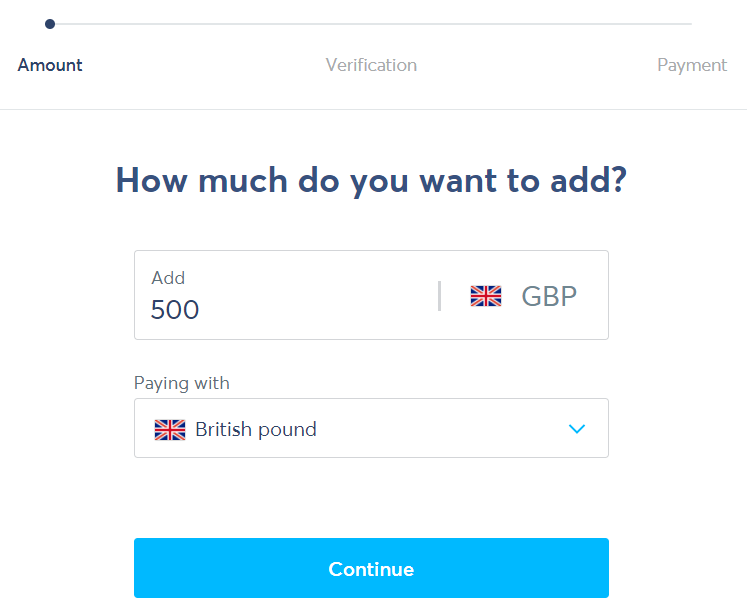

Easy! Just add money in your local currency to your Wise account; this could be GBP if you’re from the UK, or EUR if you’re from Germany.

|  |

As long as you have money in your Wise account, you’re good to go. Smart Conversion will take care of the rest.

Sometimes you’ll be asked whether you want to pay in the local currency, or your home currency. When that happens, always choose the local currency — that way you’ll make sure that Wise is doing the (smart) converting, rather than the merchant doing some (er...unwise) converting.

Bottom line: Thanks to Smart Conversion, the next time you buy that 4-EUR coffee, it’ll cost you pretty darn close to 4 EUR.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Find the best eSIM for India for UK travellers. Compare top plans, learn how to activate your eSIM, and avoid roaming charges on your trip.

Read our guide to find the best eSIM for Turkey (Türkiye), learn how to activate it and get some useful tips for your trip.

Discover 7 Eurostar destinations from London to Europe, travel times, connecting trains, and how to save money on tickets and spending abroad.

Exploring options for a group trip to Europe? Read our guide for tips, destination ideas, how to handle logistics and how to use Wise for group spending.

Read our complete guide to the Hungary digital nomad visa, covering fees, documents, eligibility requirements and application process.

Read our guide to Michelin star restaurants in Rome, featuring top picks with Michelin ratings, cuisine and location across the city.